Name

三指数均线止盈止损策略Triple-Exponential-Moving-Average-Profit-Taking-and-Stop-Loss-Strategy

Author

ChaoZhang

Strategy Description

三指数均线止盈止损策略是一种基于三条不同周期的指数移动平均线进行入市出市的趋势跟踪策略。它同时使用平均真实波幅指标设置止盈止损位,实现风险管理。

该策略使用三条指数移动平均线:快线、中线、慢线。当中线上穿慢线时做多;当快线下穿中线时平仓。这是一个典型的趋势跟踪策略,通过三条均线的多空转换判断趋势方向。

同时,该策略利用平均真实波幅指标计算止盈止损位。具体来说,多单止盈位为进场价格+平均真实波幅止盈系数;空单止盈位为进场价格-平均真实波幅止盈系数。止损原理与止盈相似。这可以有效限制单边风险。

- 决策指标直观清晰,容易理解实现。

- 系统性强,容易量化。

- 兼顾趋势跟踪和风险控制。

- 存在一定的滞后,无法及时捕捉转折。

- 震荡趋势中容易止损。

- 参数设置需要优化,否则实现效果不佳。

风险应对措施包括:适当缩短均线周期,优化止盈止损系数,添加其他决策指标辅助判断。

- 多种均线指标组合,寻找最佳参数。

- 增加其他技术指标判断,如MACD、RSI等。

- 采用机器学习算法自动优化参数。

- 基于真实波幅动态调整止盈止损位。

- 结合情绪指标避免过度拥挤交易。

该策略总体来说是一种效果稳定的趋势跟踪策略,简单参数设置,容易实现。通过平均真实波幅的动态止盈止损,可以限制单边风险。但需要注意参数优化和指标组合,防止过度优化和决策滞后。总体而言,风险收益平衡较好,值得考虑。

||

The Triple Exponential Moving Average Profit Taking and Stop Loss Strategy is a trend-following strategy based on three exponential moving averages with different periods for market entry and exit. It also uses the Average True Range indicator to set profit-taking and stop-loss levels for risk management.

The strategy uses three exponential moving averages: fast line, middle line, and slow line. It goes long when the middle line crosses above the slow line, and closes position when the fast line crosses below the middle line. This is a typical trend-following strategy that determines trend directionality through the crossing of the three moving averages.

At the same time, the strategy leverages the Average True Range indicator to calculate profit-taking and stop-loss levels. Specifically, the take profit for long positions is entry price + Average True Range * profit factor, and for short positions it is entry price - Average True Range * profit factor. The stop loss logic is similar. This effectively limits the risk of large losses.

- Decision indicators are intuitive and easy to understand.

- Systematic and easy to automate.

- Balances trend-following and risk control.

- There is some lag and inability to timely capture reversals.

- Prone to stop loss in ranging markets.

- Parameter tuning needs optimization, otherwise results may be poor.

Risk mitigation measures include: shortening moving average periods, optimizing profit/stop factor, and adding auxiliary indicators.

- Test combinations of moving averages to find optimal parameters.

- Add other technical indicators like MACD, RSI etc.

- Use machine learning to auto optimize parameters.

- Dynamically adjust profit/stop level based on true range.

- Incorporate sentiment to avoid overcrowding.

Overall this is an effective trend-following strategy with stable performance and easy implementation via simple parameters. The dynamic profit taking and stop loss based on Average True Range limits per-side risk. But parameter optimization and indicator combinations need to be done carefully to prevent overfitting or decision lag. On balance, this strategy has good risk-reward profile and is worth considering.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | timestamp(01 Jan 2017 00:00 +0000) | Start Time |

| v_input_2 | timestamp(01 Jan 2022 00:00 +0000) | End Time |

| v_input_3 | 55 | Slow EMA Length |

| v_input_4 | 21 | Middle EMA Length |

| v_input_5 | 9 | Fast EMA Length |

| v_input_6 | 200 | Trend indicator MA Length |

| v_input_7 | 14 | ATR Length |

| v_input_8 | 3 | Take profit ATR multiplier |

| v_input_9 | 2 | Stop loss ATR multiplier |

| v_input_10 | 14 | RSI Length |

Source (PineScript)

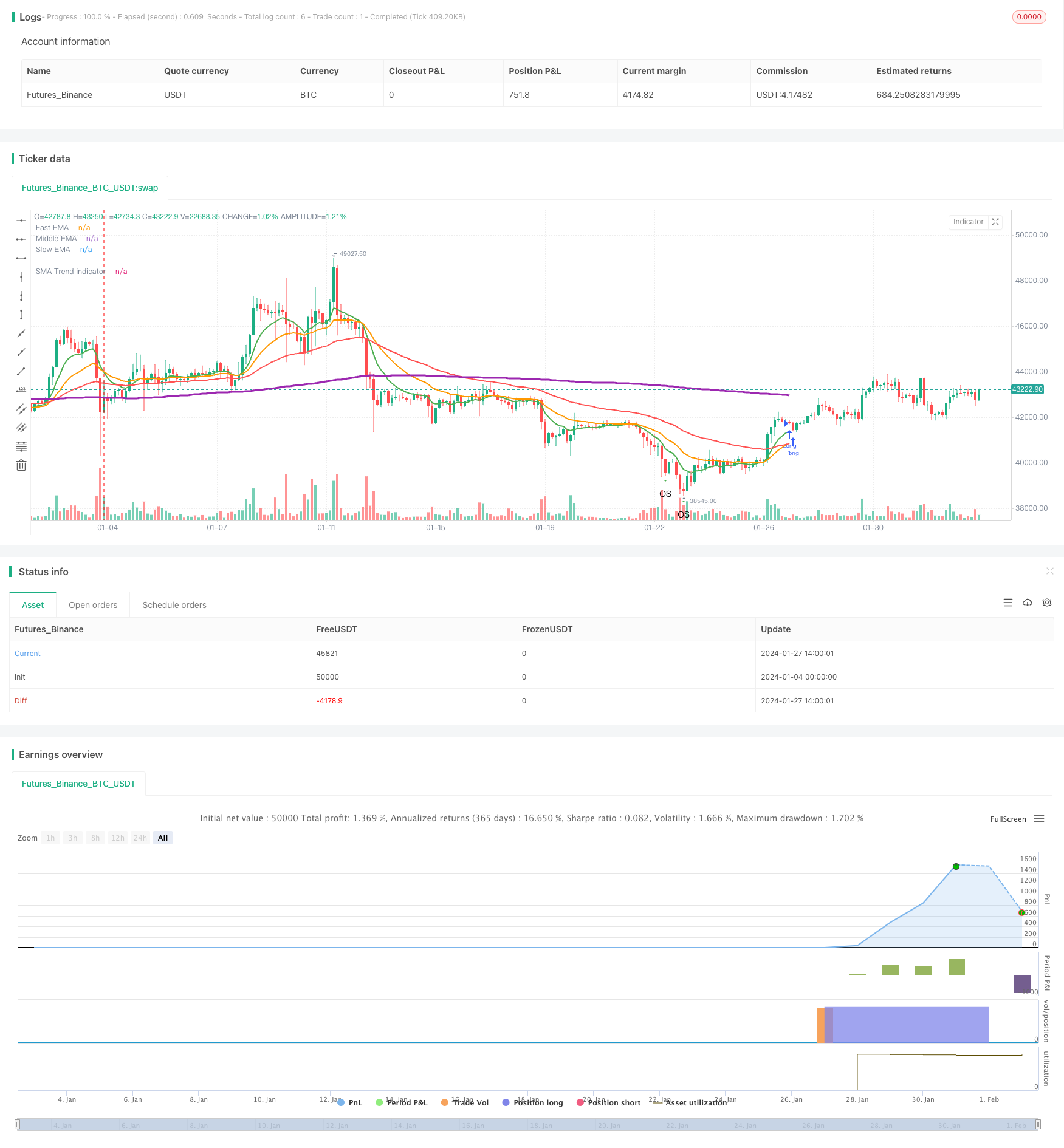

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//© Densz

strategy("3EMA with TP & SL (ATR)", overlay=true )

// INPUTS

startTime = input(title="Start Time", type = input.time, defval = timestamp("01 Jan 2017 00:00 +0000"))

endTime = input(title="End Time", type = input.time, defval = timestamp("01 Jan 2022 00:00 +0000"))

slowEMALength = input(title="Slow EMA Length", type = input.integer, defval = 55)

middleEMALength = input(title="Middle EMA Length", type = input.integer, defval = 21)

fastEMALength = input(title="Fast EMA Length", type = input.integer, defval = 9)

trendMALength = input(title="Trend indicator MA Length", type = input.integer, defval = 200)

atrLength = input(title="ATR Length", type = input.integer, defval = 14)

tpATRMult = input(title="Take profit ATR multiplier", type = input.integer, defval = 3)

slATRMult = input(title="Stop loss ATR multiplier", type = input.integer, defval = 2)

rsiLength = input(title="RSI Length", type = input.integer, defval = 14)

// Indicators

slowEMA = ema(close, slowEMALength)

middEMA = ema(close, middleEMALength)

fastEMA = ema(close, fastEMALength)

atr = atr(atrLength)

rsiValue = rsi(close, rsiLength)

isRsiOB = rsiValue >= 80

isRsiOS = rsiValue <= 20

sma200 = sma(close, trendMALength)

inDateRange = true

// Plotting

plot(slowEMA, title="Slow EMA", color=color.red, linewidth=2, transp=50)

plot(middEMA, title="Middle EMA", color=color.orange, linewidth=2, transp=50)

plot(fastEMA, title="Fast EMA", color=color.green, linewidth=2, transp=50)

plot(sma200, title="SMA Trend indicator", color=color.purple, linewidth=3, transp=10)

plotshape(isRsiOB, title="Overbought", location=location.abovebar, color=color.red, transp=0, style=shape.triangledown, text="OB")

plotshape(isRsiOS, title="Oversold", location=location.belowbar, color=color.green, transp=0, style=shape.triangledown, text="OS")

float takeprofit = na

float stoploss = na

var line tpline = na

var line slline = na

if strategy.position_size != 0

takeprofit := takeprofit[1]

stoploss := stoploss[1]

line.set_x2(tpline, bar_index)

line.set_x2(slline, bar_index)

line.set_extend(tpline, extend.none)

line.set_extend(slline, extend.none)

// STRATEGY

goLong = crossover(middEMA, slowEMA) and inDateRange

closeLong = crossunder(fastEMA, middEMA) and inDateRange

if goLong

takeprofit := close + atr * tpATRMult

stoploss := close - atr * slATRMult

// tpline := line.new(bar_index, takeprofit, bar_index, takeprofit, color=color.green, width=2, extend=extend.right, style=line.style_dotted)

// slline := line.new(bar_index, stoploss, bar_index, stoploss, color=color.red, width=2, extend=extend.right, style=line.style_dotted)

// label.new(bar_index, takeprofit, "TP", style=label.style_labeldown)

// label.new(bar_index, stoploss, "SL", style=label.style_labelup)

strategy.entry("Long", strategy.long, when = goLong)

strategy.exit("TP/SL", "Long", stop=stoploss, limit=takeprofit)

if closeLong

takeprofit := na

stoploss := na

strategy.close(id = "Long", when = closeLong)

if (not inDateRange)

strategy.close_all()

Detail

https://www.fmz.com/strategy/440957

Last Modified

2024-02-04 10:38:42