Name

交易心理控制均衡策略Trading-Psychology-Balancing-Strategy

Author

ChaoZhang

Strategy Description

此策略的目的是通过设置不同的参数,平衡交易者的心理和交易表现,以获得更稳定的回报。它使用均线、布林带、Keltner通道等指标判断市场趋势和波动率,结合PSAR指标判断反转信号,采用TTM挤压指标判断动量。交易信号由这些指标组合产生。同时,策略采用高低止损和风险回报止盈方式管理风险。

该策略的主要逻辑如下:

-

判断趋势:采用EMA均线判断价格趋势方向,价格在EMA上方为涨势,下方为跌势

-

判断反转:采用PSAR判断价格反转点。PSAR点出现在价格上方为看涨信号,出现在价格下方为看跌信号

-

判断动量:采用TTM Squeeze指标判断市场的波动率和动量。TTM Squeeze指标通过比较布林带和Keltner通道的宽度来测量波动率,挤压意味着波动率极低。挤压解除则意味着波动率增加和价格即将产生较大方向性移动的信号

-

产生交易信号:当价格上穿EMA均线、PSAR点,并且TTM Squeeze 指标解除挤压时,产生看多信号;当价格下穿EMA均线、PSAR点,并且TTM Squeeze指标进入挤压时,产生看空信号

-

止损方式:采用高低点止损。根据最近一定周期的最高价或最低价乘以设置倍数作为止损点

-

止盈方式:采用风险回报比自动止盈。根据止损点距离当前价的比率乘以设置的风险回报比参数得到止盈点

通过参数设置,可以控制交易频率、仓位管理、止损点位和止盈点位,平衡交易心理。

该策略具有以下优势:

-

多指标判断,提高信号准确率

-

反转为主,顺势为辅,捕捉反转点,减少冲高杀跌、冲低杀涨的概率

-

TTMSqueeze 指标可有效判断趋势中的调整,避免调整期无效交易

-

高低止损方式简单实用,可根据市场调整止损距离

-

风险回报比止盈方式将盈亏比例关系数值化,便于调整

-

各种参数设置灵活,可根据个人风险偏好微调

该策略也存在以下风险:

-

多指标组合判断,虽提高信号准确度,但也增加了跳过 Entry 点位的可能

-

反转为主的策略,在趋势行情中表现可能不佳

-

高低止损有时会被突破,无法全面规避风险

-

风险回报比止盈也可能因价格跳空或调整失效

-

参数设置不当可能导致亏损或频繁停损

该策略可从以下方面进行优化:

-

添加或调整指标权重,使信号更准确

-

优化反转和趋势判断的指标参数,提高获利概率

-

优化高低止损的参数,使止损更合理

-

测试不同的风险回报比例,取得最优结果

-

调整仓位数参数,降低单笔损失的影响

该策略整体来说,通过指标集合判断和参数调整,能够有效平衡交易心理,获得稳定的正收益。虽然仍有一定改进空间,但已具备实盘应用价值。通过市场反馈和参数微调,这一策略有望成为控制交易心理、获得长期稳定盈利的有效工具。

||

The goal of this strategy is to balance the psychology and performance of traders through adjusting various parameters, in order to obtain more steady returns. It uses indicators like moving averages, Bollinger Bands and Keltner Channels to determine market trends and volatility, together with the PSAR indicator to identify reversal signals. The TTM Squeeze indicator is leveraged to gauge momentum. Trading signals are generated through the combination of these indicators. In the meantime, risks are managed via the high-low stop loss and risk-reward take profit methods.

The core logic of this strategy is as follows:

-

Judge trends: the EMA moving average is used to determine the direction of price trends. Prices above EMA signify uptrends while prices below EMA indicate downtrends.

-

Identify reversals: the PSAR indicator spots price reversal points. PSAR dots appearing above prices signal longs while dots emerging below prices call for shorts.

-

Gauge momentum: the TTM Squeeze indicator measures market volatility and momentum. It compares Bollinger Bands and Keltner Channels to quantify volatility squeezes and surges. Squeeze implies extremely low volatility while a squeeze release signals an impending large directional price move.

-

Generate trading signals: long signals are triggered when prices crossover above the EMA line and PSAR dots, accompanied by a TTM Squeeze release. Short signals occur when prices crossover below the EMA and PSAR, together with a TTM Squeeze triggering.

-

Stop loss method: the high-low stop loss bases stop levels on recent high/low prices multiplied by a set factor.

-

Take profit method: the risk-reward take profit automatically calculates profit targets based on the stop loss distance from current prices multiplied by a preset risk-reward ratio.

The various parameters allow traders to balance psychology by controlling trade frequency, position sizing, stop loss levels and take profit points.

The main edges of this strategy include:

-

Higher signal accuracy from multiple indicator consensus

-

Mainly reversal-focused, reduces likelihood of false breakout fades

-

TTM Squeeze gauges consolidations to avoid ineffective trades

-

Simple and adjustable high-low stop loss

-

Risk-reward take profit quantifies profit ratio for easy tuning

-

Flexible parameters to match personal risk preferences

The risks of the strategy consist of:

-

Increased chance of missing entry signals from multiple indicators

-

Underperformance in persistent trending markets

-

Occasional stop loss breaches beyond expectations

-

Potential invalidation of risk-reward exits by price whipsaws

-

Inappropriate parameter tuning may lead to losses or over-stopping out

Possible improvement areas cover:

-

Add or adjust indicator weights for higher signal accuracy

-

Optimize reversal and trend parameters for better profit capture

-

Refine high-low stop loss levels for maximized effectiveness

-

Test different risk-reward ratios for optimum results

-

Adjust position sizing to minimize single-trade loss impacts

In summary, through indicator combos and tunable settings, this strategy is capable of balancing trading psychology and securing steady positive results. Despite some remaining upside, it has already demonstrated practical applicability. Further live market feedback and calibration will likely enhance it into an effective tool for managing emotions and achieving long-term stable profits.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_source_1_close | 0 | (?General)Choose Source: close |

| v_input_bool_1 | true | Show Signal Labels? |

| v_input_bool_2 | false | Is PSAR Adaptive? |

| v_input_float_1 | 0.98 | (?High Low Stop Loss)Multiplier |

| v_input_float_2 | 0.98 | Backup Multiplier |

| v_input_int_1 | 20 | Lookback |

| v_input_float_3 | 1.125 | (?Automatic High Low Take Profit)Risk Reward Ratio |

| v_input_int_2 | 100 | (?EMA)Length |

| v_input_int_3 | 20 | (?TTM Squeeze)Length |

| v_input_float_4 | 0.02 | (?PSAR)Start |

| v_input_float_5 | 0.02 | Increment |

| v_input_float_6 | 0.2 | Max |

| v_input_float_7 | 0.02 | (?Adaptive PSAR)Starting Acceleration Factor |

| v_input_float_8 | false | Min Step |

| v_input_float_9 | 0.02 | Max Step |

| v_input_float_10 | 0.2 | Max Acceleration Factor |

| v_input_string_1 | 0 | HiLo Mode: On |

| v_input_string_2 | 0 | Adaptive Mode: Kaufman |

| v_input_int_4 | 5 | Adaptive Smoothing Period |

| v_input_float_11 | false | Filter in Pips |

| v_input_float_12 | false | Min Change in Pips |

| v_input_string_3 | 0 | Signal Mode: Only Stops |

Source (PineScript)

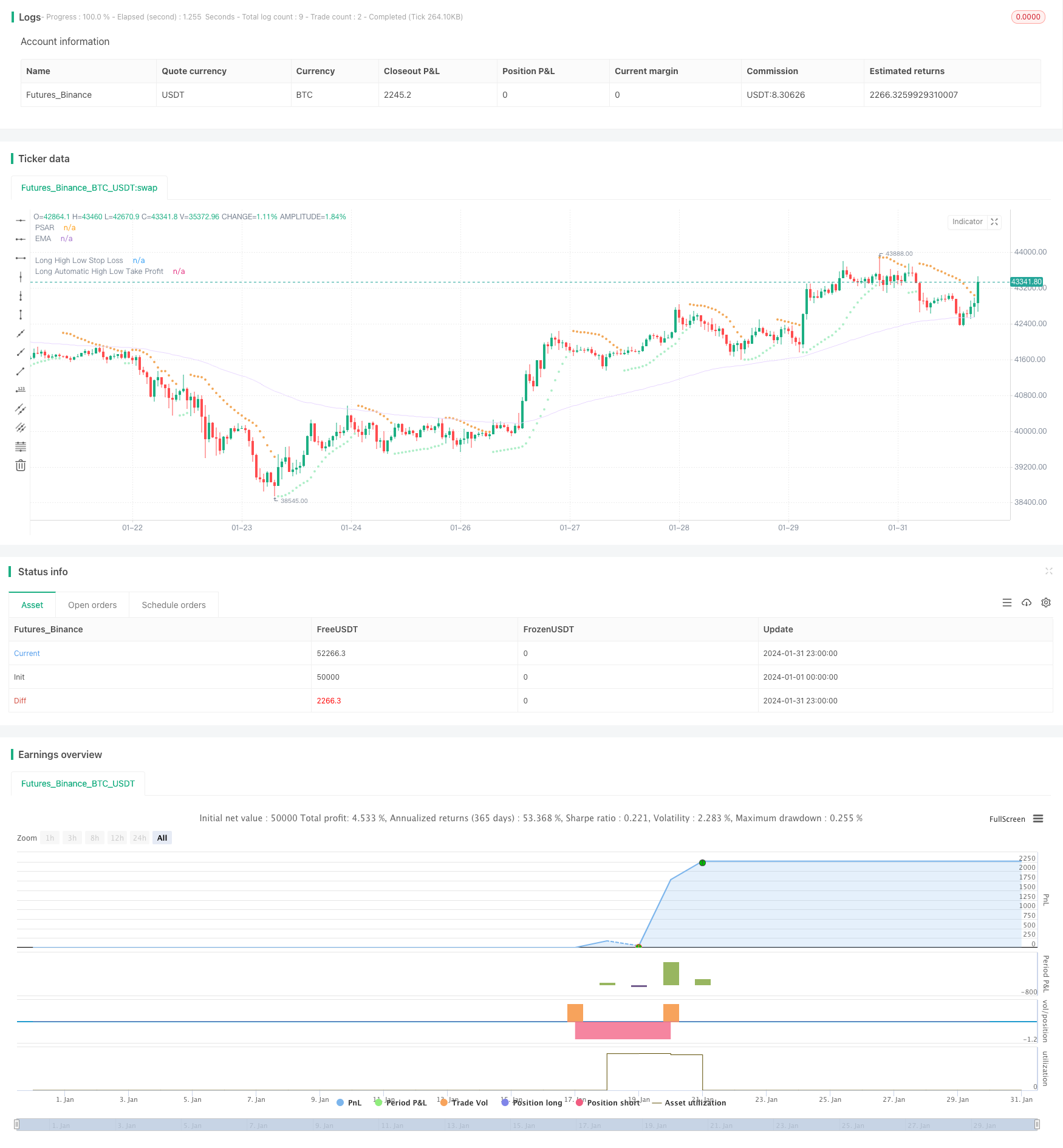

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © simwai

strategy('Octopus Nest Strategy ?', shorttitle='?', overlay=true )

// -- Colors --

color maximumYellowRed = color.rgb(255, 203, 98) // yellow

color rajah = color.rgb(242, 166, 84) // orange

color magicMint = color.rgb(171, 237, 198)

color languidLavender = color.rgb(232, 215, 255)

color maximumBluePurple = color.rgb(181, 161, 226)

color skyBlue = color.rgb(144, 226, 244)

color lightGray = color.rgb(214, 214, 214)

color quickSilver = color.rgb(163, 163, 163)

color mediumAquamarine = color.rgb(104, 223, 153)

color carrotOrange = color.rgb(239, 146, 46)

// -- Inputs --

float src = input.source(close, 'Choose Source', group='General', inline='1')

bool isSignalLabelEnabled = input.bool(title='Show Signal Labels?', defval=true, group='General', inline='2')

bool isPsarAdaptive = input.bool(title='Is PSAR Adaptive?', defval=false, group='General', inline='2')

float highLowStopLossMultiplier = input.float(defval=0.98, step=0.01, minval=0, maxval=1, title='Multiplier', group='High Low Stop Loss', inline='1')

float highLowStopLossBackupMultiplier = input.float(defval=0.98, step=0.01, minval=0, maxval=1, title='Backup Multiplier', group='High Low Stop Loss', inline='1')

int highLowStopLossLookback = input.int(defval=20, step=5, minval=1, title='Lookback', group='High Low Stop Loss', inline='2')

float automaticHighLowTakeProfitRatio = input.float(defval=1.125, step=0.1, minval=0, title='Risk Reward Ratio', group='Automatic High Low Take Profit', inline='2')

int emaLength = input.int(100, minval=2, title='Length', group='EMA', inline='1')

int ttmLength = input.int(title='Length', defval=20, minval=0, group='TTM Squeeze', inline='1')

float psarStart = input.float(0.02, 'Start', step=0.01, minval=0.0, group='PSAR', inline='1')

float psarInc = input.float(0.02, 'Increment', step=0.01, minval=0.01, group='PSAR', inline='1')

float psarMax = input.float(0.2, 'Max', step=0.05, minval=0.0, group='PSAR', inline='2')

startAFactor = input.float(0.02, 'Starting Acceleration Factor', step = 0.001, group='Adaptive PSAR', inline='1')

minStep = input.float(0.0, 'Min Step', step = 0.001, group='Adaptive PSAR', inline='1')

maxStep = input.float(0.02, 'Max Step', step = 0.001, group='Adaptive PSAR', inline='2')

maxAFactor = input.float(0.2, 'Max Acceleration Factor', step = 0.001, group='Adaptive PSAR', inline='2')

hiloMode = input.string('On', 'HiLo Mode', options = ['Off', 'On'], group='Adaptive PSAR')

adaptMode = input.string('Kaufman', 'Adaptive Mode', options = ['Off', 'Kaufman', 'Ehlers'], group='Adaptive PSAR')

adaptSmth = input.int(5, 'Adaptive Smoothing Period', minval = 1, group='Adaptive PSAR')

filt = input.float(0.0, 'Filter in Pips', group='Adaptive PSAR', minval = 0)

minChng = input.float(0.0, 'Min Change in Pips', group='Adaptive PSAR', minval = 0)

SignalMode = input.string('Only Stops', 'Signal Mode', options = ['Only Stops', 'Signals & Stops'], group='Adaptive PSAR')

// -- Functions --

tr(_high, _low, _close) => math.max(_high - _low, math.abs(_high - _close[1]), math.abs(_low - _close[1]))

// -- Calculation --

var string lastTrade = 'initial'

float _low = low

float _high = high

float _close = close

// -- TTM Squeeze – Credits to @Greeny --

bband(ttmLength, mult) =>

ta.sma(src, ttmLength) + mult * ta.stdev(src, ttmLength)

keltner(ttmLength, mult) =>

ta.ema(src, ttmLength) + mult * ta.ema(tr(_high, _low, _close), ttmLength)

e1 = (ta.highest(_high, ttmLength) + ta.lowest(_low, ttmLength)) / 2 + ta.sma(src, ttmLength)

osc = ta.linreg(src - e1 / 2, ttmLength, 0)

diff = bband(ttmLength, 2) - keltner(ttmLength, 1)

osc_color = osc[1] < osc[0] ? osc[0] >= 0 ? #00ffff : #cc00cc : osc[0] >= 0 ? #009b9b : #ff9bff

mid_color = diff >= 0 ? color.green : color.red

// -- PSAR --

// Credits to @Bjorgum

calcBaseUnit() =>

bool isForexSymbol = syminfo.type == 'forex'

bool isYenPair = syminfo.currency == 'JPY'

float result = isForexSymbol ? isYenPair ? 0.01 : 0.0001 : syminfo.mintick

// Credits to @loxx

_afact(mode,input, per, smooth) =>

eff = 0., seff = 0.

len = 0, sum = 0., max = 0., min = 1000000000.

len := mode == 'Kaufman' ? math.ceil(per) : math.ceil(math.max(20, 5 * per))

for i = 0 to len

if (mode == 'Kaufman')

sum += math.abs(input[i] - input[i + 1])

else

max := input[i] > max ? input[i] : max

min := input[i] < min ? input[i] : min

if (mode == 'Kaufman' and sum != 0)

eff := math.abs(input - input[len]) / sum

else

if (mode == 'Ehlers' and (max - min) > 0)

eff := (input - min) / (max - min)

seff := ta.ema(eff, smooth)

seff

hVal2 = nz(high[2]), hVal1 = nz(high[1]), hVal0 = high

lowVal2 = nz(low[2]), lowVal1 = nz(low[1]), lowVal0 = low

hiprice2 = nz(high[2]), hiprice1 = nz(high[1]), hiprice0 = high

loprice2 = nz(low[2]), loprice1 = nz(low[1]), loprice0 = low

upSig = 0., dnSig = 0.

aFactor = 0., step = 0., trend = 0.

upTrndSAR = 0., dnTrndSAR = 0.

length = (2 / maxAFactor - 1)

if (hiloMode == 'On')

hiprice0 := high

loprice0 := low

else

hiprice0 := src

loprice0 := hiprice0

if bar_index == 1

trend := 1

hVal1 := hiprice1

hVal0 := math.max(hiprice0, hVal1)

lowVal1 := loprice1

lowVal0 := math.min(loprice0, lowVal1)

aFactor := startAFactor

upTrndSAR := lowVal0

dnTrndSAR := 0.

else

hVal0 := hVal1

lowVal0 := lowVal1

trend := nz(trend[1])

aFactor := nz(aFactor[1])

inputs = 0.

inprice = src

if (adaptMode != 'Off')

if (hiloMode == 'On')

inprice := src

else

inprice := hiprice0

if (adaptMode == 'Kaufman')

inputs := inprice

else

if (adaptMode == 'Ehlers')

if (nz(upTrndSAR[1]) != 0.)

inputs := math.abs(inprice - nz(upTrndSAR[1]))

else

if (nz(dnTrndSAR[1]) != 0.)

inputs := math.abs(inprice - nz(dnTrndSAR[1]))

step := minStep + _afact(adaptMode, inputs, length, adaptSmth) * (maxStep - minStep)

else

step := maxStep

upTrndSAR := 0., dnTrndSAR := 0., upSig := 0., dnSig := 0.

if (nz(trend[1]) > 0)

if (nz(trend[1]) == nz(trend[2]))

aFactor := hVal1 > hVal2 ? nz(aFactor[1]) + step : aFactor

aFactor := aFactor > maxAFactor ? maxAFactor : aFactor

aFactor := hVal1 < hVal2 ? startAFactor : aFactor

else

aFactor := nz(aFactor[1])

upTrndSAR := nz(upTrndSAR[1]) + aFactor * (hVal1 - nz(upTrndSAR[1]))

upTrndSAR := upTrndSAR > loprice1 ? loprice1 : upTrndSAR

upTrndSAR := upTrndSAR > loprice2 ? loprice2 : upTrndSAR

else

if (nz(trend[1]) == nz(trend[2]))

aFactor := lowVal1 < lowVal2 ? nz(aFactor[1]) + step : aFactor

aFactor := aFactor > maxAFactor ? maxAFactor : aFactor

aFactor := lowVal1 > lowVal2 ? startAFactor : aFactor

else

aFactor := nz(aFactor[1])

dnTrndSAR := nz(dnTrndSAR[1]) + aFactor * (lowVal1 - nz(dnTrndSAR[1]))

dnTrndSAR := dnTrndSAR < hiprice1 ? hiprice1 : dnTrndSAR

dnTrndSAR := dnTrndSAR < hiprice2 ? hiprice2 : dnTrndSAR

hVal0 := hiprice0 > hVal0 ? hiprice0 : hVal0

lowVal0 := loprice0 < lowVal0 ? loprice0 : lowVal0

if (minChng > 0)

if (upTrndSAR - nz(upTrndSAR[1]) < minChng * calcBaseUnit() and upTrndSAR != 0. and nz(upTrndSAR[1]) != 0.)

upTrndSAR := nz(upTrndSAR[1])

if (nz(dnTrndSAR[1]) - dnTrndSAR < minChng * calcBaseUnit() and dnTrndSAR != 0. and nz(dnTrndSAR[1]) != 0.)

dnTrndSAR := nz(dnTrndSAR[1])

dnTrndSAR := trend < 0 and dnTrndSAR > nz(dnTrndSAR[1]) ? nz(dnTrndSAR[1]) : dnTrndSAR

upTrndSAR := trend > 0 and upTrndSAR < nz(upTrndSAR[1]) ? nz(upTrndSAR[1]) : upTrndSAR

if (trend < 0 and hiprice0 >= dnTrndSAR + filt * calcBaseUnit())

trend := 1

upTrndSAR := lowVal0

upSig := SignalMode == 'Signals & Stops' ? lowVal0 : upSig

dnTrndSAR := 0.

aFactor := startAFactor

lowVal0 := loprice0

hVal0 := hiprice0

else if (trend > 0 and loprice0 <= upTrndSAR - filt * calcBaseUnit())

trend := -1

dnTrndSAR := hVal0

dnSig := SignalMode == 'Signals & Stops' ? hVal0 : dnSig

upTrndSAR := 0.

aFactor := startAFactor

lowVal0 := loprice0

hVal0 := hiprice0

psar = upTrndSAR > 0 ? upTrndSAR : dnTrndSAR

psar := isPsarAdaptive ? psar : ta.sar(psarStart, psarInc, psarMax)

plot(psar, title='PSAR', color=src < psar ? rajah : magicMint, style=plot.style_circles)

// -- EMA --

float ema = ta.ema(src, emaLength)

plot(ema, title='EMA', color=languidLavender)

// -- Signals --

var string isTradeOpen = ''

var string signalCache = ''

bool enterLong = src > ema and ta.crossover(src, psar) and ta.crossover(osc, 0)

bool enterShort = src < ema and ta.crossunder(src, psar) and ta.crossunder(osc, 0)

// bool exitLong = ta.crossunder(src, ema)

// bool exitShort = ta.crossover(src, ema)

if (signalCache == 'long entry')

signalCache := ''

enterLong := true

else if (signalCache == 'short entry')

signalCache := ''

enterShort := true

if (isTradeOpen == '')

if (enterLong)

isTradeOpen := 'long'

else if (enterShort)

isTradeOpen := 'short'

else if (isTradeOpen == 'long')

if (enterLong)

enterLong := false

else if (isTradeOpen == 'short')

if (enterShort)

enterShort := false

plotshape((isSignalLabelEnabled and enterLong and (isTradeOpen == 'long')) ? psar : na, title='LONG', text='L', style=shape.labelup, color=mediumAquamarine, textcolor=color.white, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and enterShort and (isTradeOpen == 'short')) ? psar : na, title='SHORT', text='S', style=shape.labeldown, color=carrotOrange, textcolor=color.white, size=size.tiny, location=location.absolute)

// -- High Low Stop Loss and Take Profit --

bool isHighLowStopLossEnabled = true

bool isAutomaticHighLowTakeProfitEnabled = true

bool recalculateStopLossTakeProfit = false

bool isStrategyEntryEnabled = false

bool isLongEnabled = true

bool isShortEnabled = true

bool isStopLossTakeProfitRecalculationEnabled = true

bool longStopLossTakeProfitRecalculation = isStopLossTakeProfitRecalculationEnabled ? true : (lastTrade == 'short' or lastTrade == 'initial')

bool shortStopLossTakeProfitRecalculation = isStopLossTakeProfitRecalculationEnabled ? true : (lastTrade == 'long' or lastTrade == 'initial')

var float longHighLowStopLoss = 0

var float shortHighLowStopLoss = 0

float highLowStopLossLowest = ta.lowest(_low, highLowStopLossLookback)

float highLowStopLossHighest = ta.highest(_high, highLowStopLossLookback)

if (isHighLowStopLossEnabled)

if (((enterLong and longStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

if (highLowStopLossLowest == _low)

longHighLowStopLoss := _high * highLowStopLossBackupMultiplier

else if (highLowStopLossLowest > 0)

longHighLowStopLoss := highLowStopLossLowest * highLowStopLossMultiplier

if (((enterShort and shortStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size < 0) : true))

if (highLowStopLossHighest == _high)

shortHighLowStopLoss := _high * (1 + (1 - highLowStopLossBackupMultiplier))

else if (highLowStopLossHighest > 0)

shortHighLowStopLoss := highLowStopLossHighest * (1 + (1 - highLowStopLossMultiplier))

plot((isLongEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'long')) ? longHighLowStopLoss : na, 'Long High Low Stop Loss', color=magicMint, style=plot.style_circles, trackprice=false)

plot((isShortEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'short')) ? shortHighLowStopLoss : na, 'Short High Low Stop Loss ', color=rajah, style=plot.style_circles, trackprice=false)

// -- Automatic High Low Take Profit --

var float longAutomaticHighLowTakeProfit = na

var float shortAutomaticHighLowTakeProfit = na

if (isAutomaticHighLowTakeProfitEnabled)

if (((enterLong and longStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

longHighLowStopLossPercentage = 1 - (longHighLowStopLoss / _close)

longAutomaticHighLowTakeProfit := _close * (1 + (longHighLowStopLossPercentage * automaticHighLowTakeProfitRatio))

if (((enterShort and shortStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

shortHighLowStopLossPercentage = 1 - (_close / shortHighLowStopLoss)

shortAutomaticHighLowTakeProfit := _close * (1 - (shortHighLowStopLossPercentage * automaticHighLowTakeProfitRatio))

plot((isAutomaticHighLowTakeProfitEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'long')) ? longAutomaticHighLowTakeProfit : na, 'Long Automatic High Low Take Profit', color=magicMint, style=plot.style_circles, trackprice=false)

plot((isAutomaticHighLowTakeProfitEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'short')) ? shortAutomaticHighLowTakeProfit : na, 'Short Automatic High Low Take Profit', color=rajah, style=plot.style_circles, trackprice=false)

// log.info('Automatic Long High Low Take Profit: ' + str.tostring(longAutomaticHighLowTakeProfit))

// log.info('Automatic Short High Low Take Profit: ' + str.tostring(shortAutomaticHighLowTakeProfit))

// log.info('Long High Low Stop Loss: ' + str.tostring(longHighLowStopLoss))

// log.info('Short High Low Stop Loss: ' + str.tostring(shortHighLowStopLoss))

bool longHighLowStopLossCondition = ta.crossunder(_close, longHighLowStopLoss)

bool shortHighLowStopLossCondition = ta.crossover(_close, shortHighLowStopLoss)

bool longAutomaticHighLowTakeProfitCondition = ta.crossover(_close, longAutomaticHighLowTakeProfit)

bool shortAutomaticHighLowTakeProfitCondition = ta.crossunder(_close, shortAutomaticHighLowTakeProfit)

bool exitLong = (longHighLowStopLossCondition or longAutomaticHighLowTakeProfitCondition) and strategy.position_size > 0

bool exitShort = (shortHighLowStopLossCondition or shortAutomaticHighLowTakeProfitCondition) and strategy.position_size < 0

plotshape((isSignalLabelEnabled and exitLong and (isTradeOpen == 'long')) ? psar : na, title='LONG EXIT', style=shape.circle, color=magicMint, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and exitShort and (isTradeOpen == 'short')) ? psar : na, title='SHORT EXIT', style=shape.circle, color=rajah, size=size.tiny, location=location.absolute)

// Long Exits

if (exitLong)

strategy.close('long', comment=longAutomaticHighLowTakeProfitCondition ? 'EXIT_LONG_TP' : 'EXIT_LONG_SL')

isTradeOpen := ''

// Short Exits

if (exitShort)

strategy.close('short', comment=shortAutomaticHighLowTakeProfitCondition ? 'EXIT_SHORT_TP' : 'EXIT_SHORT_SL')

isTradeOpen := ''

// Long Entries

if (enterLong and (strategy.position_size == 0))

strategy.entry('long', strategy.long, comment='ENTER_LONG')

// Short Entries

if (enterShort and (strategy.position_size == 0))

strategy.entry('short', strategy.short, comment='ENTER_SHORT')

// Save last trade state

if (enterLong or exitLong)

lastTrade := 'long'

if (enterShort or exitShort)

lastTrade := 'short'

barcolor(color=isTradeOpen == 'long' ? mediumAquamarine : isTradeOpen == 'short' ? carrotOrange : na)

Detail

https://www.fmz.com/strategy/442372

Last Modified

2024-02-21 14:33:04