Name

动态再入场买入策略Dynamic-Re-entry-Buy-only-Strategy

Author

ChaoZhang

Strategy Description

该策略是一个仅买入的交易系统,基于移动平均线交叉和周期商品通道指数(CCI)或周期平均方向指数(ADX)生成买入信号。当快速移动平均线上穿慢速移动平均线并且周期CCI和/或周期ADX满足特定条件时,产生买入信号。

该策略还允许动态再入场,这意味着如果价格再次上穿三条移动平均线,可以打开新的多头头寸。然而,如果价格收盘价跌破第三条移动平均线,该策略将平掉多头头寸。

脚本定义了生成买入信号的条件。它检查两个条件来判断一个有效的买入信号:

- 快速移动平均线上穿慢速移动平均线

- 用户可以选择使用滤波器:周期CCI或周期ADX

动态再入场: 如果没有未平仓的多头头寸且价格高于三条移动平均线,则打开新的多头头寸。

退出条件: 如果收盘价跌破第三条移动平均线,该策略将平掉多头头寸。

该策略具有以下优势:

- 采用多种技术指标过滤信号,可以减少错误信号

- 动态再入场机制可以最大限度捕捉趋势

- 只做多,避免做空的风险

该策略也存在以下风险:

- 会有一定的空转风险

- 多头持仓时间可能过长,需要设定止损

- 参数设置不当可能导致过于频繁交易

对应解决方法:

- 采用更佳的参数组合和技术指标组合滤波

- 设置合理的止损位

- 调整参数,确保参数稳定

该策略可以从以下几个方面进行优化:

- 测试更多技术指标的组合,寻找更好的买入时机

- 对参数进行优化,找到最佳参数组合

- 增加止损机制,控制单笔损失

- 增加仓位数管理,根据市场情况加大或减小仓位

该动态再入场买入策略整合多种技术指标判断买入时机,并采用动态再入场设计,可实时跟踪趋势;同时仅做多避免做空带来的额外风险。通过参数优化、止损设定以及仓位管理,可以将该策略运用于实盘交易中,控制风险的同时获取超额收益。

||

This strategy is a buy-only trading system that generates buy signals based on moving average crossovers and the Weekly Commodity Channel Index (CCI) or Weekly Average Directional Index (ADX). It produces buy signals when the fast moving average crosses above the slow moving average and when the Weekly CCI and/or Weekly ADX meet specified conditions.

The strategy also allows for dynamic re-entry, which means it can open new long positions if the price goes above the three moving averages after an exit. However, the strategy will exit the long position if the price closes below the third moving average.

The script defines the conditions for generating buy signals. It checks two conditions for a valid buy signal:

- The fast moving average crosses above the slow moving average

- The user can choose to filter trades using Weekly CCI or Weekly ADX

Dynamic Re-entry: If there is no active long position and the price is above all three moving averages, a new long position is opened.

Exit Condition: If the closing price drops below the third moving average, the script closes the long position.

The advantages of this strategy include:

- Using multiple technical indicators to filter signals reduces false signals

- The dynamic re-entry mechanism maximizes the capture of trends

- Being long-only avoids the risks of shorting

The risks of this strategy include:

- There is some risk of whipsaws

- Long holding times could be too long, requiring stops

- Poor parameter settings may cause too frequent trading

Solutions:

- Use better parameter combinations and indicator combinations to filter

- Set reasonable stop losses

- Adjust parameters to ensure stability

This strategy can be optimized by:

- Testing more technical indicator combinations to find better entry timing

- Optimizing parameters to find the best parameter combinations

- Adding stop loss mechanisms to control single loss

- Adding position sizing to increase/decrease positions based on market conditions

This dynamic re-entry buy-only strategy integrates multiple technical indicators to determine entry timing and adopts a dynamic re-entry design to track trends in real-time. Being long-only avoids shorting risks. Through parameter optimization, stop losses, and position sizing, this strategy can be implemented in live trading to control risk while capturing excess returns.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 20 | Fast Moving Average Length |

| v_input_2 | 30 | Slow Moving Average Length |

| v_input_3 | 100 | Third Moving Average Length |

| v_input_4 | 14 | CCI Period for Weekly CCI |

| v_input_5 | true | Use CCI for Entry |

| v_input_6 | true | Use ADX for Entry |

| v_input_7 | 14 | ADX Length |

| v_input_8 | 25 | ADX Threshold |

Source (PineScript)

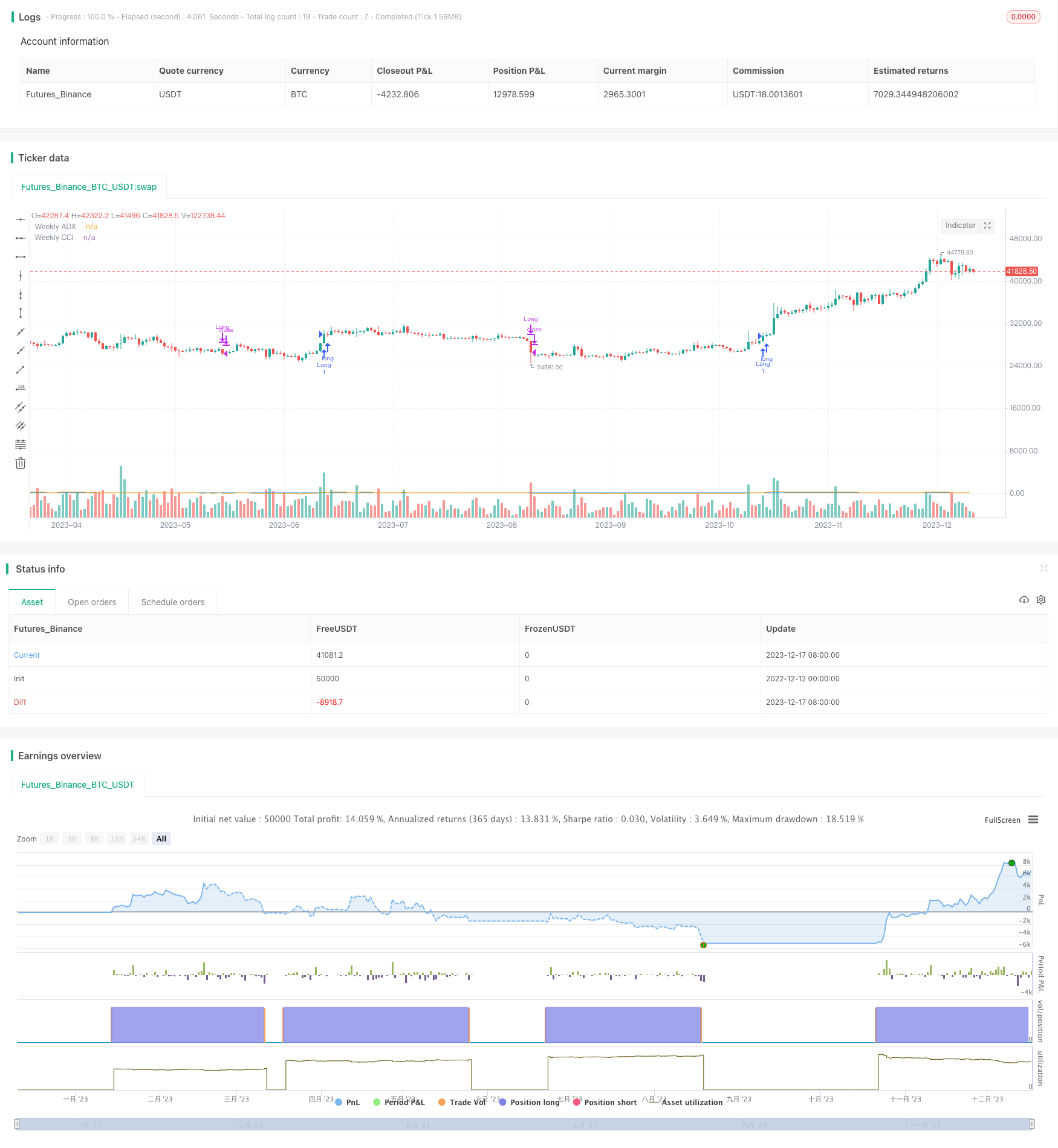

/*backtest

start: 2022-12-12 00:00:00

end: 2023-12-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy Only Strategy with Dynamic Re-Entry and Exit", overlay=true)

// Input Parameters

fast_length = input(20, title="Fast Moving Average Length")

slow_length = input(30, title="Slow Moving Average Length")

third_ma_length = input(100, title="Third Moving Average Length")

cci_period = input(14, title="CCI Period for Weekly CCI")

use_cci = input(true, title="Use CCI for Entry")

use_adx = input(true, title="Use ADX for Entry")

adx_length = input(14, title="ADX Length")

adx_threshold = input(25, title="ADX Threshold")

// Calculate Moving Averages

fast_ma = ta.sma(close, fast_length)

slow_ma = ta.sma(close, slow_length)

third_ma = ta.sma(close, third_ma_length)

// Weekly Commodity Channel Index (CCI) with user-defined period

weekly_cci = request.security(syminfo.tickerid, "W", ta.cci(close, cci_period))

// Weekly Average Directional Index (ADX)

dirmov = hlc3

plus = ta.change(dirmov) > 0 ? ta.change(dirmov) : 0

minus = ta.change(dirmov) < 0 ? -ta.change(dirmov) : 0

trur = ta.rma(ta.tr, adx_length)

plusDI = ta.rma(plus, adx_length) / trur * 100

minusDI = ta.rma(minus, adx_length) / trur * 100

sum = plusDI + minusDI

DX = sum == 0 ? 0 : math.abs(plusDI - minusDI) / sum * 100

ADX = ta.rma(DX, adx_length)

// Entry Conditions (Buy Only and Weekly CCI > 100 and/or Weekly ADX > 25)

cci_condition = use_cci ? (weekly_cci > 100) : false

adx_condition = use_adx ? (ADX > adx_threshold) : false

long_condition = ta.crossover(fast_ma, slow_ma) and (cci_condition or adx_condition)

// Exit Condition and Dynamic Re-Entry

exit_condition = close < third_ma

re_entry_condition = close > fast_ma and close > slow_ma and close > third_ma and weekly_cci > 100

// Entry and Exit Signals

strategy.entry("Long", strategy.long, when=long_condition)

strategy.close("Long", when=exit_condition)

// Dynamic Re-Entry and Exit

if strategy.position_size == 0 and re_entry_condition

strategy.entry("Long", strategy.long)

if strategy.position_size > 0 and close < third_ma

strategy.close("Long")

// Plot Weekly CCI and ADX for reference

plot(weekly_cci, title="Weekly CCI", color=color.orange)

plot(ADX, title="Weekly ADX", color=color.blue)

Detail

https://www.fmz.com/strategy/435867

Last Modified

2023-12-19 13:56:55