Name

动态布林带时间范围选择策略Bollinger-Band-Strategy-with-Date-Range-Selection

Author

ChaoZhang

Strategy Description

本策略基于布林带指标实现了一个可以选择历史时间范围的动态布林带交易策略。该策略允许用户选择回测的开始和结束时间,从而实现不同时间段内的动态布林带策略回测和比较。

本策略名称为“动态布林带时间范围选择策略”。该名称包含了“动态布林带”和“时间范围选择”两个关键词,准确概括了本策略的主要功能。

本策略的核心原理是基于布林带指标的动态上下轨来产生交易信号。布林带中轨线为n日简单移动平均线,上轨线和下轨线分别为中轨线加上和减去m倍的n日标准差。当价格穿过下轨线时,作多头入场;当价格跌破上轨线时,进行空头入场。

本策略的另一个核心功能是允许选择策略的回测时间范围。策略提供了从月、日、年、时、分等多个维度选择回测开始和结束时间的输入参数。这使得用户可以选择不同的历史时间段来回测和验证策略效果,实现更全面和动态的策略分析。

具体来说,本策略通过timestamp()函数将选择的开始和结束时间转换为时间戳格式,再通过time>=start和time<=finish的条件来设置策略的有效回测时间窗口。这样就实现了动态的时间范围选择功能。

本策略最大的优势在于实现了动态布林带策略与任意时间范围选择的完美结合。这使得用户可以更加灵活和全面地回测和验证策略。具体优势如下:

-

实现动态布林带策略,可以捕捉市场涨跌时的趋势反转信号,适合趋势交易。

-

支持选择任意历史时间范围进行回测,可以分析不同市场环境下的策略表现,实现策略的动态优化。

-

结合布林带指标的自适应性,本策略可以自动调整参数,适应更广泛的市场环境的变化。

-

提供了长期和短期参数可调功能,用户可以根据自身需要进行参数优化,使策略更符合实际情况。

-

允许选择具体的小时和分钟进行回测,精度较高,可以进行更细致的策略分析。

-

支持中文和英文语言,用户体验良好。

本策略的主要风险在于布林带指标判断趋势反转的不确定性。具体风险点如下:

-

布林带指标本身对市场波动的判断并不完美,可能出现错误信号。

-

选择不当的布林带参数可能导致策略表现不佳甚至损失。

-

特殊市场环境下指标失效的可能性。

-

回测时间范围选择不当,可能忽略了某些重要的市场情况。

对于这些风险,可以通过以下方法加以控制和改进:

-

优化布林带参数,调整中轨线周期,适应不同品种和时段。

-

结合其他指标如移动均线进行确认,减少错误信号。

-

测试更多市场时间段,评估策略的稳健性。

-

设置止损点,控制单笔损失。

本策略还有以下几个主要的优化方向:

-

结合机器学习算法,实现布林带参数的动态优化。

-

增加基于突破回测等功能,全面评估参数设置的稳定性。

-

增加移动止损、跟踪止损等功能以锁定利润、降低风险。

-

优化入场逻辑,设置更多条件如交易量突增的确认。

-

结合股指期货套利等策略,扩大策略适用范围。

-

增加自动执行交易的功能,从回测向实盘优化过渡。

通过这些优化,可以大幅提升策略的实战效果和稳定盈利能力。

本策略成功实现了布林带策略与任意历史时间范围选择的有机结合。这种高度灵活与动态的回测分析功能,使得用户可以在不同市场环境下全面而精准地调整和优化策略参数。同时提供的可视化操作也极大地提高了用户体验。可以预见,本策略可以为用户提供强大和高效的量化交易工具。

||

This strategy implements a dynamic Bollinger Band trading strategy with selectable historical date ranges based on the Bollinger Band indicator. It allows users to choose the start and end times for backtesting, thereby enabling backtesting and comparison of the dynamic Bollinger Band strategy in different time periods.

The strategy is named "Bollinger Band Strategy with Date Range Selection". The name contains the keywords "Bollinger Band" and "Date Range Selection", accurately summarizing the main functions of this strategy.

The core principle of this strategy is to generate trading signals based on the dynamic upper and lower rails of the Bollinger Band indicator. The middle rail of the Bollinger Band is the n-day simple moving average, while the upper and lower rails are the middle rail plus and minus m times the n-day standard deviation respectively. When the price breaks through the lower rail, go long; when the price breaks the upper rail, go short.

Another core feature of this strategy is allowing users to select the backtesting time range. The strategy provides input parameters to select the start and end times for backtesting in multiple dimensions such as month, day, year, hour, minute, etc. This enables users to choose different historical time periods to backtest and validate the strategy, achieving more comprehensive and dynamic strategy analysis.

Specifically, this strategy converts the selected start and end times into timestamp format through the timestamp() function, and then sets the valid backtesting time window of the strategy through the conditions time>=start and time<=finish. This achieves the dynamic time range selection function.

The biggest advantage of this strategy is that it perfectly combines the dynamic Bollinger Band strategy with arbitrary time range selection. This allows users to backtest and verify strategies in a more flexible and comprehensive manner. The specific advantages are:

-

Implement dynamic Bollinger Band strategies that can capture trend reversal signals during market ups and downs for trend trading.

-

Support choosing arbitrary historical time ranges for backtesting to analyze strategy performance in different market environments, achieving dynamic optimization of strategies.

-

Combined with the adaptability of Bollinger Band indicators, this strategy can automatically adjust parameters to adapt to wider changes in market conditions.

-

Provide adjustable parameters for long-term and short-term use so users can optimize parameters according to their own needs to make strategies more practical.

-

Allow selection of specific hours and minutes for backtesting with higher accuracy for more detailed strategy analysis.

-

Support Chinese and English languages for good user experience.

The main risks of this strategy lie in the uncertainty of the Bollinger Bands indicator in determining trend reversals. The specific risk points are:

-

The Bollinger Bands indicator itself does not perfectly determine market fluctuations, and there may be false signals.

-

Inappropriate selection of Bollinger Bands parameters can lead to poor strategy performance or even losses.

-

Possibility of indicator failure in special market conditions.

-

Improper selection of backtest date range may miss some important market conditions.

The following methods can be used to control and improve these risks:

-

Optimize Bollinger Band parameters and adjust the cycle of the middle rail to adapt to different products and time periods.

-

Use other indicators such as moving average for confirmation to reduce false signals.

-

Test more market time periods to evaluate the robustness of the strategy.

-

Set stop loss points to control single loss.

There are several main directions to optimize this strategy:

-

Combine machine learning algorithms to achieve dynamic optimization of Bollinger Band parameters.

-

Increase functionality such as break-back testing to fully evaluate parameter stability.

-

Add functions like moving stop loss and tracking stop loss to lock in profits and reduce risks.

-

Optimize entry logic and set more confirming conditions such as surges in trading volumes.

-

Combine strategies like stock index futures arbitrage to expand the scope of strategy application.

-

Add auto trade execution functions for transitioning from backtesting to live trading.

These optimizations can greatly improve the practical performance and steady profitability of the strategy.

This strategy has successfully integrated the Bollinger Band strategy with arbitrary historical time range selection. Such highly flexible and dynamic backtesting analysis enables users to accurately adjust and optimize strategy parameters in different market environments. The provided visualization also greatly improves user experience. It is foreseeable that this strategy can provide users with powerful and efficient quantitative trading tools.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 7 | From Month |

| v_input_2 | 20 | From Day |

| v_input_3 | 2019 | From Year |

| v_input_4 | 17 | From Hour |

| v_input_5 | false | From Minute |

| v_input_6 | true | To Month |

| v_input_7 | true | To Day |

| v_input_8 | 9999 | To Year |

| v_input_9 | 23 | To Hour |

| v_input_10 | 59 | To Minute |

| v_input_11 | 20 | length |

| v_input_12 | 2 | mult |

Source (PineScript)

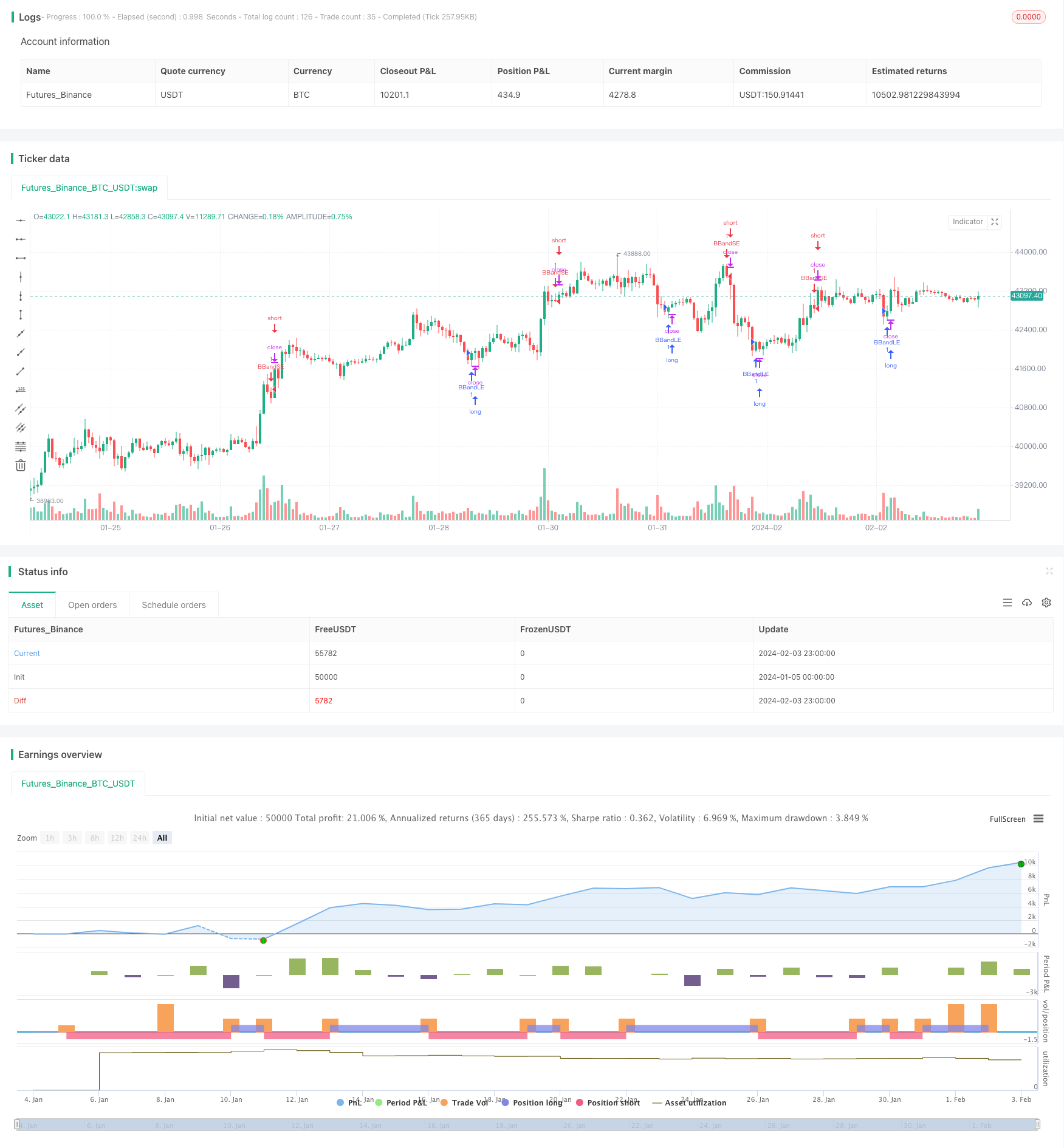

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("BB Range", shorttitle = "BB Range", overlay=true, max_bars_back=200)

// Revision: 1

// Author: @allanster

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 7, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 20, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2019, title = "From Year", minval = 2017)

FromHour = input(defval = 17, title = "From Hour", minval = 00)

FromMinute = input(defval = 00, title = "From Minute", minval = 00)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

ToHour = input(defval = 23, title = "To Hour", minval = 00)

ToMinute = input(defval = 59, title = "To Minute", minval = 00)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, FromHour, FromMinute) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, ToHour, ToMinute) // backtest finish window

window() => true

source = close

length = input(20, minval=1)

mult = input(2.0, minval=0.001, maxval=50)

basis = sma(source, length)

dev = mult * stdev(source, length)

upper = basis + dev

lower = basis - dev

upper_stop = upper * 1.05

lower_stop = lower * 0.95

buyEntry = crossover(source, lower)

sellEntry = crossunder(source, upper)

if (crossover(source, lower))

strategy.entry("BBandLE", strategy.long, stop=lower_stop, when = window(), oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if (crossunder(source, upper))

strategy.entry("BBandSE", strategy.short, stop=upper_stop, when=window(), oca_name="BollingerBands",comment="BBandSE")

else

strategy.cancel(id="BBandSE")

Detail

https://www.fmz.com/strategy/441104

Last Modified

2024-02-05 16:04:40