Name

动态移动平均线与克尔特通道交易策略Dynamic-Moving-Averages-and-Keltner-Channel-Trading-Strategy

Author

ChaoZhang

Strategy Description

概述: 本策略综合运用动态移动平均线、超级趋势指标、潜在支持与阻力位和克尔特通道,对价格变动进行多层次判断,实现自动化的趋势追踪交易。策略优点是交易信号生成清晰,胜率较高,同时结合风险管理措施,可控制单笔交易风险。

策略原理: 本策略运用动态移动平均线判断价格中短期趋势方向。具体来说,根据用户选择,脚本采用简单移动平均线或指数移动平均线。当最高价、最低价和收盘价均高于昨日时,判定为多头趋势;当最高价、最低价和收盘价均低于昨日时,判定为空头趋势。基于此,结合动态移动平均线的位置,生成买入和卖出信号。

此外,策略还运用超级趋势指标识别长期趋势。超级趋势指标结合平均真实波动幅度,当价格运行于上轨之上且昨日收盘价低于上轨时产生买入信号。当价格跌破下轨且昨日收盘价高于下轨时产生卖出信号。

为过滤假信号,本策略运用克尔特通道绘制通道上下轨。结合通道范围与超级趋势指标,可实现趋势追踪交易。具体来说,当价格由下向上突破上轨,且昨日收盘价低于上轨时产生强势买入信号;当价格由上向下跌破下轨,且昨日收盘价高于下轨时产生强势卖出信号。

此外,脚本还辅助绘制了潜在支持与阻力位,进一步确定关键价格位。总体而言,多层指标组合,严格的突破条件,从根本上提高了交易信号的质量。

策略优势:

-

多策略指标组合,交易信号生成清晰。克尔特通道确定关键价格范围,结合动态移动平均线和超级趋势指标严格判定趋势方向,有效过滤市场假突破。

-

严格的突破条件确保交易信号质量。价格需真正突破通道上下轨,同时结合昨日收盘价的位置,避免被套。

-

超级趋势指标可捕捉长期趋势,追踪长线方向性行情。

-

潜在支持与阻力位辅助判断价格关键点,可发现反转机会。

-

整体交易频率适中,不会过于密集交易。只在关键点发出高质量信号,胜率较高。

策略风险:

-

在震荡行情中,指标可能发出误导信号,导致无效突破交易亏损。可通过调整参数优化,或人工干预退出SetPosition。

-

突破通道上下轨的止损点可能过大,单笔亏损风险偏高。可适当缩小止损范围,或采用时间止损。

-

追踪长线趋势时,可能错过部分中短线反转机会。可辅助采用震荡指标判断局部调整。

-

移动平均线系统有时对突发事件反应较慢。这时可考虑降低移动平均线参数,或采用其他指标辅助。

策略优化方向: 根据不同市场环境和交易偏好,本策略可从以下几个方向进行优化:

-

调整移动平均线参数,优化指标系统对价格变动的敏感度。

-

调整超级趋势指标的ATR周期和因子参数,优化超级趋势指标的作用。

-

调整止损点,平衡每单盈亏比例。也可利用时间止损进一步控制单笔亏损风险。

-

增加其他辅助指标,如布林带、KD指标等,进一步判断局部调整与反转机会。

-

利用open、close等变量绘制K线图形,直观判断价格行情。

-

进行参数优化、回测比对不同参数组合的效果。

总结: 本策略综合运用动态移动平均线、超级趋势指标和克尔特通道等多重指标,实现自动化的趋势跟踪交易。关键优势有:信号生成清晰,胜率较高;追踪长线趋势,捕捉方向性机会;止损点合理,控制单笔亏损风险。有效的多指标组合严格过滤假突破,确保发出的交易信号质量较高,适合自动化交易。通过参数调整和优化,本策略可适应不同市场环境,并可辅助人工决策找到交易时机。

||

Overview: This strategy integrates dynamic moving averages, Super Trend indicator, potential support and resistance levels, and Keltner Channels to conduct multi-level judgments on price fluctuations and achieve automated trend-following trading. The advantages of this strategy are clear trading signal generation, relatively high win rate, and incorporation of risk management measures to control per trade risks.

Strategy Logic:

This strategy utilizes dynamic moving averages to determine the medium-term trend direction of prices. Specifically, based on user’s selection, the script adopts Simple Moving Average (SMA) or Exponential Moving Average (EMA). When the highest price, lowest price and closing price are all higher than previous day, it indicates a bullish trend. When they are all lower than previous day, it indicates a bearish trend. Based on this, combined with the position of dynamic moving averages, buy and sell signals are generated.

In addition, the strategy also employs the Super Trend indicator to identify long-term trends. The Super Trend indicator incorporates Average True Range (ATR) and generates buy signals when prices run above the upper band while previous close was below the upper band. It generates sell signals when prices break below the lower band while previous close was above the lower band.

To filter false signals, this strategy utilizes Keltner Channels to plot upper and lower channel bands. Combined with the channel range and Super Trend indicator, it can achieve trend-following trading. Specifically, when prices break out the upper band upside and yesterday's close was below the upper band, strong buy signals are generated. When prices break down the lower band and yesterday's close was above the lower band, strong sell signals are triggered.

Also, the script assists plotting potential support and resistance levels to further determine key price levels. Overall, the combination of multiple indicators and strict breakout conditions fundamentally improves the quality of trading signals.

Advantages:

-

Combination of multiple strategy indicators generates clear trading signals. Keltner Channels determine key price range. Combined with dynamic moving averages and Super Trend indicator, it strictly judges trend direction and effectively filters false breakouts in the market.

-

Strict breakout conditions ensure quality of trading signals. Prices need to truly breakout upper or lower channel bands, combined with the position of yesterday’s close to avoid traps.

-

Super Trend indicator can capture long-term trends and track directional trends.

-

Potential support and resistance levels assist in determining key price points and discovering reversal opportunities.

-

Overall trading frequency is moderate without overly intensive trading. It only issues high quality signals at critical points with relatively high win rate.

Risks:

-

In ranging markets, indicators may issue misleading signals, resulting in ineffective breakout losses. This can be optimized through parameter adjustments or manually intervening to exit positions.

-

Stop loss points when breaking out channel bands may be too wide with high per trade risks. Stop loss range can be reduced or adopt time-based stop loss.

-

When tracking long-term trends, some medium-term reversal opportunities may be missed out. Oscillators can be adopted to assist judging local corrections.

-

Moving average systems sometimes react slower to sudden events. Solutions include lowering moving average parameters or incorporating other assisting indicators.

Optimization Directions: Based on different market environments and trading preferences, this strategy can be optimized in the following aspects:

-

Adjust moving average parameters to optimize indicator system’s sensitivity to price changes.

-

Adjust ATR period and factor parameters of Super Trend indicator to optimize its functionality.

-

Adjust stop loss points to balance risk/reward ratio per trade. Time-based stop loss can further control per trade loss risks.

-

Incorporate other assisting indicators like Bollinger Bands and KD to further judge local corrections and reversal opportunities.

-

Utilize open, close etc. to plot candlestick patterns for intuitive visual judgment of price actions.

-

Conduct parameter optimization and backtesting to compare results of different parameter combinations.

Conclusion: This strategy integrates dynamic moving averages, Super Trend indicator, Keltner Channels and other multiple indicators to achieve automated trend-following trading. Key advantages include: clear signal generation, relatively high win rate; tracking long-term trends and capturing directional opportunities; reasonable stop loss points to control per trade risks. Effective multi-indicator combinations strictly filter false breakouts and ensure relatively high quality of trading signals, suitable for automated trading. Through parameter tuning and optimization, this strategy can adapt to different market environments and assist manual decisions in finding trading opportunities.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | SMA | Moving Average Type |

| v_input_int_1 | 20 | SMA Length |

| v_input_int_2 | 20 | EMA Length |

| v_input_int_3 | 7 | ATR Length for Super Trend |

| v_input_int_4 | 2 | Factor for Super Trend |

Source (PineScript)

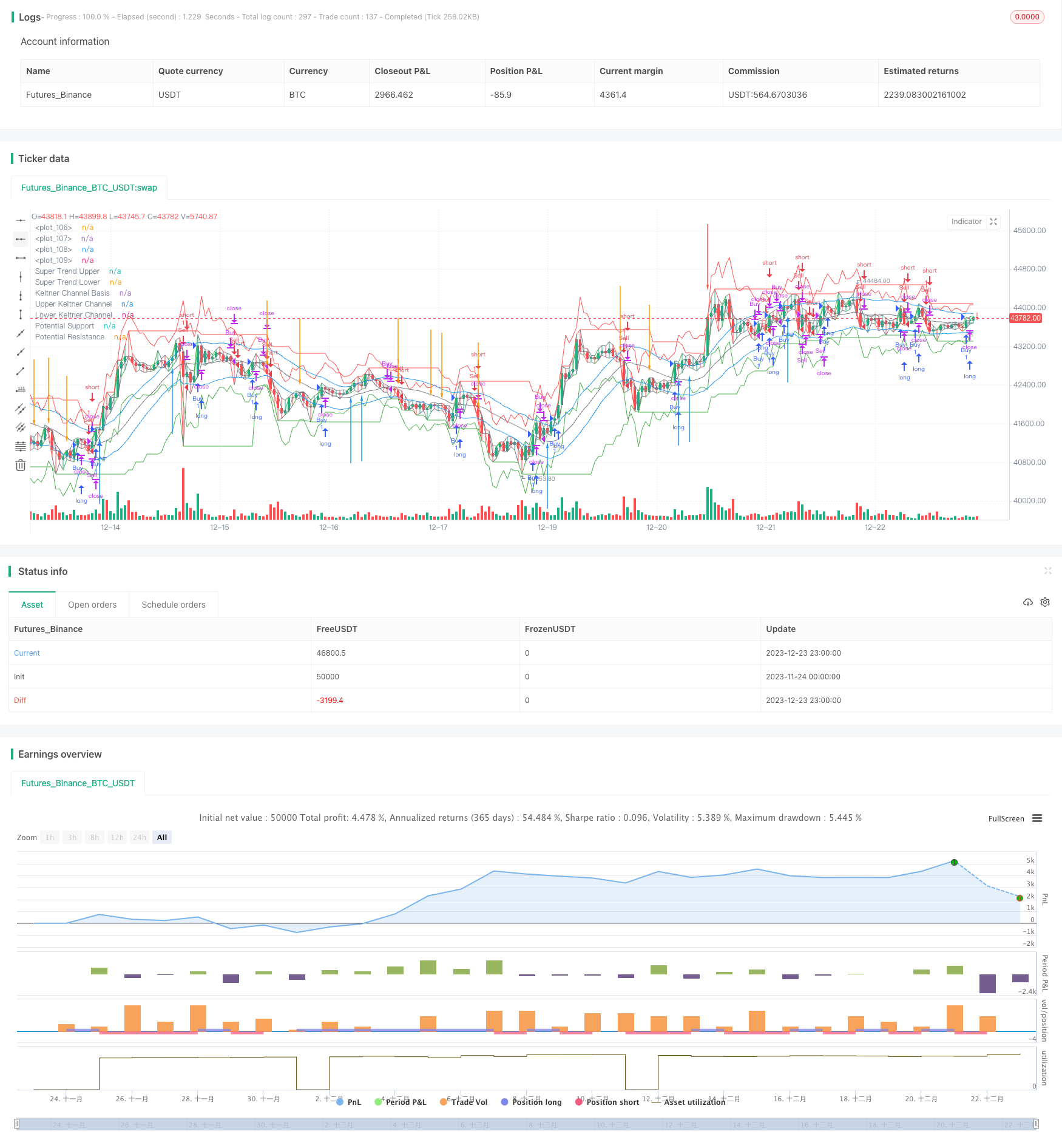

/*backtest

start: 2023-11-24 00:00:00

end: 2023-12-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mahesh_linux1989

//@version=5

strategy("Intraday Trend Identifier with Dynamic Moving Averages, Super Trend, VWAP, and Keltner Signals", overlay=true, shorttitle="ITI Keltner")

// Input for Moving Average Type

maType = input("SMA", title="Moving Average Type")

// Input for SMA Length

smaLength = input.int(20, title="SMA Length", minval=1, maxval=200)

// Input for EMA Length

emaLength = input.int(20, title="EMA Length", minval=1, maxval=200)

// Selecting Moving Average

selectedMA = maType == "SMA" ? ta.sma(close, smaLength) : ta.ema(close, emaLength)

// Bullish conditions

bullish = high > high[1] and low > low[1] and close > high[1]

// Bearish conditions

bearish = high < high[1] and low < low[1] and close < low[1]

// Strategy logic

longCondition = bullish and not bearish and close > selectedMA

shortCondition = bearish and not bullish and close < selectedMA

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

// Exit conditions

bullishExit = close < selectedMA

bearishExit = close > selectedMA

if (bullishExit)

strategy.close("Buy")

if (bearishExit)

strategy.close("Sell")

// Keltner Channels

basisKC = maType == "SMA" ? ta.sma(close, smaLength) : ta.ema(close, emaLength)

atrKC = ta.atr(14)

upperKC = basisKC + atrKC

lowerKC = basisKC - atrKC

// Super Trend

atrLengthST = input.int(7, title="ATR Length for Super Trend")

factorST = input.int(2, title="Factor for Super Trend")

atrValueST = ta.atr(atrLengthST)

var float upperST = na

var float lowerST = na

if (close[1] > upperST[1])

upperST := close[1] - factorST * atrValueST

else

upperST := close - factorST * atrValueST

if (close[1] < lowerST[1])

lowerST := close[1] + factorST * atrValueST

else

lowerST := close + factorST * atrValueST

// Potential Support and Resistance

potentialSupport = ta.lowest(low, smaLength)

potentialResistance = ta.highest(high, smaLength)

// VWAP

//vwapValue = ta.vwap(close, volume)

// Keltner Signals

buySignalKC = close > upperKC and close[1] <= upperKC[1]

sellSignalKC = close < lowerKC and close[1] >= lowerKC[1]

// Super Trend Signals

buySignalST = close > upperST and close[1] <= upperST[1]

sellSignalST = close < lowerST and close[1] >= lowerST[1]

// Plotting

plot(basisKC, color=color.gray, title="Keltner Channel Basis")

plot(upperKC, color=color.blue, title="Upper Keltner Channel")

plot(lowerKC, color=color.blue, title="Lower Keltner Channel")

plot(upperST, color=color.green, title="Super Trend Upper")

plot(lowerST, color=color.red, title="Super Trend Lower")

plot(potentialSupport, color=color.green, title="Potential Support")

plot(potentialResistance, color=color.red, title="Potential Resistance")

//plot(vwapValue, color=color.orange, title="VWAP")

// Plot Bullish and Bearish arrows

plotarrow(buySignalST ? 1 : na, colorup=color.green, offset=-1, title="Bullish Arrow ST")

plotarrow(sellSignalST ? -1 : na, colordown=color.red, offset=-1, title="Bearish Arrow ST")

plotarrow(buySignalKC ? 1 : na, colorup=color.blue, offset=-1, title="Bullish Arrow KC")

plotarrow(sellSignalKC ? -1 : na, colordown=color.orange, offset=-1, title="Bearish Arrow KC")

// Plot candlesticks

plot(open, color=color.gray)

plot(close, color=bullish ? color.green : bearish ? color.red : color.gray)

plot(high, color=bullish ? color.green : bearish ? color.red : color.gray)

plot(low, color=bullish ? color.green : bearish ? color.red : color.gray)

Detail

https://www.fmz.com/strategy/436502

Last Modified

2023-12-25 13:36:40