Name

动态突破均线交易策略Dynamic-Moving-Average-Crossover-Trading-Strategy

Author

ChaoZhang

Strategy Description

这个策略的主要思想是使用不同周期的 Ratio OCHL Averager 指标构建多条均线,根据均线的交叉形态产生买卖信号。它能够动态捕捉价格趋势,适合中短期交易。

该策略使用了两个不同周期的 Ratio OCHL Averager 指标,分别作为快线和慢线。Ratio OCHL Averager 指标的计算公式如下:

b = abs(close-open)/(high - low)

c = min(max(b, 0), 1)

Ratio OCHL Averager = c*close + (1-c)*前一日Ratio OCHL Averager

其中 b 是代表当日价格波动情况的比率,c 是对 b 做标准化处理后的值。Ratio OCHL Averager 指标综合了开盘价、收盘价、最高价和最低价四个价格构建均线。

该策略设置快线周期短,慢线周期长。当快线上穿慢线时产生买入信号,反之当快线下穿慢线时产生卖出信号。利用均线交叉原理捕捉趋势。

-

Ratio OCHL Averager 指标能够平滑价格数据,有效过滤市场噪音,使交易信号更可靠。

-

双均线交叉结合不同周期判断趋势方向,可以较好地判定新的趋势开始。

-

通过调整快线和慢线的周期参数,可以适应不同市场环境。

-

策略思路简单直观,容易理解实现。

-

可以灵活设置止损止盈标准,控制风险。

-

均线交叉策略可能产生较多的虚假信号,需要组合其他技术指标进行过滤。

-

需要合理选择快线和慢线的周期参数,参数选择不当可能影响策略效果。

-

双均线交叉策略属于趋势跟踪策略,不适合震荡行情,应于趋势行情使用。

-

需要适当调整止损点以降低亏损风险,止盈点也要合理设置。

-

可以考虑结合动量指标等进行信号过滤,提高信号质量。例如 MACD,KDJ等。

-

可以测试不同的快线和慢线周期参数组合,寻找最优参数。

-

可以基于回测结果优化止损止盈点,找到最佳设置。

-

可以考虑在特定市场环境下动态调整参数,例如大盘震荡时增大周期参数。

该策略整体思路清晰易懂,通过快慢均线交叉判断趋势方向,是一种适合中短期交易的动态跟踪策略。优化空间还很大,通过参数调整、信号过滤等方式可进一步改进策略效果。总体来说,它是一个灵活实用的趋势交易策略。

||

The key idea of this strategy is to build multiple moving averages based on the Ratio OCHL Averager indicator of different timeframes and generate trading signals based on the crossover. It can dynamically capture the price trend and is suitable for medium-term trading.

The strategy uses two Ratio OCHL Averager indicators with different timeframes as the fast and slow lines. The Ratio OCHL Averager is calculated as:

b = abs(close-open)/(high - low)

c = min(max(b, 0), 1)

Ratio OCHL Averager = c*close + (1-c)*previous Ratio OCHL Averager

Here b represents the intraday price movement ratio and c is the normalized b. The Ratio OCHL Averager incorporates open, close, high and low prices to build the moving average.

The strategy sets a shorter period for the fast line and a longer period for the slow line. A buy signal is generated when the fast line crosses above the slow line, and a sell signal when the fast line crosses below. It captures the trend by the moving average crossover logic.

-

The Ratio OCHL Averager smoothes the price data and filters out market noise, making the trading signal more reliable.

-

The dual moving average crossover combined with different timeframes can better detect the start of a new trend.

-

The periods of the fast and slow line can be adjusted for different market conditions.

-

The strategy logic is simple and intuitive. Easy to understand and implement.

-

Stop loss and take profit can be flexibly set to control risks.

-

Moving average crossover may generate excessive false signals. Other technical indicators may be needed for filtration.

-

The periods of the fast and slow line should be reasonably chosen, otherwise it may affect the strategy performance.

-

It is a trend following strategy not suitable for range-bound market. Should be used in trending conditions.

-

Stop loss and take profit should be adjusted properly to reduce loss and optimize profit level.

-

Consider combining momentum indicators like MACD, KDJ for signal filtration and quality improvement.

-

Test different fast and slow line period combinations to find the optimal parameters.

-

Optimize the stop loss and take profit based on backtest results.

-

Consider dynamically adjusting parameters in certain market conditions, for example, increase the period in a range-bound market.

The strategy has a clear logic of using fast and slow moving average crossover to determine trend direction. It is a dynamic trend following strategy suitable for medium-term trading. There is still much room for optimization by parameters tuning, signal filtration etc. Overall it is a flexible and practical trend trading strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | STRATEGY 1? —> |

| v_input_2 | false | Recursive |

| v_input_3 | 600 | Resolution Line 1 |

| v_input_4 | 0 | Resolution Line 1: Min |

| v_input_5 | 1440 | Resolution Line 2 |

| v_input_6 | 0 | Resolution Line 2: Min |

| v_input_7 | 500 | Stop Loss |

| v_input_8 | 2500 | Take Profit |

| v_input_9 | true | BACKTEST RANGE — |

| v_input_10 | 2019 | From Year |

| v_input_11 | true | From Month |

| v_input_12 | 2 | From Day |

| v_input_13 | 9999 | To Year |

| v_input_14 | true | To Month |

| v_input_15 | true | To Day |

Source (PineScript)

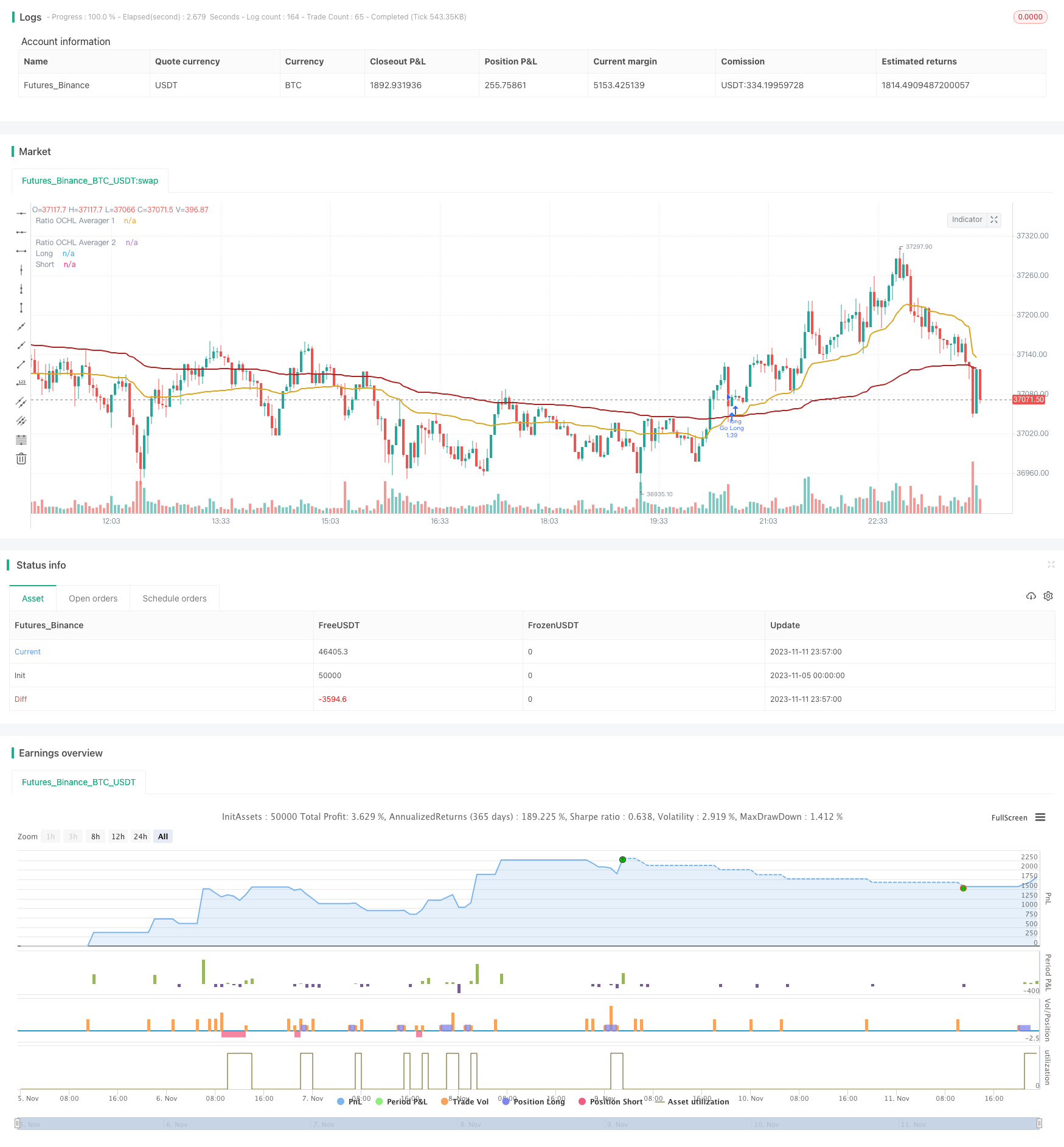

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-12 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="[XC] Adaptive Strategy V3 - Ratio OCHL Averager no repaint",shorttitle="R_OHCL", overlay=true, currency=currency.EUR,initial_capital=10000,

default_qty_value=100, default_qty_type=strategy.percent_of_equity , calc_on_every_tick=false, calc_on_order_fills=true)

// ╔═ SETTINGS ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

strategy_1 = input ( defval=true , type=input.bool , title="STRATEGY 1? —>" )

Recursive = input(false)

RES201 = "Min",RES202= "D",RES203 = "W",RES204 = "M"

//++ Resolution 1 ++

inp_resolution1 = input(600, minval=1, title="Resolution Line 1")

restype1 = input ( defval="Min" , type=input.string , title= "Resolution Line 1" , options=[ "Min","D","W","M"])

multiplier1 = restype1 == "Min" ? "" : restype1 == "D" ? "D" : restype1 == "W" ? "W" : "M"

resolution1 = tostring(inp_resolution1)+ multiplier1

//++ Resolution 2 ++

inp_resolution2 = input(1440, minval=1, title="Resolution Line 2")

restype2 = input ( defval="Min" , type=input.string , title= "Resolution Line 2" , options=["Min","D","W","M"])

multiplier2 = restype2 == "Min" ? "" : restype2 == "D" ? "D" : restype2 == "W" ? "W" : "M"

resolution2 = tostring(inp_resolution2)+ multiplier2

StopLoss = input(defval = 500 , title = "Stop Loss", minval = 0)

TakeProfit = input(defval = 2500 , title = "Take Profit", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = TakeProfit >= 1 ? TakeProfit : na

useStopLoss = StopLoss >= 1 ? StopLoss : na

// ╔═ BACKTEST RANGE ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

line_breakBTR = input ( defval = true , type=input.bool , title="BACKTEST RANGE —" )

FromYear = input ( defval = 2019, title = "From Year", minval = 2017)

FromMonth = input ( defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input ( defval = 2, title = "From Day", minval = 1, maxval = 31)

//FromHour = input ( defval = 1, title = "From Hour", minval = 1, maxval = 24)

ToYear = input ( defval = 9999, title = "To Year", minval = 2017)

//ToHour = input ( defval = 0, title = "From Hour", minval = 0, maxval = 24)

ToMonth = input ( defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input ( defval = 1, title = "To Day", minval = 1, maxval = 31)

// === FUNCTION EXAMPLE ===

start = timestamp(syminfo.timezone, FromYear, FromMonth, FromDay, 0, 00) // backtest start window

finish = timestamp(syminfo.timezone, ToYear , ToMonth , ToDay , 0, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

// ╔═ INDICATOR ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

// "Ratio OCHL Averager" -> alexgrover / tradingview.com/script/RGAtOI6h-Ratio-OCHL-Averager-An-Alternative-to-VWAP/

rochla( res,Recursive)=>

//Recursive = false

H = security(syminfo.tickerid,res,high[1],gaps = barmerge.gaps_off, lookahead = barmerge.lookahead_on)

L = security(syminfo.tickerid,res,low[1] ,gaps = barmerge.gaps_off, lookahead = barmerge.lookahead_on)

d = 0.

//----

a = Recursive ? nz(d[1],open) : open

b = abs(close-a)/(H - L)

c = b > 1 ? 1 : b

d := c*close+(1-c)*nz(d[1],close)

strat1_line1=rochla(resolution1,Recursive)

strat1_line2=rochla(resolution2,Recursive)

plot(strat1_line1, title="Ratio OCHL Averager 1", color=#DAA520,linewidth=2,transp=0)

plot(strat1_line2, title="Ratio OCHL Averager 2", color=#B22222,linewidth=2,transp=0)

// ╔═ STRATEGY 1 ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

trading_strat1_line1 = strategy_1 == 1 ? strat1_line1 : na

trading_strat1_line2 = strategy_1 == 1 ? strat1_line2 : na

longCross = crossunder (trading_strat1_line2, trading_strat1_line1) ? true : false

shortCross = crossover (trading_strat1_line2, trading_strat1_line1) ? true : false

plot( longCross ? trading_strat1_line1 : na , title = "Long" , color=color.aqua, style=plot.style_circles, linewidth=5, offset= 0)

plot( shortCross ? trading_strat1_line2 : na , title = "Short" , color=color.red , style=plot.style_circles, linewidth=5, offset= 0)

// ╔═ Backtest 1 ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

strategy.exit("close",loss = useStopLoss, profit = useTakeProfit)

if longCross and window() and strategy_1 == 1

strategy.entry("Go Long", strategy.long)

if shortCross and window() and strategy_1 == 1

strategy.entry("Go Short", strategy.short)

//end

Detail

https://www.fmz.com/strategy/431893

Last Modified

2023-11-13 10:27:54