Name

动态CCI支撑阻力策略Dynamic-CCI-Support-and-Resistance-Strategy

Author

ChaoZhang

Strategy Description

本策略利用CCI指标的枢纽点来计算动态的支撑位和阻力位,结合趋势判断来寻找买入和卖出信号。该策略融合了CCI的反转特征以及趋势跟踪能力,旨在抓住中期趋势中的反转点来实现盈利。

CCI指标能够显示市场是否过于疲弱或过于强势,80和-80这两个极限值可以用来判断市场是否进入超买超卖状态。本策略利用CCI的这个特性,通过计算左右两边各50根K线的枢纽点,得到上枢纽点和下枢纽点,然后在枢纽点的基础上加减缓冲区构建动态的阻力线和支撑线。

当收盘价高于开盘价且低于上支撑线时生成买入信号;当收盘价低于开盘价且高于下阻力线时生成卖出信号。为了过滤掉非主流趋势方向的交易信号,策略还结合EMA和斜率指标来判断目前的主流趋势方向。只有当趋势判断为多头时,才会进行买入操作;只有当趋势判断为空头时,才会进行卖出操作。

止损和止盈基于ATR指标动态计算,使得本策略的风险控制也比较合理。

- 利用CCI指标的反转特征,选取反转点附近进行买卖,增加获利概率。

- 结合趋势判断,避免逆势操作,减少损失。

- 动态止损止盈设定让风险控制更合理。

- 可自定义参数如CCI周期、缓冲区大小等,适应更多市场环境。

- CCI指标容易产生虚假信号,需结合趋势过滤。

- 反转不一定成功,存在一定概率亏损的风险。

- 参数设置不当可能导致过于频繁交易或错过交易机会。

可以通过优化参数,调整止损幅度等方法来减少风险。此外,本策略也可作为其它指标的辅助工具,而不必完全依赖其交易信号。

- 优化缓冲区大小,适应不同波动率市场。

- 优化ATR周期参数,以取得更准确的动态止损止盈。

- 尝试不同的CCI参数设置。

- 测试其它类型的趋势判断指标的效果。

本策略整合了CCI指标的多空筛选能力与趋势判断的过滤确认,具有一定的实战价值。动态止损止盈也使得策略在实际应用中风险可控。通过参数优化和改进,可望获得更好的效果。

||

This strategy uses the pivot points of the CCI indicator to calculate dynamic support and resistance levels, and combines trend judgment to find buy and sell signals. The strategy integrates the reversal characteristics of CCI and the trend tracking ability to capture reversal points in the medium-term trend for profit.

CCI indicator can show whether the market is too weak or too strong. The two extremes of 80 and -80 can be used to determine whether the market has entered an overbought or oversold state. This strategy utilizes this characteristic of CCI. By calculating the pivot points of the left and right 50 bars, the upper and lower pivot points are obtained. Then support and resistance lines are constructed dynamically by adding or subtracting a buffer on the basis of the pivot points.

A buy signal is generated when the close is higher than the open and lower than the upper support level. A sell signal is generated when the close is lower than the open and higher than the lower resistance level. In order to filter out trading signals against the main trend direction, the strategy also combines EMA and slope indicators to determine the current main trend direction. Long entry trades are only placed when the trend is determined as bullish. Short entry trades are only placed when the trend is determined as bearish.

The stop loss and take profit are calculated dynamically based on the ATR indicator, making the risk control of this strategy more reasonable.

- Taking advantage of the reversal characteristic of CCI, entries are made near potential reversal points, increasing the probability of profit.

- Combining with trend judgment avoids trading against the trend and reduces losses.

- Dynamic stop loss and take profit settings make risk control more sensible.

- Customizable parameters such as CCI length, buffer size, etc. adapt to more market environments.

- CCI indicator tends to generate false signals, needing the filter from trend judgment.

- Reversals do not always succeed, with certain probability of loss risk.

- Improper parameter settings may lead to over-trading or missing opportunities.

Methods like parameter optimization, adjusting stop loss range, etc. can help reduce risks. Also, this strategy can be used as an auxiliary tool for other indicators, not having to completely rely on its signals.

- Optimize buffer size to adapt to markets of different volatility levels.

- Optimize ATR period parameters for more accurate dynamic stop loss and take profit.

- Test different CCI parameter settings.

- Test the effects of other types of trend judgment indicators.

This strategy integrates the long/short screening ability from CCI and the filter confirmation from trend judgment, possessing certain practical value. The dynamic stop loss and take profit also makes the risk controllable when applying the strategy in actual trading. Through parameter optimization and improvements, better results can be expected. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 50 | cci length |

| v_input_int_2 | 50 | right pivot |

| v_input_int_3 | 50 | left pivot |

| v_input_float_1 | 10 | buffer |

| v_input_bool_1 | true | trend matter? |

| v_input_bool_2 | false | show mid? |

| v_input_string_1 | 0 | trend type: cross |

| v_input_int_4 | 100 | slow ma length |

| v_input_int_5 | 50 | fast ma length |

| v_input_int_6 | 5 | slope's length for trend detection |

| v_input_float_2 | 1.1 | ksl |

| v_input_float_3 | 2.2 | ktp |

| v_input_timeframe_1 | D | Time Frame of Last Period for Calculating max |

Source (PineScript)

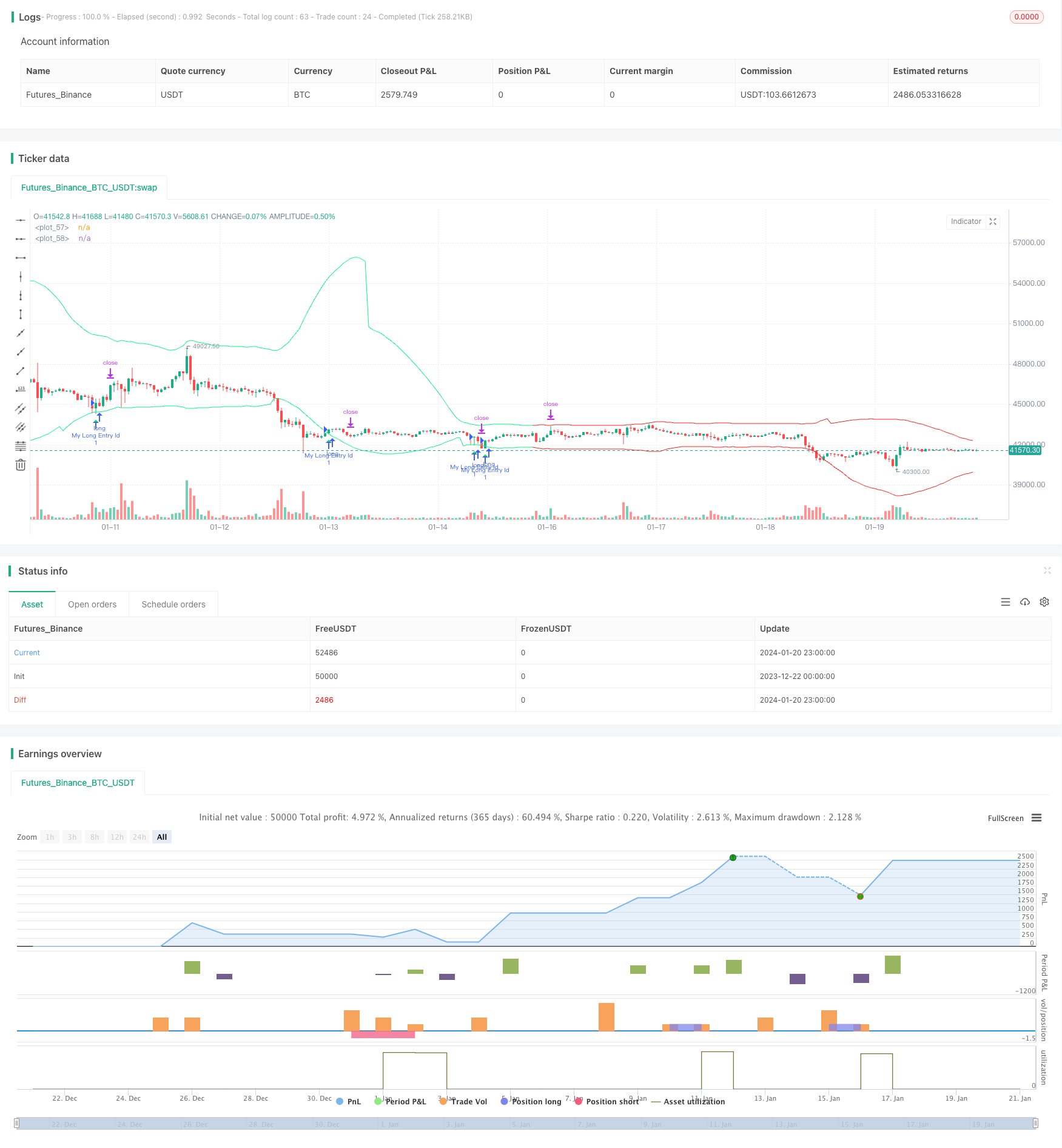

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AliSignals

//@version=5

strategy("CCI based support and resistance strategy", overlay=true )

cci_length = input.int(50, "cci length")

right_pivot = input.int(50, "right pivot")

left_pivot = input.int(50, "left pivot")

buffer = input.float(10.0, "buffer")

trend_matter = input.bool(true, "trend matter?")

showmid = input.bool ( false , "show mid?")

trend_type = input.string("cross","trend type" ,options = ["cross","slope"])

slowma_l = input.int(100, "slow ma length")

fastma_l = input.int(50, "fast ma length")

slope_l = input.int(5, "slope's length for trend detection")

ksl = input.float(1.1)

ktp = input.float(2.2)

restf = input.timeframe(title="Time Frame of Last Period for Calculating max" , defval="D")

// Calculating Upper and Lower CCI

cci = ta.cci(hlc3,cci_length)

uppercci = 0.0

lowercci = 0.0

uppercci := fixnan(ta.pivothigh(cci, left_pivot, right_pivot)) - buffer

lowercci := fixnan(ta.pivotlow (cci, left_pivot, right_pivot)) + buffer

midccci = math.avg(uppercci,lowercci)

// Support and Resistance based on CCI

res = uppercci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

sup = lowercci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

mid = midccci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

// Calculating trend

t_cross = 0

t_cross := ta.ema(close,fastma_l) > ta.ema(close,slowma_l) ? 1 : ta.ema(close,fastma_l) < ta.ema(close,slowma_l) ? -1 : t_cross[1]

t_slope = 0

t_slope := ta.ema(close,slowma_l) > ta.ema(close,slowma_l)[slope_l] ? 1 : ta.ema(close,slowma_l) < ta.ema(close,slowma_l)[slope_l] ? -1 : t_slope[1]

t = 0

t := trend_type == "cross" ? t_cross : trend_type == "slope" ? t_slope : na

colort = trend_matter == false ? color.rgb(201, 251, 0) : t == 1 ? color.rgb(14, 243, 132) : t == -1 ? color.rgb(255, 34, 34) : na

bull_t = trend_matter == false or t == 1

bear_t = trend_matter == false or t == -1

plot(res, color = colort)

plot(sup, color = colort)

plot(showmid == true ? mid : na)

// Long and Short enter condition

buy = bull_t == 1 and ta.lowest (2) < sup and close > open and close > sup

sell = bear_t == 1 and ta.highest(2) > res and close < open and close < res

plotshape( buy , color=color.rgb(6, 255, 23) , location = location.belowbar, style = shape.triangleup , size = size.normal)

plotshape( sell, color=color.rgb(234, 4, 4) , location = location.abovebar, style = shape.triangledown, size = size.normal)

atr = ta.atr(100)

CLOSE=request.security(syminfo.tickerid, restf, close)

max = 0.0

max := CLOSE == CLOSE[1] ? math.max(max[1], atr) : atr

act_atr = 0.0

act_atr := CLOSE == CLOSE[1] ? act_atr[1] : max[1]

atr1 = math.max(act_atr, atr)

dis_sl = atr1 * ksl

dis_tp = atr1 * ktp

var float longsl = open[1] - dis_sl

var float shortsl = open[1] + dis_sl

var float longtp = open[1] + dis_tp

var float shorttp = open[1] - dis_tp

longCondition = buy

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = sell

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)

longsl := strategy.position_size > 0 ? longsl[1] : close - dis_sl

shortsl := strategy.position_size < 0 ? shortsl[1] : close + dis_sl

longtp := strategy.position_size > 0 ? longtp[1] : close + dis_tp

shorttp := strategy.position_size < 0 ? shorttp[1] : close - dis_tp

if strategy.position_size > 0

strategy.exit(id="My Long close Id", from_entry ="My Long Entry Id" , stop=longsl, limit=longtp)

if strategy.position_size < 0

strategy.exit(id="My Short close Id", from_entry ="My Short Entry Id" , stop=shortsl, limit=shorttp)

Detail

https://www.fmz.com/strategy/439639

Last Modified

2024-01-22 16:37:46