Name

动量价格趋势跟踪策略Momentum-Price-Trend-Tracking-Strategy

Author

ChaoZhang

Strategy Description

动量价格趋势跟踪策略运用多种动量指标来识别价格的趋势,在趋势开始阶段建立仓位,通过设置止盈止损来锁定盈利,实现对价格趋势的跟踪。

动量价格趋势跟踪策略主要应用以下技术指标:

- ROC指标:该指标通过计算某一时间段价格变动速度的百分比,来判断价格动量。当ROC为正时,说明价格在上涨;当ROC为负时,说明价格在下跌。策略通过ROC指标判断价格趋势方向。

2.多空能量指标:该指标反映多头和空头力量对比关系。多空能量>0代表多头力量大于空头力量,价格上涨;反之价格下跌。策略利用该指标判断多空力量比较,预测价格方向。

3.背离指标:该指标通过计算价格与成交量背离情况,来判断趋势反转。策略利用背离信号作为入场时机。

4.Donchian通道:该指标通过价格最高价和最低价构建通道,通道边界可作为支持和阻力位。策略利用通道判断趋势方向。

5.移动平均线:该指标能滤掉价格supportedare忽高忽低的震荡,揭示主要趋势方向。策略利用其判断价格总体走势。

策略根据以上多个指标判断价格趋势和反转时机,在趋势开始阶段根据指标信号建立多头或空头仓位。然后根据止盈止损点来及时平仓锁定盈利,实现对价格趋势的捕捉。

该策略具有以下优势:

-

应用多种指标 判断趋势,减少误判概率。

-

利用指标背离实现精准捕捉趋势反转点。

-

结合通道、移动均线判断大趋势方向。

-

设置止盈止损点,能够及时止盈,避免回撤扩大。

-

可根据参数调整,适用于不同周期和品种的交易。

-

策略逻辑清晰易理解,便于后期优化。

该策略也存在一定的风险:

-

多指标组合判断增加了错误信号的概率,需要调整参数优化指标权重。

-

止损点设置过小可能增加止损概率,设置过大可能扩大回撤。需要综合考虑确定合理的止损点。

-

不同市场周期参数需要调整,盲目应用可能导致不适应市场环境。

-

需要足够的资金支持多单位同向交易,否则难以获取 excess returns。

-

程序交易存在回测过拟合风险,实盘效果存有一定的不确定性。

该策略可以从以下几个方面进行优化:

-

优化指标参数,找到不同周期及品种的参数最优组合。

-

增加机器学习算法,自动寻找最优参数。

-

增加自适应止损机制,根据市场情况调整止损点。

-

结合高频因子和基本面指标,提高策略的 alpha。

-

开发自动测试框架,调整参数组合并验证交易效果。

-

引入风险管理模块,控制仓位规模,降低回撤。

-

增加模拟交易和实盘验证环节,提高策略的稳定性。

本策略综合运用多种动量指标判断价格趋势,并设置止盈止损来锁定收益。该策略能够有效捕捉价格趋势,具有较强的稳定性。通过调整参数、优化结构以及风险控制,本策略可以进一步增强效果并降低交易风险。本策略为量化交易提供了一个可靠、易于操作的趋势跟踪方案。

||

The momentum price trend tracking strategy uses multiple momentum indicators to identify price trends, establishes positions at the beginning of trends, and locks in profits through stop profit and stop loss settings to track price trends.

The momentum price trend tracking strategy mainly applies the following technical indicators:

-

ROC indicator: This indicator calculates the percentage rate of change in price over a certain period to determine price momentum. When ROC is positive, it means prices are rising. When ROC is negative, it means prices are falling. The strategy uses the ROC indicator to determine the direction of the price trend.

-

Bulls Power and Bears Power indicator: This indicator reflects the power comparison between bulls and bears. Bulls Power > 0 indicates bulls power is greater than bears power and prices rise. The strategy uses this indicator to predict price direction by comparing bull and bear power.

-

Divergence: This indicator identifies trend reversal by calculating price and volume divergence. The strategy uses divergence signals as entry timing.

-

Donchian Channel: This indicator constructs a channel using highest and lowest prices, and the channel boundaries can serve as support and resistance. The strategy uses the channel to determine trend direction.

-

Moving Average: This indicator smooths out price fluctuations to identify the overall trend direction. The strategy uses it to determine the general price trend.

The strategy determines price trends and reversal points based on the above indicators, and establishes long or short positions according to indicator signals at the beginning of trends. It then closes positions in a timely manner based on stop profit and stop loss points to capture price trends.

The advantages of this strategy include:

-

Using multiple indicators to determine trends reduces misjudgement probability.

-

Using indicator divergences enables accurately capturing trend reversal points.

-

Combining channels and moving averages helps determine the overall trend.

-

Setting stop profit and stop loss secures profits timely and avoids expanded drawdowns.

-

Adjustable parameters make the strategy adaptable to different periods and products.

-

The clear logic facilitates further optimization.

The potential risks of this strategy include:

-

The multiple indicators may increase erroneous signal probability. Optimizing indicator weights is needed.

-

Stop loss points set too small may increase stop loss probability, while too wide may expand drawdowns. Reasonable points need comprehensive consideration.

-

Blind application across varying market periods may lead to inadaptability. Periodic parameter tuning is required.

-

Sufficient capital to support high position units is required to achieve excess returns.

-

Backtest overfitting risks exist. Real-trading performance has uncertainties.

The strategy can be optimized in the following aspects:

-

Optimize indicator parameters to find the optimal combinations for different periods and products.

-

Introduce machine learning algorithms to find the optimal parameters automatically.

-

Build in adaptive stop loss mechanisms based on market conditions.

-

Incorporate high-frequency factors and fundamentals to improve alpha.

-

Develop automated testing frameworks for parameter optimization and performance verification.

-

Introduce risk management modules to control position sizing and reduce drawdowns.

-

Add simulated and live trading and testing to improve stability.

This strategy combines multiple momentum indicators to determine price trends and uses stop profit/loss to lock in profits. It can effectively capture trends with strong stability. Further enhancements in parameter tuning, structure optimization and risk control will improve its performance and risk management. The strategy provides a reliable and easy-to-use trend following solution for quantitative trading.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 3000 | Take Profit |

| v_input_2 | 2200 | Stop Loss |

| v_input_3 | 186 | ROC Length |

| v_input_4 | 50 | Smoothing Length |

| v_input_5_close | 0 | Source: close |

| v_input_6 | 53 | Upper Channel |

| v_input_7 | 53 | Lower Channel |

| v_input_8 | 91 | Offset Bars |

| v_input_9 | 65 | BearsP WMA Period |

| v_input_10 | 15 | BoP Exponential Smoothing |

| v_input_11 | 74 | SMA Period |

| v_input_12 | 37 | SMA Shift |

| v_input_13 | false | My Price |

| v_input_14 | 0 | Label Style: Lower Right |

Source (PineScript)

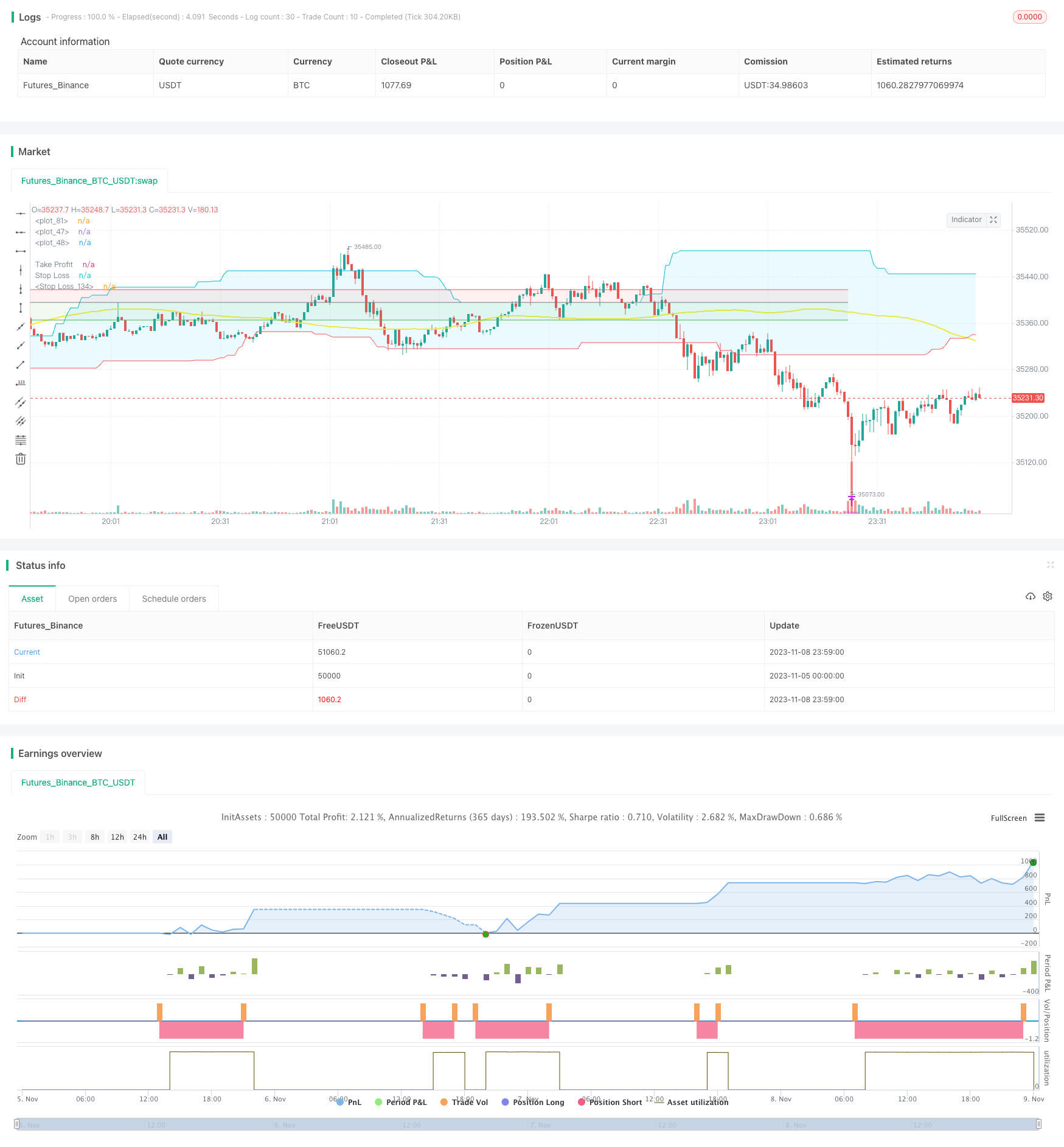

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-09 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mbagheri746

//@version=4

strategy("Bagheri IG Ether v2", overlay=true, margin_long=100, margin_short=100)

TP = input(3000, minval = 1 , title ="Take Profit")

SL = input(2200, minval = 1 , title ="Stop Loss")

//_________________ RoC Definition _________________

rocLength = input(title="ROC Length", type=input.integer, minval=1, defval=186)

smoothingLength = input(title="Smoothing Length", type=input.integer, minval=1, defval=50)

src = input(title="Source", type=input.source, defval=close)

ma = ema(src, smoothingLength)

mom = change(ma, rocLength)

sroc = nz(ma[rocLength]) == 0

? 100

: mom == 0

? 0

: 100 * mom / ma[rocLength]

//srocColor = sroc >= 0 ? #0ebb23 : color.red

//plot(sroc, title="SROC", linewidth=2, color=srocColor, transp=0)

//hline(0, title="Zero Level", linestyle=hline.style_dotted, color=#989898)

//_________________ Donchian Channel _________________

length1 = input(53, minval=1, title="Upper Channel")

length2 = input(53, minval=1, title="Lower Channel")

offset_bar = input(91,minval=0, title ="Offset Bars")

upper = highest(length1)

lower = lowest(length2)

basis = avg(upper, lower)

DC_UP_Band = upper[offset_bar]

DC_LW_Band = lower[offset_bar]

l = plot(DC_LW_Band, style=plot.style_line, linewidth=1, color=color.red)

u = plot(DC_UP_Band, style=plot.style_line, linewidth=1, color=color.aqua)

fill(l,u,color = color.new(color.aqua,transp = 90))

//_________________ Bears Power _________________

wmaBP_period = input(65,minval=1,title="BearsP WMA Period")

line_wma = ema(close, wmaBP_period)

BP = low - line_wma

//_________________ Balance of Power _________________

ES_BoP=input(15, title="BoP Exponential Smoothing")

BOP=(close - open) / (high - low)

SBOP = rma(BOP, ES_BoP)

//_________________ Alligator _________________

//_________________ CCI _________________

//_________________ Moving Average _________________

sma_period = input(74, minval = 1 , title = "SMA Period")

sma_shift = input(37, minval = 1 , title = "SMA Shift")

sma_primary = sma(close,sma_period)

SMA_sh = sma_primary[sma_shift]

plot(SMA_sh, style=plot.style_line, linewidth=2, color=color.yellow)

//_________________ Long Entry Conditions _________________//

MA_Lcnd = SMA_sh > low and SMA_sh < high

ROC_Lcnd = sroc < 0

DC_Lcnd = open < DC_LW_Band

BP_Lcnd = BP[1] < BP[0] and BP[1] < BP[2]

BOP_Lcnd = SBOP[1] < SBOP[0]

//_________________ Short Entry Conditions _________________//

MA_Scnd = SMA_sh > low and SMA_sh < high

ROC_Scnd = sroc > 0

DC_Scnd = open > DC_UP_Band

BP_Scnd = BP[1] > BP[0] and BP[1] > BP[2]

BOP_Scnd = SBOP[1] > SBOP[0]

//_________________ OPEN POSITION __________________//

if strategy.position_size == 0

strategy.entry(id = "BUY", long = true , when = MA_Lcnd and ROC_Lcnd and DC_Lcnd and BP_Lcnd and BOP_Lcnd)

strategy.entry(id = "SELL", long = false , when = MA_Scnd and ROC_Scnd and DC_Scnd and BP_Scnd and BOP_Scnd)

//_________________ CLOSE POSITION __________________//

strategy.exit(id = "CLOSE BUY", from_entry = "BUY", profit = TP , loss = SL)

strategy.exit(id = "CLOSE SELL", from_entry = "SELL" , profit = TP , loss = SL)

//_________________ TP and SL Plot __________________//

currentPL= strategy.openprofit

pos_price = strategy.position_avg_price

open_pos = strategy.position_size

TP_line = (strategy.position_size > 0) ? (pos_price + TP/100) : strategy.position_size < 0 ? (pos_price - TP/100) : 0.0

SL_line = (strategy.position_size > 0) ? (pos_price - SL/100) : strategy.position_size < 0 ? (pos_price + SL/100) : 0.0

// hline(TP_line, title = "Take Profit", color = color.green , linestyle = hline.style_dotted, editable = false)

// hline(SL_line, title = "Stop Loss", color = color.red , linestyle = hline.style_dotted, editable = false)

Tline = plot(TP_line != 0.0 ? TP_line : na , title="Take Profit", color=color.green, trackprice = true, show_last = 1)

Sline = plot(SL_line != 0.0 ? SL_line : na, title="Stop Loss", color=color.red, trackprice = true, show_last = 1)

Pline = plot(pos_price != 0.0 ? pos_price : na, title="Stop Loss", color=color.gray, trackprice = true, show_last = 1)

fill(Tline , Pline, color = color.new(color.green,transp = 90))

fill(Sline , Pline, color = color.new(color.red,transp = 90))

//_________________ Alert __________________//

//alertcondition(condition = , title = "Position Alerts", message = "Bagheri IG Ether\n Symbol: {{ticker}}\n Type: {{strategy.order.id}}")

//_________________ Label __________________//

inMyPrice = input(title="My Price", type=input.float, defval=0)

inLabelStyle = input(title="Label Style", options=["Upper Right", "Lower Right"], defval="Lower Right")

posColor = color.new(color.green, 25)

negColor = color.new(color.red, 25)

dftColor = color.new(color.aqua, 25)

posPnL = (strategy.position_size != 0) ? (close * 100 / strategy.position_avg_price - 100) : 0.0

posDir = (strategy.position_size > 0) ? "long" : strategy.position_size < 0 ? "short" : "flat"

posCol = (strategy.openprofit > 0) ? posColor : (strategy.openprofit < 0) ? negColor : dftColor

myPnL = (inMyPrice != 0) ? (close * 100 / inMyPrice - 100) : 0.0

var label lb = na

label.delete(lb)

lb := label.new(bar_index, close,

color=posCol,

style=inLabelStyle=="Lower Right"?label.style_label_upper_left:label.style_label_lower_left,

text=

"╔═══════╗" +"\n" +

"Pos: " +posDir +"\n" +

"Pos Price: "+tostring(strategy.position_avg_price) +"\n" +

"Pos PnL: " +tostring(posPnL, "0.00") + "%" +"\n" +

"Profit: " +tostring(strategy.openprofit, "0.00") + "$" +"\n" +

"TP: " +tostring(TP_line, "0.00") +"\n" +

"SL: " +tostring(SL_line, "0.00") +"\n" +

"╚═══════╝")

Detail

https://www.fmz.com/strategy/431957

Last Modified

2023-11-13 16:44:58