Name

动量反转缩量突破型低吸金叉策略Camarilla-Pivot-Points-Breakthrough-and-Momentum-Reversal-Low-Absorption-Golden-Cross-Strategy

Author

ChaoZhang

Strategy Description

[trans]

该策略基于Camarilla支点的突破信号,结合RSI反转指标作为低吸机会,形成高级的动量反转型低吸策略。当价格突破Camarilla支点时产生交易信号,RSI低位则进一步确认吸筹机会,属于高级的动量反转策略。

策略的核心信号来自于Camarilla支点。Camarilla支点基于昨日价格范围计算,分为S1到S5支点和R1到R5支点。当价格从S1支点向上突破时产生买入信号,当价格从R1支点向下突破时产生卖出信号。此外,结合RSI指标判断是否处于超卖状态,可以提高入场的成功率。

具体来说,策略首先根据昨日最高价、最低价以及收盘价,计算Camarilla支点。然后判断收盘价是否突破支点,以此产生交易信号。同时判断RSI指标是否处于低位,低于30视为超卖。只有收盘价突破支点并且RSI低于30,才会产生真正的交易信号。做多信号为向上突破S1支点,做空信号为向下突破R1支点。

举例来说,如果昨日价格在10-11之间波动,今日收盘价突破11.05(S1支点),同时RSI指标显示20,则产生买入信号。如果今日收盘价突破10.95(R1支点),RSI显示20,则产生卖出信号。因此,该策略融合了突破信号和超卖信号的优点。

该策略最大的优势在于识别超跌和反转机会。Camarilla支点本身会把握价格的重要支持和阻力点。结合RSI指标判断反转时机,可以精确定位底部,避免追涨杀跌。这属于比较高级的突破策略。

另外,支点是动态计算的,会及时跟进价格变化。不像传统技术指标,需要设置参数。策略继承了支点分析的优势,更加灵活。此外,反转机会比较明确,不会出现频繁的虚假信号。

该策略最大的风险在于,价格可能假突破。尽管结合RSI指标来确认超卖状态,但是价格突破支点后仍有可能出现反转。这会导致止损被击穿。

另一个风险是,RSI指标发生失效。即使出现超跌,但是RSI未降到30以下。这时并没有形成交易信号,会错过反转机会。针对这一风险,可以适当优化RSI的参数设置。

该策略可以通过以下几个方面进行优化:

-

优化RSI的参数。可以测试不同的超卖线,是30好还是20更合适。

-

增加其他指标进行组合。比如KDJ指标,可以进一步确认反转信号的可靠性。

-

测试不同的Camarilla支点。可以只使用S1和R1,减少假突破的概率。

-

优化止损策略。可以根据ATR指标设置止损位,或者追踪突破的支点作为止损位。

-

测试不同的品种合约。适用于股指、外汇、商品等不同品种。参数需要调整。

该策略属于高级的动量反转型突破策略。通过Camarilla支点判断突破信号,RSI指标确定超卖状态。策略优势在于识别反转机会,最大的风险是价格假突破。通过参数优化以及风险管理,可以进一步提高策略的稳定性和盈利能力。

||

This strategy is based on the breakthrough signals of Camarilla pivot points, combined with the RSI reversal indicator as a low absorption opportunity, forming an advanced momentum reversal low absorption strategy. When the price breaks through the Camarilla pivot point, a trading signal is generated. The low RSI further confirms the dip opportunity. This belongs to an advanced momentum reversal strategy.

The core signal of the strategy comes from the Camarilla pivot points. Camarilla pivot points are calculated based on the price range of the previous day and divided into S1 to S5 pivot points and R1 to R5 pivot points. A buy signal is generated when the price breaks upward from the S1 pivot point, and a sell signal is generated when the price breaks downward from the R1 pivot point. In addition, the RSI indicator is used to determine whether it is in an oversold state to improve the success rate of entry.

Specifically, the strategy first calculates the Camarilla pivot points based on yesterday's highest price, lowest price and closing price. Then it judges whether the closing price breaks through the pivot point to generate trading signals. At the same time, it determines whether the RSI indicator is in a low position. Below 30 is considered oversold. Only when the closing price breaks through the pivot point and the RSI is below 30 will a real trading signal be generated. The buy signal is the upward breakthrough of the S1 pivot point, and the sell signal is the downward breakthrough of the R1 pivot point.

For example, if yesterday's price fluctuated between 10-11, today's closing price breaks through 11.05 (S1 pivot point), and at the same time the RSI indicator shows 20, a buy signal is generated. If today's closing price breaks through 10.95 (R1 pivot point), and RSI shows 20, a sell signal is generated. Therefore, this strategy combines the advantages of breakthrough signals and oversold signals.

The biggest advantage of this strategy is to identify oversold and reversal opportunities. Camarilla pivot points itself will grasp important support and resistance points of prices. Combined with the RSI indicator to determine the timing of reversals, it can accurately locate the bottom and avoid chasing rises and falls. This belongs to a more advanced breakthrough strategy.

In addition, pivot points are calculated dynamically to keep up with price changes in a timely manner. Unlike traditional technical indicators that require parameter settings. The strategy inherits the advantages of pivot point analysis and is more flexible. In addition, reversal opportunities are quite clear and will not appear frequent false signals.

The biggest risk of this strategy is that prices may have false breakouts. Although the RSI indicator is used to confirm the oversold state, the price may still reverse after breaking through the pivot point. This will cause the stop loss to be hit.

Another risk is that the RSI indicator fails. Even if there is a plunge, if the RSI does not fall below 30, no trading signal is formed, and reversal opportunities will be missed. To address this risk, RSI parameter settings can be optimized accordingly.

The following aspects of the strategy can be optimized:

-

Optimize RSI parameters. Test different oversold lines, is 30 better or 20 more appropriate?

-

Add other indicators for combination. For example, the KDJ indicator can further confirm the reliability of the reversal signal.

-

Test different Camarilla pivot points. You can only use S1 and R1 to reduce the probability of false breakouts.

-

Optimize stop loss strategies. You can set stop loss based on ATR indicators or track breakthrough pivot points as stop loss.

-

Test different types of contracts. Applicable to different types of products such as stock index, foreign exchange, commodities. Parameters need to be adjusted.

This strategy belongs to an advanced momentum reversal breakthrough strategy. It judges breakthrough signals through Camarilla pivot points and determines oversold status through RSI indicators. The advantage of the strategy is to identify reversal opportunities. The biggest risk is the false breakthrough of prices. By optimizing parameters and risk management, the stability and profitability of the strategy can be further improved. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | D | Resolution |

| v_input_2 | 0 | Sell from : R1 |

| v_input_3 | 0 | Buu from : S1 |

| v_input_4 | false | Trade reverse |

Source (PineScript)

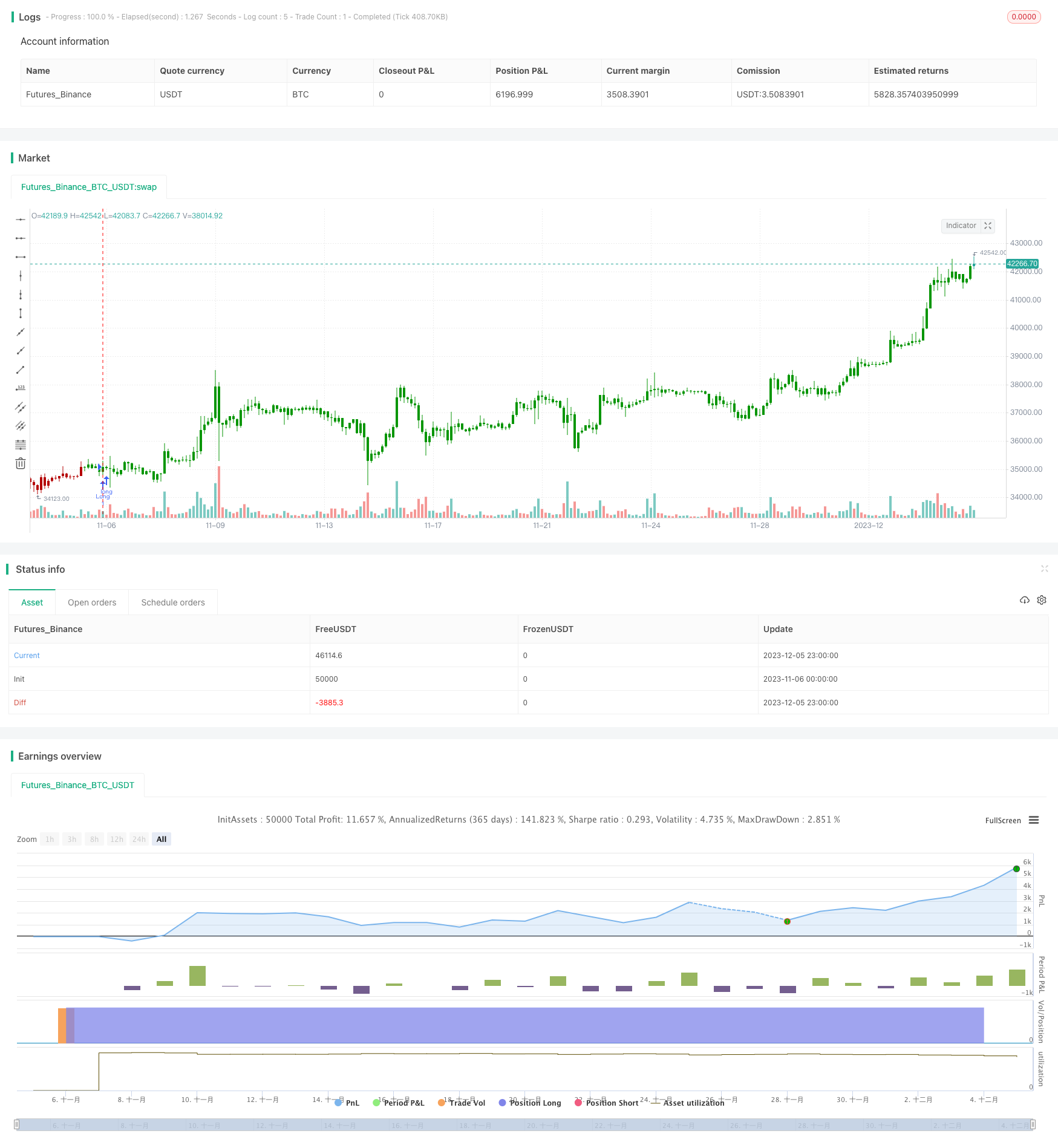

/*backtest

start: 2023-11-06 00:00:00

end: 2023-12-06 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 07/05/2020

// Pivot point studies highlight prices considered to be a likely turning point

// when looking at values from a previous period, whether it be daily, weekly,

// quarterly or annual. Each pivot point study has its own characteristics on

// how these points are calculated.

//

// Red color = Sell

// Green color = Buy

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points Backtest", shorttitle="CPP", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4", "R5"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4", "S5"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

xXLC3 = (xHigh+xLow+xClose) / 3

xRange = xHigh-xLow

S1 = xClose - xRange * (1.1 / 12)

S2 = xClose - xRange * (1.1 / 6)

S3 = xClose - xRange * (1.1 / 4)

S4 = xClose - xRange * (1.1 / 2)

R1 = xClose + xRange * (1.1 / 12)

R2 = xClose + xRange * (1.1 / 6)

R3 = xClose + xRange * (1.1 / 4)

R4 = xClose + xRange * (1.1 / 2)

R5 = (xHigh/xLow) * xClose

S5 = xClose - (R5 - xClose)

pos = 0

S = iff(BuyFrom == "S1", S1,

iff(BuyFrom == "S2", S2,

iff(BuyFrom == "S3", S3,

iff(BuyFrom == "S4", S4,

iff(BuyFrom == "S5", S5, 0)))))

B = iff(SellFrom == "R1", R1,

iff(SellFrom == "R2", R2,

iff(SellFrom == "R3", R3,

iff(SellFrom == "R4", R4,

iff(SellFrom == "R5", R5, 0)))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Detail

https://www.fmz.com/strategy/434586

Last Modified

2023-12-07 16:57:11