Name

动量均线交叉量化策略Momentum-Moving-Average-Crossover-Quant-Strategy

Author

ChaoZhang

Strategy Description

该策略结合了移动平均线和交易量两个关键技术指标,设计了长仓和短仓的入场和退出规则,形成一个完整的量化交易策略。

- 移动平均线:快速移动平均线(蓝线)和慢速移动平均线(红线)。

- 交易量:24小时交易量(紫色)和7天平均交易量(橙线)。

长仓入场条件:

- 快速移动平均线上穿慢速移动平均线

- 24小时交易量低于7天平均交易量的50%

短仓入场条件:

快速移动平均线下穿慢速移动平均线

**长仓入场:**满足长仓入场条件时做多

**短仓入场:**满足短仓入场条件时做空

止盈和止损: 显示做多后的止盈位和止损位

- 结合价格指标和交易量指标,避免假突破

- 清晰的入场和退出规则

- 有止盈止损机制控制风险

- 双均线策略容易产生频繁交易

- 交易量数据质量无法保证

- 参数优化存在过优化风险

改进方法:

- 适当调整均线参数,减少交易频率

- 结合更多数据源验证量化信号

- 严格的回测验证,防止过优化

- 增加其他指标过滤信号

- 动态调整止盈止损位

- 多时间框架分析,提高稳定性

该策略整合移动平均线指标和交易量指标,通过双确认机制设计了完整的量化交易策略。具有入场条件清晰,有止盈止损,简单可操作的优点。同时也要防止双均线策略的频繁交易问题,关注交易量数据质量,防止参数过优化。NEXT步进行多指标优化,动态止盈止损以及多时间框架分析。

||

This strategy combines the moving average and trading volume indicators to design the long and short entry and exit rules, forming a complete quantitative trading strategy.

- Moving Averages: Fast MA (Blue Line) and Slow MA (Red Line)

- Volume: 24-hour Volume (Purple) and 7-day Average Volume (Orange)

Long Entry Conditions:

- Fast MA crosses above Slow MA

- 24-hour Volume below 50% of 7-day Average Volume

Short Entry Conditions:

Fast MA crosses below Slow MA

Long Entry: Go long when long conditions are met

Short Entry: Go short when short conditions are met

Take Profit and Stop Loss: Displayed take profit and stop loss levels for long position

- Combining price and volume avoid false breakout

- Clear entry and exit rules

- Take profit and stop loss to control risk

- Frequent trading with moving average strategy

- Unreliable volume data quality

- Overoptimization in parameter tuning

Improvements:

- Adjust MA parameters to reduce trading frequency

- Verify signals with more data sources

- Strict backtesting to prevent overoptimization

- Add other indicators to filter signals

- Dynamic take profit and stop loss

- Multiple timeframe analysis to improve stability

This strategy integrates MA and volume indicators to design a complete quant strategy with clear entry conditions, take profit/stop loss, easy to operate. Need to prevent frequent trading issue, monitor volume data quality and overoptimization. NEXT steps are multivariate optimization, dynamic TP/SL and multiple timeframe analysis.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 9 | Fast MA Length |

| v_input_2 | 21 | Slow MA Length |

| v_input_3 | 50 | Volume Percentage Threshold |

Source (PineScript)

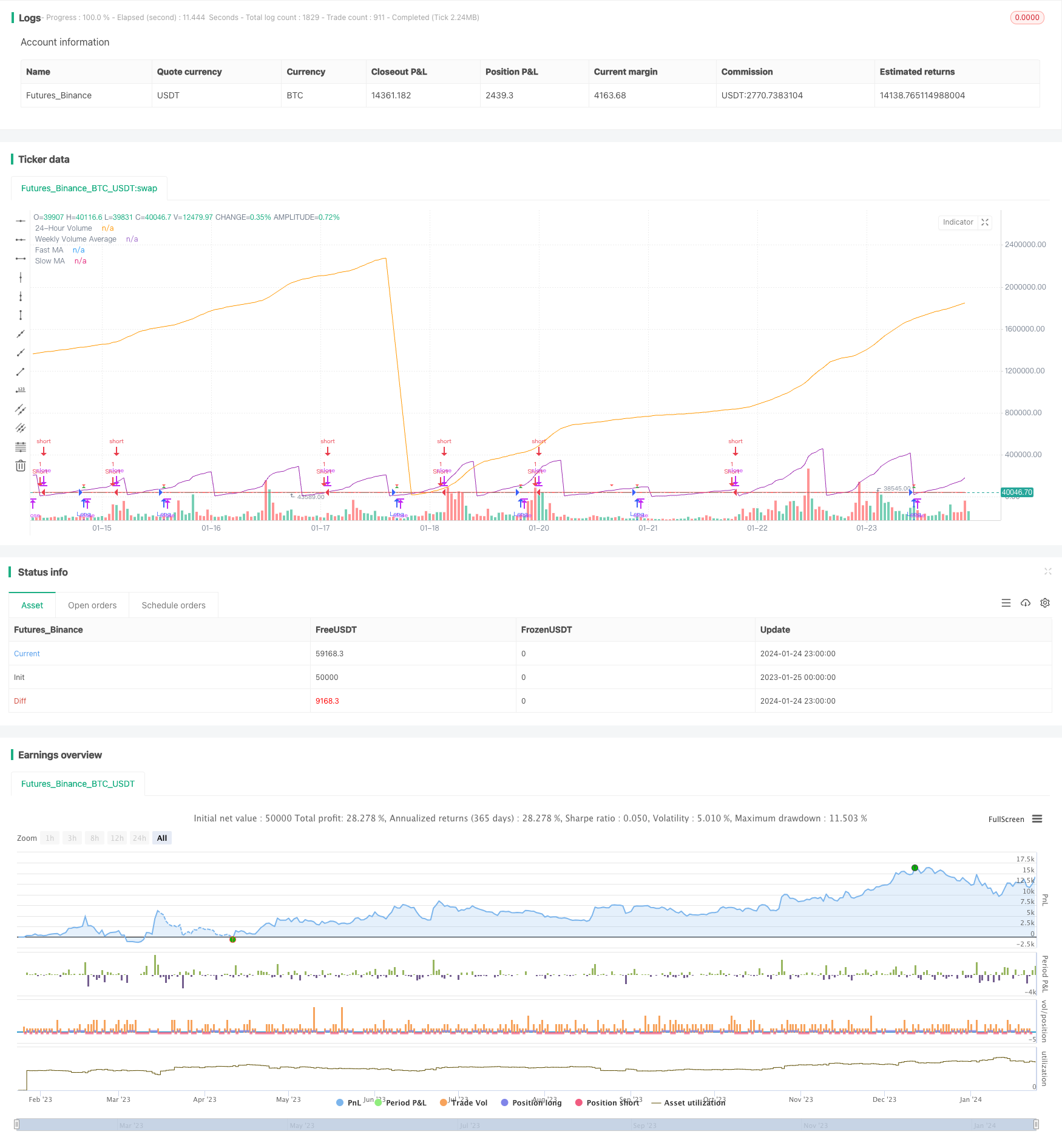

/*backtest

start: 2023-01-25 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MA and Volume Strategy", overlay=true)

// Input parameters

fastLength = input(9, title="Fast MA Length")

slowLength = input(21, title="Slow MA Length")

volumePercentageThreshold = input(50, title="Volume Percentage Threshold")

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Calculate 24-hour volume and weekly volume average

dailyVolume = request.security(syminfo.tickerid, "D", volume)

weeklyVolumeAvg = ta.sma(request.security(syminfo.tickerid, "W", volume), 7)

// Strategy conditions

longCondition = ta.crossover(fastMA, slowMA) and dailyVolume < (weeklyVolumeAvg * volumePercentageThreshold / 100)

shortCondition = ta.crossunder(fastMA, slowMA)

// Set take profit and stop loss levels

takeProfitLong = close * 1.50

stopLossLong = close * 0.90

// Strategy orders

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Plot moving averages

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Plot 24-hour volume and weekly volume average

plot(dailyVolume, color=color.purple, title="24-Hour Volume", transp=0)

plot(weeklyVolumeAvg, color=color.orange, title="Weekly Volume Average")

// Plot entry signals

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.triangledown, size=size.small)

// Plot take profit and stop loss levels only when a valid trade is active

plotshape(series=longCondition, title="Take Profit Long", color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=longCondition, title="Stop Loss Long", color=color.red, style=shape.triangledown, size=size.small)

Detail

https://www.fmz.com/strategy/440063

Last Modified

2024-01-26 11:39:26