Name

动量指标辅助均线回转交易策略Supply-Demand-Momentum-Reversal-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略运用动量指标和均线的组合,识别市场趋势和回转点,在趋势发生转折的时候进行交易,属于趋势跟踪和逆势交易策略。主要由供需区、EMA均线、各类HH、LL、LH、HL多空区域标记、ATR止损等模块组成。

根据K线高低点范围区分供需关系,红色区域为供过于求的供给区,绿色区域为求大于供的需求区。

计算长度为200的EMA均线并绘制,通过价格与EMA的大小关系判断多空趋势,价格高于EMA视为上升趋势,价格低于EMA视为下降趋势。

根据最近2根K线高低点情况判断回转区域:

- HH区( Higher High区域) — 连续2根K线高点创新高

- LL区( Lower Low区域) — 连续2根K线低点创新低

- LH区(Lower High区域) — 最近1根K线高点创新高,次根K线高点反转,属回落高点

- HL区(Higher Low区域) — 最近1根K线低点创新低,次根K线低点反转,属回升低点

计算14周期的ATR值,乘以系数2成为本策略的止损位。

监测价格与前一日Kline的高低点关系。当价格高于前一日的高点则产生多头信号;当价格低于前一日的低点则产生空头信号。入场信号延迟到第3根K线确认,避免冲击波动带来的错误信号。采用ATR 止损追踪方式,价格回撤超过止损线则主动止损退出当前信号。

- 运用多种指标识别趋势与关键回转区域,提高获利概率。

- ATR止损方式能有效控制单笔损失风险。

- 延迟入场确定有效信号,减少错误交易概率。

- 仅依赖技术指标,没有结合基本面信息,可能错过重要信息导致交易失败。

- ATR止损方式可能在大幅度行情中被突破从而造成亏损。

- 在震荡趋势中,EMA回转交易信号频繁,可能导致过度交易。

风险解决方法:

- 结合重大经济数据与政策判断来决定操作。

- 可适当扩大ATR 止损的系数,确保有足够空间。

- 调整ATR 止损的周期参数,避免在震荡中过于敏感。

- 结合其他技术指标如MACD、RSI等判断入场时机。

- 测试不同周期参数与系数参数的组合,寻找最优参数。

- 可考虑加入再突破过滤,避免信号被套。

- 运用机器学习等方法动态优化参数。

本策略综合运用供需分析、趋势判断、回转识别和止损管理模块,能有效识别市场在关键区域转折的机会,是一套行之有效的趋势跟踪与逆势交易策略。同时也需要不断测试与优化,辅以人工经验判断,方能取得长期稳定收益。

||

This strategy combines momentum indicators and moving averages to identify market trends and reversal points for trading when the trend changes direction. It belongs to trend following and countertrend trading strategies. The main components include supply and demand zones, EMA, various HH, LL, LH, HL long and short zones, ATR trailing stop loss etc.

Distinguish supply and demand relationship based on high and low range of Kline. Red areas indicate supply exceeds demand supply zones. Green areas indicate demand exceeds supply demand zones.

Plot 200 period EMA and determine uptrend and downtrend by comparing price with EMA. Price above EMA is considered as uptrend, while price below EMA as downtrend.

Determine reversal zones based on recent 2 candle’s high and low points:

- HH Zone (Higher High Zone) - Consecutive 2 candle highs make higher high

- LL Zone (Lower Low Zone) - Consecutive 2 candle lows make lower low

- LH Zone (Lower High Zone) - Recent higher high reversing into lower high

- HL Zone (Higher Low Zone) - Recent lower low reversing into higher low

Calculate 14 period ATR value which will be multiplied by a factor of 2 to derive the stop loss level.

Monitor price relationship with previous candle’s high/low points. Long signal triggers when price breaks above previous high. Short signal triggers when price breaks below previous low. Delay entry signal confirmation until the 3rd candle to avoid false signals. Exit with stop loss when price pulls back beyond the ATR trailing stop loss level.

- Utilize multiple indicators to identify trend and key reversal areas to improve profitability rate.

- ATR stop loss can effectively limit per trade loss risk.

- Delayed entry signal confirmation minimizes false trading.

- Rely solely on technical indicators without considering fundamental information may lead to trading failures from missing key data.

- ATR stop loss may get run-over during huge volatility resulting in losses.

- Frequent EMA reversal signals during ranging markets can lead to over-trading.

Risk Solutions:

- Complement with economic data and policy judgements.

- Allow wider buffer for ATR multiplier coefficient.

- Adjust ATR period parameter to avoid sensitivity during ranges.

- Complement with technical indicators like MACD, RSI etc to improve timing.

- Backtest different period and multiplier parameter combinations for optimization.

- Consider adding re-breakout filter to avoid signal whipsaws.

- Employ machine learning etc to dynamically optimize parameters.

This strategy combines supply/demand analysis, trend determination, reversal identification and risk management modules effectively to spot market reversal opportunities at key areas. It is a robust system for trend following and countertrend setups. Continuous testing, optimization and human experience judgements are crucial for long term steady profits.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | (?Signals)Show Buy Signals |

| v_input_2 | true | Show Sell Signals |

| v_input_3 | true | (?Zones)Show HL Zone |

| v_input_4 | true | Show LH Zone |

| v_input_5 | true | Show HH Zone |

| v_input_6 | true | Show LL Zone |

| v_input_7 | 200 | (?EMA Settings)EMA Length |

| v_input_8 | 14 | (?Trailing Stop)ATR Length |

| v_input_9 | 2 | ATR Multiplier |

Source (PineScript)

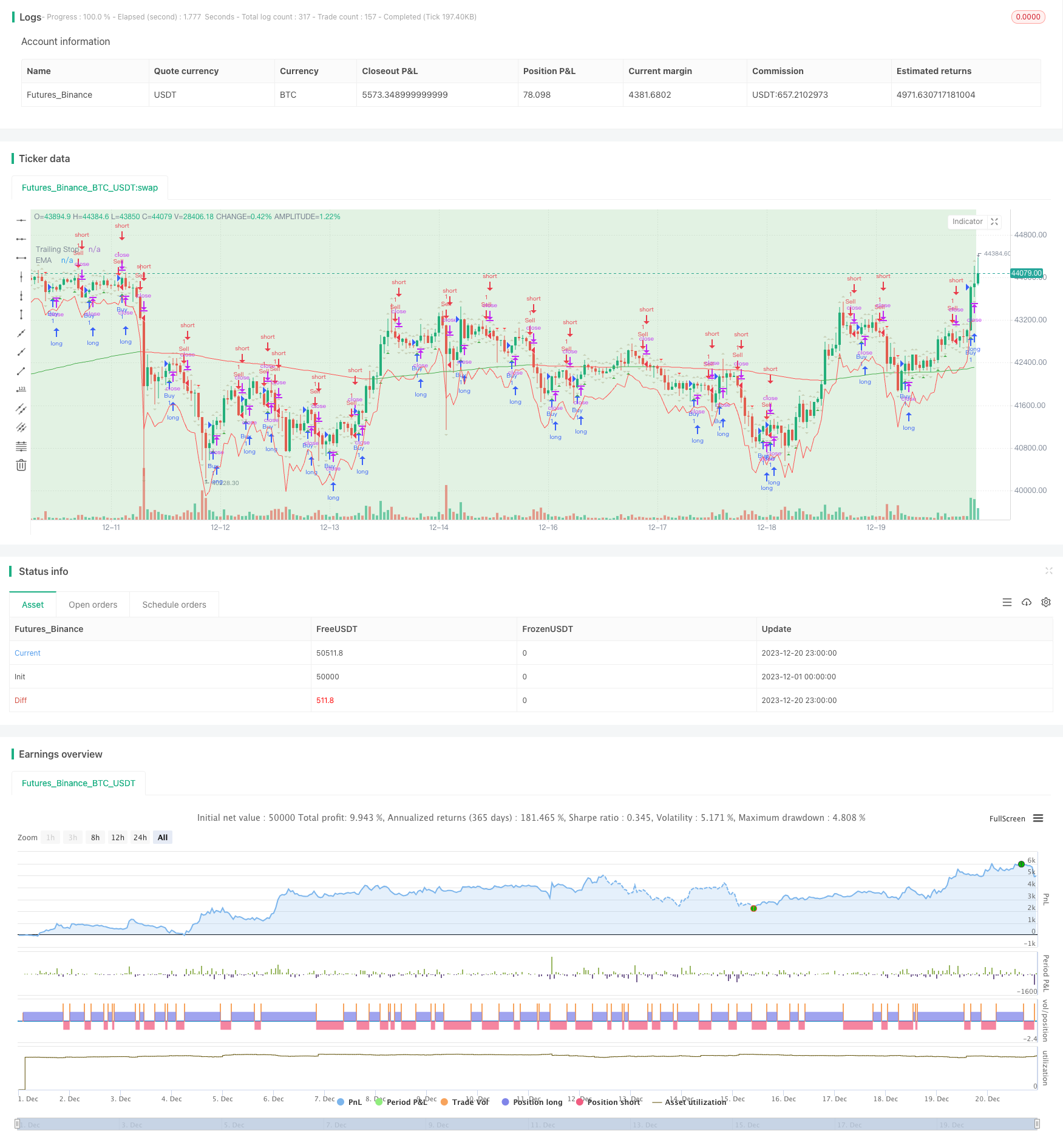

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-20 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Supply and Demand Zones with EMA and Trailing Stop", shorttitle="SD Zones", overlay=true)

showBuySignals = input(true, title="Show Buy Signals", group="Signals")

showSellSignals = input(true, title="Show Sell Signals", group="Signals")

showHLZone = input(true, title="Show HL Zone", group="Zones")

showLHZone = input(true, title="Show LH Zone", group="Zones")

showHHZone = input(true, title="Show HH Zone", group="Zones")

showLLZone = input(true, title="Show LL Zone", group="Zones")

emaLength = input(200, title="EMA Length", group="EMA Settings")

atrLength = input(14, title="ATR Length", group="Trailing Stop")

atrMultiplier = input(2, title="ATR Multiplier", group="Trailing Stop")

// Function to identify supply and demand zones

getZones(src, len, mult) =>

base = request.security(syminfo.tickerid, "D", close)

upper = request.security(syminfo.tickerid, "D", high)

lower = request.security(syminfo.tickerid, "D", low)

multiplier = request.security(syminfo.tickerid, "D", mult)

zonetype = base + multiplier * len

zone = src >= zonetype

[zone, upper, lower]

// Identify supply and demand zones

[supplyZone, _, _] = getZones(close, high[1] - low[1], 1)

[demandZone, _, _] = getZones(close, high[1] - low[1], -1)

// Plot supply and demand zones

bgcolor(supplyZone ? color.new(color.red, 80) : na)

bgcolor(demandZone ? color.new(color.green, 80) : na)

// EMA with Linear Weighted method

ema = ta.ema(close, emaLength)

// Color code EMA based on its relation to candles

emaColor = close > ema ? color.new(color.green, 0) : close < ema ? color.new(color.red, 0) : color.new(color.yellow, 0)

// Plot EMA

plot(ema, color=emaColor, title="EMA")

// Entry Signal Conditions after the third candle

longCondition = ta.crossover(close, high[1]) and (bar_index >= 2)

shortCondition = ta.crossunder(close, low[1]) and (bar_index >= 2)

// Trailing Stop using ATR

atrValue = ta.atr(atrLength)

trailStop = close - atrMultiplier * atrValue

// Strategy Entry and Exit

if (longCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("TrailStop", from_entry="Buy", loss=trailStop)

if (shortCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("TrailStop", from_entry="Sell", loss=trailStop)

// Plot Entry Signals

plotshape(series=showBuySignals ? longCondition : na, title="Buy Signal", color=color.new(color.green, 0), style=shape.triangleup, location=location.belowbar)

plotshape(series=showSellSignals ? shortCondition : na, title="Sell Signal", color=color.new(color.red, 0), style=shape.triangledown, location=location.abovebar)

// Plot Trailing Stop

plot(trailStop, color=color.new(color.red, 0), title="Trailing Stop")

// Plot HH, LL, LH, and HL zones

plotshape(series=showHHZone and ta.highest(high, 2)[1] and ta.highest(high, 2)[2] ? 1 : na, title="HH Zone", color=color.new(color.blue, 80), style=shape.triangleup, location=location.abovebar)

plotshape(series=showLLZone and ta.lowest(low, 2)[1] and ta.lowest(low, 2)[2] ? 1 : na, title="LL Zone", color=color.new(color.blue, 80), style=shape.triangledown, location=location.belowbar)

plotshape(series=showLHZone and ta.highest(high, 2)[1] and ta.lowest(low, 2)[2] ? 1 : na, title="LH Zone", color=color.new(color.orange, 80), style=shape.triangleup, location=location.abovebar)

plotshape(series=showHLZone and ta.lowest(low, 2)[1] and ta.highest(high, 2)[2] ? 1 : na, title="HL Zone", color=color.new(color.orange, 80), style=shape.triangledown, location=location.belowbar)

Detail

https://www.fmz.com/strategy/439652

Last Modified

2024-01-22 17:34:05