Name

双向反转动量指数交易策略Dual-Reversal-Momentum-Index-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略是一个利用双向反转动量指数指标进行交易的策略。该策略通过计算一定时间周期内的最高价、最低价、收盘价来构建一个反转动量指数,并计算其移动平均线构成交易信号。当指数从超买区反转下跌或从超卖区反转上涨时产生交易信号。该策略同时设置了突破止损机制。

本策略的核心指标是反转动量指数(Stochastic Momentum Index,SMI)。SMI的计算公式如下:

其中,HH是过去N天的最高价,LL是过去N天的最低价,N由参数a确定;AVGDIFF是HH-LL的M日移动平均,M由参数b确定。

SMI指数体现了价格反转特性。当股票价格接近最近N天的最高点时,SMI接近100,表示股票超买;当接近最近N天的最低点时,SMI接近-100,表示股票超卖。SMI从100水平反转下跌或从-100水平反转上涨时,发出买入/卖出信号。

本策略使用SMI的M日移动平均线SMA作为交易信号线。当SMI从超买区向下反转跌破SMA时,产生买入信号;当SMI从超卖区向上反转突破SMA时,产生卖出信号。

同时,策略判断K线实体突破来设置止损。

本策略具有以下优势:

-

利用价格反转原理,能够在趋势反转点产生交易信号,捕捉反转机会。

-

SMI指数将最高价、最低价和收盘价结合在一起,综合判断超买超卖情况,信号较为可靠。

-

结合K线实体突破来设置止损,可以及时止损Exiting the position,有效控制风险。

-

策略参数较少,容易实现和优化。

本策略也存在一些风险:

-

反转交易难以判断反转成功的时点,可能产生多次亏损后才捕捉到趋势反转。

-

反转时点判断错误可能造成损失放大。

-

实体突破止损可能过于灵敏,被套牢的概率较大。

对应解决方法:

-

优化SMI参数,调整反转交易频率。

-

结合其他指标判断反转时点。

-

调整实体大小止损参数,防止过于灵敏。

本策略可以从以下几个方向进行优化:

-

优化SMI的参数a和b,调整反转捕捉的灵敏度。

-

增加其他指标判断,避免错过主要趋势方向。比如结合均线、波动率指标等。

-

增加止损方式,防止止损过于灵敏或迟钝。可以考虑跟踪止损、曲线止损等。

-

结合机器学习模型判断反转成功概率,避免反转失败的交易。

本策略整体来说是一个利用反转指数SMI进行双向交易的策略。优点是利用价格反转特性,在反转点产生交易信号,能捕捉较多短线交易机会。但也存在一些典型的反转交易风险,需要对参数和止损进行优化,防止亏损放大。总体来说,本策略适合对反转交易感兴趣的投资者,但必须用复合其他指标判断和严格止损来控制风险。

||

This strategy is based on the Dual Reversal Momentum Index indicator for trading. It calculates a reversal momentum index over a certain time period using highest price, lowest price, and closing price, and generates trading signals when the index reverses down from the overbought zone or reverses up from the oversold zone. It also sets a breakout stop loss mechanism.

The core indicator of this strategy is Stochastic Momentum Index (SMI). The calculation formula of SMI is:

Where HH is the highest price over the past N days, LL is the lowest price over past N days, N is determined by parameter a; AVGDIFF is the M-day moving average of HH-LL, M is determined by parameter b.

SMI shows the reversal characteristic of prices. When the stock price approaches the highest point over the past N days, SMI is close to 100, indicating overbought of the stock; when it approaches the lowest point over the past N days, SMI is close to -100, indicating oversold. The buy/sell signals are generated when SMI reverses down from the 100 level or reverses up from the -100 level.

The strategy uses the M-day moving average SMA of SMI as the trading signal line. When SMI reverses down from the overbought zone and breaks below SMA, a buy signal is generated. When SMI reverses up from the oversold zone and breaks above SMA, a sell signal is generated.

Also, the strategy judges the candlestick body breakout for stop loss.

The advantages of this strategy are:

-

Utilizing the price reversal principle, it can generate trading signals at reversal points and capture reversal opportunities.

-

SMI combines highest price, lowest price and closing price for judging overbought and oversold conditions, making more reliable signals.

-

With candlestick body breakout stop loss, it can exit positions in time and effectively control risks.

-

The strategy has few parameters and is easy to implement and optimize.

There are also some risks for this strategy:

-

Reversal trading finds it hard to determine the exact timing of successful reversals, and may incur multiple losses before capturing trend reversal.

-

Wrong judgement of reversal points may lead to amplified losses.

-

The body breakout stop loss may be too sensitive with high probability of being trapped.

The solutions are:

-

Optimize SMI parameters to adjust reversal trading frequency.

-

Combine other indicators to determine reversal timing.

-

Adjust body size for stop loss to prevent being too sensitive.

The strategy can be optimized in the following aspects:

-

Optimize parameters a and b of SMI to adjust the sensitivity of capturing reversals.

-

Add other indicators for judgement to avoid missing major trend directions, e.g. moving averages, volatility indicators etc.

-

Add more stop loss methods to prevent being too sensitive or insensitive, such as trailing stop loss, curve stop loss etc.

-

Incorporate machine learning models to judge the probability of reversal success, avoiding failed reversal trades.

In conclusion, this is a dual-direction trading strategy based on the reversal momentum index SMI. The advantage lies in capturing more short-term trading opportunities by utilizing price reversal and generating signals at reversal points. But there are also typical risks of reversal trading. Parameter tuning and stop loss optimization are needed to prevent amplified losses. Overall speaking, this strategy suits investors interested in reversal trading, but must incorporate other indicators and strict stop loss to control risks. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Long |

| v_input_2 | true | Short |

| v_input_3 | 100 | Capital, % |

| v_input_4 | 5 | Percent K Length |

| v_input_5 | 3 | Percent D Length |

| v_input_6 | 50 | SMI Limit |

| v_input_7 | 2018 | From Year |

| v_input_8 | 2100 | To Year |

| v_input_9 | true | From Month |

| v_input_10 | 12 | To Month |

| v_input_11 | true | From day |

| v_input_12 | 31 | To day |

Source (PineScript)

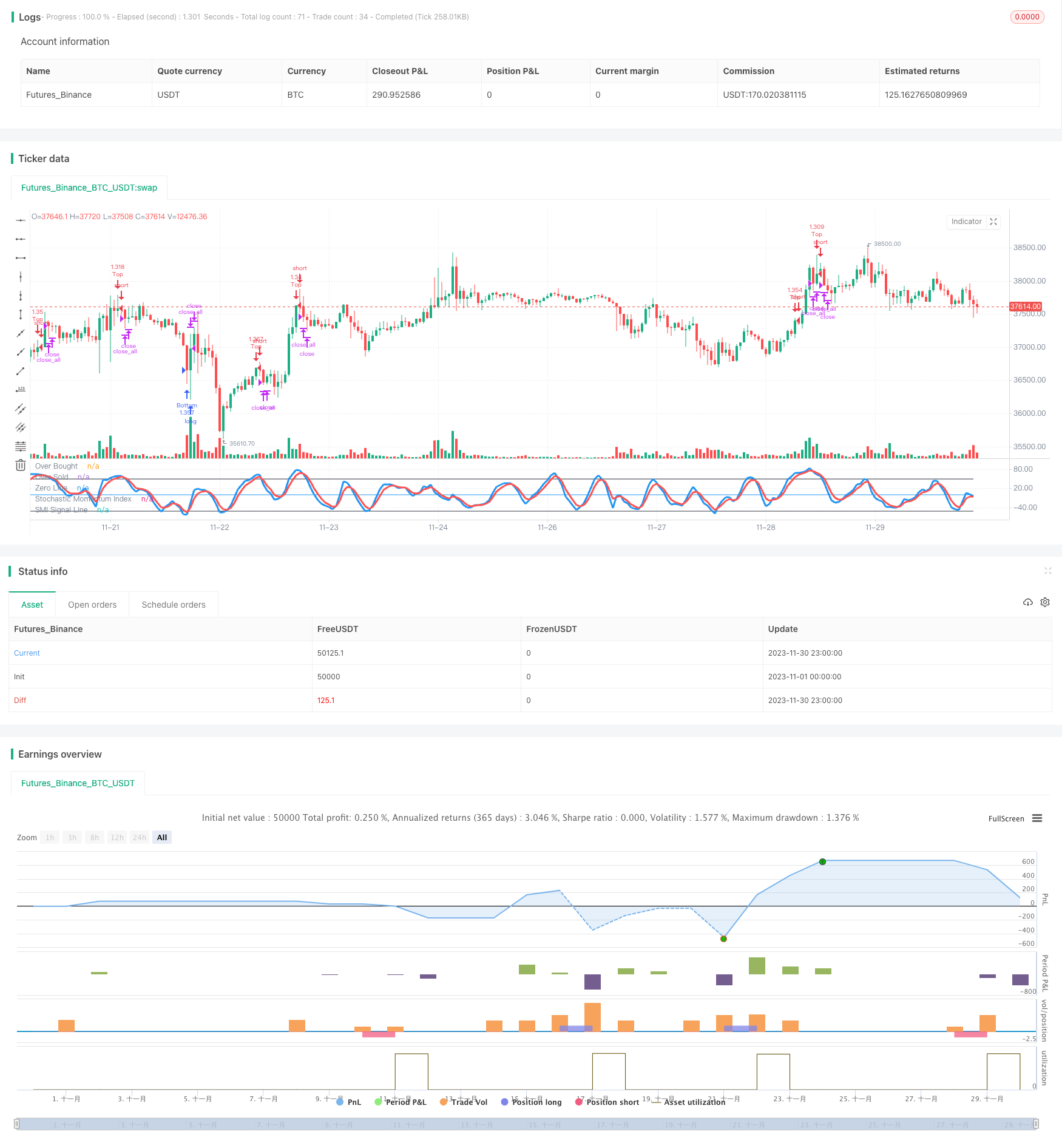

/*backtest

start: 2023-11-01 00:00:00

end: 2023-11-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Stochastic Strategy v1.0", shorttitle = "Stochastic str 1.0", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

a = input(5, "Percent K Length")

b = input(3, "Percent D Length")

limit = input(50, defval = 50, minval = 1, maxval = 100, title = "SMI Limit")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Stochastic Momentum Index

ll = lowest (low, a)

hh = highest (high, a)

diff = hh - ll

rdiff = close - (hh+ll)/2

avgrel = ema(ema(rdiff,b),b)

avgdiff = ema(ema(diff,b),b)

SMI = avgdiff != 0 ? (avgrel/(avgdiff/2)*100) : 0

SMIsignal = ema(SMI,b)

//Lines

plot(SMI, color = blue, linewidth = 3, title = "Stochastic Momentum Index")

plot(SMIsignal, color = red, linewidth = 3, title = "SMI Signal Line")

plot(limit, color = black, title = "Over Bought")

plot(-1 * limit, color = black, title = "Over Sold")

plot(0, color = blue, title = "Zero Line")

//Body

body = abs(close - open)

abody = sma(body, 10)

//Signals

up = SMIsignal < -1 * limit and close < open

dn = SMIsignal > limit and close > open

exit = ((strategy.position_size > 0 and close > open) or (strategy.position_size < 0 and close < open)) and body > abody / 2

//Trading

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 : lot[1]

if up

if strategy.position_size < 0

strategy.close_all()

strategy.entry("Bottom", strategy.long, needlong == false ? 0 : lot)

if dn

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Top", strategy.short, needshort == false ? 0 : lot)

if exit

strategy.close_all()

Detail

https://www.fmz.com/strategy/436490

Last Modified

2023-12-25 12:02:57