Name

双向自适应范围滤波动量跟踪策略This-strategy-is-a-bidirectional-adaptive-range-filtering-momentum-tracking-strategy

Author

ChaoZhang

Strategy Description

[trans]

该策略是一种双向自适应的范围滤波动量跟踪策略。它利用自适应范围滤波器跟踪价格波动,并结合量能指标判断价值方向,实现低买高卖。

- 利用自适应范围滤波器跟踪价格波动。滤波器大小根据用户设定的范围周期、数量和规模进行自适应调整。

- 滤波器分为Type 1和Type 2两种类型。Type 1为标准范围跟踪型,Type 2为阶梯约整型。

- 根据滤波器和收盘价的大小关系判断价格波动方向。价格在上轨之上为看涨,下轨之下为看跌。

- 结合收盘价较前一日的涨跌关系,判断价值方向。价值上升为多头,下降为空头。

- 当价格突破上轨且价值上升时发出买入信号;当价格跌破下轨且价值下降时发出卖出信号。

- 自适应范围滤波器可以准确抓取市场波动。

- 两种类型的滤波器可以满足不同交易偏好。

- 结合量能指标可有效识别价值方向。

- 策略灵活,可以根据市场调整参数。

- 可 Customize 选择合适的交易条件逻辑。

- 参数设置不当可能导致过度交易或漏单。

- 突破信号存在一定滞后。

- 量能指标存在一定卡顿风险。

- 范围突破容易被套。

风险防范:

- 选择合适的参数组合并适时调整。

- 结合其他指标识别趋势。

- 在关键位附近及趋势反转时审慎交易。

- 测试不同的范围大小和平滑周期参数组合,找到最佳组合。

- 尝试不同的滤波器类型,选择个人偏好类型。

- 试验其他量能指标或辅助技术指标。

- 优化和调整交易条件逻辑以减少非理性交易。

- 结合市场分型理论设定自适应调仓比例。

||

This strategy is a bidirectional adaptive range filtering momentum tracking strategy. It uses an adaptive range filter to track price fluctuations and combines volume indicators to determine the direction of value, in order to implement low buying and high selling.

-

Use an adaptive range filter to track price fluctuations. The size of the filter is adjusted adaptively according to the user-defined range period, quantity and scale.

-

There are two types of filters: Type 1 and Type 2. Type 1 is a standard range tracking type, and Type 2 is a stepped rounding type.

-

Determine the direction of price fluctuation based on the relationship between the filter and the closing price. Above the upper rail is bullish, and below the lower rail is bearish.

-

Combined with the rise and fall of the closing price compared to the previous day, determine the direction of value. Value rising is bullish and value falling is bearish.

-

Issue a buy signal when the price breaks through the upper track and the value rises; Issue a sell signal when the price breaks through the lower track and the value falls.

-

The adaptive range filter can accurately capture market fluctuations.

-

Two types of filters can meet different trading preferences.

-

Combining volume indicators can effectively identify value direction.

-

The strategy is flexible and parameters can be adjusted according to market conditions.

-

Customizable trading condition logic.

-

Improper parameter settings may lead to overtrading or missing trades.

-

Breakout signals have a certain lag.

-

Volume indicators have a certain risk of stalling.

-

Range breaks are prone to being trapped.

Risk Prevention:

-

Choose appropriate parameter combinations and adjust them in a timely manner.

-

Combine other indicators to identify trends.

-

Trade cautiously around key levels and trend reversals.

-

Test different combinations of range sizes and smoothing cycles to find the optimal combination.

-

Try different types of filters and choose your preferred type.

-

Experiment with other volume indicators or auxiliary technical indicators.

-

Optimize and adjust trading condition logic to reduce irrational trading.

-

Incorporate market theorems to set adaptive position sizing.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 0 | Filter Type: Type 1 |

| v_input_2 | 0 | Movement Source: Close |

| v_input_3 | 2.618 | Range Size |

| v_input_4 | 0 | Range Scale: Average Change |

| v_input_5 | 14 | Range Period (for ATR, Average Change, and Standard Deviation) |

| v_input_6 | true | Smooth Range |

| v_input_7 | 27 | Smoothing Period |

| v_input_8 | true | Average Filter Changes |

| v_input_9 | 2 | Number Of Changes To Average |

Source (PineScript)

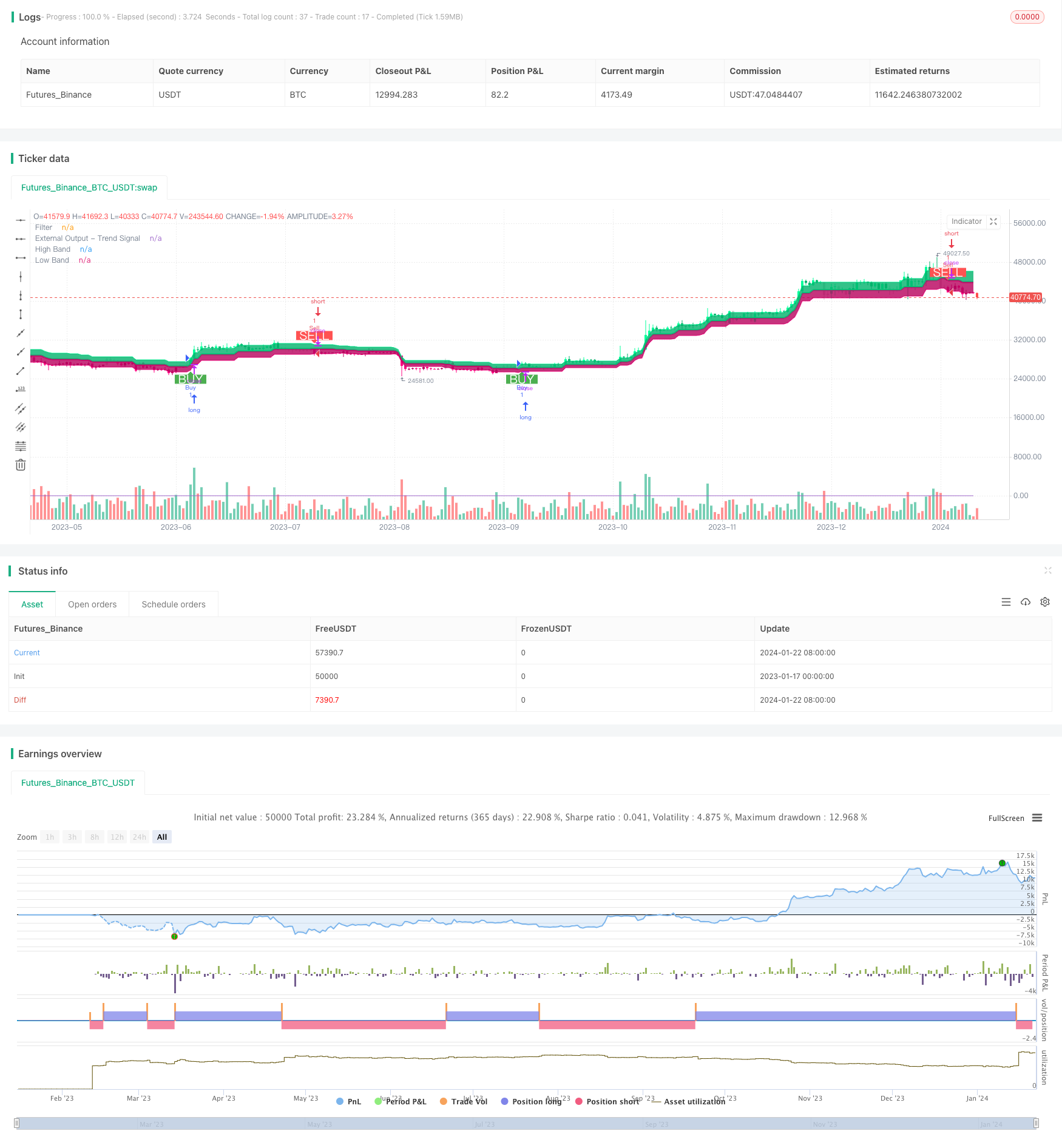

/*backtest

start: 2023-01-17 00:00:00

end: 2024-01-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Range Filter [DW] & Labels", shorttitle="RF [DW] & Labels", overlay=true)

//Conditional Sampling EMA Function

Cond_EMA(x, cond, n)=>

var val = array.new_float(0)

var ema_val = array.new_float(1)

if cond

array.push(val, x)

if array.size(val) > 1

array.remove(val, 0)

if na(array.get(ema_val, 0))

array.fill(ema_val, array.get(val, 0))

array.set(ema_val, 0, (array.get(val, 0) - array.get(ema_val, 0))*(2/(n + 1)) + array.get(ema_val, 0))

EMA = array.get(ema_val, 0)

EMA

//Conditional Sampling SMA Function

Cond_SMA(x, cond, n)=>

var vals = array.new_float(0)

if cond

array.push(vals, x)

if array.size(vals) > n

array.remove(vals, 0)

SMA = array.avg(vals)

SMA

//Standard Deviation Function

Stdev(x, n)=>

sqrt(Cond_SMA(pow(x, 2), 1, n) - pow(Cond_SMA(x, 1, n), 2))

//Range Size Function

rng_size(x, scale, qty, n)=>

ATR = Cond_EMA(tr(true), 1, n)

AC = Cond_EMA(abs(x - x[1]), 1, n)

SD = Stdev(x, n)

rng_size = scale=="Pips" ? qty*0.0001 : scale=="Points" ? qty*syminfo.pointvalue : scale=="% of Price" ? close*qty/100 : scale=="ATR" ? qty*ATR :

scale=="Average Change" ? qty*AC : scale=="Standard Deviation" ? qty*SD : scale=="Ticks" ? qty*syminfo.mintick : qty

//Two Type Range Filter Function

rng_filt(h, l, rng_, n, type, smooth, sn, av_rf, av_n)=>

rng_smooth = Cond_EMA(rng_, 1, sn)

r = smooth ? rng_smooth : rng_

var rfilt = array.new_float(2, (h + l)/2)

array.set(rfilt, 1, array.get(rfilt, 0))

if type=="Type 1"

if h - r > array.get(rfilt, 1)

array.set(rfilt, 0, h - r)

if l + r < array.get(rfilt, 1)

array.set(rfilt, 0, l + r)

if type=="Type 2"

if h >= array.get(rfilt, 1) + r

array.set(rfilt, 0, array.get(rfilt, 1) + floor(abs(h - array.get(rfilt, 1))/r)*r)

if l <= array.get(rfilt, 1) - r

array.set(rfilt, 0, array.get(rfilt, 1) - floor(abs(l - array.get(rfilt, 1))/r)*r)

rng_filt1 = array.get(rfilt, 0)

hi_band1 = rng_filt1 + r

lo_band1 = rng_filt1 - r

rng_filt2 = Cond_EMA(rng_filt1, rng_filt1 != rng_filt1[1], av_n)

hi_band2 = Cond_EMA(hi_band1, rng_filt1 != rng_filt1[1], av_n)

lo_band2 = Cond_EMA(lo_band1, rng_filt1 != rng_filt1[1], av_n)

rng_filt = av_rf ? rng_filt2 : rng_filt1

hi_band = av_rf ? hi_band2 : hi_band1

lo_band = av_rf ? lo_band2 : lo_band1

[hi_band, lo_band, rng_filt]

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Inputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Filter Type

f_type = input(defval="Type 1", options=["Type 1", "Type 2"], title="Filter Type")

//Movement Source

mov_src = input(defval="Close", options=["Wicks", "Close"], title="Movement Source")

//Range Size Inputs

rng_qty = input(defval=2.618, minval=0.0000001, title="Range Size")

rng_scale = input(defval="Average Change", options=["Points", "Pips", "Ticks", "% of Price", "ATR", "Average Change", "Standard Deviation", "Absolute"], title="Range Scale")

//Range Period

rng_per = input(defval=14, minval=1, title="Range Period (for ATR, Average Change, and Standard Deviation)")

//Range Smoothing Inputs

smooth_range = input(defval=true, title="Smooth Range")

smooth_per = input(defval=27, minval=1, title="Smoothing Period")

//Filter Value Averaging Inputs

av_vals = input(defval=true, title="Average Filter Changes")

av_samples = input(defval=2, minval=1, title="Number Of Changes To Average")

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Definitions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//High And Low Values

h_val = mov_src=="Wicks" ? high : close

l_val = mov_src=="Wicks" ? low : close

//Range Filter Values

[h_band, l_band, filt] = rng_filt(h_val, l_val, rng_size((h_val + l_val)/2, rng_scale, rng_qty, rng_per), rng_per, f_type, smooth_range, smooth_per, av_vals, av_samples)

//Direction Conditions

var fdir = 0.0

fdir := filt > filt[1] ? 1 : filt < filt[1] ? -1 : fdir

upward = fdir==1 ? 1 : 0

downward = fdir==-1 ? 1 : 0

//Colors

filt_color = upward ? #05ff9b : downward ? #ff0583 : #cccccc

bar_color = upward and (close > filt) ? (close > close[1] ? #05ff9b : #00b36b) :

downward and (close < filt) ? (close < close[1] ? #ff0583 : #b8005d) : #cccccc

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Outputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Filter Plot

filt_plot = plot(filt, color=filt_color, transp=0, linewidth=3, title="Filter")

//Band Plots

h_band_plot = plot(h_band, color=#05ff9b, transp=100, title="High Band")

l_band_plot = plot(l_band, color=#ff0583, transp=100, title="Low Band")

//Band Fills

fill(h_band_plot, filt_plot, color=#00b36b, transp=85, title="High Band Fill")

fill(l_band_plot, filt_plot, color=#b8005d, transp=85, title="Low Band Fill")

//Bar Color

barcolor(bar_color)

//External Trend Output

plot(fdir, transp=100, editable=false, display=display.none, title="External Output - Trend Signal")

// Trading Conditions Logic

longCond = close > filt and close > close[1] and upward > 0 or close > filt and close < close[1] and upward > 0

shortCond = close < filt and close < close[1] and downward > 0 or close < filt and close > close[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

// Strategy Entry and Exit

strategy.entry("Buy", strategy.long, when = longCondition)

strategy.entry("Sell", strategy.short, when = shortCondition)

strategy.close("Buy", when = shortCondition)

strategy.close("Sell", when = longCondition)

// Plot Buy and Sell Labels

plotshape(longCondition, title = "Buy Signal", text ="BUY", textcolor = color.white, style=shape.labelup, size = size.normal, location=location.belowbar, color = color.green, transp = 0)

plotshape(shortCondition, title = "Sell Signal", text ="SELL", textcolor = color.white, style=shape.labeldown, size = size.normal, location=location.abovebar, color = color.red, transp = 0)

// Alerts

alertcondition(longCondition, title="Buy Alert", message = "BUY")

alertcondition(shortCondition, title="Sell Alert", message = "SELL")

Detail

https://www.fmz.com/strategy/439838

Last Modified

2024-01-24 11:32:23