Name

双因子反转波段突破组合策略Reversal-Breakout-Bandpass-Combo-Strategy

Author

ChaoZhang

Strategy Description

本策略是一种双因子组合策略,由反转型因子和波段通道因子共同驱动,实现了多因子叠加,可以在不同市场环境中发挥策略优势。

该策略由两个子策略组成:

-

123反转策略:当收盘价连续两日下跌后,如果今日收盘价突破此前连续两日的最低价,同时9日随机指标的快线上穿慢线时,做多;当收盘价连续两日上涨后,如果今日收盘价跌破此前连续两日的最高价,同时9日随机指标的快线下穿慢线时,做空。

-

波段过滤器:计算一定周期内价格的波段指标,当波段指标大于某一阈值时做多,当波段指标小于某一阈值时做空。

组合信号为:如果123反转策略和波段过滤器策略同为做多信号,则采取做多持仓;如果两者同为做空信号,则采取做空持仓;否则清仓。

- 双因子驱动,市场适应性强,可在多种行情中获利

- 123反转策略可在震荡盘整形态中捕捉反转机会

- 波段过滤器可在趋势明确的行情中跟踪趋势

- 组合信号进行验证,可减少失误交易概率

- 参数设置不当可能导致过于频繁交易

- 震荡行情中可能出现多次亏损

- 需要关注交易手续费的影响

- 调整波段过滤器的参数,优化波段指标的计算

- 调整123反转策略的参数,优化做多做空的反转判定

- 加入止损机制,控制单笔亏损

本策略综合运用反转因子和趋势因子,实现了多因子驱动的量化交易。通过双因子的验证可减少误交易的概率,使策略在多种市场中表现优异。后续可通过参数调整和止损设置进一步优化,使策略的稳定性和盈利能力得到提升。

||

This is a combo strategy driven by two factors - reversal and bandpass, which achieves multi-factor overlay and adapts to different market conditions.

The strategy consists of two sub-strategies:

-

123 Reversal Strategy: When the close price drops for two consecutive days, if today's close breaks through the lowest price in the previous two days, and the fast line of 9-day Stochastic oscillator crosses above the slow line, go long. When the close price rises for two consecutive days, if today's close drops below the highest price in the previous two days, and the fast line crosses below the slow line, go short.

-

Bandpass Filter: Calculate a bandpass indicator over a certain period, go long when it is above a threshold, and go short when below.

The combined signal is: take long position if both strategies give long signals, take short position if both give short signals, otherwise clear all positions.

- Driven by dual factors, adapts to various market conditions, profitable across regimes

- 123 reversal captures reversal opportunities in range-bound markets

- Bandpass filter tracks trends in trending markets

- Combined signal verifies and avoids erroneous trades

- Improper parameters may cause over-trading

- Multiple losses may occur in choppy markets

- Transaction costs need to be monitored

- Tune bandpass filter parameters to optimize bandpass calculation

- Adjust 123 reversal parameters to optimize long/short reversal identification

- Add stop loss to control losses for single trades

This strategy integrates reversal and trend factors to achieve multi-factor driven quantitative trading. The dual-factor verification reduces the probability of erroneous trades, making the strategy perform well across various markets. Further improvements on parameter tuning and stop loss will enhance the strategy's stability and profitability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | Length |

| v_input_2 | true | KSmoothing |

| v_input_3 | 3 | DLength |

| v_input_4 | 50 | Level |

| v_input_5 | 20 | LengthBF |

| v_input_6 | 0.5 | Delta |

| v_input_7 | false | TriggerLevel |

| v_input_8 | false | Trade reverse |

Source (PineScript)

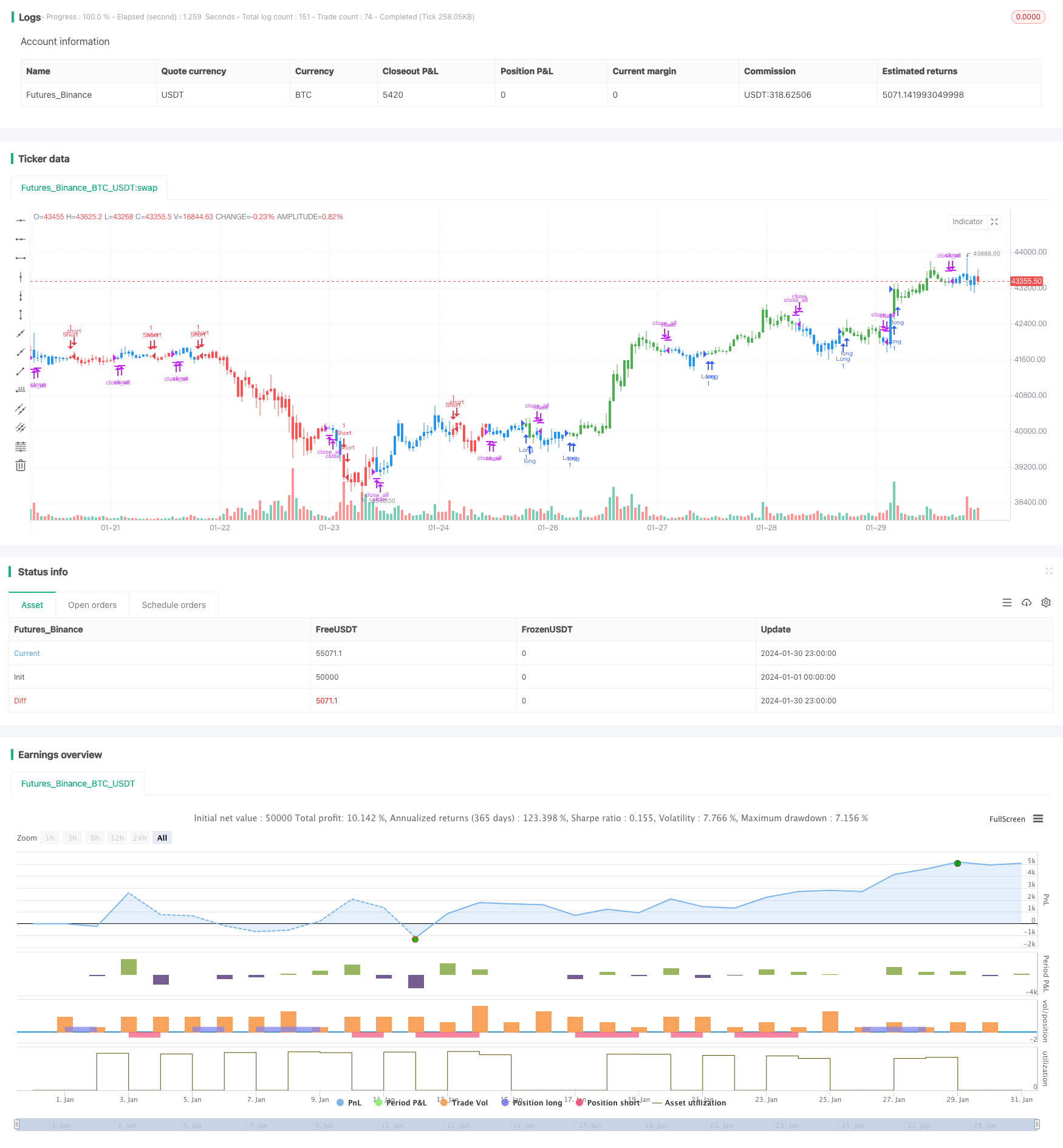

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/05/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The related article is copyrighted material from

// Stocks & Commodities Mar 2010

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Bandpass_Filter(Length, Delta, TriggerLevel) =>

xPrice = hl2

beta = cos(3.14 * (360 / Length) / 180)

gamma = 1 / cos(3.14 * (720 * Delta / Length) / 180)

alpha = gamma - sqrt(gamma * gamma - 1)

BP = 0.0

pos = 0.0

BP := 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(BP[1]) - alpha * nz(BP[2])

pos := iff(BP > TriggerLevel, 1,

iff(BP <= TriggerLevel, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Bandpass Filter", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthBF = input(20, minval=1)

Delta = input(0.5)

TriggerLevel = input(0)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBandpass_Filter = Bandpass_Filter(LengthBF, Delta, TriggerLevel)

pos = iff(posReversal123 == 1 and posBandpass_Filter == 1 , 1,

iff(posReversal123 == -1 and posBandpass_Filter == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

Detail

https://www.fmz.com/strategy/440685

Last Modified

2024-02-01 10:45:12