Name

双均线穿叉策略Dual-Moving-Average-Crossover-Strategy

Author

ChaoZhang

Strategy Description

[trans]

这是一个基于均线指标的简单量化交易策略。它利用快慢均线的金叉死叉来判断买入和卖出时机。当快线从下方向上突破慢线时,产生买入信号;当快线从上方向下突破慢线时,产生卖出信号。

该策略主要基于均线的趋势跟踪功能。快线参数小,能快速响应价格变化;慢线参数大,代表长期趋势。快线从下方穿过慢线意味着短期行情开始反转,进入上涨趋势;而快线从上方穿过慢线意味着短期行情开始反转,进入下跌趋势。通过捕捉这些信号,可以顺势进行交易。

具体来说,该策略中定义了5日(快线)和34日(慢线)的双均线。每日计算这两个均线的值,并比较快线是否从下方向上突破慢线。如果发生金叉信号,则做多;如果发生死叉信号,则平仓。

这种策略简单易懂,容易实现。相比其他复杂策略,它更适合量化交易的初学者。

双均线策略可以有效过滤市场噪音,捕捉主要趋势。通过调整快慢均线的日数参数,可以适应不同周期的行情变化。

该策略还内置了止损机制。当价格开始反向,快慢均线发生死叉时,它会及时止损,可以有效控制风险。

双均线策略可能出现止损不住、曲线拟合失败等风险。具体来说,主要存在以下问题:

-

均线有滞后性,可能出现完全调头之后才发出信号的情况。这时已获利变成亏损。

-

震荡行情中,可能出现多次虚假信号。这时将造成过多不必要的交易,增加交易成本和滑点损失。

-

该策略完全依赖技术指标,没有结合基本面分析。遇到重大消息驱动的行情时,效果可能会很差。

-

未考虑位置管理和风险控制。一个意外事件可能让策略爆仓。

为更好发挥该策略优势、减少风险,可以从以下几个方面进行优化:

-

结合趋势指标和波动指标,设定更严格的入场条件,过滤假信号。例如 MACD 或 KDJ 指标。

-

加入适当的止损机制。如在金叉后下跌一定比例就止损。或在形成新高(低)点后下跌一定幅度就止损。

-

优化快慢均线的日数参数组合,针对不同周期价格变化进行调整。可以做参数组合优化寻找最佳参数。

-

可以根据大盘指数来判断整体行情走势,避免在震荡行情高频交易。

-

结合交易量变化来验证趋势信号的可靠性。例如增加必须有放量突破的条件。

双均线策略是一个非常典型的量化交易策略。它有着简单、直观、容易实现等特点,十分适合量化交易初学者来学习和掌握。通过不断测试和优化参数,能获得较好的效果。但该策略也存在一些问题,如滞后识别信号、容易产生假信号等。这需要加入辅助条件进行过滤,并做好风险管理,使之成为一个稳定盈利的策略。

||

This is a simple quantitative trading strategy based on moving average indicators. It uses the golden cross and death cross of fast and slow moving averages to determine entry and exit signals. When the fast MA crosses above the slow MA from below, a buy signal is generated. When the fast MA crosses below the slow MA from above, a sell signal is generated.

The strategy mainly leverages the trend tracking capability of moving averages. The fast MA has a smaller parameter and can quickly respond to price changes, while the slow MA has a larger parameter and represents the long-term trend. The fast MA crossing above the slow MA signals a reversal in short-term moves and the start of an uptrend. The fast MA crossing below the slow MA signals a reversal to a downtrend. By capturing these signals, we can trade along with the momentum.

Specifically, this strategy defines a 5-day (fast) and 34-day (slow) double moving average. It calculates these two MAs daily and checks if the fast MA crosses above or below the slow MA. If a golden cross happens, it goes long. If a death cross happens, it exits positions.

This is a simple and easy to understand strategy, suitable for quant trading beginners. Compared to complex strategies, it is much easier to implement.

The dual MA strategy can filter out market noise effectively and capture the main trend. By tuning the MA days parameters, it can adapt to price swings across different time frames.

It also has a built-in stop loss mechanism. When prices start to reverse direction and the MAs death cross happens, it will exit positions timely to control risks.

The dual MA strategy has risks like failed stop losses or curve fitting failures. The main issues are:

-

MAs have lagging effects and may generate signals only after the trend has already reversed. Profitable trades can turn into losses.

-

In ranging markets, there can be many false signals, causing unnecessary trades, increased costs and slippage.

-

It relies solely on technical indicators without combining fundamental analysis. It may perform poorly during events driving market moves.

-

It does not consider position sizing and risk management. One black swan event can cause the strategy to blow up.

To better leverage its strengths and reduce risks, optimizations can be made in the following ways:

-

Add trending indicators like MACD and volatility indicators like KDJ to set more rigorous entry rules and filter out false signals.

-

Incorporate appropriate stop loss mechanisms, like exiting after prices drop a certain percentage post golden cross, or after prices fall a set range from new highs/lows.

-

Optimize fast and slow MA days combinations to adapt to price swings across different time frames. Parameter optimization can find the best parameters.

-

Reference broad market indices to determine overall market regime and avoid overtrading in ranging markets.

-

Incorporate trading volume changes to verify the reliability of trend signals. For example, require strong volume when signals trigger.

The dual moving average crossover strategy is a very typical quantitative trading strategy. It has pros like simplicity, intuitiveness and ease of implementation. With continuous testing and parameter tuning, it can produce decent results. However, issues like lagging signal identification and false signals do exist. Additional filters and risk management mechanisms need to incorporated to make it a stable profit-generating strategy. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | From Month |

| v_input_2 | true | From Day |

| v_input_3 | 2017 | From Year |

| v_input_4 | 34 | Length Slow |

| v_input_5 | 5 | Length Fast |

| v_input_6 | false | Include Short Trades |

| v_input_7 | false | Trade reverse |

| v_input_8 | 14 | length |

Source (PineScript)

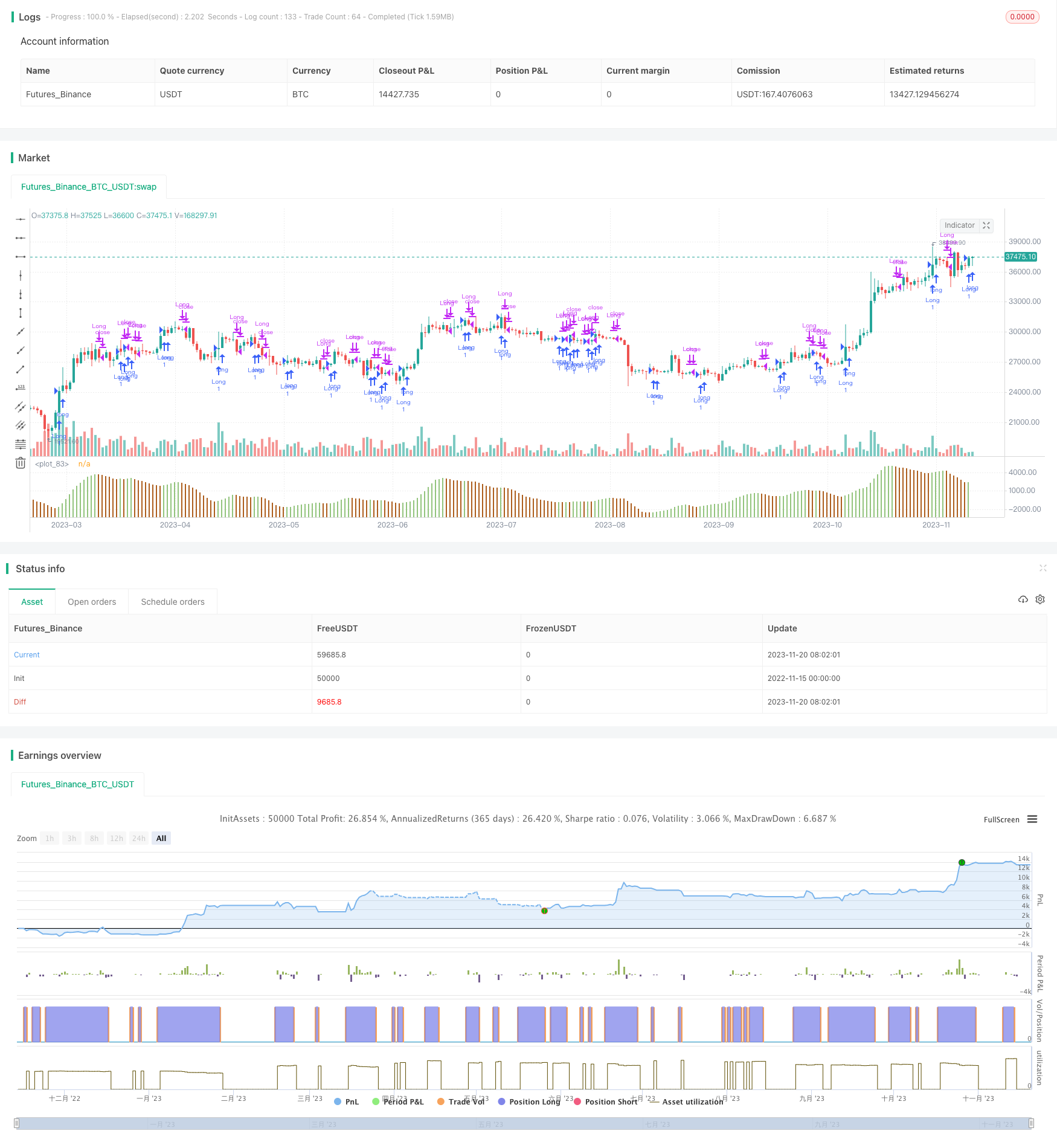

/*backtest

start: 2022-11-15 00:00:00

end: 2023-11-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// This strategy is a modification to the "Bill Williams, Awesome Oscillator

// (AO) Backtest" strategy (Copyright by HPotter v1.0 29/12/2016)

//

// This version of the strategy by Midnight Mouse. 10/4/2018

//

// DESCRIPTION

//

// This indicator plots the oscillator as a column where periods fit for buying

// are marked as green, and periods fit for selling as orange/brown. If the

// current value of AO (Awesome Oscillator) is > the previous, the period is

// deemed fit for buying and the indicator is marked green. If the AO values is

// not over the previous, the period is deemed fit for selling and the indicator

// is marked orange/brown.

//

// You can change long to short in the Input Settings

//

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy("Awesome Oscillator.MMouse_Lager_BCE")

// === SETTINGS ===

// Strategy start date

FromMonth = input(defval = 1, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2017, title = "From Year", minval = 2014)

// Strategy settings

nLengthSlow = input(34, minval=1, title="Length Slow")

nLengthFast = input(5, minval=1, title="Length Fast")

allowShorts = input(false, title="Include Short Trades")

reverse = input(false, title="Trade reverse")

// === BODY ===

// Use Heikin-Ashi candles for the buy/sell signal

ha_t = heikinashi(syminfo.tickerid)

ha_high = security(ha_t, timeframe.period, high)

ha_low = security(ha_t, timeframe.period, low)

length = input( 14 )

price = open

vrsi = rsi(price, length)

// Calc (H+L)/2 for each length

xSMA1_hl2 = sma((ha_high + ha_low)/2, nLengthFast)

xSMA2_hl2 = sma((ha_high + ha_low)/2, nLengthSlow)

// Get SMA difference (Fast - Slow)

xSMA1_SMA2 = xSMA1_hl2 - xSMA2_hl2

// Derive the color of the column

cClr = xSMA1_SMA2 > xSMA1_SMA2[1] ? #93c47d : #ad5e1d

// Determine the position to take (Long vs. Short)

pos = iff(xSMA1_SMA2 > xSMA1_SMA2[1], 1, iff(xSMA1_SMA2 < xSMA1_SMA2[1], -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1, iff(reverse and pos == -1, 1, pos))

// Only apply strategy from the start date

if (time >= timestamp(FromYear, FromMonth, FromDay, 00, 00))

if (possig == 1)

// Market is currently fit for a Long position

strategy.entry("Long", strategy.long)

if (possig == -1)

// Market is currently fit for a Short position

if(allowShorts)

// Shorts are allowed. Record a Short position

strategy.entry("Short", strategy.short)

else

// Shorts are not allowed. Closec the Long position.

strategy.close("Long")

// Define the candle colors

//barcolor(possig == -1 ? red :

// possig == 1 ? green :

// blue )

// Plot the oscillator

plot(xSMA1_SMA2, style=columns, linewidth=1, color=cClr)

Detail

https://www.fmz.com/strategy/432902

Last Modified

2023-11-22 16:10:21