Name

双均线追踪止损策略Trailing-Stop-Loss-Dual-Moving-Average-Strategy

Author

ChaoZhang

Strategy Description

该策略基于快速均线和慢速均线的交叉来决定做多做空。当快速均线上穿慢速均线时做多,当快速均线下穿慢速均线时平仓。为了追求更高的利润,该策略采用了追踪止损机制。做多之后,并不直接在成交价下方设置止损价,而是在成交价下方设立一个追踪止损价,这个追踪止损价会随着价格上涨而上移,直到价格下跌触发止损价的下限。

该策略使用快速简单移动平均线(SMA)和慢速SMA来决定做多和平仓的时机。当快速SMA上穿慢速SMA时,判断趋势变为上涨,此时做多;当快速SMA下穿慢速SMA时,判断趋势反转,准备平仓。

为了追求更高的利润,该策略引入了追踪止损机制。做多之后,并不会在固定价格设置止损单,而是设立一个追踪止损价,它会随着价格上涨而向上追踪,每次价格上涨一定比例后,追踪止损价就会向上调整一定幅度。当价格出现回调,触碰到追踪止损价时,会触发止损单,将头寸平仓。

具体来说,追踪止损价的计算公式为:

追踪止损价 = 价格 × (1 - 止损追踪百分比)

其中,止损追踪百分比由策略参数“Deviation %”设定。策略会在开仓后每次K线收盘时计算新的追踪止损价。新的追踪止损价不能低于上一根K线的追踪止损价,以确保止损价只能上移,不能回落。

当价格下跌,触及追踪止损价时,会触发平仓信号,头寸会使用市价单平仓。

- 使用双均线判断趋势方向,回测效果较好

- 采用追踪止损,可以追求更高的利润

- 可自定义均线周期和止损追踪幅度

- 在趋势向上时,止损线会不断上移,确保了大部分利润

- 在趋势反转时,能够快速止损,避免造成更大的亏损

- 均线交叉时机选择不当,可能造成虚拟信号。可以测试不同参数,找到最佳均线组合

- 追踪止损过于激进,可能造成止损过早被击穿。可以适当调整止损追踪百分比参数

- 价格出现跳空缺口,也可能直接击穿止损价。建议组合其他指标判断趋势,避免在震荡行情中交易

- 可以测试不同均线周期参数,找到最佳参数组合

- 可以测试不同的止损追踪百分比参数,找到最佳止损水平

- 可以加入其他指标判断,在震荡行情中暂停交易,避免受突发事件影响

本策略综合利用均线指标判断趋势方向,以及追踪止损机制锁定利润,在训练数据中表现不俗。通过优化参数组合,控制风险,有望获得稳定收益。但任何策略都无法完全避免亏损,建议适当调整仓位管理,测试不同品种,分散风险。

||

This strategy uses fast and slow moving average crossovers to determine long and short positions. It goes long when the fast MA crosses over the slow MA and closes position when the fast MA crosses below the slow MA. To pursue higher profits, the strategy adopts a trailing stop loss mechanism. Instead of setting the stop loss price right below the entry price after opening long positions, it sets a trailing stop loss price which moves up following the price rise until the price drop hits the stop loss price limit.

The strategy uses fast and slow Simple Moving Average (SMA) lines to determine entries and exits. When the fast SMA crosses over the slow SMA, it signals an uptrend so the strategy goes long. When the fast SMA crosses below the slow SMA, it signals a trend reversal so the strategy prepares to close position.

To maximize profits, the strategy introduces a trailing stop loss mechanism. Instead of using a fixed stop loss price after opening long positions, it sets a trailing stop loss price which moves up following the price rise. Each time the price rises by a certain percentage, the trailing stop loss price adjusts up by a predefined percentage. When the price pulls back and hits the trailing stop loss price, it triggers the stop loss order to close position.

Specifically, the trailing stop loss price is calculated as:

Trailing Stop Loss Price = Price × (1 - Stop Loss Trailing Percentage)

The Stop Loss Trailing Percentage is defined by the strategy parameter “Deviation %”. The strategy recalculates the trailing stop loss price on every bar's close. The new trailing stop loss price cannot be lower than that of the previous bar, so as to ensure the stop loss price only moves up, not down.

When the price drops and hits the trailing stop loss price, it triggers the closing signal and the position will be closed by a market order.

- Use dual moving average to determine trend direction with good backtest results

- Adopt trailing stop loss to pursue higher profits

- Customizable moving average periods and stop loss trailing percentage

- Stop loss line keeps moving up when trend goes up, locking in most profits

- Quick stop loss when trend reverses to avoid further losses

- Improper moving average crossover timing may cause false signals. Test different parameters to find the optimal MA combination

- Overly aggressive trailing stop loss may get stopped out prematurely. Adjust the stop loss trailing percentage parameter properly

- Price gaps may directly penetrate the stop loss price. Consider combining other indicators to judge trend and avoid trading during ranging periods

- Test different moving average period parameters to find the optimal combination

- Test different stop loss trailing percentage parameters to find the optimal stop loss level

- Add other indicators to suspend trading during ranging periods to avoid being affected by sporadic events

This strategy combines moving average indicators to judge trend direction and trailing stop loss mechanism to lock in profits, performing well on training data. By optimizing parameters and controlling risks, it has the potential to achieve steady profits. However, no strategy can completely avoid losses. It's recommended to adjust position sizing, test different products, and diversify risks.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_bool_1 | true | (?Filters)From |

| v_input_1 | timestamp(01 Jan 2021 00:00 UTC) | fromDate |

| v_input_bool_2 | false | To |

| v_input_2 | timestamp(31 Dec 2121 23:59 UTC) | toDate |

| v_input_int_1 | 21 | (?Strategy)Fast/Slow SMA Length |

| v_input_int_2 | 49 | slowMALen |

| v_input_bool_3 | true | (?Exit)Enable Trailing |

| v_input_float_1 | 3 | Deviation % |

| v_input_source_1_low | 0 | Source Exit Control: low |

Source (PineScript)

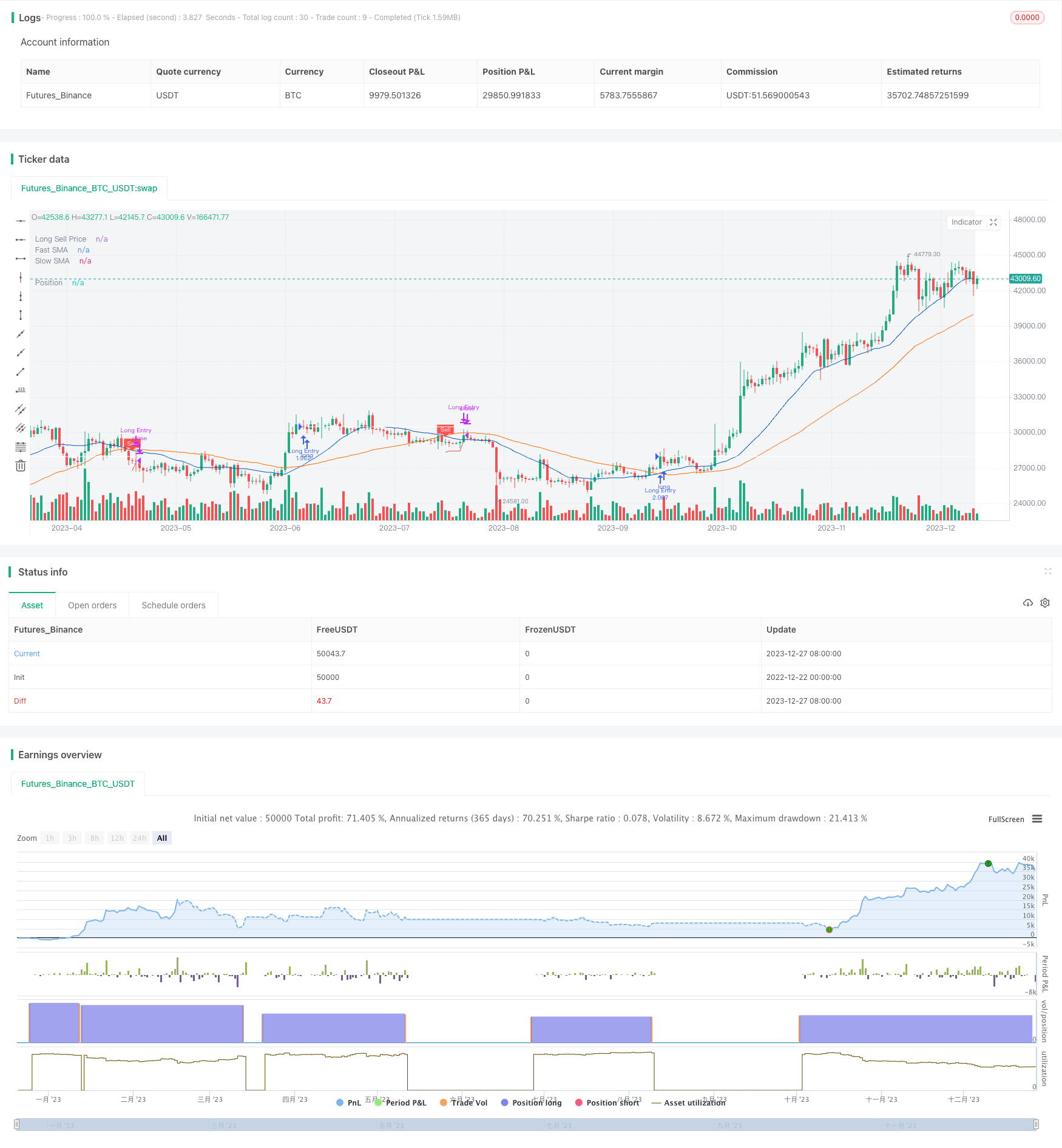

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2022 Iason Nikolas | jason5480

// Trailing Buy script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @jason5480

// Revision: v1.0.1

// Date: 24-Feb-2022

//

// Description

// =============================================================================

// This strategy will go long if fast MA crosses over slow MA.

// If the 'Enable Trailing` is checked then the strategy instead of exiting from the position

// directly it will follow the price upwards (percentagewise) with small steps

// If the price drops by this percentage then the exit order will be executed

//

// The strategy has the following parameters:

//

// Fast SMA Length - How many candles back to calculte the fast SMA.

// Slow SMA Length - How many candles back to calculte the slow SMA.

// Enable Trailing - Enable or disable the trailing

// Deviation % - The step to follow the price when the open position condition is met.

// Source Exit Control - The source price to compare with the exit price to trigger the exit order when trailing.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealer. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// SETUP ============================================================================================================

strategy(title = 'Trailing Sell',

shorttitle = 'TS',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 100000)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// FILTERS ==========================================================================================================

// INPUT ============================================================================================================

usefromDate = input.bool(defval = true, title = 'From', inline = "From Date", group = "Filters")

fromDate = input(defval = timestamp('01 Jan 2021 00:00 UTC'), title = '', inline = "From Date", group = 'Filters')

usetoDate = input.bool(defval = false, title = 'To ', inline = "To Date", group = "Filters")

toDate = input(defval = timestamp('31 Dec 2121 23:59 UTC'), title = '', inline = "To Date", group = 'Filters')

// LOGIC ============================================================================================================

isWithinPeriod() => true // create function "within window of time"

// PLOT =============================================================================================================

bgcolor(color = isWithinPeriod() ? color.new(color.gray, 90) : na, title = 'Period')

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// STRATEGY =========================================================================================================

// INPUT ============================================================================================================

fastMALen = input.int(defval = 21, title = 'Fast/Slow SMA Length', inline = 'MA Length', group = 'Strategy')

slowMALen = input.int(defval = 49, title = '', tooltip = 'How many candles back to calculte the fast/slow SMA.', inline = 'MA Length', group = 'Strategy')

// LOGIC ============================================================================================================

fastMA = ta.sma(close, fastMALen)

slowMA = ta.sma(close, slowMALen)

bool openLongPosition = isWithinPeriod() and ta.crossover(fastMA, slowMA)

bool closeLongPosition = ta.crossunder(fastMA, slowMA)

// PLOT =============================================================================================================

var fastColor = color.new(#0056BD, 0)

plot(series = fastMA, title = 'Fast SMA', color = fastColor, linewidth = 1, style = plot.style_line)

var slowColor = color.new(#FF6A00, 0)

plot(series = slowMA, title = 'Slow SMA', color = slowColor, linewidth = 1, style = plot.style_line)

plotshape(series = closeLongPosition and strategy.position_size > 0 ? fastMA : na, title = 'Sell', text = 'Sell', style = shape.labeldown, location = location.absolute, color = color.new(color.red, 0), textcolor = color.new(color.white, 0), size = size.tiny)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// EXIT ============================================================================================================

// INPUT ============================================================================================================

enableTrailing = input.bool(defval = true, title = 'Enable Trailing', tooltip = 'Enable or disable the trailing for exit position.', group = 'Exit')

devExitPerc = input.float(defval = 3.0, title = 'Deviation %', minval = 0.01, maxval = 100, step = 0.05, tooltip = 'The step to follow the price when the open position condition is met.', group = 'Exit') / 100

ctrLongExitSrc = input.source(defval = low, title = 'Source Exit Control', tooltip = 'The source price to compare with the exit price to trigger the exit order when trailing.', group = 'Exit')

// LOGIC ============================================================================================================

var bool exitLongPosition = false

int barsSinceOpenLong = nz(ta.barssince(openLongPosition), 999999)

int barsSinceCloseLong = nz(ta.barssince(closeLongPosition), 999999)

int barsSinceExitLong = nz(ta.barssince(exitLongPosition), 999999)

bool closeLongIsActive = barsSinceOpenLong >= barsSinceCloseLong

bool exitLongIsPending = barsSinceExitLong >= barsSinceCloseLong

bool tryExitLongPosition = isWithinPeriod() and closeLongIsActive and exitLongIsPending

float longExitPrice = na

longExitPrice := if closeLongPosition and strategy.position_size > 0

close * (1 - devExitPerc)

else if tryExitLongPosition

math.max(high * (1 - devExitPerc), nz(longExitPrice[1], 999999))

else

na

exitLongPosition := enableTrailing ? isWithinPeriod() and ta.crossunder(closeLongPosition ? close : ctrLongExitSrc, longExitPrice) : closeLongPosition

// PLOT =============================================================================================================

var sellPriceColor = color.new(#e25141, 0)

plot(series = enableTrailing ? longExitPrice : na, title = 'Long Sell Price', color = sellPriceColor, linewidth = 1, style = plot.style_linebr)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS ==================================================================================================

// LOGIC ============================================================================================================

// getting into LONG position

strategy.entry(id = 'Long Entry', direction = strategy.long, when = openLongPosition, alert_message = 'Long(' + syminfo.ticker + '): Started')

// submit close order on trend reversal

strategy.close(id = 'Long Entry', when = exitLongPosition, comment = 'Close Long', alert_message = 'Long(' + syminfo.ticker + '): Closed at market price')

// PLOT =============================================================================================================

var posColor = color.new(color.white, 0)

plot(series = strategy.position_avg_price, title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

// ==================================================================================================================

Detail

https://www.fmz.com/strategy/437040

Last Modified

2023-12-29 16:59:17