Name

双均线Stoch指标二元期权交易策略Dual-Moving-Average-Stochastic-Indicator-Binary-Options-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略结合双均线和Stoch指标,实现了一个简单有效的二元期权交易策略。该策略同时使用价格的高点EMA、低点EMA和收盘价EMA构建双均线系统,并结合Stoch指标来发出交易信号,以捕捉二元期权中的短期价格波动。

本策略主要基于以下原理:

-

使用价格的高点EMA和低点EMA构建上轨和下轨,hesesEMA lines作为支撑阻力位。

-

计算收盘价EMA判断价格相对双均线的位置关系。如果收盘价上穿上轨或下破下轨,说明可能形成趋势反转。

-

Stoch指标判断超买超卖情况。K值和D值同时低于50表示超卖区,高于50表示超买区。

-

根据Stoch指标的超买超卖区配合价格突破上下轨的反转信号,可以进行短期买入卖出操作。

具体交易规则如下:

-

如果收盘价低于下轨且开盘价低于双均线中点,同时Stoch指标显示超卖区(K<50, D<50),做多;

-

如果收盘价高于上轨且开盘价高于双均线中点,同时Stoch指标显示超买区(K>50, D>50),做空。

这套策略结合双均线和Stoch指标,能够有效捕捉二元期权价格的短期趋势反转,具有以下优势:

-

均线系统过滤震荡,Stoch指标判断超买超卖提高准确率。

-

交易规则简单清晰,容易实施。

-

资金利用效率高,一次只持仓一个方向。

-

回撤可控,避免无谓亏损。

-

易于优化,可调整均线参数和Stoch输入值。

虽然这套策略有一定优势,但也存在以下风险:

-

双均线产生虚假突破的概率,可能错过较强趋势或反转。

-

Stoch指标存在滞后,发出信号时趋势可能已发生反转。

-

无法适应大幅震荡市场,应避开重大事件。

-

参数设置不当可能导致交易频率过高或信号不足。

-

无法准确预测二元期权价格走势,存在一定亏损风险。

对应风险可以通过调整参数、优化规则、严格止损来减小。除此之外,需要考虑账户资金规模和止损点的匹配关系,控制单笔损失和最大回撤。

这套策略还有进一步优化的潜力,主要方向如下:

-

增加其他指标过滤,如MACD、RSI等,提高信号准确率。

-

加入趋势指标判断,避免逆势交易。

-

优化均线系统参数,找到最佳长度组合。

-

调整超买超卖判定条件,降低Stoch滞后问题。

-

设置动态止损或移动止损。

-

结合相关技术分析工具,找到最佳的入场时机。

-

测试不同品种套利可行性。

通过以上优化手段,可以进一步提升策略的稳定性和盈利能力。

本策略整合双均线和Stoch指标优势,形成一个简单可靠的二元期权短期交易策略。它标准化了交易规则,有助于风险控制。虽然仍存在一定改进空间,但其思路清晰,易于操作,是一种值得考虑的选择。通过优化参数设置和规则,可望获得更理想的策略效果。

||

This strategy combines dual moving averages and the Stochastic indicator to implement a simple and effective binary options trading strategy. It uses the EMA of high prices, EMA of low prices and EMA of closing prices to build a dual moving average system, and incorporates the Stochastic indicator to generate trading signals, in order to capture short-term price fluctuations in binary options.

The strategy is mainly based on the following principles:

-

Use the EMA of high prices and EMA of low prices to build upper and lower bands as support and resistance levels.

-

Calculate the EMA of closing prices to determine the relationship between price and dual moving averages. If the closing price crosses above the upper band or breaks below the lower band, it indicates a possible trend reversal.

-

The Stochastic indicator determines overbought and oversold conditions. K and D values below 50 indicate oversold while above 50 overbought.

-

According to the overbought/oversold signals from Stochastic combined with price breakouts of the upper/lower bands, short-term buy/sell operations can be executed.

The specific trading rules are:

-

If the closing price is below the lower band and the opening price is below the midpoint of the dual moving averages, while Stochastic shows oversold (K<50, D<50), go long.

-

If the closing price is above the upper band and the opening price is above the midpoint of the dual moving averages, while Stochastic shows overbought (K>50, D>50), go short.

By combining dual moving averages and the Stochastic oscillator, this strategy can effectively capture short-term trend reversals in binary options prices, with the following advantages:

-

The moving average system filters out consolidation while Stochastic increases accuracy by determining overbought/oversold levels.

-

The trading rules are simple and clear, easy to implement.

-

High capital utilization efficiency, only hold one direction at a time.

-

Controllable drawdowns, avoid unnecessary losses.

-

Easy to optimize by adjusting moving average parameters and Stochastic inputs.

Although this strategy has some merits, it also has the following risks:

-

There is a probability of false breakouts with the dual moving averages, potentially missing strong trends or reversals.

-

Stochastic has lagging issues, signals may come after trend reversals have already begun.

-

Cannot adapt to highly volatile markets, should avoid major events.

-

Improper parameter settings may lead to excessive trading frequency or insufficient signals.

-

Unable to accurately predict binary option price movements, has inherent loss risks.

Corresponding risks can be reduced by adjusting parameters, optimizing rules and strict stop loss. In addition, account size and stop loss levels should match to control single trade loss amount and maximum drawdown.

There is further optimization potential for this strategy:

-

Add other indicators for filtration, like MACD, RSI etc, to improve signal accuracy.

-

Incorporate trend indicators to avoid counter-trend trading.

-

Optimize moving average parameters to find the best length combinations.

-

Adjust overbought/oversold criteria to reduce Stochastic lag.

-

Set dynamic or trailing stop loss.

-

Combine relevant technical analysis tools to find optimal entry timing.

-

Test spread trading feasibility across different products.

Through the above optimization means, strategy stability and profitability can be further enhanced.

This strategy integrates the advantages of dual moving averages and Stochastic oscillator into a simple and reliable short-term binary options trading strategy. It standardizes trading rules for better risk control. Although there is still room for improvement, its logic is clear and easy to implement, making it a viable choice worth considering. By optimizing parameters and rules, better strategy performance may be achieved.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | length1 |

| v_input_2 | true | smoothK |

| v_input_3 | 3 | smoothD |

| v_input_4 | 4 | Length |

| v_input_5_high | 0 | Source: high |

| v_input_6 | 4 | Length |

| v_input_7_low | 0 | Source: low |

| v_input_8 | 21 | Length |

| v_input_9_close | 0 | Source: close |

Source (PineScript)

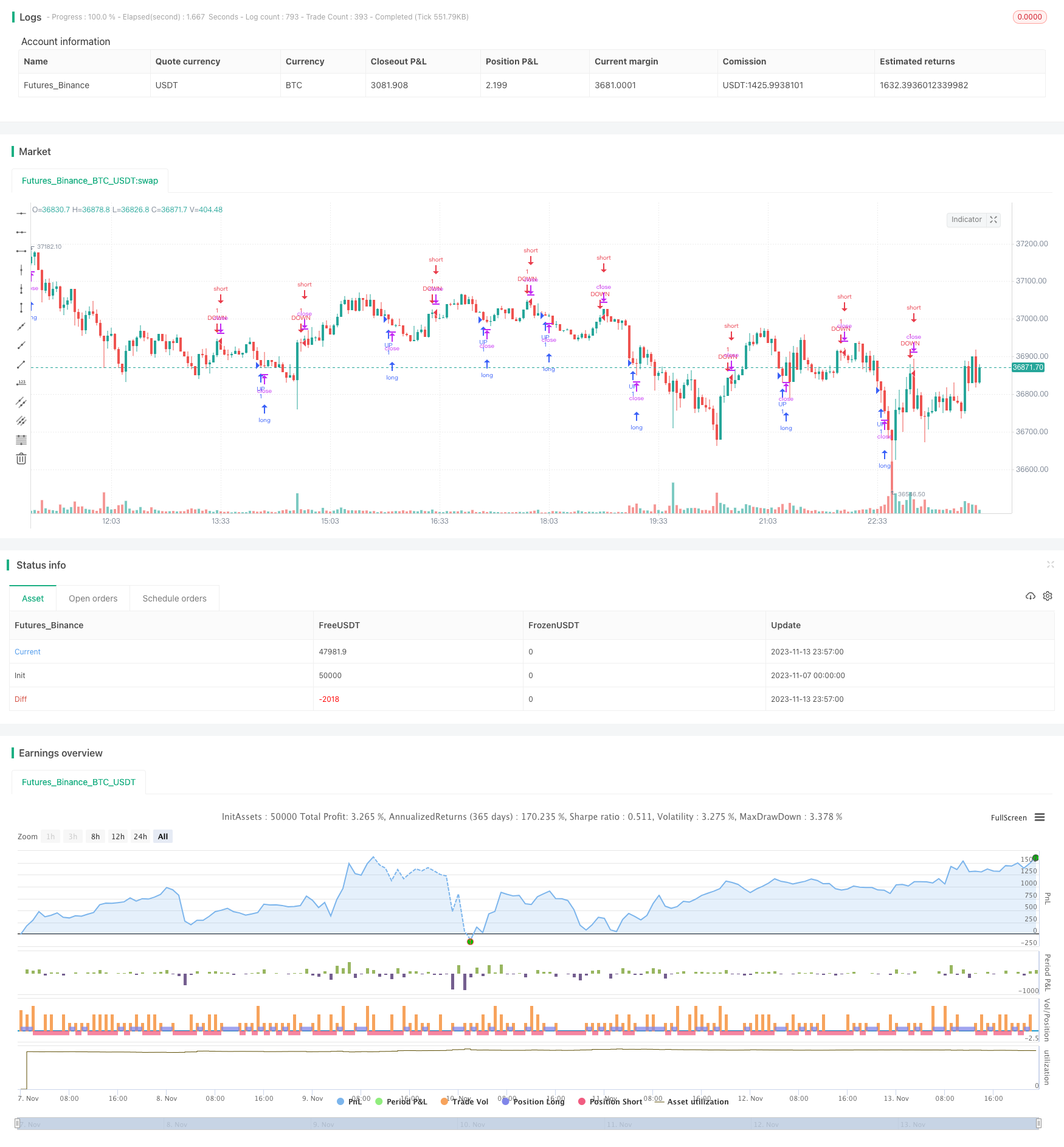

/*backtest

start: 2023-11-07 00:00:00

end: 2023-11-14 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Binary Option EMA/Stoch strategy Corrected", overlay=true)

//stoch

length1 = input(14, minval=1), smoothK = input(1, minval=1), smoothD = input(3, minval=1)

k = sma(stoch(close, high, low, length1), smoothK)

d = sma(k, smoothD)

len = input(4, minval=1, title="Length")

src = input(high, title="Source")

out = ema(src, len)

HIGH = out

len1 = input(4, minval=1, title="Length")

src1 = input(low, title="Source")

out1 = ema(src1, len1)

LOW = out1

HL2 = (HIGH+LOW)/2

len2 = input(21, minval=1, title="Length")

src2 = input(close, title="Source")

out2 = ema(src2, len2)

EMA = out2

x = close < LOW and open < HL2 and close < EMA and d < 50 and k < 50

y = close > HIGH and open > HL2 and close > EMA and d > 50 and k > 50

if (x)

strategy.entry("UP", strategy.long)

if (y)

strategy.entry("DOWN", strategy.short)

Detail

https://www.fmz.com/strategy/432228

Last Modified

2023-11-15 16:56:47