Name

双移动平均线与StochRSI交叉的趋势追踪策略BlackBit-Trader-XO-Macro-Trend-Scanner-Strategy

Author

ChaoZhang

Strategy Description

该策略联合使用双移动平均线和StochRSI指标来识别趋势方向和入场点。主要特点是可以在趋势开始阶段就进入市场,同时利用StochRSI指标的超买超卖特征来过滤假突破。

该策略使用快速移动平均线EMA(12)和慢速移动平均线EMA(25)构建双移动平均线系统,当快速线上穿慢速线时产生买入信号,快速线下穿慢速线时产生卖出信号,用以判断大趋势方向。

同时,该策略结合StochRSI指标的交叉来进一步识别入场时机。StochRSI指标结合随机指标KDJ和RSI,当K线从超卖区上穿D线时产生买入信号,当K线从超买区下穿D线时产生卖出信号。

只有当双移动平均线产生信号,且StochRSI也产生对应的信号时,该策略才会开仓。从而能有效过滤掉部分假突破情况,避免无效交易。

该策略最大的优势在于能够早期判断趋势方向和潜在入场点。移动平均线系统可以在趋势开始时就产生信号,而StochRSI指标的加入又可有效过滤假突破,避免错误交易。

另外,该策略同时结合了趋势分析和超买超卖判断,兼具趋势追踪和反转交易的优点。无论是追踪趋势还是逢低买进逢高卖出,该策略都可全方位捕捉机会。

该策略的主要风险在于移动平均线体系本身的滞后性。当行情突然发生剧烈变化时,双移动平均线系统往往会晚一些才能产生信号,容易让策略错过最佳入场时机。

此外,StochRSI指标也可能会产生错误信号,引发不必要的交易。尤其是行情震荡时期,K线和D线可能频繁交叉,给策略带来过多无效操作的风险。

该策略的优化主要集中在以下几个方面:

-

调整双移动平均线的参数,使用更有利于捕捉趋势的均线周期;

-

优化StochRSI的参数,制定更合理的超买超卖判断标准;

-

加大下单量或调整止损止盈水平,以追求更高收益率;

-

结合其他指标作为过滤条件,进一步减少无效信号。

该策略整体来说非常适合捕捉中长线趋势,可在趋势初期获利潜力大。同时结合StochRSI指标作为辅助判断,可有效过滤误导信号,避免不必要的亏损。通过参数优化和风险管理的改进,该策略可以成为获取稳定收益的有力工具。

||

This strategy combines double moving average and StochRSI indicator to identify trend direction and entry points. The main feature is that it can enter the market in the early stage of trend, while using the overbought/oversold characteristics of StochRSI to filter false breakouts.

The strategy uses fast moving average EMA(12) and slow moving average EMA(25) to build a double moving average system. When fast line crosses above slow line, buy signal is generated. When fast line crosses below slow line, sell signal is generated. This is used to determine the major trend direction.

At the same time, the strategy incorporates StochRSI crossover to further identify entry timing. StochRSI combines stochastic KDJ and RSI. When K line crosses D line upward from oversold zone, buy signal is generated. When K line crosses D line downward from overbought zone, sell signal is generated.

Only when double moving average produces signal and StochRSI also produces corresponding signal, this strategy will open positions. This can effectively filter out some false breakouts and avoid invalid trades.

The biggest advantage of this strategy is being able to judge trend direction and potential entry points early. The moving average system can produce signals at the beginning of a trend, while the addition of StochRSI effectively filters false breakouts and avoids erroneous trades.

In addition, the strategy combines both trend analysis and overbought/oversold judgment, featuring the strengths of both trend following and mean-reversion. Whether tracking trends or buying low and selling high, this strategy can capture opportunities in all aspects.

The main risk of this strategy lies in the lag of the double moving average system itself. When the market changes violently in a sudden, the double moving average system often takes time to generate signals, easily missing the best entry timing.

In addition, StochRSI may also generate false signals, leading to unnecessary trades, especially in ranging markets where K and D line can frequently crossover, posing risks of excessive invalid operations.

The optimization of this strategy mainly focuses on several aspects:

-

Adjust the parameters of double moving average to adopt moving average periods more conducive to capturing trends;

-

Optimize the parameters of StochRSI to come up with more sensible overbought/oversold criteria;

-

Increase order size or adjust stop loss/take profit to pursue higher return;

-

Incorporate other indicators as filter conditions to further reduce invalid signals.

Overall, this strategy is very suitable for capturing medium-to-long term trends, with great profit potential in early stage of trends. Combining StochRSI as an auxiliary judge can effectively filter misleading signals and avoid unnecessary losses. With improvements in parameter tuning and risk management, this strategy can become a powerful tool to obtain steady returns.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | OHLC Type: close |

| v_input_2 | 12 | Fast EMA |

| v_input_3 | 25 | Slow EMA |

| v_input_4 | 25 | Consolidated EMA |

| v_input_5 | true | Show Both EMAs |

| v_input_int_1 | 3 | K |

| v_input_int_2 | 3 | D |

| v_input_int_3 | 14 | RSI Length |

| v_input_int_4 | 14 | Stochastic Length |

| v_input_int_5 | 80 | (?Bands change this instead of length in Style for Stoch RSI colour to work properly)Upper Band |

| v_input_int_6 | 50 | Middle Band |

| v_input_int_7 | 20 | Lower Band |

| v_input_bool_1 | false | (?Crossover Alerts)Crossover Alert Background Colour (Middle Level) [ON/OFF] |

| v_input_bool_2 | false | Crossover Alert Background Colour (OB/OS Level) [ON/OFF] |

| v_input_bool_3 | false | Crossover Alert >input [ON/OFF] |

| v_input_bool_4 | false | Crossover Alert <input [ON/OFF] |

| v_input_string_1 | 0 | (?Moving Average)MA Type: EMA |

| v_input_source_1_close | 0 | MA Source: close |

| v_input_int_8 | 200 | MA Length |

| v_input_6 | timestamp(2000-12-24T00:00:00) | (?---------TIME RANGE SETTINGS---------)startDate |

| v_input_7 | timestamp(2029-02-26T00:00:00) | finishDate |

| v_input_8 | 200 | (?EMA FILTER SETTINGS)EMA Filter Length |

| v_input_9_close | 0 | EMA Filter Source: close |

| v_input_10 | 26 | (?MACD FILTER SETTINGS)Fast Length |

| v_input_11 | 100 | Slow Length |

| v_input_12_close | 0 | Source: close |

| v_input_int_9 | 9 | Signal Smoothing |

| v_input_string_2 | 0 | Oscillator MA Type: EMA |

| v_input_string_3 | 0 | Signal Line MA Type: EMA |

| v_input_float_1 | 0.3 | (?TP/SL CONDITION INPUTS HERE)Enter The Take Profit % |

| v_input_float_2 | 0.16 | Enter The Stop % |

| v_input_13 | Long entry | (?ALERT MESSAGE SETTINGS)Long entry alert |

| v_input_14 | Short entry | Short entry alert |

Source (PineScript)

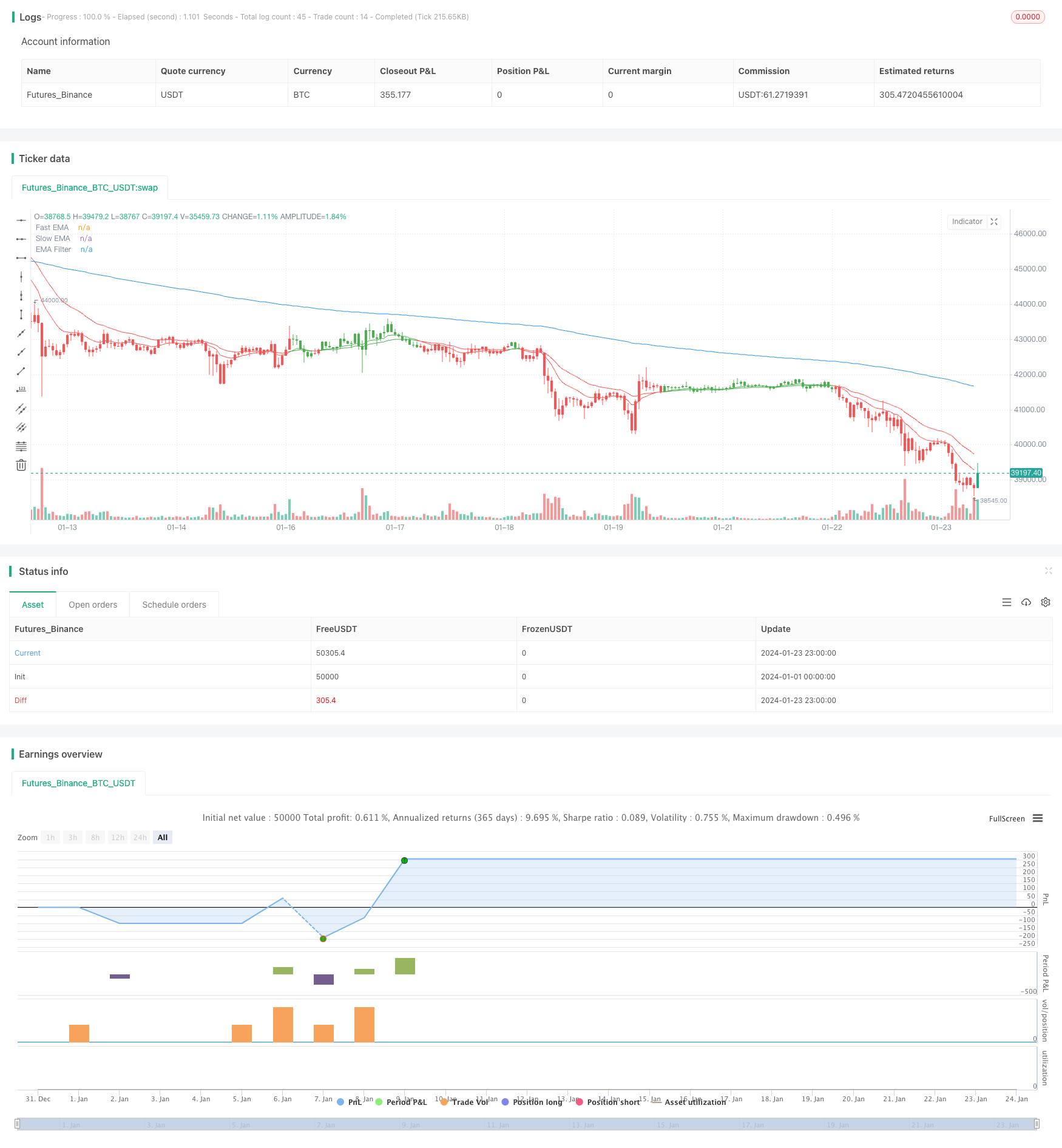

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © btc_charlie / @TheParagonGrp

//@version=5

strategy('BlackBit Trader XO Macro Trend Scanner', overlay=true)

// Variables

var ok = 0

var countBuy = 0

var countSell = 0

src = input(close, title='OHLC Type')

i_fastEMA = input(12, title='Fast EMA')

i_slowEMA = input(25, title='Slow EMA')

i_defEMA = input(25, title='Consolidated EMA')

// Allow the option to show single or double EMA

i_bothEMAs = input(title='Show Both EMAs', defval=true)

// Define EMAs

v_fastEMA = ta.ema(src, i_fastEMA)

v_slowEMA = ta.ema(src, i_slowEMA)

v_biasEMA = ta.ema(src, i_defEMA)

// Color the EMAs

emaColor = v_fastEMA > v_slowEMA ? color.green : v_fastEMA < v_slowEMA ? color.red : #FF530D

// Plot EMAs

plot(i_bothEMAs ? na : v_biasEMA, color=emaColor, linewidth=3, title='Consolidated EMA')

plot(i_bothEMAs ? v_fastEMA : na, title='Fast EMA', color=emaColor)

plot(i_bothEMAs ? v_slowEMA : na, title='Slow EMA', color=emaColor)

// Colour the bars

buy = v_fastEMA > v_slowEMA

sell = v_fastEMA < v_slowEMA

if buy

countBuy += 1

countBuy

if buy

countSell := 0

countSell

if sell

countSell += 1

countSell

if sell

countBuy := 0

countBuy

buysignal = countBuy < 2 and countBuy > 0 and countSell < 1 and buy and not buy[1]

sellsignal = countSell > 0 and countSell < 2 and countBuy < 1 and sell and not sell[1]

barcolor(buysignal ? color.green : na)

barcolor(sellsignal ? color.red : na)

bull = countBuy > 1

bear = countSell > 1

barcolor(bull ? color.green : na)

barcolor(bear ? color.red : na)

// Set Alerts

// alertcondition(ta.crossover(v_fastEMA, v_slowEMA), title='Bullish EMA Cross', message='Bullish EMA crossover')

// alertcondition(ta.crossunder(v_fastEMA, v_slowEMA), title='Bearish EMA Cross', message='Bearish EMA Crossover')

// Stoch RSI code

smoothK = input.int(3, 'K', minval=1)

smoothD = input.int(3, 'D', minval=1)

lengthRSI = input.int(14, 'RSI Length', minval=1)

lengthStoch = input.int(14, 'Stochastic Length', minval=1)

rsi1 = ta.rsi(src, lengthRSI)

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

bandno0 = input.int(80, minval=1, title='Upper Band', group='Bands (change this instead of length in Style for Stoch RSI colour to work properly)')

bandno2 = input.int(50, minval=1, title='Middle Band', group='Bands (change this instead of length in Style for Stoch RSI colour to work properly)')

bandno1 = input.int(20, minval=1, title='Lower Band', group='Bands (change this instead of length in Style for Stoch RSI colour to work properly)')

// Alerts

crossoverAlertBgColourMidOnOff = input.bool(title='Crossover Alert Background Colour (Middle Level) [ON/OFF]', group='Crossover Alerts', defval=false)

crossoverAlertBgColourOBOSOnOff = input.bool(title='Crossover Alert Background Colour (OB/OS Level) [ON/OFF]', group='Crossover Alerts', defval=false)

crossoverAlertBgColourGreaterThanOnOff = input.bool(title='Crossover Alert >input [ON/OFF]', group='Crossover Alerts', defval=false)

crossoverAlertBgColourLessThanOnOff = input.bool(title='Crossover Alert <input [ON/OFF]', group='Crossover Alerts', defval=false)

maTypeChoice = input.string('EMA', title='MA Type', group='Moving Average', options=['EMA', 'WMA', 'SMA', 'None'])

maSrc = input.source(close, title='MA Source', group='Moving Average')

maLen = input.int(200, minval=1, title='MA Length', group='Moving Average')

maValue = if maTypeChoice == 'EMA'

ta.ema(maSrc, maLen)

else if maTypeChoice == 'WMA'

ta.wma(maSrc, maLen)

else if maTypeChoice == 'SMA'

ta.sma(maSrc, maLen)

else

0

crossupCHECK = maTypeChoice == 'None' or open > maValue and maTypeChoice != 'None'

crossdownCHECK = maTypeChoice == 'None' or open < maValue and maTypeChoice != 'None'

crossupalert = crossupCHECK and ta.crossover(k, d) and (k < bandno2 or d < bandno2)

crossdownalert = crossdownCHECK and ta.crossunder(k, d) and (k > bandno2 or d > bandno2)

crossupOSalert = crossupCHECK and ta.crossover(k, d) and (k < bandno1 or d < bandno1)

crossdownOBalert = crossdownCHECK and ta.crossunder(k, d) and (k > bandno0 or d > bandno0)

aboveBandalert = ta.crossunder(k, bandno0)

belowBandalert = ta.crossover(k, bandno1)

bgcolor(color=crossupalert and crossoverAlertBgColourMidOnOff ? #4CAF50 : crossdownalert and crossoverAlertBgColourMidOnOff ? #FF0000 : na, title='Crossover Alert Background Colour (Middle Level)', transp=70)

bgcolor(color=crossupOSalert and crossoverAlertBgColourOBOSOnOff ? #fbc02d : crossdownOBalert and crossoverAlertBgColourOBOSOnOff ? #000000 : na, title='Crossover Alert Background Colour (OB/OS Level)', transp=70)

bgcolor(color=aboveBandalert and crossoverAlertBgColourGreaterThanOnOff ? #ff0014 : crossdownalert and crossoverAlertBgColourMidOnOff ? #FF0000 : na, title='Crossover Alert - K > Upper level', transp=70)

bgcolor(color=belowBandalert and crossoverAlertBgColourLessThanOnOff ? #4CAF50 : crossdownalert and crossoverAlertBgColourMidOnOff ? #FF0000 : na, title='Crossover Alert - K < Lower level', transp=70)

// alertcondition(crossupalert or crossdownalert, title='Stoch RSI Crossover', message='STOCH RSI CROSSOVER')

// Calculate start/end date and time condition

startDate = input(timestamp('2000-12-24T00:00:00'),group = "---------TIME RANGE SETTINGS---------")

finishDate = input(timestamp('2029-02-26T00:00:00'),group = "---------TIME RANGE SETTINGS---------")

time_cond = true

//ema filter

emalen = input(200,"EMA Filter Length",group = "EMA FILTER SETTINGS")

emasource = input(close,"EMA Filter Source",group = "EMA FILTER SETTINGS")

ema_fil = ta.ema(emasource,emalen)

plot(ema_fil,"EMA Filter")

//macd

fast_length = input(title="Fast Length", defval=26,group = "MACD FILTER SETTINGS")

slow_length = input(title="Slow Length", defval=100,group = "MACD FILTER SETTINGS")

src_macd = input(title="Source", defval=close,group = "MACD FILTER SETTINGS")

signal_length = input.int(title="Signal Smoothing", minval = 1, maxval = 50, defval = 9,group = "MACD FILTER SETTINGS")

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"],group = "MACD FILTER SETTINGS")

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"],group = "MACD FILTER SETTINGS")

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src_macd, fast_length) : ta.ema(src_macd, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src_macd, slow_length) : ta.ema(src_macd, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

//tpsl

takeprofit=input.float(defval=0.3,title="Enter The Take Profit %",group="TP/SL CONDITION INPUTS HERE")/100

stoploss=input.float(defval=0.16,title="Enter The Stop %",group="TP/SL CONDITION INPUTS HERE")/100

tp = strategy.opentrades.entry_price(0)*takeprofit/syminfo.mintick

sl = strategy.opentrades.entry_price(0)*stoploss/syminfo.mintick

lg_rule = buysignal and hist > 0 and close > ema_fil

sh_rule = sellsignal and hist < 0 and close < ema_fil

// Plot Bull/Bear

plotshape(lg_rule, title='Bull', text='Bull', style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.black, 0), size=size.tiny)

plotshape(sh_rule, title='Bear', text='Bear', style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.black, 0), size=size.tiny)

//alert

lg_entryal = input("Long entry","Long entry alert",group = "ALERT MESSAGE SETTINGS")

sh_entryal = input("Short entry","Short entry alert",group = "ALERT MESSAGE SETTINGS")

if lg_rule and time_cond and barstate.isconfirmed

strategy.entry("LONG",strategy.long)

alert(lg_entryal,alert.freq_once_per_bar_close)

if strategy.position_size > 0

strategy.exit("LONG EX","LONG",loss = sl,profit = tp,comment_loss = "LONG SL",comment_profit = "LONG TP")

if sh_rule and time_cond and barstate.isconfirmed

strategy.entry("SHORT",strategy.short)

alert(sh_entryal,alert.freq_once_per_bar_close)

if strategy.position_size < 0

strategy.exit("SHORT EX","SHORT",loss = sl,profit = tp,comment_loss = "SHORT SL",comment_profit = "SHORT TP")

//end

Detail

https://www.fmz.com/strategy/439984

Last Modified

2024-01-25 15:21:46