Name

双移动平均线反转策略Dual-Moving-Average-Reversal-Strategy

Author

ChaoZhang

Strategy Description

双移动平均线反转策略(Dual Moving Average Reversal Strategy)是一个利用双移动平均线来识别短期和长期趋势的量化交易策略。该策略结合10日简单移动平均线和200日简单移动平均线,在长期看涨的大趋势下,捕捉短期回调买入机会。同时,该策略还具有一定的趋势跟踪和损失控制机制。

双移动平均线反转策略主要基于以下假设:

-

200日简单移动平均线能够识别市场的长期趋势方向。当价格高于200日线时,代表大盘处于长期看涨趋势。

-

10日简单移动平均线能够识别市场的短期拉回。当价格低于10日线时,代表短期内出现回调。

-

在长期看涨的趋势下,任何短期回调都可被视为一个低吸机会,可以高效率的进行捕捉。

基于以上假设,该策略的交易信号生成逻辑为:

-

当收盘价上穿200日线,且同时下穿10日线时,代表长期趋势看涨,短期出现回调,因此产生买入信号。

-

当持有头寸时,如果收盘价重新上穿10日线,代表短期趋势反转,应立即止损离场。此外,如果股价有较大幅度下跌导致亏损达到事先设定的止损线,也会主动止损。

-

当大盘整体出现较大幅度下跌时,可作为低吸的机会,通过事先设定的跌幅阈值来判断买入时机。

通过这样的设计,可在牛市长期看涨的大趋势下,有效地进行低吸追涨,并设置止损来控制风险。

双移动平均线反转策略具有以下几个优势:

- 策略思路清晰简单,容易理解和实现。

- 利用双移动平均线过滤器,可以有效识别大盘和个股的长短期趋势。

- 具有较好的时效性。通过捕捉短期反转,可以获得较高的资金使用效率。

- 内置止损机制,可以很好的控制个别仓位的损失。

- 可以灵活设置参数,适用于大盘指数和热门个股。

尽管双移动平均线反转策略优势明显,但也存在以下一些风险:

- 大盘处于长期盘整时,容易产生误信号,从而影响策略表现。此时需要暂停策略,等待明确趋势再启用。

- 仅依靠移动平均线来判断趋势和产生信号,可能会漏掉其他有效特征。可以考虑引入更多指标进行组合优化。

- 单一止损方式可能过于死板,可以测试不同类型的止损机制。

- 策略参数需要针对不同标的进行调整优化,否则会影响稳定性。

双移动平均线反转策略还有如下几个可优化的方向:

- 测试不同长度的移动平均线组合,寻找最优参数。

- 增加其他辅助指标,形成更稳定的信号。比如成交量,震荡指标等。

- 测试不同类型的止损方式。如跟踪止损,时间止损等。

- 优化买入和止损的参数,使其能自适应变化的市场情况。

- 增加机器学习算法,利用更多历史数据对参数进行优化。

双移动平均线反转策略整体而言是一个非常实用的量化策略。它利用移动平均线的优点,在长线多头行情中进行低吸与止损,从而获得较高的单轮收益。同时它也具备一定的大盘识别能力和风险控制。通过持续的测试与优化,相信该策略的表现会更加出色。

||

The Dual Moving Average Reversal Strategy is a quantitative trading strategy that utilizes dual moving averages to identify short-term and long-term trends. The strategy combines the 10-day simple moving average (SMA) and the 200-day SMA to capitalize on short-term pullbacks within an underlying long-term uptrend. It also features trend-following and risk management mechanisms.

The Dual Moving Average Reversal Strategy is based on the following assumptions:

-

The 200-day SMA identifies the prevailing long-term trend of the market. When the price is above the 200-day line, it signals that the market is in a long-term uptrend.

-

The 10-day SMA pinpoints short-term pullbacks in price. When the price falls below the 10-day line, it indicates a temporary pullback has occurred.

-

In an ongoing bull market uptrend, any short-term pullback can be viewed as a buying opportunity to efficiently catch the upside rebound.

Based on the above assumptions, the trade signals are generated as follows:

-

When the closing price crosses above the 200-day SMA and simultaneously crosses below the 10-day SMA, it triggers a buy signal as it shows the long-term trend remains positive but a short-term pullback has occurred.

-

If the price recrosses above the 10-day SMA when in a long position, the short-term trend has reversed so the position will be closed immediately. Also, if the market falls substantially leading to a stop loss breach, the position will close.

-

Whenever there is a major downturn (exceeding a predefined threshold), it presents an opportunity to buy the dip as a contrarian signal.

With this design, the strategy aims to efficiently capitalize on upside snapbacks during sustained uptrends while controlling risk using stop losses.

The Dual Moving Average Reversal Strategy has these key advantages:

- The strategy logic is straightforward and easily understandable.

- The dual moving average filters effectively identify short and long-term trends.

- It offers good time efficiency by capitalizing on short-term reversals.

- The built-in stop loss mechanism tightly controls risk on individual positions.

- Flexible parametrization makes this strategy widely applicable for indexes and stocks.

While being generally effective, the strategy has these limitations:

- Whipsaws and false signals may occur if the market is range-bound. The strategy should be deactivated during extended consolidations.

- Reliance solely on moving averages has signal accuracy limitations. More indicators could augment performance.

- The fixed stop loss methodology lacks flexibility. Other stop loss techniques could be tested.

- Optimal parameters need to be calibrated for different markets. Suboptimal settings reduce reliability.

Further improvements for this strategy include:

- Testing other moving average lengths to find the optimal combination.

- Adding supporting indicators to generate more reliable signals e.g. volume, volatility metrics.

- Exploring other stop loss techniques like trailing stop loss, time-based stop loss.

- Building adaptive capabilities into entry rules and stop loss parameters enabling adjustment to changing market dynamics.

- Incorporating machine learning algorithms to further optimize parameters leveraging more historical data.

In summary, the Dual Moving Average Reversal Strategy is a highly practical approach. It enables profitable pullback fading during sustained uptrends using moving average analysis paired with stop losses. It also offers market regime detection capabilities and risk control. With continual enhancement, the strategy offers strong potential to deliver differentiated performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 200 | (?Strategy Parameters)MA Length 1 |

| v_input_int_2 | 10 | MA Length 2 |

| v_input_int_3 | 50 | MA Length 3 |

| v_input_float_1 | 0.15 | Stop Loss Percent |

| v_input_bool_1 | true | Exit on lower close |

| v_input_bool_2 | true | Buy whenever more than x% drawdown |

| v_input_int_4 | 14 | Trigger % drop to buy the dip |

| v_input_bool_3 | false | Include stop condition using MA crossover |

| v_input_1 | timestamp(01 Jan 2013 13:30 +0000) | (?Time filter)Start filter |

| v_input_2 | timestamp(01 Jan 2099 19:30 +0000) | End filter |

Source (PineScript)

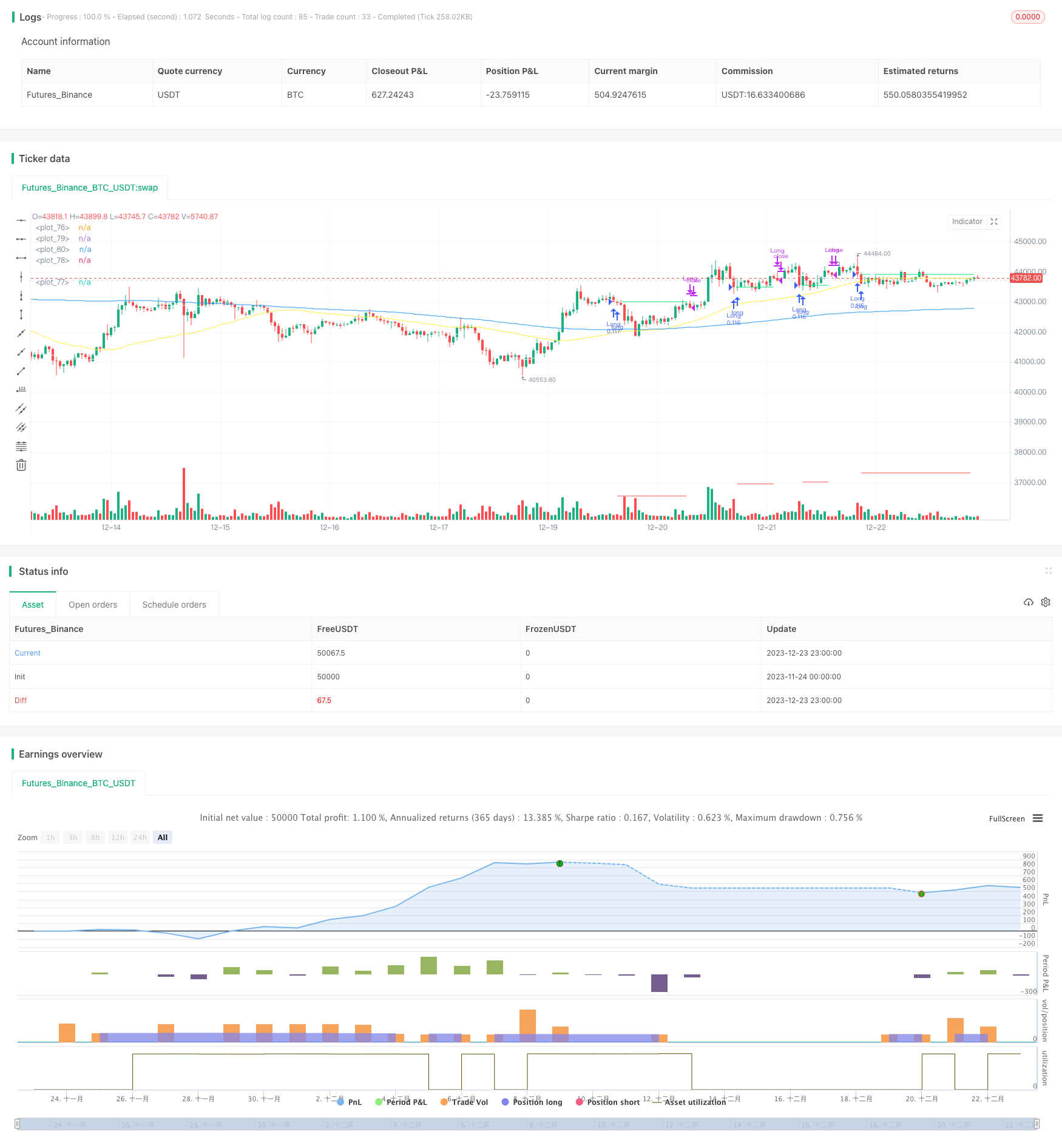

/*backtest

start: 2023-11-24 00:00:00

end: 2023-12-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Gold_D_Roger

//note: spreading 1 statement over multiple lines needs 1 apce + 1 tab | multi line function is 1 tab

//Recommended tickers: SPY (D), QQQ (D) and big indexes, AAPL (4H)

//@version=5

strategy("Davin's 10/200MA Pullback on SPY Strategy v2.0",

overlay=true,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10, // 10% of equity on each trade

commission_type=strategy.commission.cash_per_contract,

commission_value=0.1) //Insert your broker's rate, IB is 0.005USD or tiered

//Best parameters

// SPY D

// Stop loss 0.15

// commission of 0.005 USD using Interactive brokers

// Exit on lower close

// Buy more when x% down --> 14%

// DO NOT include stop condition using MA crossover

// Get User Input

i_ma1 = input.int(title="MA Length 1", defval=200, step=10, group="Strategy Parameters", tooltip="Long-term MA 200")

i_ma2 = input.int(title="MA Length 2", defval=10, step=10, group="Strategy Parameters", tooltip="Short-term MA 10")

i_ma3 = input.int(title="MA Length 3", defval=50, step=1, group="Strategy Parameters", tooltip="MA for crossover signals`")

i_stopPercent = input.float(title="Stop Loss Percent", defval=0.15, step=0.01, group="Strategy Parameters", tooltip="Hard stop loss of 10%")

i_startTime = input(title="Start filter", defval=timestamp("01 Jan 2013 13:30 +0000"), group="Time filter", tooltip="Start date and time to begin")

i_endTime = input(title="End filter", defval=timestamp("01 Jan 2099 19:30 +0000"), group="Time filter", tooltip="End date and time to stop")

i_lowerClose = input.bool(title="Exit on lower close", defval=true, group="Strategy Parameters", tooltip="Wait for lower close after above 10SMA before exiting") // optimise exit strat, boolean type creates tickbox type inputs

i_contrarianBuyTheDip = input.bool(title="Buy whenever more than x% drawdown", defval=true, group="Strategy Parameters", tooltip="Buy the dip! Whenever x% or more drawdown on SPY")

i_contrarianTrigger = input.int(title="Trigger % drop to buy the dip", defval=14, step=1, group="Strategy Parameters", tooltip="% drop to trigger contrarian Buy the Dip!")

//14% to be best for SPY 1D

//20% best for AMZN 1D

i_stopByCrossover_MA2_3 = input.bool(title="Include stop condition using MA crossover", defval=false, group="Strategy Parameters", tooltip="Sell when crossover of MA2/1 happens")

// Get indicator values

ma1 = ta.sma(close,i_ma1) //param 1

ma2 = ta.sma(close,i_ma2) //param 2

ma3 = ta.sma(close,i_ma3) //param 3

ma_9 = ta.ema(close,9) //param 2

ma_20 = ta.ema(close,20) //param 3

// Check filter(s)

f_dateFilter = true //make sure date entries are within acceptable range

// Highest price of the prev 52 days: https://www.tradingcode.net/tradingview/largest-maximum-value/#:~:text=()%20versus%20ta.-,highest(),max()%20and%20ta.

highest52 = ta.highest(high,52)

overall_change = ((highest52 - close[0]) / highest52) * 100

// Check buy/sell conditions

var float buyPrice = 0 //intialise buyPrice, this will change when we enter a trade ; float = decimal number data type 0.0

buyCondition = (close > ma1 and close < ma2 and strategy.position_size == 0 and f_dateFilter) or (strategy.position_size == 0 and i_contrarianBuyTheDip==true and overall_change > i_contrarianTrigger and f_dateFilter) // higher than 200sma, lower than short term ma (pullback) + avoid pyramiding positions

sellCondition = close > ma2 and strategy.position_size > 0 and (not i_lowerClose or close < low[1]) //check if we already in trade + close above 10MA;

// third condition: EITHER i_lowerClose not turned on OR closing price has to be < previous candle's LOW [1]

stopDistance = strategy.position_size > 0 ? ((buyPrice - close)/close) : na // check if in trade > calc % drop dist from entry, if not na

stopPrice = strategy.position_size > 0 ? (buyPrice - (buyPrice * i_stopPercent)) : na // calc SL price if in trade, if not, na

stopCondition = (strategy.position_size > 0 and stopDistance > i_stopPercent) or (strategy.position_size > 0 and (i_stopByCrossover_MA2_3==true and ma3 < ma1))

// Enter positions

if buyCondition

strategy.entry(id="Long", direction=strategy.long) //long only

if buyCondition[1] // if buyCondition is true prev candle

buyPrice := open // entry price = current bar opening price

// Exit position

if sellCondition or stopCondition

strategy.close(id="Long", comment = "Exit" + (stopCondition ? "Stop loss=true" : "")) // if condition? "Value for true" : "value for false"

buyPrice := na //reset buyPrice

// Plot

plot(buyPrice, color=color.lime, style=plot.style_linebr)

plot(stopPrice, color=color.red, style=plot.style_linebr, offset = -1)

plot(ma1, color=color.blue) //defval=200

plot(ma2, color=color.white) //defval=10

plot(ma3, color=color.yellow) // defval=50

Detail

https://www.fmz.com/strategy/436500

Last Modified

2023-12-25 13:24:14