Name

双轨道反向MACD量化交易策略Ergotic-Dual-rail-Reverse-MACD-Quantitative-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略是一个双轨道反向MACD量化交易策略。它借鉴了William Blau在他的著作《Momentum, Direction and Divergence》中描述的技术指标,并在此基础上进行了扩展。该策略同时具有回测功能,可以加上警报、过滤器、跟踪止损等附加功能。

该策略的核心指标是MACD。它计算快速移动平均线EMA(r)和慢速移动平均线EMA(slowMALen),然后计算它们的差值xmacd。另外计算xmacd的EMA(signalLength)得到xMA_MACD。当xmacd上穿xMA_MACD时做多,下穿时做空。该策略的关键在于反向交易信号,即xmacd和xMA_MACD的关系与常规MACD指标相反,这也是“反向MACD”这个名称的由来。

此外,该策略还引入了趋势过滤器。在做多信号发出时,如果配置了看涨趋势过滤器,会检测价格是否在上涨;类似的,做空信号会检测价格下跌趋势。RSI指标和MFI指标也可用来过滤信号。配置止损机制,可以防止超过阈值的损失。

该策略最大的优势在于回测功能强大。可以选择不同的交易品种,设置回测的时间范围,针对具体品种数据进行策略优化。相比简单的MACD策略,它增加了趋势、超买超卖的判断,可以过滤掉一些雷同信号。双轨道反向MACD与传统MACD不同,可以把握一些传统MACD可能遗漏的机会。

该策略的风险主要源于反向交易的思路。反向信号虽然可以获取一些机会,但也意味着放弃了一些传统MACD买卖点,这需要谨慎评估。此外,MACD本身就容易产生多头虚假信号的问题。如果遇到震荡行情,该策略可能会产生过多交易,增加交易成本和滑点损失。

为降低风险,可以适当调整参数,优化移动平均线的长度;结合趋势和指标过滤器,避免在震荡市产生信号;适当调高止损距离,保证个别交易亏损控制。

该策略可以从以下几个方面进行优化:

- 调整快慢轨参数,优化移动平均线长度,对具体品种数据进行测试,找到最佳参数组合

- 增加或调整趋势过滤器,根据回测结果判断是否有提高策略收益率

- 测试不同的止损机制,是固定止损好还是跟踪止损好

- 尝试结合其他指标,如KD、布林带等,设定更多过滤条件,确保信号质量

双轨道反向MACD量化策略借鉴了经典MACD指标的思想,在此基础上进行了扩展与改进。该策略同时具备灵活的参数配置、丰富的过滤机制选择,以及强大的回测功能等优点。这使其能够针对不同交易品种进行个性化优化,是一种值得探索的有潜力的量化交易策略。

||

This strategy is a dual-rail reverse MACD quantitative trading strategy. It draws on the technical indicators described by William Blau in his book "Momentum, Direction and Divergence" and expands on them. The strategy also has backtesting capabilities and can incorporate additional features like alerts, filters, trailing stop loss, etc.

The core indicator of this strategy is MACD. It calculates the fast moving average EMA(r) and slow moving average EMA(slowMALen), then computes their difference xmacd. It also calculates the EMA(signalLength) of xmacd to get xMA_MACD. A long signal triggers when xmacd crosses above xMA_MACD, and a short signal triggers on a cross below. The key aspect of this strategy is the reverse trading signals, i.e. the relationship between xmacd and xMA_MACD is opposite to that of the conventional MACD indicator, which is also where the name "Reverse MACD" comes from.

In addition, the strategy incorporates trend filters. When a long signal fires, if the bullish trend filter is configured, it will check if the price is increasing. Similarly, the short signal checks for a downward price trend. RSI and MFI indicators can also be used to filter out signals. A stop loss mechanism is included to prevent losses beyond a threshold.

The biggest advantage of this strategy is the powerful backtesting capabilities. You can choose different trading instruments, set the backtest timeframe, and optimize the strategy parameters based on specific instrument data. Compared to a simple MACD strategy, it incorporates trend and overbought/oversold analysis to filter out some identical signals. The dual-rail reverse MACD is different from the traditional MACD, allowing it to capitalize on some opportunities that the traditional MACD may miss.

The primary risk of this strategy comes from the reverse trading logic. While reverse signals can capture some opportunities missed by traditional signals, it also means forfeiting some conventional MACD entry points, necessitating careful assessment. Moreover, the MACD itself is prone to generating false bullish signals. The strategy may result in excessive trades and increased costs during choppy, directionless markets.

To mitigate risks, parameters can be optimized - tuning the moving average lengths; combining trends and indicator filters avoids signals in choppy markets; raising stop loss distances ensures capped losses on individual trades.

The strategy can be improved in several aspects:

- Adjust fast and slow rail parameters, optimize moving average lengths, backtest to find optimal parameter sets for specific instruments

- Add or tune trend filters, judge from backtest results whether it improves return

- Test different stop loss mechanisms, fixed or trailing, to determine the better performer

- Try combining other indicators like KD, Bollinger Bands to set additional filter conditions and ensure signal quality

The dual-rail reverse MACD quantitative strategy builds upon the classic MACD indicator with extensions and improvements. With flexible parameter configurations, abundant filter choices, and powerful backtesting functionality, it can be tuned to suit different trading instruments. Hence it is an intriguing and promising quantitative trading strategy worthy of further exploration.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | source: close |

| v_input_2 | 0 | strategyType: Long Only |

| v_input_3 | 7 | From Month |

| v_input_4 | true | From Day |

| v_input_5 | 2018 | From Year |

| v_input_6 | 12 | To Month |

| v_input_7 | true | To Day |

| v_input_8 | 2030 | To Year |

| v_input_9 | 144 | R (32,55,89,100,144,200) |

| v_input_10 | 6 | slowMALen |

| v_input_11 | 6 | signalLength |

| v_input_12 | false | Trade reverse (long/short switch) |

| v_input_13 | true | Long only if price has increased |

| v_input_14 | false | Short only if price has decreased |

| v_input_15 | 2 | trending_price_length |

| v_input_16 | false | trending_price_with_ema |

| v_input_17 | 3 | trending_price_ema |

| v_input_18 | 14 | rsi_length |

| v_input_19 | 14 | RSI Sell Cutoff (Sell only if >= #) |

| v_input_20 | 82 | RSI Buy Cutoff (Buy only if <= #) |

| v_input_21 | false | Long only if RSI has increased |

| v_input_22 | 2 | trending_rsi_length |

| v_input_23 | 14 | mfi_length |

| v_input_24 | 14 | mfi_lower |

| v_input_25 | 82 | mfi_upper |

| v_input_26 | false | Long only if MFI has increased |

| v_input_27 | 2 | trending_mfi_length |

| v_input_28_hlc3 | 0 | TSL source: hlc3 |

| v_input_29 | 5 | Use different timeframe for stop trigger? Uncheck box above. |

| v_input_30 | 3 | tslTrigger |

| v_input_31 | 0.6 | tslStop |

| v_input_32 | 7 | Stop Loss % |

| v_input_33 | 1.8 | Take Profit % |

Source (PineScript)

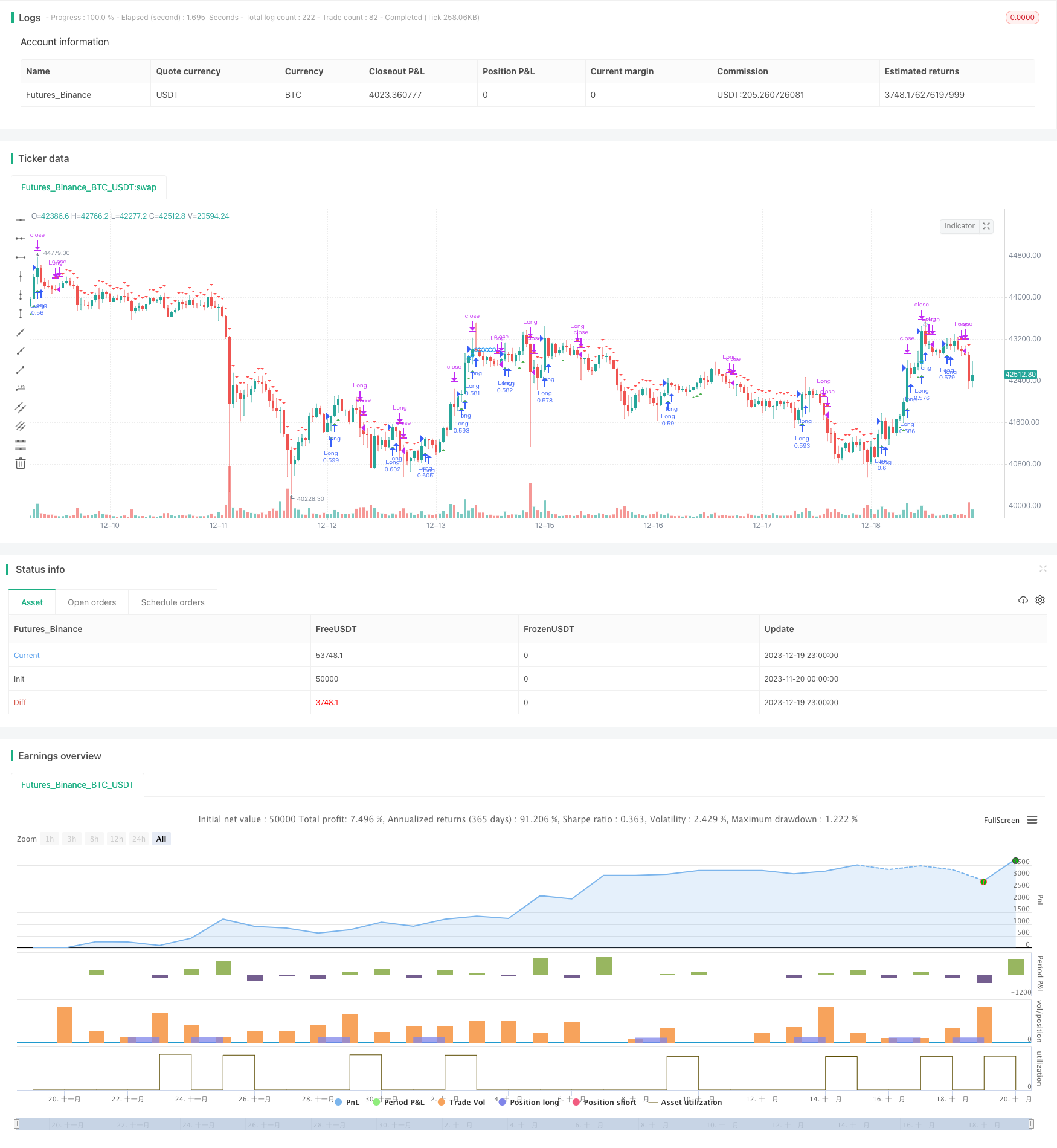

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 09/12/2016

// This is one of the techniques described by William Blau in his book

// "Momentum, Direction and Divergence" (1995). If you like to learn more,

// we advise you to read this book. His book focuses on three key aspects

// of trading: momentum, direction and divergence. Blau, who was an electrical

// engineer before becoming a trader, thoroughly examines the relationship

// between price and momentum in step-by-step examples. From this grounding,

// he then looks at the deficiencies in other oscillators and introduces some

// innovative techniques, including a fresh twist on Stochastics. On directional

// issues, he analyzes the intricacies of ADX and offers a unique approach to help

// define trending and non-trending periods.

// Blau`s indicator is like usual MACD, but it plots opposite of meaningof

// stndard MACD indicator.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

//

//

// 2018-09 forked by Khalid Salomão

// - Backtesting

// - Added filters: RSI, MFI, Price trend

// - Trailing Stop Loss

// - Other minor adjustments

//

////////////////////////////////////////////////////////////

strategy(title="Ergotic MACD Backtester [forked from HPotter]", shorttitle="Ergotic MACD Backtester", overlay=true, pyramiding=0, default_qty_type=strategy.cash, default_qty_value=25000, initial_capital=50000, commission_type=strategy.commission.percent, commission_value=0.15, slippage=3)

// === BACKTESTING: INPUT BACKTEST RANGE ===

source = input(close)

strategyType = input(defval="Long Only", options=["Long & Short", "Long Only", "Short Only"])

FromMonth = input(defval = 7, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2030, title = "To Year", minval = 2017)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => true // window of time verification

// === STRATEGY ===

r = input(144, minval=1, title="R (32,55,89,100,144,200)") // default 32

slowMALen = input(6, minval=1) // default 32

signalLength = input(6, minval=1)

reverse = input(false, title="Trade reverse (long/short switch)")

//hline(0, color=blue, linestyle=line)

fastMA = ema(source, r)

slowMA = ema(source, slowMALen)

xmacd = fastMA - slowMA

xMA_MACD = ema(xmacd, signalLength)

pos = 0

pos := iff(xmacd < xMA_MACD, 1,

iff(xmacd > xMA_MACD, -1, nz(pos[1], 0)))

possig = 0

possig := iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

// === FILTER: price trend ====

trending_price_long = input(true, title="Long only if price has increased" )

trending_price_short = input(false, title="Short only if price has decreased" )

trending_price_length = input( 2, minval=1 )

trending_price_with_ema = input( false )

trending_price_ema = input( 3, minval=1 )

price_trend = trending_price_with_ema ? ema(source, trending_price_ema) : source

priceLongTrend() => (trending_price_long ? rising(price_trend, trending_price_length) : true)

priceShortTrend() => (trending_price_short ? falling(price_trend, trending_price_length) : true)

// === FILTER: RSI ===

rsi_length = input( 14, minval=1 )

rsi_overSold = input( 14, minval=0, title="RSI Sell Cutoff (Sell only if >= #)" )

rsi_overBought = input( 82, minval=0, title="RSI Buy Cutoff (Buy only if <= #)" )

vrsi = rsi(source, rsi_length)

rsiOverbought() => vrsi > rsi_overBought

rsiOversold() => vrsi < rsi_overSold

trending_rsi_long = input(false, title="Long only if RSI has increased" )

trending_rsi_length = input( 2 )

rsiLongTrend() => trending_rsi_long ? rising(vrsi, trending_rsi_length) : true

// === FILTER: MFI ===

mfi_length = input(14, minval=1)

mfi_lower = input(14, minval=0, maxval=50)

mfi_upper = input(82, minval=50, maxval=100)

upper_s = sum(volume * (change(source) <= 0 ? 0 : source), mfi_length)

lower_s = sum(volume * (change(source) >= 0 ? 0 : source), mfi_length)

mf = rsi(upper_s, lower_s)

mfiOverbought() => (mf > mfi_upper)

mfiOversold() => (mf < mfi_lower)

trending_mfi_long = input(false, title="Long only if MFI has increased" )

trending_mfi_length = input( 2 )

mfiLongTrend() => trending_mfi_long ? rising(mf, trending_mfi_length) : true

// === SIGNAL CALCULATION ===

long = window() and possig == 1 and rsiLongTrend() and mfiLongTrend() and not rsiOverbought() and not mfiOverbought() and priceLongTrend()

short = window() and possig == -1 and not rsiOversold() and not mfiOversold() and priceShortTrend()

// === trailing stop

tslSource=input(hlc3,title="TSL source")

//suseCurrentRes = input(true, title="Use current chart resolution for stop trigger?")

tslResolution = input(title="Use different timeframe for stop trigger? Uncheck box above.", defval="5")

tslTrigger = input(3.0) / 100

tslStop = input(0.6) / 100

currentPrice = request.security(syminfo.tickerid, tslResolution, tslSource, barmerge.gaps_off, barmerge.lookahead_off)

isLongOpen = false

isLongOpen := nz(isLongOpen[1], false)

entryPrice=0.0

entryPrice:= nz(entryPrice[1], 0.0)

trailPrice=0.0

trailPrice:=nz(trailPrice[1], 0.0)

// update TSL high mark

if (isLongOpen )

if (not trailPrice and currentPrice >= entryPrice * (1 + tslTrigger))

trailPrice := currentPrice

else

if (trailPrice and currentPrice > trailPrice)

trailPrice := currentPrice

if (trailPrice and currentPrice <= trailPrice * (1 - tslStop))

// FIRE TSL SIGNAL

short:=true // <===

long := false

// if short clean up

if (short)

isLongOpen := false

entryPrice := 0.0

trailPrice := 0.0

if (long)

isLongOpen := true

if (not entryPrice)

entryPrice := currentPrice

// === BACKTESTING: ENTRIES ===

if long

if (strategyType == "Short Only")

strategy.close("Short")

else

strategy.entry("Long", strategy.long, comment="Long")

if short

if (strategyType == "Long Only")

strategy.close("Long")

else

strategy.entry("Short", strategy.short, comment="Short")

//barcolor(possig == -1 ? red: possig == 1 ? green : blue )

//plot(xmacd, color=green, title="Ergotic MACD")

//plot(xMA_MACD, color=red, title="SigLin")

plotshape(trailPrice ? trailPrice : na, style=shape.circle, location=location.absolute, color=blue, size=size.tiny)

plotshape(long, style=shape.triangleup, location=location.belowbar, color=green, size=size.tiny)

plotshape(short, style=shape.triangledown, location=location.abovebar, color=red, size=size.tiny)

// === Strategy Alert ===

alertcondition(long, title='BUY - Ergotic MACD Long Entry', message='Go Long!')

alertcondition(short, title='SELL - Ergotic MACD Long Entry', message='Go Short!')

// === BACKTESTING: EXIT strategy ===

sl_inp = input(7, title='Stop Loss %', type=float)/100

tp_inp = input(1.8, title='Take Profit %', type=float)/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

strategy.exit("Stop Loss/Profit", "Long", stop=stop_level, limit=take_level)

Detail

https://www.fmz.com/strategy/436095

Last Modified

2023-12-21 11:07:51