Name

双重反转震荡带趋势跟踪策略Dual-Reversal-Oscillating-Band-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

双重反转震荡带趋势跟踪策略通过结合双重反转信号和震荡带指标,实现趋势跟踪交易。它首先利用123反转系统生成反转信号,然后结合Fractal Chaos Bands指标过滤信号,实现趋势跟踪。该策略既可以识别反转机会,又可以跟踪趋势,是一种非常全面的交易策略。

123反转系统来源于Ulf Jensen的《我如何在期货市场获得三倍收益》一书中第183页的内容。它的交易信号是:

当收盘价连续2日高于前一日收盘价,且9日Slow K线低于50时,做多;当收盘价连续2日低于前一日收盘价,且9日Fast K线高于50时,做空。

该部分主要利用Stochastic oscillator指标在超买超卖区域生成信号。当股票连续上涨但Stochastic oscillator指标显示仍有更多空间上涨时,采取看涨策略;当股票连续下跌但Stochastic oscillator指标显示仍有更多空间下跌时,采取看跌策略。

Fractal Chaos Bands指标通过绘制股票价格的最高点和最低点,形成上轨和下轨,来判断市场的趋势。具体规则是:

当价格上涨突破上轨时,做多;当价格下跌突破下轨时,做空。

该部分主要作为趋势过滤,与123反转信号配合使用。只有当两者信号一致时,才会开仓。

- 结合反转和趋势,全面捕捉机会

双重反转震荡带趋势跟踪策略既可以捕捉反转机会,也可以跟踪趋势,非常全面。无论市场是否处于震荡或趋势状态,都可以获得交易信号。

- 减少假信号,提高胜率

相比单一指标,该策略通过双重指标的结合过滤,可以大大减少假信号,提高实际交易的胜率和盈利率。

- 参数调节灵活,适应性强

双重反转震荡带趋势跟踪策略的参数都很好理解,用户可以根据自己的需要和市场环境进行调整,非常灵活。无论震荡市还是趋势市,都可以通过参数调整适应。

- 大趋势下无法适应

策略本身更依赖于中短线交易机会。在大的行情趋势下,该策略可能会产生过多反向信号而停损出局。这是可以通过参数调整来优化的。

- 需要边际资金支持

双重反转震荡带趋势跟踪策略属于频繁交易类型,需要有足够的边际资金来支持开仓保证金的需求。对于资金不足的用户来说,可能需要适当调小仓位。

- 可结合更多指标过滤

该策略可以在现有基础上,引入更多不同类型的指标来丰富信号源,提高策略的稳健性。比如加上量能指标、波动率指标等来检验反转和趋势信号。

双重反转震荡带趋势跟踪策略成功结合反转交易和趋势跟踪的优点,既可以捕捉反转,又可以跟随趋势,非常全面和高效。相比单一指标,它可以大大减少假信号,提高实际交易的胜率和盈利水平。此外,该策略参数调节灵活,用户可以根据自己的风格和市场环境进行优化。总的来说,这是一种非常出色的量化策略,值得实盘验证。

||

The Dual Reversal Oscillating Band Trend Following strategy combines dual reversal signals and oscillating band indicators to implement trend following trading. It first uses the 123 reversal system to generate reversal signals, and then combines the Fractal Chaos Bands indicator to filter signals and follow trends. This strategy can identify both reversal opportunities and follow trends, making it a very comprehensive trading strategy.

The 123 reversal system is from page 183 of the book "How I Tripled My Money in The Futures Market" by Ulf Jensen. Its trading signals are:

Buy when the closing price is higher than the previous day's close for 2 consecutive days, and 9-day Slow K-line is below 50; Sell when the closing price is lower than the previous day's close for 2 consecutive days, and 9-day Fast K-line is above 50.

This section mainly uses the Stochastic oscillator indicator to generate signals in the overbought and oversold regions. When the stocks rise continuously but the Stochastic oscillator indicator shows there is still room to rise, take a bullish view; when the stocks fall continuously but the Stochastic oscillator indicator shows there is still room to fall, take a bearish view.

The Fractal Chaos Bands indicator determines market trends by plotting price highs and lows to form upper and lower rails. The specific rules are:

Buy when price breaks through the upper rail upwards; Sell when price breaks through the lower rail downwards.

This section mainly serves as a trend filter, combined with the 123 reversal signal. Only when both signals are consistent will a position be opened.

- Combining reversal and trend to capture opportunities comprehensively

The Dual Reversal Oscillating Band Trend Following Strategy can capture both reversal opportunities and follow trends, making it very comprehensive. It can obtain trading signals regardless of whether the market is oscillating or trending.

- Reducing false signals and improving win rate

Compared with a single indicator, this strategy can greatly reduce false signals and improve actual trading win rate and profit rate through the filtering of dual indicator combinations.

- Flexible parameter adjustment and strong adaptability

The parameters of the Dual Reversal Oscillating Band Trend Following Strategy are easy to understand. Users can adjust them according to their own needs and market conditions, making it very flexible. It can adapt to both oscillating and trending markets through parameter tuning.

- Unable to adapt under major trends

The strategy itself relies more on medium-term trading opportunities. Under major market trends, the strategy may generate too many reverse signals and stop out with losses. This can be optimized through parameter adjustment.

- Requires margin capital support

The Dual Reversal Oscillating Band Trend Following Strategy belongs to frequent trading types, requiring sufficient margin capital to support the margin requirements for opening positions. For users with insufficient capital, it may be necessary to appropriately reduce the position size.

- Can combine more indicators for filtering

The strategy can introduce more different types of indicators on the existing basis to enrich signal sources and improve the robustness of the strategy. For example, adding indicators like volume, volatility index, etc. to verify reversal and trend signals.

The Dual Reversal Oscillating Band Trend Following Strategy successfully combines the advantages of reversal trading and trend following. It can capture both reversals and follow trends, making it very comprehensive and efficient. Compared with a single indicator, it can greatly reduce false signals and improve the actual trading win rate and profit level. In addition, this strategy has flexible parameter adjustment for users to optimize according to their own style and market environment. In general, this is an excellent quantitative strategy that is worth live trading verification.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 15 | Length |

| v_input_2 | true | KSmoothing |

| v_input_3 | 3 | DLength |

| v_input_4 | 50 | Level |

| v_input_5 | true | Pattern |

| v_input_6 | false | Trade reverse |

Source (PineScript)

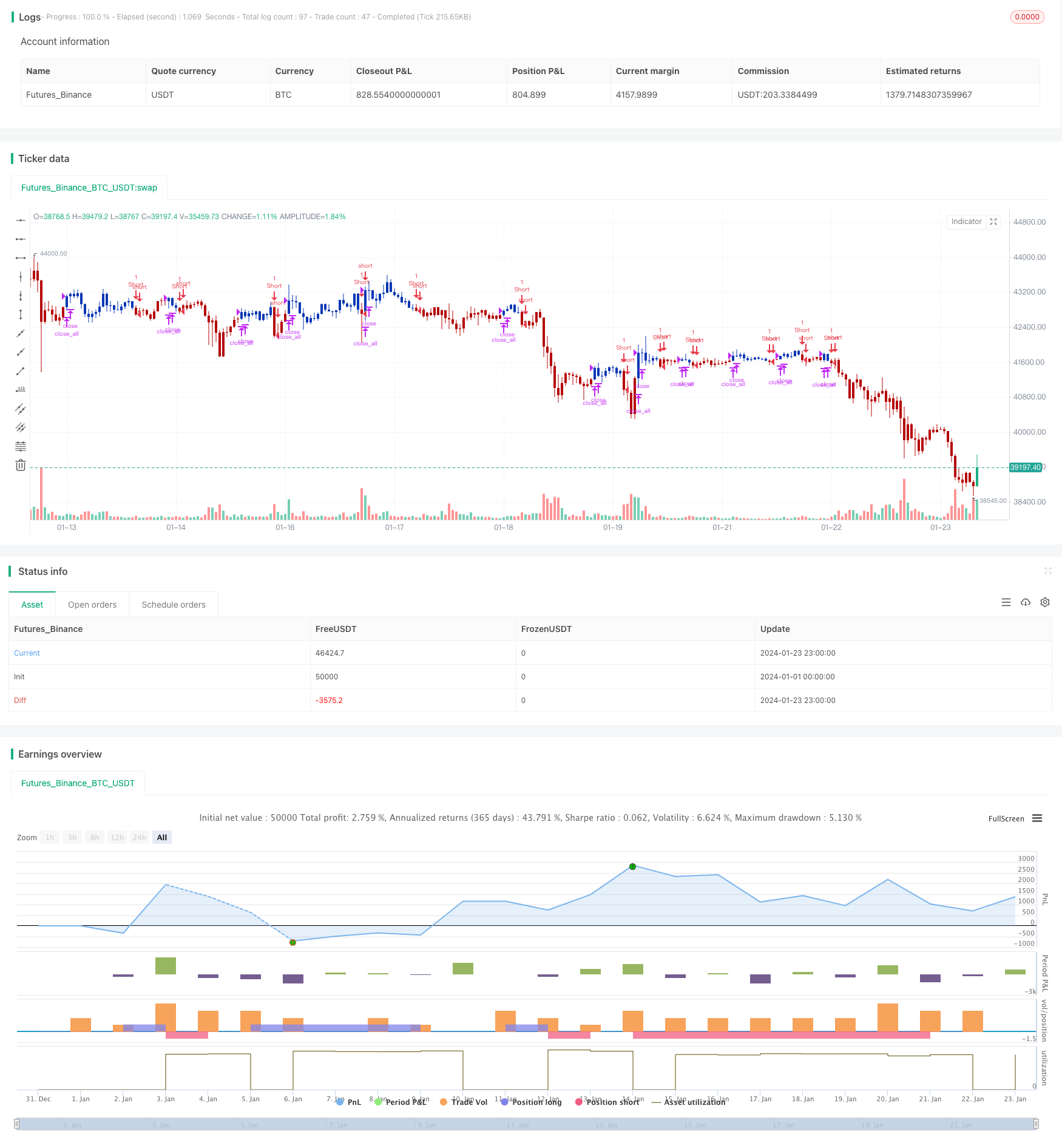

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/09/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Stock market moves in a highly chaotic way, but at a larger scale, the movements

// follow a certain pattern that can be applied to shorter or longer periods of time

// and we can use Fractal Chaos Bands Indicator to identify those patterns. Basically,

// the Fractal Chaos Bands Indicator helps us to identify whether the stock market is

// trending or not. When a market is trending, the bands will have a slope and if market

// is not trending the bands will flatten out. As the slope of the bands decreases, it

// signifies that the market is choppy, insecure and variable. As the graph becomes more

// and more abrupt, be it going up or down, the significance is that the market becomes

// trendy, or stable. Fractal Chaos Bands Indicator is used similarly to other bands-indicator

// (Bollinger bands for instance), offering trading opportunities when price moves above or

// under the fractal lines.

//

// The FCB indicator looks back in time depending on the number of time periods trader selected

// to plot the indicator. The upper fractal line is made by plotting stock price highs and the

// lower fractal line is made by plotting stock price lows. Essentially, the Fractal Chaos Bands

// show an overall panorama of the price movement, as they filter out the insignificant fluctuations

// of the stock price.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fractalUp(pattern) =>

p = high[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(high[i] < high[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(high[i] < high[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

fractalDn(pattern) =>

p = low[pattern+1]

okl = 1

okr = 1

res =0.0

for i = pattern to 1

okl := iff(low[i] > low[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(low[i] > low[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

FCB(Pattern) =>

pos = 0.0

xUpper = fractalUp(Pattern)

xLower = fractalDn(Pattern)

pos := iff(close > xUpper, 1,

iff(close < xLower, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Fractal Chaos Bands", shorttitle="Combo", overlay = true)

Length = input(15, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Pattern = input(1, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posFCB = FCB(Pattern)

pos = iff(posReversal123 == 1 and posFCB == 1 , 1,

iff(posReversal123 == -1 and posFCB == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Detail

https://www.fmz.com/strategy/439996

Last Modified

2024-01-25 16:01:04