Name

双顺势破坏均线止损策略Dual-SSL-Strategy-with-EMA-Stop-Loss

Author

ChaoZhang

Strategy Description

该策略融合了双顺势指标和移动均线指标,运用双顺势指标来判断市场趋势方向,以及利用移动均线进行趋势确认,属于趋势跟踪策略。结合止损来控制风险,属于较为稳定的策略。

-

计算昨日收盘价与指定周期内最高价的SMA均值构成的上轨,以及昨日收盘价与指定周期内最低价的SMA均值构成的下轨。

-

比较当前收盘价与上轨、下轨的关系,判断目前趋势方向。收盘价高于上轨,判断为多头;收盘价低于下轨,判断为空头。

-

计算200周期的收盘价SMA均线,作为中长线趋势的判断标准。

-

当判断为多头时,如果收盘价由下方向上突破SMA均线,产生买入信号;当判断为空头时,如果收盘价由上方向下突破SMA均线,产生卖出信号。

-

进入多头仓位后,若收盘价下破上轨,作为平仓信号;进入空头仓位后,若收盘价上破下轨,作为平仓信号。

-

设置固定比例的止损点,如收盘价下破止损点,则激活止损单。

-

使用双顺势指标判断趋势方向,可有效识别趋势,增强进入正确方向的概率。

-

均线的加入,可过滤掉部分噪音信号,避免在震荡行情中错交易。

-

采用止损来控制单笔损失风险,可以有效避免亏损过大。

-

策略操作相对简单,容易理解实现,适合初学者练手。

-

双顺势指标对参数设置较为敏感,不同周期参数组合,会导致结果差异较大,需谨慎测试参数的优化。

-

均线设置过长,会过滤掉较多交易机会;均线过短,则对去噪效果不佳。需权衡均线周期参数的设置。

-

止损点设置过宽,无法起到很好的风险控制;过窄则容易被价格常规波动触发退出。需谨慎设定止损范围。

-

策略较依赖参数优化,如果参数设置不当,则可能无法正确识别趋势方向,导致交易决策失误。

-

可以测试不同周期参数的组合,寻找使双顺势指标对趋势判断更准确的参数。

-

可以测试不同周期的均线指标,找到平衡去噪效果和保留信号的最佳均线参数。

-

可以尝试根据市场波动程度,设计自适应调整的止损机制,使止损更贴近市场情况。

-

还可以尝试加入其他指标进行辅助,如量价确认、多时间框架畅通等,来提升策略的稳定性。

-

优化后的策略,可以使用walk forward分析进行验证,以确保参数仍具有稳健性。

该策略整合双顺势指标和移动均线的优势,属于参数优化余地较大的趋势跟踪策略。通过合理的参数设定及优化,可以获得较好的策略表现。但需注意控制参数过度优化的风险,保证参数稳健性。整体来说,该策略适合用作策略探索和学习的案例。

||

This strategy integrates the Dual SSL indicator and moving average indicator, using the Dual SSL indicator to determine market trend direction, and moving averages for trend confirmation. It belongs to a trend following strategy. With the addition of a stop loss to control risk, it is a relatively stable strategy.

-

Calculate the upper rail by taking the SMA of the highest price over a specified period vs. yesterday's close. Calculate the lower rail by taking the SMA of the lowest price over a specified period vs. yesterday's close.

-

Compare the current closing price with the upper and lower rails to determine the current trend direction. If the closing price is above the upper rail, the trend is determined as bullish. If the closing price is below the lower rail, the trend is determined as bearish.

-

Calculate the 200-period SMA of closing prices as a benchmark for medium to long term trends.

-

When bullish, if the closing price breaks above the SMA from below, a buy signal is generated. When bearish, if the closing price breaks below the SMA from above, a sell signal is generated.

-

After entering a long position, if the closing price breaks below the upper rail, it is a close signal. After entering a short position, if the closing price breaks above the lower rail, it is a close signal.

-

Set a fixed percentage stop loss point. If the closing price breaks below the stop loss point, the stop loss order is triggered.

-

Using the Dual SSL indicator to determine trend direction can effectively identify trends and increase the probability of entering in the right direction.

-

Adding moving averages can filter out some noise signals and avoid wrong trades in choppy markets.

-

Using a stop loss to control single trade risk can effectively avoid excessive losses.

-

The strategy logic is relatively simple and easy to understand, suitable for beginners to practice on.

-

The Dual SSL indicator is sensitive to parameter tuning, different period combinations can lead to very different results. Parameters should be carefully optimized.

-

A MA that is too long filters out too many trading opportunities, while one too short fails to denoise effectively. A balanced MA period should be used.

-

A stop loss range set too wide fails to control risk effectively, while one too tight may be triggered by normal price fluctuations. The stop loss range needs to be set carefully.

-

The strategy relies heavily on parameter optimization. Incorrect parameters may fail to identify trends correctly, leading to wrong trading decisions.

-

Test different period combinations to find parameters that can improve trend determination accuracy for the Dual SSL indicator.

-

Test different period MAs to find the optimal balance between denoising and preserving signals.

-

Explore adaptive stop losses that adjust based on market volatility to make the stop loss more responsive.

-

Incorporate other indicators for confirmation, such as volume, multi-timeframe confluence, to improve robustness.

-

Walk forward analysis should be conducted on the optimized strategy to ensure robustness.

This strategy combines the strengths of the Dual SSL indicator and moving averages. With significant potential for parameter optimization, it is a trend following strategy. With reasonable parameter tuning and optimization, good results can be achieved. However, the risk of overfitting should be controlled to ensure robustness. Overall, this strategy serves as a good example for exploration and learning.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_float_1 | 2 | Stop Loss |

| v_input_1 | 10 | Period |

| v_input_2 | 10 | Period |

Source (PineScript)

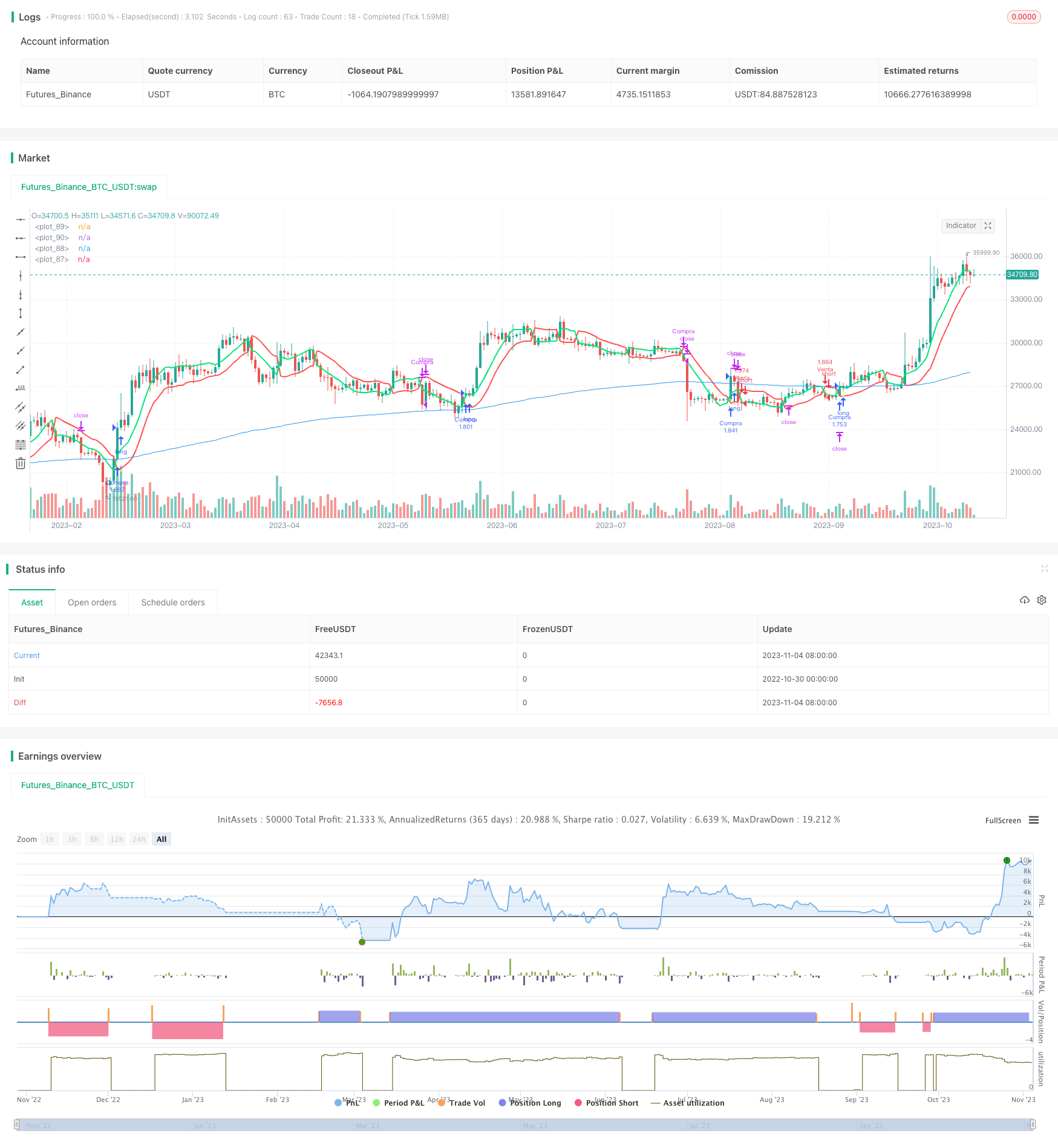

/*backtest

start: 2022-10-30 00:00:00

end: 2023-11-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@Isaac

//Estrategia vista en ▼▼

//YT: Trading Zone

strategy('SSL Strategy + EMA 200 AND Stop Loss', overlay=true)

ema = ta.ema(close, 200)

stop_loss = input.float(2.00, title='Stop Loss', step=0.10)

period = input(title='Period', defval=10)

len = input(title='Period', defval=10)

smaHigh = ta.sma(high, len)

smaLow = ta.sma(low, len)

Hlv = int(na)

Hlv := close > smaHigh ? 1 : close < smaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? smaHigh : smaLow

sslUp = Hlv < 0 ? smaLow : smaHigh

cruceArriba = ta.crossover(sslUp, sslDown)

cruceAbajo = ta.crossunder(sslUp, sslDown)

alcista = (close > ema ) and (cruceArriba)

bajista = (close < ema) and (cruceAbajo)

var SL = 0.0

//Cerrar compra por cruce

por_cruce = ta.crossunder(sslUp, sslDown)

//Cerrar venta por cruce

por_cruceAB = ta.crossunder(sslDown, sslUp)

//Cerrar compra y venta por stop loss

Stop = SL

comprado = strategy.position_size > 0

vendido = strategy.position_size < 0

UTmpconvertL = strategy.position_avg_price * (1 + 0.1)

UTmpdefineL = (UTmpconvertL > close and strategy.openprofit > 0.1)

UTSPL = UTmpdefineL

SPL = UTSPL

///////////////////////////////////////////////////////////////////////

UTmpconvertLS = strategy.position_avg_price * (1 + 0.1)

UTmpdefineLS = (UTmpconvertLS > close and strategy.openprofit > 0.1)

UTSPLS = UTmpdefineLS

SPLS = UTSPLS

////////////////////////////////////////////////////////////////////////

if not comprado and not vendido and alcista

cantidad = (strategy.equity / close)

strategy.entry('Compra', strategy.long, qty=cantidad, comment="Long")

SL := sslDown

if comprado and not vendido and por_cruce and SPL

strategy.close("Compra", comment="Exit Long")

SL := 0

if comprado and not vendido and Stop

strategy.exit('Compra', stop=Stop, comment="SL")

SL := 0

///////////////////////////////////////////////////////////////////

if not comprado and not vendido and bajista

cantidad = (strategy.equity / close)

strategy.entry('Venta', strategy.short, qty=cantidad, comment="Short")

SL := sslDown

if not comprado and vendido and por_cruceAB and SPLS

strategy.close("Venta", comment="Exit Short")

SL := 0

if not comprado and vendido and Stop

strategy.exit('Venta', stop=Stop, comment="SLS")

SL := 0

plot(Stop > 0 ? Stop : na, style=plot.style_circles, color=color.new(color.yellow,0))

plot(ema)

plot(sslDown, linewidth=2, color=color.new(color.red, 0))

plot(sslUp, linewidth=2, color=color.new(color.lime, 0))

Detail

https://www.fmz.com/strategy/431284

Last Modified

2023-11-06 16:52:11