Name

可扩展突破交易策略Breakout-Trading-Strategy-with-Scalability

Author

ChaoZhang

Strategy Description

可扩展突破交易策略通过识别价格的关键支撑阻力区域,在价格突破这些区域时生成交易信号,是一个非常灵活可扩展的突破策略。该策略可以通过调整参数适用于不同时间周期,也可以轻松地集成各种额外的过滤条件和风险管理机制,从而针对特定资产进行优化。

该策略首先利用swings()函数基于回看期计算出当前价格的波动高点和波动低点。回看期通过swingLookback参数设置,默认为20根K线。之后,当价格突破波动高点时,做多;当价格跌破波动低点时,做空。

做多信号的具体逻辑是,当收盘价大于等于波动高价时,做多。做空信号的具体逻辑是,当收盘价小于等于波动低价时,做空。

此外,策略还设置了止损位,通过stopTargetPercent参数来设定止损幅度。如做多止损价设置为最高价的5%以下,做空止损价设置为最低价的5%以上。

该策略的优势在于可以通过调整回看期来控制交易频率。回看期越短,对突破越敏感,交易频率越高。回看期过长则相反,交易频率下降但可能错过机会。所以找到最佳回看期对策略优化很关键。

- 简单的突破思路,容易理解实现

- 可通过调节回看期优化参数,控制交易频率

- 可轻松集成止损、移动止损等风险管理机制

- 可扩展性强,可以加入各种过滤条件提高获利率

- 可应用在任何时间周期,适合日内和长线交易

- 回看期设置过短可能造成过度交易

- 回看期过长可能错过交易机会

- 止损设置过宽可能缩小盈利空间

- 止损过窄可能导致止损频繁被触发

对策:

- 测试不同的回看期,找到最佳参数组合

- 优化止损幅度,平衡获利空间和风险控制

- 可以加入移动止损或环形止损来锁定利润

- 增加过滤条件,提高获利交易的概率

该策略可以从以下几个方面进行优化:

-

测试不同的回看期参数,找到最优参数组合;

-

测试不同的交易周期,如5分钟、15分钟、1小时等,选择最佳周期;

-

优化止损幅度,平衡获利空间和风险控制;

-

增加过滤条件,如交易量过滤,涨跌幅过滤等,减少不优质信号;

-

集成更多风险管理机制,如移动止损、锁定利润等;

-

参数优化,使用步进优化、随机搜索等找到最优参数;

-

集成机器学习技术,利用AI对参数进行自动优化。

可扩展突破交易策略是一个非常实用的突破系统。它简单易用,可定制性强,可以通过调整回看期和集成各种过滤条件来针对不同资产进行优化。同时,可轻松集成各类风险管理机制来控制交易风险。通过参数优化和机器学习等技术的引入,该策略可以不断升级,适应市场的变化。总体来说,它是一个值得推荐的通用突破策略。

||

The scalable breakout trading strategy generates trading signals when the price breaks through key support and resistance levels identified by the price swings. It is a highly flexible and extensible breakout strategy. The strategy can be adapted to different timeframes by adjusting parameters and can easily integrate additional filters and risk management mechanisms for optimization.

The strategy first uses the swings() function to calculate the swing highs and lows based on the lookback period. The lookback period is set with the swingLookback parameter, default to 20 bars. Long signals are triggered when the price breaks above the swing high, and short signals are triggered when the price breaks below the swing low.

Specifically, a long signal is triggered when the close price is greater than or equal to the swing high price. A short signal is triggered when the close price is less than or equal to the swing low price.

The strategy also sets a stop target based on the stopTargetPercent parameter to define the stop loss level. For example, the long stop loss can be set at 5% below the swing high, and the short stop loss can be set at 5% above the swing low.

The advantage of this strategy is the flexibility to adjust the lookback period to control the trade frequency. A shorter lookback period makes it more sensitive to breakouts and increases trade frequency. A longer lookback period decreases sensitivity and trade frequency but may miss opportunities. Finding the optimal lookback period is crucial for optimizing the strategy.

- Simple breakout logic, easy to understand and implement

- Lookback period allows optimizing parameters and controlling trade frequency

- Easily integrates stop loss, trailing stop and other risk management

- Highly extensible to add filters and improve profitability

- Applicable to any timeframe for intraday or swing trading

- Too short lookback period may cause overtrading

- Too long lookback period may miss trading opportunities

- Stop loss too wide reduces profit potential

- Stop loss too tight may get stopped out frequently

Mitigations:

- Test different lookback periods to find optimal parameters

- Optimize stop loss level to balance profit vs. risk control

- Add trailing stop or chandelier exit to lock in profits

- Add filters to improve quality of trading signals

- Optimize parameters through backtesting

The strategy can be enhanced in several ways:

-

Test different lookback period values to find optimal parameters.

-

Test different timeframes such as 5m, 15m, 1h to determine the best timeframe.

-

Optimize the stop loss percentage to balance profit potential vs. risk management.

-

Add filters like volume, volatility to reduce inferior setups.

-

Integrate more risk management mechanisms like trailing stop, profit taking.

-

Parameter optimization through walk forward analysis and machine learning.

-

Introduce AI/machine learning for auto optimization of parameters.

The scalable breakout trading strategy is a robust and customizable breakout system. It is simple to use and highly adaptable by adjusting lookback and adding filters. It can easily integrate risk management for risk control. With parameter optimization and machine learning integration, the strategy can evolve over time to adapt to changing markets. Overall, it is a recommended universal breakout strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 20 | Swing Lookback |

| v_input_float_1 | 5 | Stop Target Percentage |

| v_input_bool_1 | true | (?Backtest Time Period)Begin Backtest at Start Date |

| v_input_1 | timestamp(1 Jan 2020) | Start Date |

Source (PineScript)

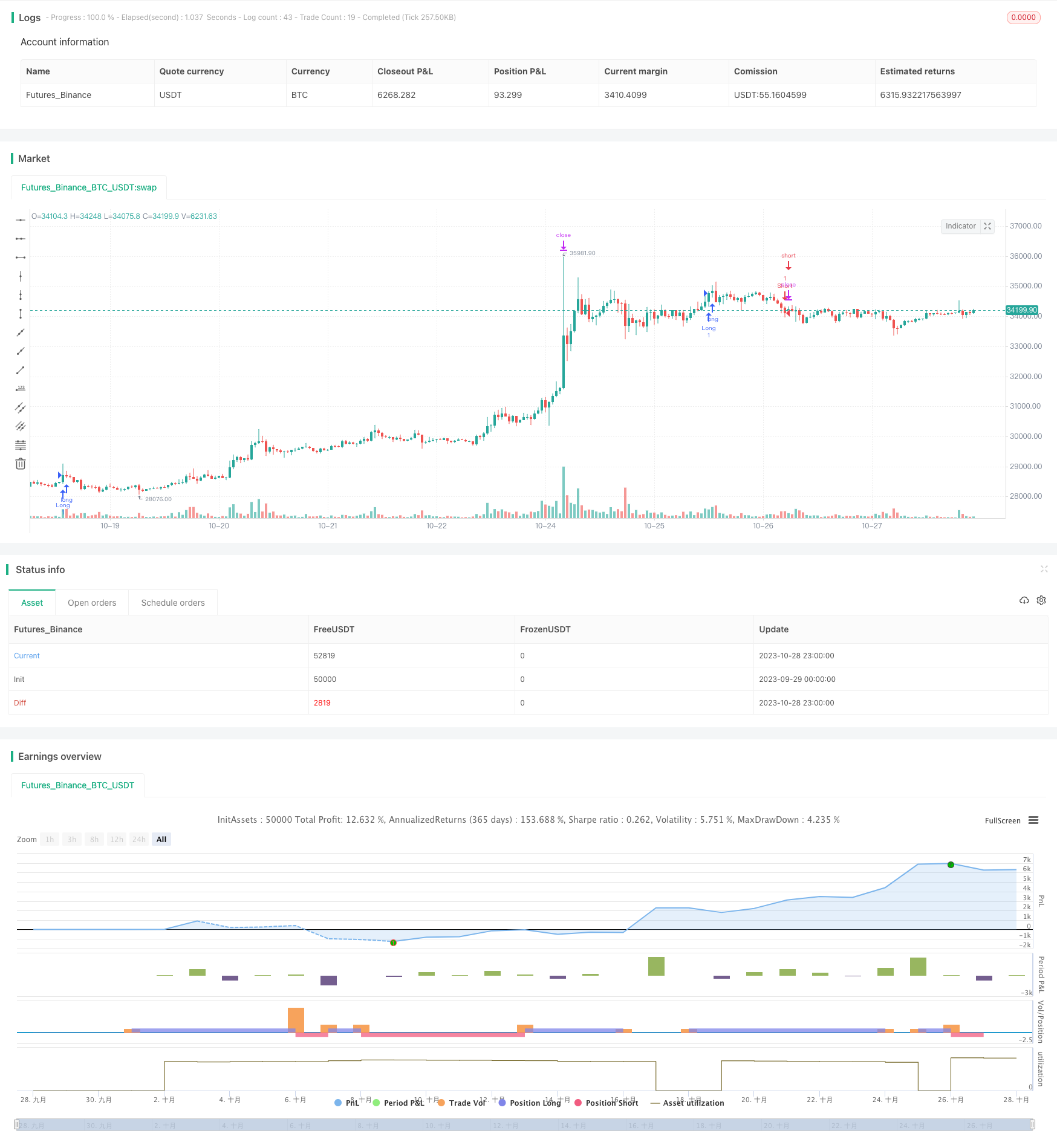

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © deperp

//@version=5

// strategy("Range Breaker", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, commission_type=strategy.commission.percent, commission_value=0.07, pyramiding=0)

// Backtest Time Period

useDateFilter = input.bool(true, title="Begin Backtest at Start Date",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 Jan 2020"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

swingLookback = input.int(20, title="Swing Lookback", minval=3)

stopTargetPercent = input.float(5, title="Stop Target Percentage", step=0.1)

// Calculate lockback swings

swings(len) =>

var highIndex = bar_index

var lowIndex = bar_index

var swingHigh = float(na)

var swingLow = float(na)

upper = ta.highest(len)

lower = ta.lowest(len)

if high[len] > upper

highIndex := bar_index[len]

swingHigh := high[len]

if low[len] < lower

lowIndex := bar_index[len]

swingLow := low[len]

[swingHigh, swingLow, highIndex, lowIndex]

// Strategy logic

[swingHigh, swingLow, highIndex, lowIndex] = swings(swingLookback)

longCondition = inTradeWindow and (ta.crossover(close, swingHigh))

shortCondition = inTradeWindow and (ta.crossunder(close, swingLow))

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

longStopTarget = close * (1 + stopTargetPercent / 100)

shortStopTarget = close * (1 - stopTargetPercent / 100)

strategy.exit("Long Stop Target", "Long", limit=longStopTarget)

strategy.exit("Short Stop Target", "Short", limit=shortStopTarget)

// Plot break lines

// line.new(x1=highIndex, y1=swingHigh, x2=bar_index, y2=swingHigh, color=color.rgb(255, 82, 82, 48), width=3, xloc=xloc.bar_index, extend=extend.right)

// line.new(x1=lowIndex, y1=swingLow, x2=bar_index, y2=swingLow, color=color.rgb(76, 175, 79, 47), width=3, xloc=xloc.bar_index, extend=extend.right)

// Alert conditions for entry and exit

longEntryCondition = inTradeWindow and (ta.crossover(close, swingHigh))

shortEntryCondition = inTradeWindow and (ta.crossunder(close, swingLow))

longExitCondition = close >= longStopTarget

shortExitCondition = close <= shortStopTarget

alertcondition(longEntryCondition, title="Long Entry Alert", message="Enter Long Position")

alertcondition(shortEntryCondition, title="Short Entry Alert", message="Enter Short Position")

alertcondition(longExitCondition, title="Long Exit Alert", message="Exit Long Position")

alertcondition(shortExitCondition, title="Short Exit Alert", message="Exit Short Position")

Detail

https://www.fmz.com/strategy/430598

Last Modified

2023-10-30 17:25:17