Name

唐奇安通道突破趋势跟踪策略Donchian-Channel-Breakout-Strategy

Author

ChaoZhang

Strategy Description

唐奇安通道突破策略是一种趋势跟踪策略,它通过计算一定时间段内的最高价和最低价,形成价格通道,并以通道边界作为买入和卖出信号。当价格突破上轨时,做空;当价格突破下轨时,做多。该策略适用于高波动的数字货币交易。

该策略使用唐奇安通道指标来判断价格趋势和计算入场退出点。唐奇安通道由上轨、下轨和中轨组成。上轨为一定周期内的最高价,下轨为最低价,中轨为平均价。

入场和退出周期长度可以独立配置。当价格向上突破下轨时,做多进入;当价格向下突破上轨时,做空进入。退出点则为价格再次触碰对应轨道。也可以选择以中轨作为止损线。

此外,策略中还设置了止盈点。做多仓位的止盈价为入场价的(1+止盈比例),做空仓位则相反。启用该功能可以锁定盈利,避免亏损扩大。

总体来说,该策略判断趋势的同时,确保有足够的空间来设置止损和止盈。这使其特别适合数字货币等波动率高的品种。

该策略具有以下优势:

- 策略判断清晰,信号生成简单可靠。

- 唐奇安通道指标对价格震荡不敏感,有利于捕捉趋势。

- 可自定义通道参数,适应不同品种和时间周期。

- 内置止损止盈功能,可以有效控制风险。

- 适用于高波动品种如数字货币,收益潜力大。

该策略也存在以下风险:

- 虽有止损功能,但无法完全规避巨幅行情的风险。

- 参数设置不当可能导致过于频繁交易,增加交易成本和滑点风险。

- 该策略对价格震荡不敏感,可能错过部分交易机会。

为控制上述风险,建议采取以下措施:

- 适当缩小单笔投入资金,分散投资品种,控制总体风险。

- 优化参数,寻找最佳参数组合。可尝试采用机器学习等方法自动优化。

- 结合额外指标判断突破信号的可靠性,避免误交易。

该策略可从以下维度进一步优化:

- 测试并优化更多参数组合,寻找最佳参数。主要参数包括通道周期、止盈比例、是否允许做多做空等。

- 增加机器学习模型,自动识别最优参数。可采用强化学习等方法。

- 结合其他指标判断趋势和信号可靠性,如均线、成交量等。

- 开发止损策略,如跟踪止损、 Chandelier Exit 等,进一步控制风险。

- 扩展至更多品种,寻找最匹配该策略的交易品种。

唐奇安通道突破策略整体来说是一种判断清晰、风险可控的趋势跟踪策略。它特别适合数字货币等高波动品种,收益潜力大。同时,该策略也存在一定的参数优化空间和结合其他指标的可能性,这些都是未来可扩展的方向。通过不断优化与创新,该策略有望成为数字货币算法交易的重要选择。

||

The Donchian channel breakout strategy is a trend following strategy. It forms a price channel by calculating the highest and lowest prices over a certain period of time and uses the channel boundaries as buy and sell signals. It goes short when the price breaks through the upper rail and goes long when the price breaks through the lower rail. This strategy is suitable for highly volatile cryptocurrency trading.

This strategy uses the Donchian Channel indicator to determine price trends and calculate entry and exit points. The Donchian Channel consists of an upper rail, lower rail and middle rail. The upper rail is the highest price over a certain period, the lower rail is the lowest price, and the middle rail is the average price.

The entry and exit period lengths can be configured independently. When the price breaks through the lower rail upward, it goes long. When the price breaks through the upper rail downward, it goes short. The exit point is when the price touches the corresponding rail again. The middle rail can also be used as a stop loss line.

In addition, the strategy also sets a take profit point. The take profit price for long positions is the entry price multiplied by (1 + take profit percentage), and vice versa for short positions. Enabling this feature locks in profits and prevents losses from expanding.

In summary, while judging the trend, this strategy ensures sufficient room to set stops and take profits. This makes it particularly suitable for highly volatile assets like cryptocurrencies.

The advantages of this strategy include:

- Clear signal logic and simple/reliable signal generation.

- The Donchian Channel indicator is insensitive to price fluctuations, which helps capture the trend.

- Customizable channel parameters to suit different assets and timeframes.

- Built-in stop loss/take profit functions effectively control risk.

- High profit potential for volatile assets like cryptocurrencies.

The risks of this strategy include:

- Unable to fully avoid risks from huge price swings despite stop loss.

- Improper parameter settings may lead to over-trading, increasing costs.

- Insensitive to price fluctuations, may miss some trading opportunities.

To mitigate the above risks:

- Appropriately size positions and diversify across assets to control overall risk.

- Optimize parameters to find the best combination, possibly using machine learning.

- Incorporate additional indicators to determine signal reliability.

This strategy can be further optimized in the following dimensions:

- Test and optimize more parameter combinations to find the optimum values. Key parameters include channel periods, take profit percentage, allowing long/short etc.

- Incorporate machine learning models to automatically identify optimal parameters, e.g. using reinforcement learning.

- Combine other indicators like moving averages and volume to determine trend and signal reliability.

- Develop more advanced stop loss strategies e.g. trailing stop loss, Chandelier Exit etc. to better control risks.

- Expand strategy across more asset classes to find the best fit.

In conclusion, the Donchian channel breakout strategy provides clear signals and controllable risks for trend trading. It is especially suitable for volatile assets like cryptocurrencies with great profit potential. There are also possibilities to further optimize parameters and incorporate other indicators, which are avenues for future enhancements. With continuous innovations, this strategy has the potential to become an important algorithmic trading strategy for cryptocurrencies.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 10 | Channel Period for Long enter position |

| v_input_2 | 10 | Channel Period for Long exit position |

| v_input_3 | true | Is exit on Base Line? If 'no' - exit on bottom line |

| v_input_4 | 2.5 | Take Profit (%) for Long position |

| v_input_5 | true | Allow Long? |

| v_input_6 | 20 | Channel Period for Short enter position |

| v_input_7 | 20 | Channel Period for Short exit position |

| v_input_8 | true | Is exit on Base Line? If 'no' - exit on upper line |

| v_input_9 | 2.5 | Take Profit (%) for Short position |

| v_input_10 | true | Allow Short? |

| v_input_11 | 2005 | Test Start Year |

| v_input_12 | true | Test Start Month |

| v_input_13 | true | Test Start Day |

| v_input_14 | 2050 | Test End Year |

| v_input_15 | 12 | Test End Month |

| v_input_16 | 30 | Test End Day |

Source (PineScript)

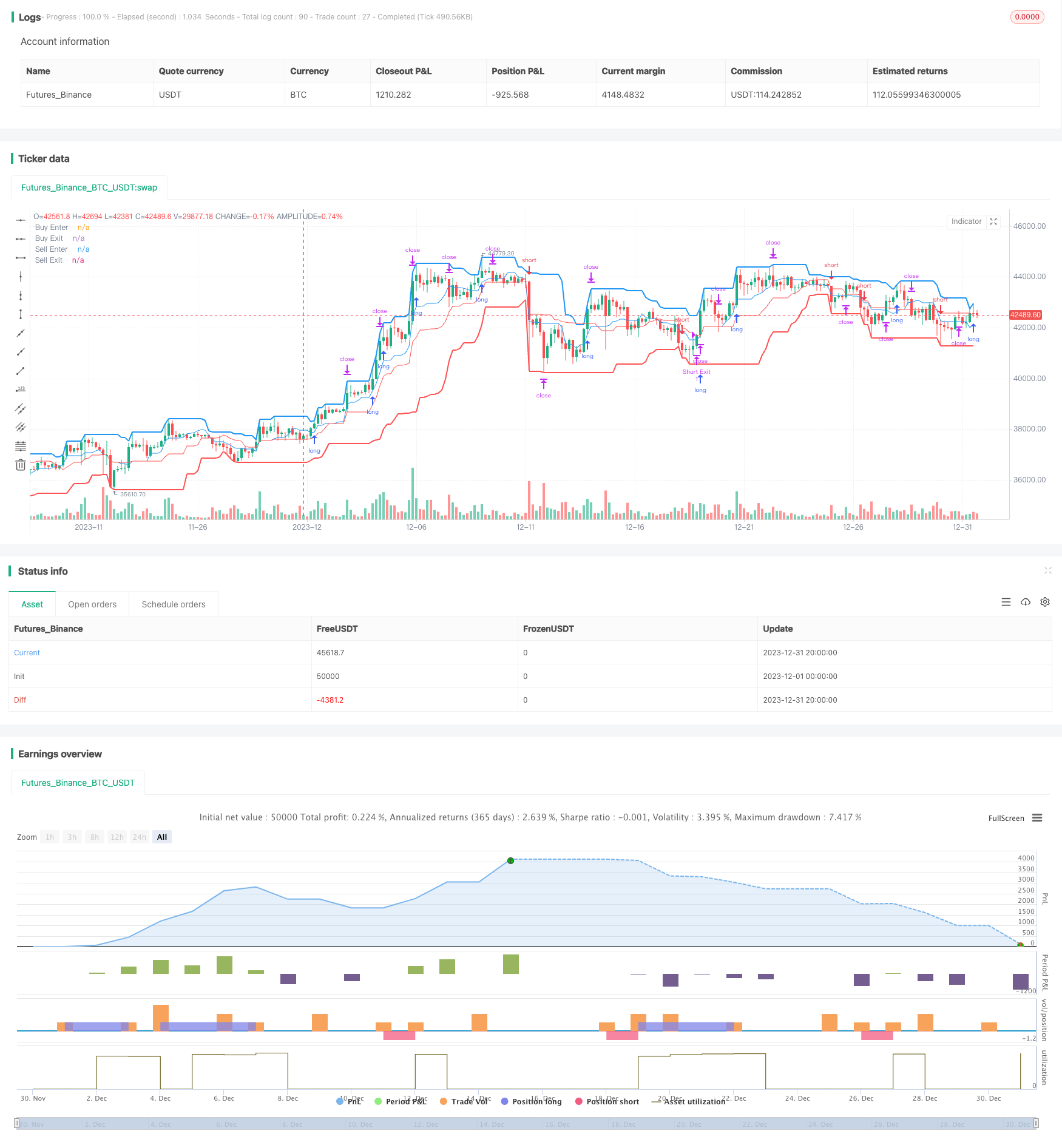

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © algotradingcc

// Strategy testing and optimisation for free trading bot

//@version=4

strategy("Donchian Channel Strategy [for free bot]", overlay=true )

//Long optopns

buyPeriodEnter = input(10, "Channel Period for Long enter position")

buyPeriodExit = input(10, "Channel Period for Long exit position")

isMiddleBuy = input(true, "Is exit on Base Line? If 'no' - exit on bottom line")

takeProfitBuy = input(2.5, "Take Profit (%) for Long position")

isBuy = input(true, "Allow Long?")

//Short Options

sellPeriodEnter = input(20, "Channel Period for Short enter position")

sellPeriodExit = input(20, "Channel Period for Short exit position")

isMiddleSell = input(true, "Is exit on Base Line? If 'no' - exit on upper line")

takeProfitSell = input(2.5, "Take Profit (%) for Short position")

isSell = input(true, "Allow Short?")

// Test Start

startYear = input(2005, "Test Start Year")

startMonth = input(1, "Test Start Month")

startDay = input(1, "Test Start Day")

startTest = timestamp(startYear,startMonth,startDay,0,0)

//Test End

endYear = input(2050, "Test End Year")

endMonth = input(12, "Test End Month")

endDay = input(30, "Test End Day")

endTest = timestamp(endYear,endMonth,endDay,23,59)

timeRange = time > startTest and time < endTest ? true : false

// Long&Short Levels

BuyEnter = highest(buyPeriodEnter)

BuyExit = isMiddleBuy ? ((highest(buyPeriodExit) + lowest(buyPeriodExit)) / 2): lowest(buyPeriodExit)

SellEnter = lowest(sellPeriodEnter)

SellExit = isMiddleSell ? ((highest(sellPeriodExit) + lowest(sellPeriodExit)) / 2): highest(sellPeriodExit)

// Plot Data

plot(BuyEnter, style=plot.style_line, linewidth=2, color=color.blue, title="Buy Enter")

plot(BuyExit, style=plot.style_line, linewidth=1, color=color.blue, title="Buy Exit", transp=50)

plot(SellEnter, style=plot.style_line, linewidth=2, color=color.red, title="Sell Enter")

plot(SellExit, style=plot.style_line, linewidth=1, color=color.red, title="Sell Exit", transp=50)

// Calc Take Profits

TakeProfitBuy = 0.0

TakeProfitSell = 0.0

if strategy.position_size > 0

TakeProfitBuy := strategy.position_avg_price*(1 + takeProfitBuy/100)

if strategy.position_size < 0

TakeProfitSell := strategy.position_avg_price*(1 - takeProfitSell/100)

// Long Position

if isBuy and timeRange

strategy.entry("Long", strategy.long, stop = BuyEnter, when = strategy.position_size == 0)

strategy.exit("Long Exit", "Long", stop=BuyExit, limit = TakeProfitBuy, when = strategy.position_size > 0)

// Short Position

if isSell and timeRange

strategy.entry("Short", strategy.short, stop = SellEnter, when = strategy.position_size == 0)

strategy.exit("Short Exit", "Short", stop=SellExit, limit = TakeProfitSell, when = strategy.position_size < 0)

// Close & Cancel when over End of the Test

if time > endTest

strategy.close_all()

strategy.cancel_all()

Detail

https://www.fmz.com/strategy/440321

Last Modified

2024-01-29 11:51:08