Name

回调后周期反转趋势跟随策略Cycle-Reversal-Trend-Following-Strategy-after-Pullback

Author

ChaoZhang

Strategy Description

本策略综合利用两种指标:移均线反转和价格震荡指标,形成交易信号,实现在周期反转出现后抓住反弹的趋势交易策略。

本策略主要利用以下两种技术指标进行交易信号判断:

-

移均线反转

该部分通过计算收盘价在过去两日的涨跌情况,与快线K值大小的组合,实现判断是否出现反转信号。当价格在过去两日持续上涨,且快线K值低于慢线K值时产生买入信号;当价格在过去两日持续下跌,且快线K值高于慢线K值时产生卖出信号。

-

价格脱离指标

Detrend Price Oscillator指标通过绘制水平移动平均线,并根据价格与该线的关系来识别价格周期。它过滤掉长于计算周期的趋势,因此可以识别出移动平均线所隐藏的短周期波动。当价格高于平均线时为买入信号,低于平均线时为卖出信号。

本策略将两种指标的信号进行综合,即在出现移均线反转信号时,同时价格脱离指标也给出确认的反转信号,则产生交易指令。这样可以过滤掉部分无效反转信号,在反转后抓住反弹的趋势机会。

该策略最大的优势在于合理利用了两种指标的优势,进行互补确认,可以有效过滤无效信号,增强信号的可靠性。

移均线反转指标本身容易产生错误信号,仅仅依靠它来判断,容易追高杀跌。而引入价格脱离指标进行组合,可以避免在非理想的震荡区间进行反转操作。

价格脱离指标的参数设置也决定了它只识别较短周期的波动,从而与移均线反转的判断非常契合,可以识别合理的反转时机。

该策略主要存在以下风险:

- 反弹力度不足,容易形成套牢

移均线反转容易发生在盘整震荡区间。如果反弹力度不足,很容易再次回调触碰止损线,无法获利。

- 参数设置不当

价格脱离指标的参数设置过大,会识别中长线周期趋势;过小则会增加误判风险。需要针对不同品种谨慎测试。

- 突发事件导致反转失败

重大突发消息事件介入,会打乱原有的趋势判断,导致反转信号失效。这需要关注基本面消息,避免消息事件发生时盲目交易。

可以从以下几点进一步优化该策略:

- 增加止损机制

合理设置移动止损或时间止损,可以控制单次损失。

- 结合交易量指标

增加交易量的确认,例如突破平均成交量时才发出信号,可以避免量能不足的无效突破。

- 动态参数优化

根据市场阶段对参数进行动态优化,在趋势明显时适当放宽参数,在震荡时收紧参数。

- 采用机器学习方法动态优化

使用随机森林等机器学习方法对参数组合进行评估和选择,实现动态智能优化。

本策略较好地结合了两种指标的优势,在反转点抓住反弹趋势。虽然仍存在被套、参数优化等问题,但整体思路清晰,逻辑合理,值得进一步测试和优化,以实现稳定获利。

||

This strategy combines two indicators: moving average reversal and price detrend oscillator to generate trading signals and catch the rebound trend after cycle reversals.

This strategy mainly utilizes the following two technical indicators for trading signal judgment:

-

Moving Average Reversal

It calculates the price uptrend or downtrend in the past two days combined with the fast line K value to determine if a reversal signal occurs. When the price keeps rising in the past two days and the fast line K value is lower than the slow line K value, a buy signal is generated. When the price keeps falling in the past two days and the fast line K value is higher than the slow line K value, a sell signal is generated.

-

Price Detrend Oscillator

The Detrend Price Oscillator draws a horizontal moving average line and identifies price cycles based on the relationship between the price and the line. It filters out trends longer than the calculation period, thus revealing hidden short-term fluctuations. When the price is above the moving average line, it is a buy signal. When the price is below the line, it is a sell signal.

This strategy combines the signals of the two indicators. That is, when a moving average reversal signal appears and the price detrend oscillator also gives a confirming reversal signal, a trading order is generated. This can filter out some invalid reversal signals and catch the rebound trend after reversals.

The biggest advantage of this strategy is that it makes good use of the strengths of the two indicators for complementary confirmation, which can effectively filter out invalid signals and increase signal reliability.

The moving average reversal indicator itself tends to generate false signals. Relying solely on it for judgments tends to chase tops and hit bottoms. The introduction of the price detrend oscillator for combination can avoid reversal operations in non-ideal oscillation zones.

The parameter settings of the price detrend oscillator also determine that it only identifies short-term fluctuations, which matches very well with the judgment of the moving average reversal and can identify reasonable reversal timing.

The main risks of this strategy include:

- Insufficient rebound momentum, tends to be trapped

Moving average reversals tend to occur in sideways ranges. If the rebound momentum is insufficient, it is likely to callback and touch the stop loss again, failing to profit.

- Improper parameter settings

If the parameters of the price detrend oscillator are set too large, it will identify medium- and long-term trends; if too small, it will increase misjudgment risks. Parameters need to be carefully tested for different products.

- Reversal failures due to sudden events

Major news events can disrupt existing trend judgments, resulting in failure of reversal signals. It is necessary to pay attention to fundamentals and avoid trading blindly when news events occur.

The strategy can be further optimized in the following aspects:

- Add stop loss mechanisms

Reasonably set stop loss or time stop loss to control single loss.

- Combine with volume indicators

Add volume confirmation, such as issuing signals only when breaking through the average volume, to avoid ineffective breakthroughs due to insufficient momentum.

- Dynamic parameter optimization

Dynamically optimize parameters according to market conditions, relax parameters appropriately during obvious trends, and tighten parameters during consolidations.

- Use machine learning methods for dynamic optimization

Use machine learning methods like random forest to evaluate and select parameter combinations to achieve dynamic intelligent optimization.

This strategy combines the strengths of two indicators reasonably to catch the rebound trend at reversal points. Although problems like being trapped and parameter optimization remain, the overall idea is clear and logical. It is worth further testing and optimization to achieve stable profits.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | Length |

| v_input_2 | true | KSmoothing |

| v_input_3 | 3 | DLength |

| v_input_4 | 50 | Level |

| v_input_5 | 14 | LengthDPO |

| v_input_6 | false | Trade reverse |

Source (PineScript)

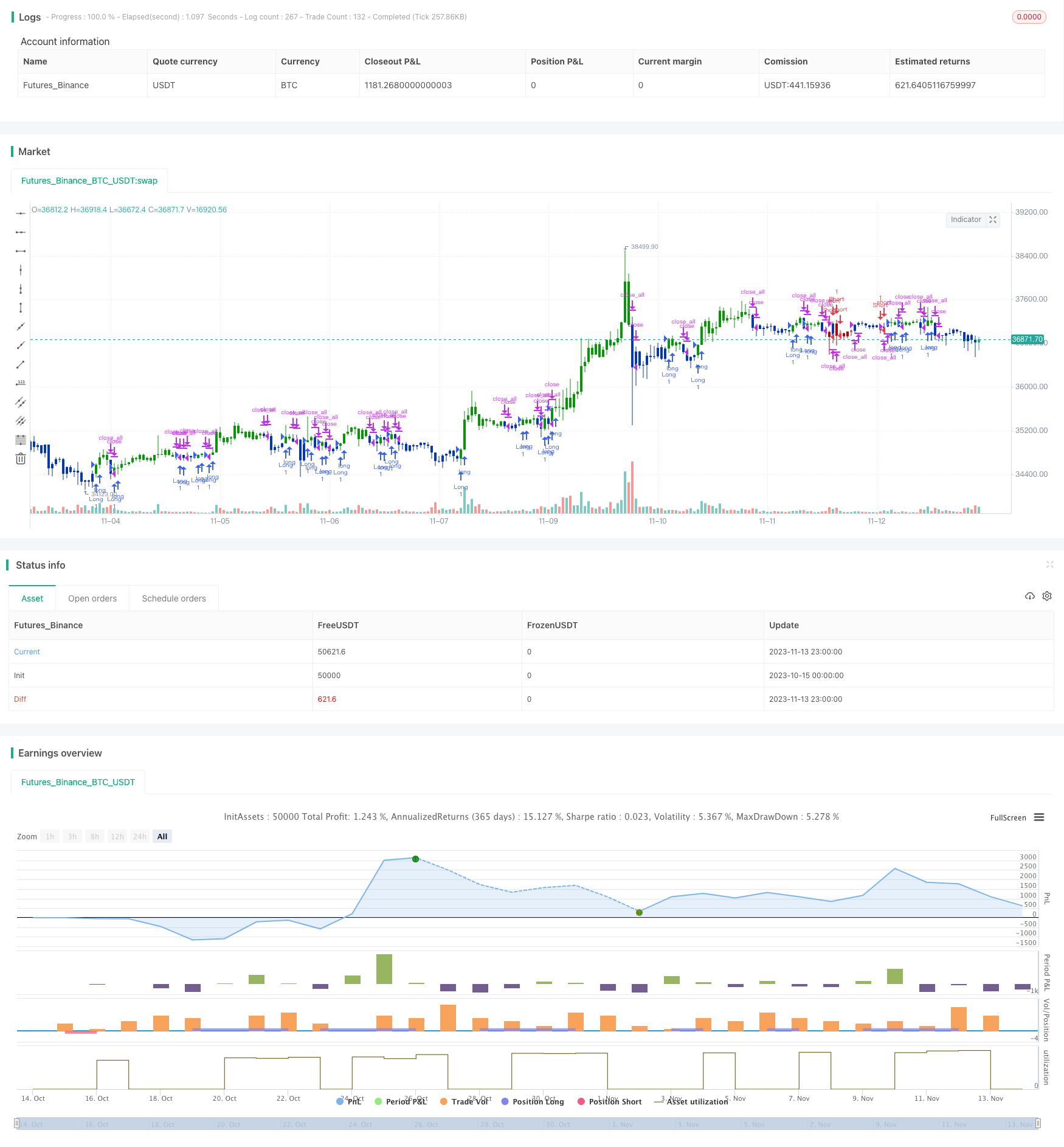

/*backtest

start: 2023-10-15 00:00:00

end: 2023-11-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 30/12/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Detrend Price Osc indicator is similar to a moving average,

// in that it filters out trends in prices to more easily identify

// cycles. The indicator is an attempt to define cycles in a trend

// by drawing a moving average as a horizontal straight line and

// placing prices along the line according to their relation to a

// moving average. It provides a means of identifying underlying

// cycles not apparent when the moving average is viewed within a

// price chart. Cycles of a longer duration than the Length (number

// of bars used to calculate the Detrend Price Osc) are effectively

// filtered or removed by the oscillator.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

DPO(Length) =>

pos = 0.0

xPrice = close

xsma = sma(xPrice, Length)

nRes = xPrice - xsma

pos := iff(nRes > 0, 1,

iff(nRes < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Detrended Price Oscillator", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthDPO = input(14, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posDPO = DPO(LengthDPO)

pos = iff(posReversal123 == 1 and posDPO == 1 , 1,

iff(posReversal123 == -1 and posDPO == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Detail

https://www.fmz.com/strategy/432231

Last Modified

2023-11-15 17:13:18