Name

均线先行指标短期做空策略Short-term-Bearish-Strategy-Based-on-EMA-Crossover-and-Bear-Power-Indicators

Author

ChaoZhang

Strategy Description

[trans]

本策略结合了均线先行指标和熊强力指标,形成短期看跌方向信号的组合策略。均线先行指标判断趋势,熊强力指标确定做空时机。策略适合短线操作,追踪市场调整行情。

-

均线先行指标:计算2/20周期的指数移动平均线EMA,当价格低于SMA时看跌,高于时看涨。

-

熊强力指标:计算当日收盘价与开盘价的差值,作为“强力值”。强力值大于预设的卖出参数时为熊ish信号,-1做空;强力值小于预设买入参数时为多头信号,1做多;否则为0 持平。

-

结合两个指标,当均线先行指标<0 且熊强力指标<-1时生成做空信号。

-

根据做空信号,策略开仓做空;根据平仓信号,策略平掉头寸。可设置反转参数,将做多做空方向对调。

-

均线先行指标可提前判断趋势反转点。

-

熊强力指标可捕捉当日强力跌势的做空时机。

-

组合双指标,可过滤假突破,确定较强势跌势的短线做空点。

-

可调参数灵活,适合不同品种及市场环境。

-

可反转做多做空方向,应对多空双向行情。

-

均线指标存在滞后性,可能错过趋势反转最佳点位。

-

熊强力指标对盘整震荡市容易造成错误信号。

-

无法判断趋势中长线走势,存在被套风险。

-

需谨慎选择参数,如EMA周期过短、卖出阈值过大等都会增加假信号。

-

需关注重要经济数据发布,避免计划交易时间段。

-

可考虑加入止损策略,降低单笔损失。

-

可配合动量指标等过滤器,减少较弱势跌的假信号。

-

可加入更长周期均线判断大趋势方向,避免逆势操作。

-

可优化参数设置,如自适应EMA周期,实时调整卖出阈值等。

-

可考虑跨时间周期组合,同时关注短中长线指标信号。

本策略首先利用均线先行判断大盘走势和趋势反转点,再通过熊强力指标捕捉当日强势做空时机,形成较强势跌的短线做空策略。策略优点是简单实用,可灵活调参适应不同市场环境,且可反转做多做空方向。但也存在错过最优点位、产生假信号等风险。可通过严格的参数优化、加入过滤器及止损等进一步提高策略稳定性。

||

This strategy combines the EMA crossover indicator and the bear power indicator to generate short-term bearish signals. The EMA crossover judges the trend while the bear power pinpoints the short selling timing. The strategy is suitable for short-term trading to catch market corrections.

-

EMA Crossover: Calculates the 2/20 period exponential moving average (EMA) and generates sell signals when price is below EMA.

-

Bear Power: Calculates the difference between the closing price and opening price of the day as the "power value". Power value greater than the sell threshold gives bearish signal (-1 for short); power value lower than the buy threshold gives bullish signal (1 for long); otherwise 0 for neutral.

-

Combining the two indicators, short signal is generated when EMA crossover <0 and bear power <-1.

-

The strategy opens short based on the sell signal and closes position based on the exit signal. The reverse parameter can switch the long/short directions.

-

EMA crossover can predict trend reversal points in advance.

-

Bear power captures short-selling opportunities during strong intraday drops.

-

Combining two indicators helps filter false breakouts and identify stronger bearish momentum.

-

Flexible parameters suit different products and market environments.

-

Reversal function adapts to two-way markets.

-

EMA crossover may lag behind the optimal turning points.

-

Bear power may generate false signals during range-bound consolidations.

-

It fails to determine medium-long term trends, with risk of being trapped.

-

Parameter tuning required as inappropriate settings like overly short EMA period or too high sell threshold could increase false signals.

-

Pay attention to key economic events to avoid planned trading sessions.

-

Consider adding stop loss to limit per trade loss.

-

Add filters like momentum indicators to avoid weak bearish signals.

-

Add longer period EMAs to determine major trend direction and avoid counter-trend trades.

-

Optimize parameters like adaptive EMA period and dynamic sell threshold.

-

Consider combining multiple timeframes to incorporate short, medium and long-term indicators.

This strategy first uses EMA crossover to determine the major trend and reversal points, then captures strong intraday sell-off opportunities using the bear power indicator, forming a robust short-term bearish strategy. The advantages lie in its simplicity, flexibility to adapt to different market environments, and ability to reverse long/short directions. However, risks like missing optimal points and generating false signals remain. Further improvements on parameter optimization, adding filters and stop loss could help enhance the strategy stability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 14 | (?●═════ 2/20 EMA ═════●)Length |

| v_input_float_1 | 10 | (?●═════ Bear Power ═════●)SellLevel |

| v_input_float_2 | true | BuyLevel |

| v_input_bool_1 | false | (?●═════ MISC ═════●)Trade reverse |

| v_input_int_2 | true | (?●═════ Time Start ═════●)From Day |

| v_input_int_3 | true | From Month |

| v_input_int_4 | 2005 | From Year |

Source (PineScript)

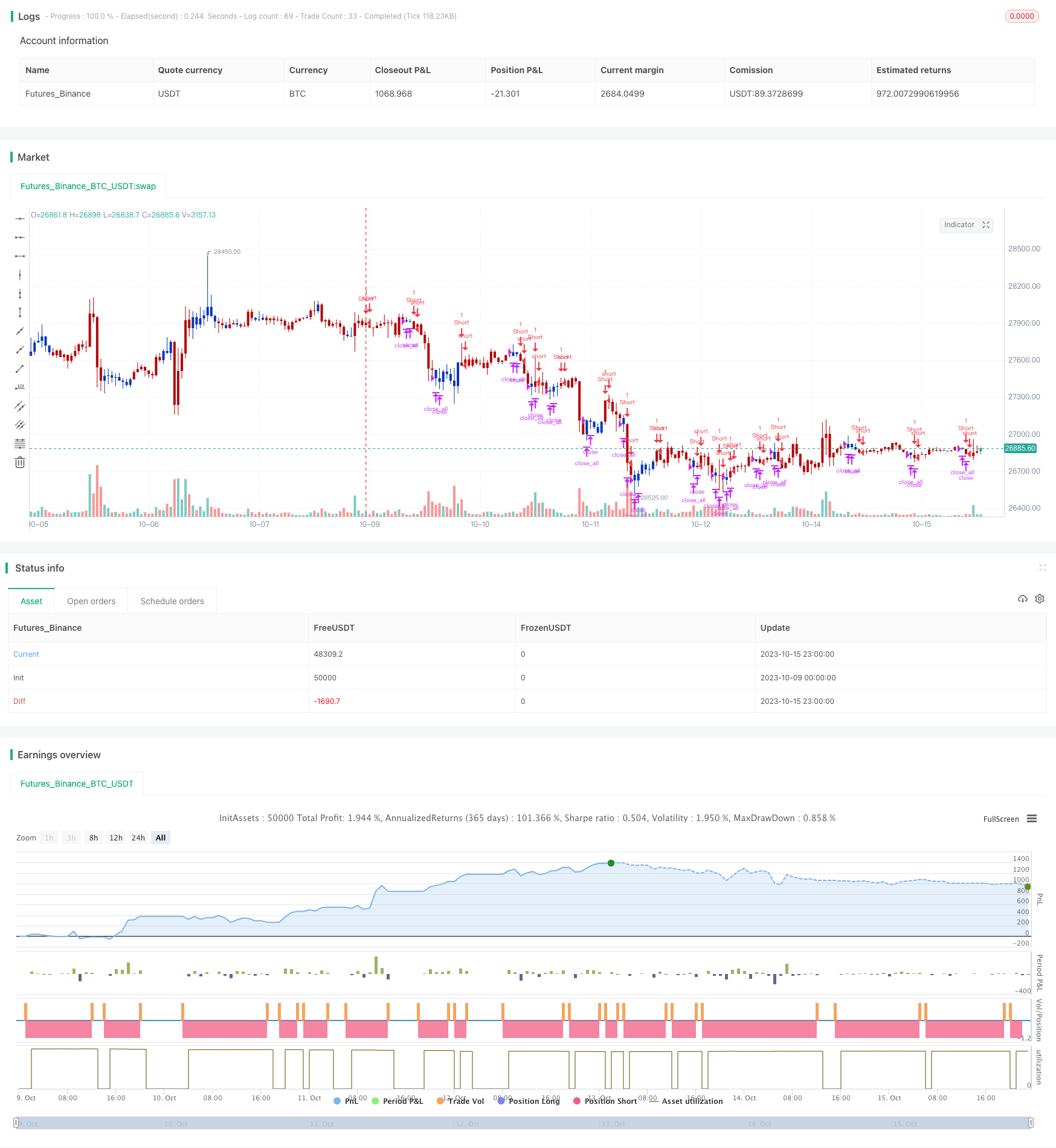

/*backtest

start: 2023-10-09 00:00:00

end: 2023-10-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// Bear Power Indicator

// To get more information please see "Bull And Bear Balance Indicator"

// by Vadim Gimelfarb.

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

BP(SellLevel,BuyLevel) =>

pos = 0.0

value = close < open ?

close[1] > open ? math.max(close - open, high - low): high - low:

close > open ?

close[1] > open ? math.max(close[1] - low, high - close): math.max(open - low, high - close):

high - close > close - low ?

close[1] > open ? math.max(close[1] - open, high - low) : high - low :

high - close < close - low ?

close > open ? math.max(close - low, high - close) : open - low :

close > open ? math.max(close[1] - open, high - close) :

close[1] < open ? math.max(open - low, high - close) : high - low

pos := value > SellLevel ? -1 :

value <= BuyLevel ? 1 :nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & Bear Power', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ Bear Power ═════●'

SellLevel = input.float(10, step=0.01, group=I2)

BuyLevel = input.float(1, step=0.01, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosBP = BP(SellLevel,BuyLevel)

iff_1 = posEMA20 == -1 and prePosBP == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosBP == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)

Detail

https://www.fmz.com/strategy/429466

Last Modified

2023-10-17 14:00:41