Name

均线叉趋势追踪策略Crossing-Moving-Average-Trend-Tracking-Strategy

Author

ChaoZhang

Strategy Description

[trans]

该策略通过计算双均线的交叉来判断价格趋势,并结合一定的参数限制来发出买入和卖出信号。主要分为三部分:第一,通过计算快速均线和慢速均线的交叉来判断价格趋势;第二,结合一定的参数限制来避免错误交易;第三,利用止盈止损来控制风险。

该策略的核心在于计算快速均线和慢速均线。快速均线参数为均线周期的一半,反应价格变化更加敏感;慢速均线参数为均线周期,反应价格变化更加平稳。当快速均线上穿慢速均线时,认为价格进入上升趋势;当快速均线下穿慢速均线时,认为价格进入下降趋势。

此外,策略还设置了一定的参数来避免错误交易。如设置了决策阈值,只有快慢均线差值超过一定幅度时才会发出交易信号;confidence参数用于波动过滤,只有价格波动达到一定程度才会发出信号。

最后,策略采用止盈止损来控制风险。 openprofit小于止损点就退出仓位,超过止盈点就退出仓位,有效控制单笔损失。

该策略最大的优势在于结合均线指标判断价格趋势和波动特征。双均线交叉判断价格趋势是经典有效的技术指标方法,参数优化后可准确抓取趋势;波动性指标confidence可有效过滤震荡市,避免频繁错误交易。

此外,决策阈值、止盈止损等参数设置也可大大降低交易风险,避免追高杀跌。

该策略主要风险在于双均线指标发出错误信号的可能。快速均线和慢速均线均为加权移动平均线,对突发事件反应较慢,可能错过短期价格反转。此时就要依赖参数confidence进行双重过滤。

此外,止盈止损点设置不当也会增大风险。止盈点过高、止损点过低都可能造成超出预期的损失。这需要根据不同品种特点和波动率来设置合理的参数。

该策略可从以下几个方面进行优化:

-

优化均线周期,设置自适应均线,使其能更好地对不同周期的价格波动进行建模;

-

设置止盈止损动态跟踪机制,通过行情实时计算波动率,使止盈止损点能够动态变化;

-

增加机器学习模型判断价格趋势方向,利用更多历史数据判断当前价格走向,减少错误信号。

该策略整体来说是一种经典简单有效的趋势交易策略。采用双均线交叉判定趋势,参数设置进行风险控制,可配置性强,适用于多品种交易。如果能引入机器学习等更加智能的判断手段,整体效果会更好,值得进一步研究。

||

This strategy judges the price trend by calculating the cross of double moving averages, and issues buy and sell signals with certain parameter restrictions. It mainly consists of three parts: first, judge the price trend by calculating the cross of fast and slow moving averages; second, set certain parameter restrictions to avoid wrong trades; third, use stop profit and stop loss to control risks.

The core of this strategy lies in the calculation of fast and slow moving averages. The fast moving average has a period of half of the total moving average period, which is more sensitive to price changes; the slow moving average has a period of total moving average period, which reflects price changes more smoothly. When the fast moving average goes above the slow one, it is believed that the price rises up; when below, it falls down.

In addition, the strategy sets certain parameters to avoid wrong trades. For example, the decision threshold is to ensure that signals are issued only when the difference between the two moving averages exceeds a certain level; the confidence parameter is used to filter out small price fluctuations.

Finally, stop profit and stop loss are employed to control risks. If openprofit is less than stop loss point or larger than stop profit point, positions will be closed. This effectively limits the loss of a single trade.

The biggest advantage of this strategy is to combine the judgment of price trend and volatility characteristics through moving average indicators. Cross of double moving averages is a classic effective technical approach to determine price trends. With parameter optimization, it can accurately capture trends. The confidence parameter can effectively filter out choppy markets and avoid frequent wrong trades.

In addition, parameters like decision threshold, stop profit and stop loss can also greatly reduce trading risks by avoiding chasing highs and selling lows.

The main risk of this strategy is the possibility of wrong signals from the double moving averages. Both fast and slow MAs are weighted moving averages which react slowly to sudden events, thus missing short-term price reversals. At this time, the confidence parameter can provide double confirmation.

In addition, improper settings of stop profit and stop loss points will also increase risks. Overly high profit target and low stop loss point may lead to losses beyond expectations. Reasonable parameters need to be set according to the characteristics of different trading products and volatility.

The strategy can be optimized in the following aspects:

-

Optimize the moving average periods, set adaptive moving averages to better model price fluctuations of different cycles;

-

Set dynamic tracking mechanisms for stop profit and stop loss, calculate volatility in real time based on market conditions, so that the stop points can change dynamically;

-

Increase machine learning models to judge price trend directions, utilize more historical data to determine current price movements, and reduce wrong signals.

In general, this is a classic simple and effective trend trading strategy. It uses double moving average cross to determine trends, sets parameters to control risks, and has high configurability for multi-product trading. If more intelligent judgment means like machine learning can be introduced, the overall effect could be even better for further research.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | Double HullMA |

| v_input_2 | 0.001 | Decision Threshold (0.001) |

| v_input_3 | -10 | Stop Loss in $ |

| v_input_4 | 100 | Target Point in $ |

| v_input_5 | 9 | Conversion Line Periods |

| v_input_6 | 26 | Base Line Periods |

| v_input_7 | 52 | Lagging Span 2 Periods |

| v_input_8 | 26 | Displacement |

| v_input_9 | 9 | MACD_Length |

| v_input_10 | 12 | MACD_fastLength |

| v_input_11 | 26 | MACD_slowLength |

Source (PineScript)

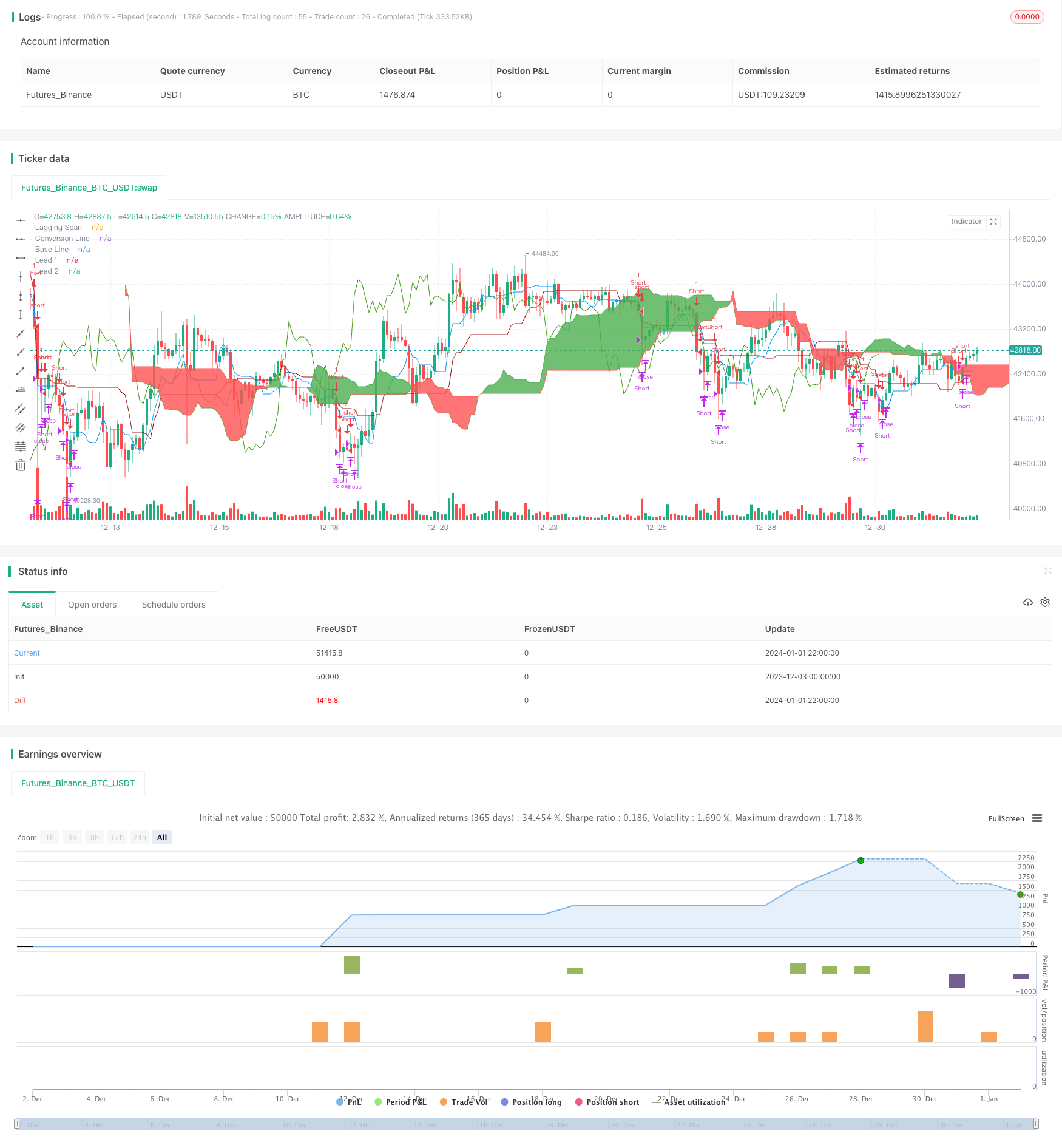

/*backtest

start: 2023-12-03 00:00:00

end: 2024-01-02 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

// Any timeFrame ok but good on 15 minute & 60 minute , Ichimoku + Daily-Candle_cross(DT) + HULL-MA_cross + MacD combination 420 special blend

strategy("Trade Signal", shorttitle="Trade Alert", overlay=true )

keh=input(title="Double HullMA",defval=14, minval=1)

dt = input(defval=0.0010, title="Decision Threshold (0.001)", type=float, step=0.0001)

SL = input(defval=-10.00, title="Stop Loss in $", type=float, step=1)

TP = input(defval=100.00, title="Target Point in $", type=float, step=1)

ot=1

n2ma=2*wma(close,round(keh/2))

nma=wma(close,keh)

diff=n2ma-nma

sqn=round(sqrt(keh))

n2ma1=2*wma(close[1],round(keh/2))

nma1=wma(close[1],keh)

diff1=n2ma1-nma1

sqn1=round(sqrt(keh))

n1=wma(diff,sqn)

n2=wma(diff1,sqn)

b=n1>n2?lime:red

c=n1>n2?green:red

d=n1>n2?red:green

confidence=(request.security(syminfo.tickerid, '5', close[1])-request.security(syminfo.tickerid, '60', close[1]))/request.security(syminfo.tickerid, '60', close[1])

conversionPeriods = input(9, minval=1, title="Conversion Line Periods")

basePeriods = input(26, minval=1, title="Base Line Periods")

laggingSpan2Periods = input(52, minval=1, title="Lagging Span 2 Periods")

displacement = input(26, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

LS=close, offset = -displacement

MACD_Length = input(9)

MACD_fastLength = input(12)

MACD_slowLength = input(26)

MACD = ema(close, MACD_fastLength) - ema(close, MACD_slowLength)

aMACD = ema(MACD, MACD_Length)

closelong = n1<n2 and close<n2 and confidence<dt or strategy.openprofit<SL or strategy.openprofit>TP

if (closelong)

strategy.close("Long")

closeshort = n1>n2 and close>n2 and confidence>dt or strategy.openprofit<SL or strategy.openprofit>TP

if (closeshort)

strategy.close("Short")

longCondition = n1>n2 and strategy.opentrades<ot and confidence>dt and close>n2 and leadLine1>leadLine2 and open<LS and MACD>aMACD

if (longCondition)

strategy.entry("Long",strategy.long)

shortCondition = n1<n2 and strategy.opentrades<ot and confidence<dt and close<n2 and leadLine1<leadLine2 and open>LS and MACD<aMACD

if (shortCondition)

strategy.entry("Short",strategy.short)

//alerts

alertcondition(closelong, title='Close Buy Position', message='Close Buy Position')

alertcondition(closeshort, title='Close Short Position', message='Close Short Position')

alertcondition(longCondition, title='Buy Signal', message='Buy Signal Alert')

alertcondition(shortCondition, title='Sell Signal', message='Sell Signal Alert')

//a1=plot(n1,color=c)

//a2=plot(n2,color=c)plot(cross(n1, n2) ? n1 : na, style = circles, color=b, linewidth = 4)

//plot(cross(n1, n2) ? n1 : na, style = line, color=d, linewidth = 4)

plot(conversionLine, color=#0496ff, title="Conversion Line")

plot(baseLine, color=#991515, title="Base Line")

plot(close, offset = -displacement, color=#459915, title="Lagging Span")

p1=plot (leadLine1, offset = displacement, color=green, title="Lead 1")

p2=plot (leadLine2, offset = displacement, color=red, title="Lead 2")

fill(p1, p2, color = leadLine1 > leadLine2 ? green : red)

// remove the "//" from before the plot script if want to see the indicators on chart

Detail

https://www.fmz.com/strategy/437555

Last Modified

2024-01-03 17:01:38