Name

坚果离线趋势追踪策略Walnut-Trend-Following-Strategy-Based-on-Distance-from-200-EMA

Author

ChaoZhang

Strategy Description

本文将详细分析一种基于200日移动平均线与价格距离的趋势追踪型策略,称为“坚果离线趋势追踪策略”。该策略通过追踪价格与200日移动平均线的距离,在超过设定阈值时建立部位,达到获利目标后平仓离场。

一、策略原理

该策略的核心指标是200日指数移动平均线(200 EMA)。策略判断价格是否偏离200日线达到设定百分比后,在最近一根K线为阳线(多头入场)或阴线(空头入场)时建立部位。多头入场条件为价格低于200日线且价格与200日线距离百分比大于阈值,并在最近一根K线收阳线时入场做多;空头入场条件为价格高于200日线且价格与200日线距离百分比大于阈值,并在最近一根K线收阴线时入场做空。

出场条件为价格回归到200日线时或达到止盈目标(入场价1.5倍)时平仓离场。设定止损为期权申报价值的20%。

详细的入场、出场条件如下:

多头入场: 收盘价<200日线 并且 收盘价与200日线距离百分比≥阈值 并且 最近一根K线收阳线

空头入场: 收盘价>200日线 并且 收盘价与200日线距离百分比≥阈值 并且 最近一根K线收阴线

多头出场: 收盘价≥200日线 或 达到止盈目标 或 交易日结束

空头出场: 收盘价<=200日线 或 达到止盈目标 或 交易日结束

止损条件为期权申报价值的20%。

二、策略优势

该策略主要具有以下优势:

- 使用200日移动平均线判断价格中长线趋势方向,避免被短期市场噪音干扰

- 建立趋势追踪机制,跟踪中长线价格趋势

- 优化入场时机判断,最后一个K线方向与大趋势一致时入场

- 合理止损和止盈机制,避免亏损扩大

三、策略风险

该策略主要存在以下风险:

- 大盘震荡期价格可能多次触碰移动平均线造成多次亏损

- 趋势突然反转造成止损退出

- 设定的参数例如移动平均线周期选择不当,无法准确判断趋势

为降低上述风险,可以优化如下几个方面:

- 调整移动平均线参数,或加入其他指标判断大趋势

- 优化止损机制,例如随价格变化调整止损距离

- 优化入场条件,加入更多判断指标

四、策略优化方向

该策略主要可从以下几个方面进行优化:

- 优化移动平均线参数,测试不同周期参数对策略效果的影响

- 增加其他指标判断大趋势,如布林线通道、KDJ指标等

- 调整止损策略,使止损水平能根据行情变化而动态调整

- 优化入场条件,避免因短期调整而错误入场

五、总结

本文详细分析了基于价格与200日移动平均线距离的趋势追踪策略的原理、优势、风险与优化方向。该策略通过追踪价格与长期均线的距离来判断中长线趋势方向,在价格达到超过均线一定阈值时建仓追踪趋势,退出条件为止损或止盈触发。该策略能很好地跟踪中长期价格趋势,但也存在一定的参数优化空间。未来可从多个方面继续完善该策略,使之能够在更多不同行情下获得稳定收益。

||

This article will analyze in detail a trend following strategy based on the distance between price and 200-day moving average, called “Walnut Trend Following Strategy Based on Distance from 200 EMA”. This strategy establishes positions when the price exceeds a preset threshold from the 200-day moving average and closes positions when reaching the profit target.

I. Strategy Logic

The core indicator of this strategy is the 200-day exponential moving average (200 EMA). The strategy judges if the price deviates from the 200-day line by a set percentage threshold. Long positions are established when the last candlestick is a green candle and short positions are established when the last candlestick is a red candle. The long entry conditions are price below 200 EMA and price percentage deviation above threshold. The short entry conditions are price above 200 EMA and price percentage deviation above threshold.

The exit conditions are when price reverts to 200 EMA or reaches 1.5 times the entry price as profit target. The stop loss is set at 20% of the option premium.

The detailed entry and exit conditions are:

Long Entry: Close < 200 EMA && Percentage Distance ≥ Threshold && Last Candle Green

Short Entry: Close > 200 EMA && Percentage Distance ≥ Threshold && Last Candle Red

Long Exit: Close ≥ 200 EMA || Reaches Profit Target || End of Day

Short Exit: Close <= 200 EMA || Reaches Profit Target || End of Day

The stop loss is 20% of the option premium.

II. Advantages

The main advantages of this strategy are:

- Using 200-day moving average to determine medium-long term trend, avoiding short-term market noise

- Establishing trend following mechanism to track medium-long term price trend

- Optimizing entry timing when last candle direction aligns with major trend

- Reasonable stop loss and take profit to avoid larger losses

III. Risks

The main risks of this strategy are:

- Multiple losses may occur during market consolidation around moving average

- Sudden trend reversal triggers stop loss

- Inappropriate parameter selection like moving average period leads to inaccurate trend judgment

The following aspects can be optimized to reduce the above risks:

- Adjust moving average parameters or add other indicators to determine major trend

- Optimize stop loss mechanism like adjusting stop distance based on price change

- Optimize entry conditions with more judgment indicators

IV. Optimization Directions

The main optimization directions for this strategy are:

- Optimize moving average parameters, test impacts of different period parameters

- Add other indicators like Bollinger Bands, KDJ to determine major trend

- Adjust stop loss strategy to trail price dynamically

- Optimize entry conditions to avoid wrong entries due to short-term corrections

V. Conclusion

This article analyzed in detail the logic, strengths, weaknesses and optimization directions of the trend following strategy based on the distance between price and 200-day moving average. This strategy judges medium-long term trend by tracking the price deviation from long-term moving average. Positions are established when the deviation exceeds a threshold and closed when hitting stop loss or take profit targets. This strategy can track medium-long term trend well but still has some parameter optimization space. Future improvements can be made from multiple perspectives to make the strategy more robust across different market conditions.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 200 | EMA Period |

| v_input_2 | 0.75 | Threshold Percent |

Source (PineScript)

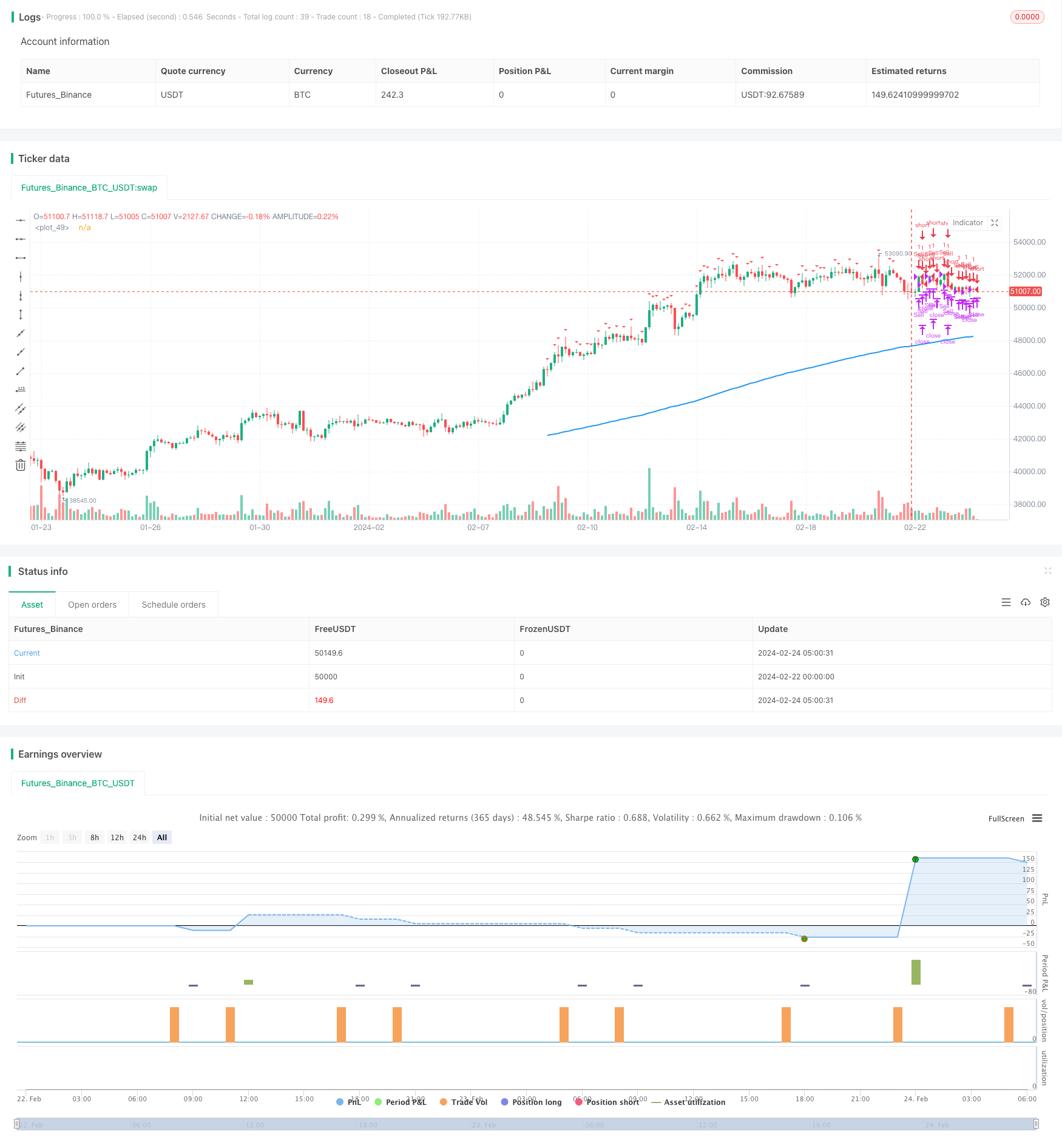

/*backtest

start: 2024-02-22 00:00:00

end: 2024-02-24 06:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Intraday Price Away from 200 EMA Strategy", overlay=true)

// Define inputs

emaPeriod = input(200, title="EMA Period")

thresholdPercent = input(0.75, title="Threshold Percent", minval=0) // Define the threshold percentage

// Calculate 200 EMA

ema = ema(close, emaPeriod)

// Calculate distance from 200 EMA as a percentage

distance_percent = ((close - ema) / ema) * 100

// Track average entry price

var float avgEntryPrice = na

// Buy conditions

buy_condition = close < ema and abs(distance_percent) >= thresholdPercent and close[1] < close[2]

// Exit conditions for buy

exit_buy_condition = close >= ema or time_close(timeframe.period) or (avgEntryPrice * 1.5) <= close

// Sell conditions

sell_condition = close > ema and abs(distance_percent) >= thresholdPercent and close[1] > close[2]

// Exit conditions for sell

exit_sell_condition = close <= ema or time_close(timeframe.period) or (avgEntryPrice * 1.5) >= close

// Execute buy and sell orders only if there are no open trades

if strategy.opentrades == 0

strategy.entry("Buy", strategy.long, when=buy_condition)

strategy.entry("Sell", strategy.short, when=sell_condition)

// Update average entry price for buy condition

if buy_condition

avgEntryPrice := close

// Update average entry price for sell condition

if sell_condition

avgEntryPrice := close

// Close buy position if exit condition is met

strategy.close("Buy", when=exit_buy_condition)

// Close sell position if exit condition is met

strategy.close("Sell", when=exit_sell_condition)

// Plot 200 EMA

plot(ema, color=color.blue, linewidth=2)

// Plot buy and sell signals

plotshape(buy_condition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(sell_condition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

Detail

https://www.fmz.com/strategy/443228

Last Modified

2024-03-01 10:50:03