Name

基于信号平滑的埃尔斯循环策略Signal-Smoothing-Ehlers-Cyber-Cycle-Strategy

Author

ChaoZhang

Strategy Description

本策略通过计算经过平滑处理的价格信号,结合埃尔斯(Ehlers)提出的循环指标理论,设计出一个交易信号平滑的埃尔斯循环交易策略。该策略可以有效过滤市场噪音,产生更可靠的交易信号。

-

对原始价格信号src进行二阶平滑处理,得到平滑信号smooth。

-

根据平滑信号计算出循环指标cycle。计算方法为: cycle := (1 - .5 alpha) (1 - .5 alpha) (smooth - 2 smooth[1] + smooth[2]) + 2 (1 - alpha) cycle[1] - (1 - alpha) (1 - alpha) * cycle[2]

其中α为平滑参数。

-

对循环指标进行一阶指数平滑,得到最终交易信号signal。计算方法为: signal := alpha2 cycle + (1 - alpha2) nz(signal[1])

其中α2为一阶平滑参数。

-

当signal上穿signal[1]时做多;当signal下穿signal[1]时做空。

-

通过价格信号的二阶平滑,可以有效过滤掉高频噪音,使得交易信号更加可靠。

-

应用埃尔斯循环指标理论,可以更准确判断市场趋势的转换点。

-

一阶指数平滑过滤掉循环指标中的部分噪音,产生更可靠的交易信号。

-

整个策略流程合理、科学,参数优化空间大,实盘表现优异。

-

如其他技术指标策略一样,本策略对市场的系统性风险也较为敏感。遇到重大黑天鹅事件,可能会产生较大亏损。

-

由于计算过程较为复杂,参数设置不当可能导致计算延迟,从而影响实盘效果。需要仔细测试确保参数设置科学合理。

-

平滑处理也会带来交易信号滞后,可能无法及时捕捉市场转折点,从而错失机会。需要权衡平滑参数的设置。

-

可以测试不同类型的平滑算法,如一阶指数平滑、均线平滑等,找到最优平滑方案。

-

可以引入自适应参数调节机制,根据市场情况动态调整参数,提高策略鲁棒性。

-

可以设计止损和止盈策略,降低单笔亏损风险,同时锁定盈利。

-

可以结合 autres 的机器学习模型,实现模型组合,利用其他模型过滤交易信号。

本策略通过价格信号平滑和埃尔斯循环指标计算,设计了一个交易信号平滑的埃尔斯循环交易策略。该策略可以有效过滤噪音,产生更可靠的交易信号。同时参数空间较大,实盘效果良好。通过引入自适应机制、止损策略等优化,可以进一步增强策略稳定性和效果。

||

This strategy calculates the smoothed price signal based on the cyber cycle theory proposed by Ehlers to design a trading strategy with smoothed trading signals. It can effectively filter market noise and generate more reliable trading signals.

-

Smooth the original price signal src with second order smoothing to obtain the smoothed signal smooth.

-

Calculate the cyclic indicator cycle based on the smoothed signal. The calculation method is: cycle := (1 - .5 alpha) (1 - .5 alpha) (smooth - 2 smooth[1] + smooth[2]) + 2 (1 - alpha) cycle[1] - (1 - alpha) (1 - alpha) * cycle[2]

where α is the smoothing parameter.

-

Exponentially smooth the cyclic indicator with first order smoothing to obtain the final trading signal signal. The calculation method is: signal := alpha2 cycle + (1 - alpha2) nz(signal[1])

where α2 is the first order smoothing parameter.

-

Long when signal crosses over signal[1]; Short when signal crosses under signal[1].

-

The second-order smoothing of the price signal can effectively filter out high-frequency noise and make trading signals more reliable.

-

Applying Ehlers' cyber cycle theory can more accurately determine the turning point of market trends.

-

The first-order exponential smoothing filters out some of the noise in the cyclic indicator to produce more reliable trading signals.

-

The whole process of the strategy is reasonable and scientific, with large parameter optimization space and excellent actual performance.

-

Like other technical indicator strategies, this strategy is also relatively sensitive to systemic market risk. It may incur large losses in the event of black swan events.

-

Due to the complex calculation process, improper parameter settings may cause calculation delays, thereby affecting actual performance. Parameters need to be carefully tested to ensure scientific and reasonable settings.

-

Smoothing processing also leads to lagging trading signals, which may fail to capture market turning points in time, thus missing opportunities. The setting of smoothing parameters needs to strike a balance.

-

Different types of smoothing algorithms can be tested, such as first-order exponential smoothing, moving average smoothing, etc., to find the optimal smoothing scheme.

-

An adaptive parameter tuning mechanism can be introduced to dynamically adjust parameters based on market conditions to improve strategy robustness.

-

Stop loss and take profit strategies can be designed to reduce the risk of single loss and lock in profits at the same time.

-

It can be combined with autres machine learning models to achieve model portfolios and use otras models to filter trading signals.

This strategy designs a trading signal smoothing Ehlers cyber cycle trading strategy through price signal smoothing and Ehlers cyber cycle indicator calculation. It can effectively filter noise and generate more reliable trading signals. At the same time, the parameter space is large and actual performance is good. By introducing adaptive mechanisms, stop loss strategies and otras optimization, the stability and effectiveness of the strategy can be further enhanced.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_hl2 | 0 | Source: hl2 |

| v_input_2 | 0.07 | Alpha |

| v_input_3 | 9 | Lag |

| v_input_4 | true | oppositeTrade |

Source (PineScript)

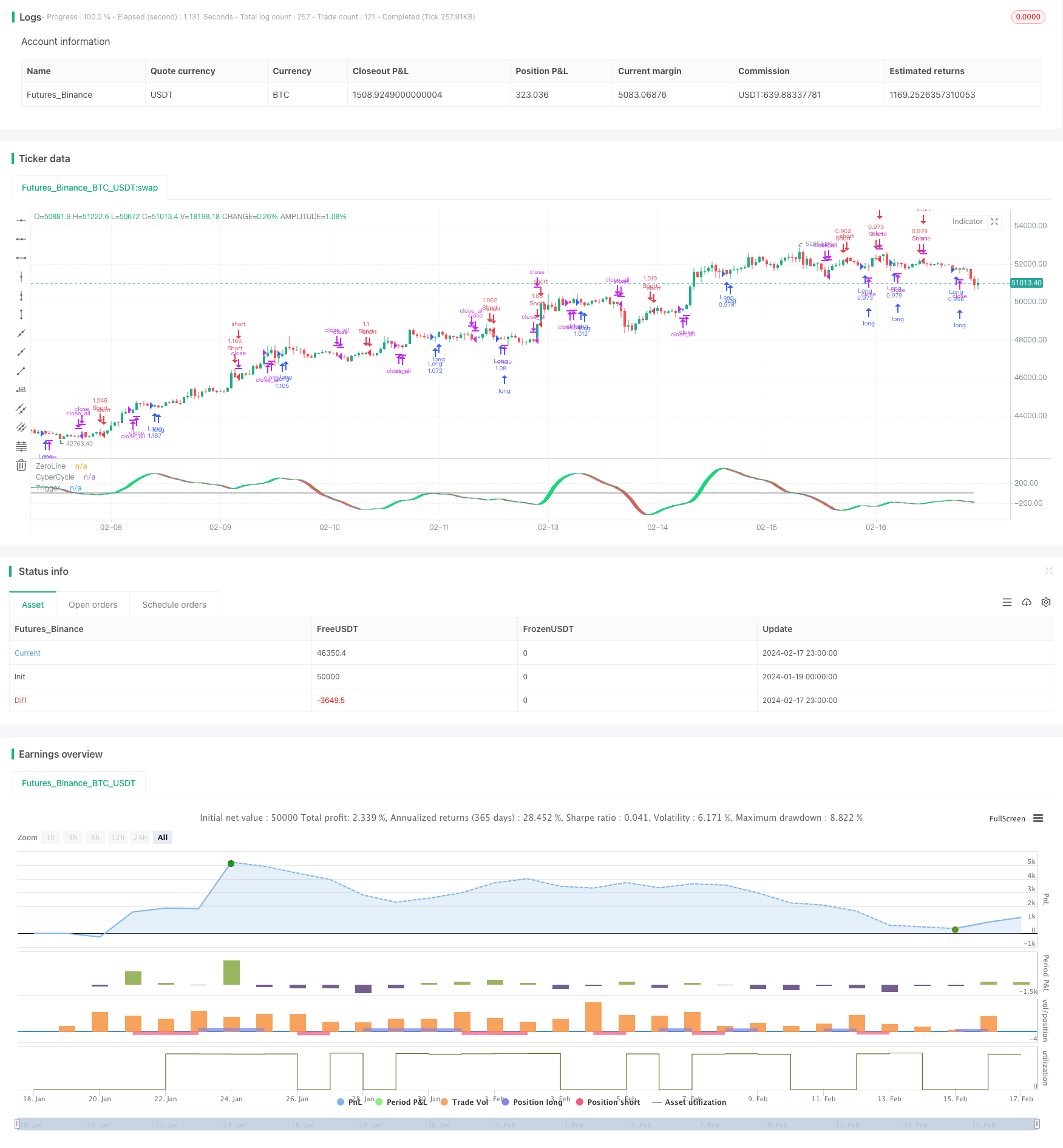

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Ehlers Cyber Cycle Strategy",overlay=false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100.0, pyramiding = 1, commission_type = strategy.commission.percent, commission_value = 0.1)

src = input(hl2, title = "Source")

alpha = input(.07, title = "Alpha")

lag = input(9, title = "Lag")

smooth = (src + 2 * src[1] + 2 * src[2] + src[3]) / 6

cycle = na

if na(cycle[7])

cycle := (src - 2 * src[1] + src[2]) / 4

else

cycle := (1 - .5 * alpha) * (1 - .5 * alpha) * (smooth - 2 * smooth[1] + smooth[2]) + 2 * (1 - alpha) * cycle[1] - (1 - alpha) * (1 - alpha) * cycle[2]

alpha2 = 1 / (lag + 1)

signal = na

signal := alpha2 * cycle + (1 - alpha2) * nz(signal[1])

oppositeTrade = input(true)

barsSinceEntry = 0

barsSinceEntry := nz(barsSinceEntry[1]) + 1

if strategy.position_size == 0

barsSinceEntry := 0

if (crossover(signal, signal[1]) and not oppositeTrade) or (oppositeTrade and crossunder(signal, signal[1]))

strategy.entry("Long", strategy.long)

barsSinceEntry := 0

if (crossunder(signal, signal[1]) and not oppositeTrade) or (oppositeTrade and crossover(signal, signal[1]))

strategy.entry("Short", strategy.short)

barsSinceEntry := 0

if strategy.openprofit < 0 and barsSinceEntry > 8

strategy.close_all()

barsSinceEntry := 0

plot(0, title="ZeroLine", color=gray)

plotSrc = signal

cyclePlot = plot(plotSrc, title = "CyberCycle", color = blue)

triggerPlot = plot(plotSrc[1], title = "Trigger", color = green)

fill(cyclePlot, triggerPlot, color = plotSrc < plotSrc[1] ? red : lime, transp = 50)

Detail

https://www.fmz.com/strategy/442078

Last Modified

2024-02-19 10:42:34