Name

基于动态均线交叉策略Dynamic-Moving-Average-Crossover-Strategy

Author

ChaoZhang

Strategy Description

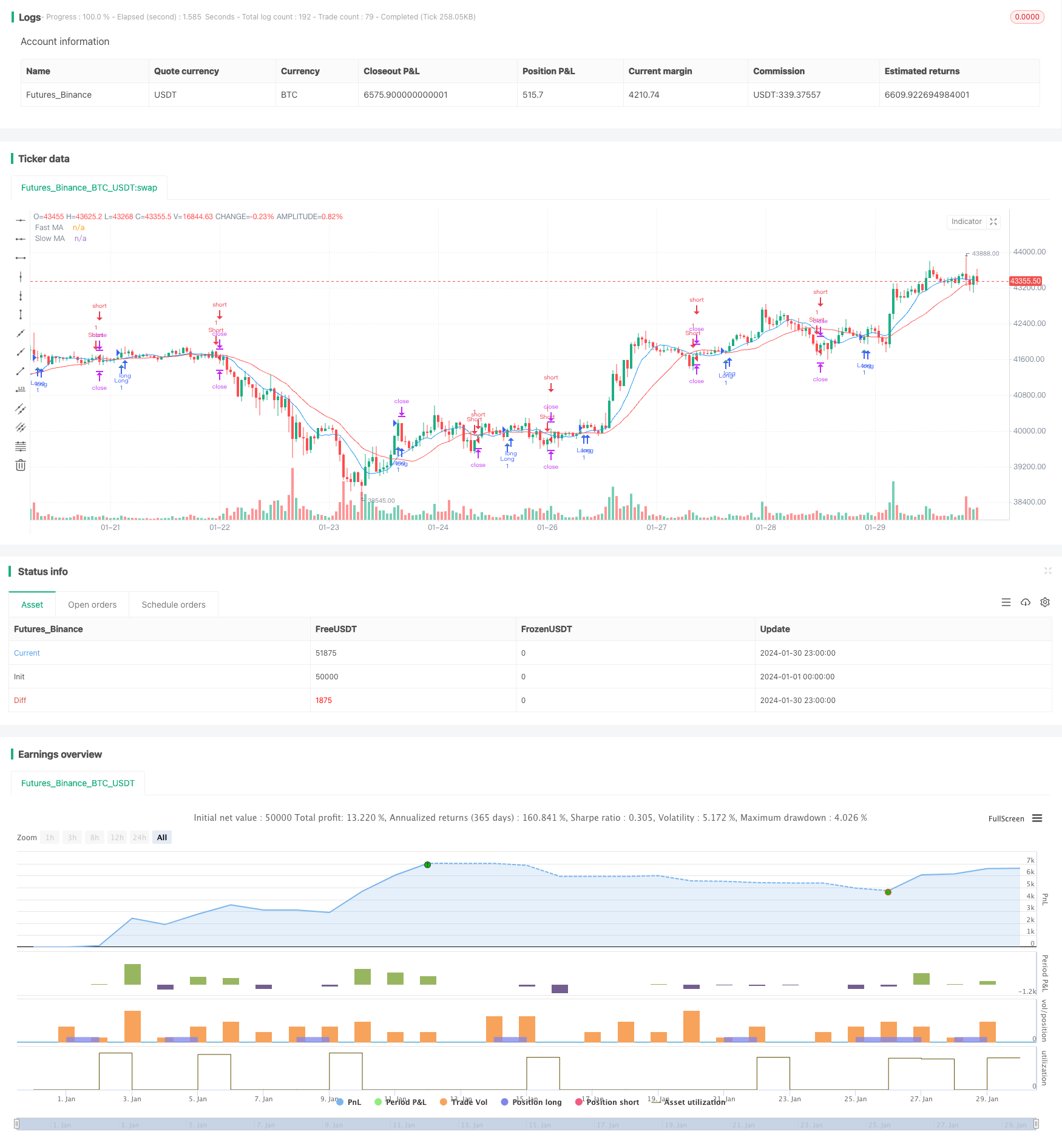

动态均线交叉策略(Dynamic Moving Average Crossover Strategy)是一种典型的趋势跟踪策略。该策略通过计算快速移动平均线(Fast MA)和慢速移动平均线(Slow MA),并在它们交叉时产生买入和卖出信号,以捕捉市场趋势的转折点。

该策略的核心逻辑是:当快速移动平均线从下方上穿越慢速移动平均线时,产生买入信号;当快速移动平均线从上方下穿慢速移动平均线时,产生卖出信号。

移动平均线能有效地滤波市场噪音,捕捉价格趋势。快速移动平均线更加灵敏,能及时捕捉趋势的变化;慢速移动平均线更加稳定,有效滤除短期波动的影响。当快慢均线发生金叉(由下向上穿越)时,表示市场步入多头行情;当发生死叉(由上向下穿越)时,表示步入空头行情。

该策略会在均线交叉时立即发出交易信号,采取趋势追踪策略,跟踪市场趋势赚取较大盈利。同时,策略会设置止损位和止盈位,严格控制风险。

- 策略回测表现良好,跟踪趋势捕捉较大行情

- 均线交叉产生清晰信号,容易实施

- 设置止损止盈,严格控制风险

- 容易产生损失严重的信号错误交易

- 交易频繁,持仓时间较短

- 需要合理设置参数

可以通过优化参数,调整均线周期长度,或加入过滤条件等方法来改善。

- 调整均线参数,寻找最佳参数组合

- 加入量能指标等过滤条件,减少错误信号

- 优化止损止盈设定

- 结合其他指标判断趋势方向

动态均线交叉策略整体效果较好,通过调整参数优化可以进一步改善策略表现。该策略容易实施,适合初学者实战练习。但也需要警惕产生错误信号的风险,需辅助其他指标判断效果才会更好。

||

The Dynamic Moving Average Crossover Strategy is a typical trend-following strategy. It generates buy and sell signals by calculating the fast moving average (Fast MA) and slow moving average (Slow MA) and detecting crosses between them to capture trend reversal points in the market.

The core logic of this strategy is: when the fast moving average crosses above the slow moving average from below, a buy signal is generated; when the fast moving average crosses below the slow moving average from above, a sell signal is generated.

Moving averages can effectively filter market noise and capture price trends. The fast moving average is more sensitive and can timely capture changes in the trend; the slow moving average is more stable and can effectively filter out the impact of short-term fluctuations. When the fast and slow MAs have a golden cross (moving up from below), it indicates that the market has entered a bullish phase; when they see a death cross (moving down from above), it indicates that the market has entered a bearish phase.

This strategy will immediately issue trading signals when the moving averages cross, adopt a trend-chasing strategy to follow market trends and earn bigger profits. At the same time, the strategy sets stop loss and take profit to strictly control risks.

- Good backtest performance of the strategy, capturing big moves by following trends

- Clear signals generated by moving average crosses, easy to implement

- With stop loss and take profit to strictly control risks

- Prone to signal errors and suffering severe losses

- High trading frequency, short holding periods

- Need reasonable parameter settings

Improvements can be made by optimizing parameters, adjusting the moving average periods, adding filter conditions etc.

- Adjust moving average parameters to find optimal parameter combinations

- Add momentum indicators etc. as filters to reduce false signals

- Optimize stop loss and take profit settings

- Combine other indicators to determine trend direction

The Dynamic Moving Average Crossover Strategy overall performs quite well. Further improvements can be made by optimizing parameters. The strategy is easy to implement and suitable for beginner's practice. But the risk of false signals should be watched out for, and needs to be used together with other indicators to perform better.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 9 | Fast MA Length |

| v_input_int_2 | 21 | Slow MA Length |

| v_input_float_1 | true | Stop Loss (%) |

| v_input_float_2 | 2 | Take Profit (%) |

Source (PineScript)

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple Moving Average Crossover", shorttitle="SMAC", overlay=true)

// Define input parameters

fast_length = input.int(9, title="Fast MA Length")

slow_length = input.int(21, title="Slow MA Length")

stop_loss = input.float(1, title="Stop Loss (%)", minval=0, maxval=100)

take_profit = input.float(2, title="Take Profit (%)", minval=0, maxval=100)

// Calculate moving averages

fast_ma = ta.sma(close, fast_length)

slow_ma = ta.sma(close, slow_length)

// Define conditions for long and short signals

long_condition = ta.crossover(fast_ma, slow_ma)

short_condition = ta.crossunder(fast_ma, slow_ma)

// Plot moving averages on the chart

plot(fast_ma, title="Fast MA", color=color.blue)

plot(slow_ma, title="Slow MA", color=color.red)

// Execute long and short trades

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

// Set stop loss and take profit levels

stop_loss_price = close * (1 - stop_loss / 100)

take_profit_price = close * (1 + take_profit / 100)

strategy.exit("Take Profit/Stop Loss", stop=stop_loss_price, limit=take_profit_price)

// Plot signals on the chart

plotshape(series=long_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=short_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

Detail

https://www.fmz.com/strategy/440684

Last Modified

2024-02-01 10:42:53