Name

基于动量和标准差的黄金交易策略All-About-Momentum-Trading-Strategy-with-Stop-Loss-for-Gold

Author

ChaoZhang

Strategy Description

本策略通过计算黄金价格相对于21日指数移动平均线的偏离程度,结合标准差来判断市场的超买超卖情况,在偏离程度达到一定标准差时,采取趋势跟踪策略,同时设置止损机制来控制风险。

- 计算21日指数移动平均线作为中轴

- 计算黄金价格与移动平均线的偏离度

- 对偏离度进行标准化,转换为Z-Score

- 当Z-Score上穿0.5时,做多;当Z-Score下穿-0.5时,做空

- Z-Score回落至阈值0.5/-0.5时,平仓

- Z-Score超过3/-3时,止损

这是一个基于价格动量和标准差判断市场超买超卖的趋势跟踪策略,具有如下优势:

- 使用移动平均线作为dynamic support/resistance,能抓住趋势

- 标准差和Z-Score能很好判断超买超卖情况,降低假信号

- 采用指数移动平均线,对最近价格影响更大,更sensitive

- Z-Score标准化价格偏离度,使判断规则更统一规范

- 设置止损机制,可以及时止损,控制风险

该策略也存在一些风险:

- 移动平均线作为判断基准,当价格出现明显跳空或突破时,会产生错误信号

- 标准差和Z-Score判断阈值需要恰当设置,过大或过小都会影响策略表现

- 止损设置不当,可能过于激进,造成不必要的亏损

- 突发事件导致价格大幅波动,会触发止损而错过趋势机会

解决方法:

- 合理设置移动平均线参数,Identify主要趋势

- 通过回测优化标准差参数,寻找最佳阈值

- 设置Trailing Stop损检查策略止损合理性

- 在事件发生后及时重新评估市场状况,调整策略参数

该策略可以从以下几个方面进行优化:

- 利用波动率 indictor如ATR代替简单标准差,更好判定Risk appetite

- 尝试不同类型的移动平均线,寻找更合适的中轴指标

- 优化移动平均线参数,Identify最佳均线周期

- 优化Z-Score阈值,寻找最佳策略表现参数点

- 增加基于波动率的止损方式,使止损更加智能合理

本策略整体来说是一个基础合理的趋势跟踪策略。它利用移动平均线判断主要趋势方向,同时通过价格偏离度的标准化处理,可以清楚判断市场的超买超卖状况,从而产生交易信号。设置合理的止损方式也使得策略在保证盈利的同时控制风险。通过进一步优化参数以及增加更多条件判断,可以使策略更加稳定可靠,具有很强的应用价值。

||

This strategy calculates the deviation of gold price from its 21-day exponential moving average to determine overbought and oversold situations in the market. It adopts a momentum trading approach with stop loss mechanism to control risk when deviation reaches certain thresholds in terms of standard deviation.

- Calculate 21-day EMA as the baseline

- Compute deviation of price from EMA

- Standardize deviation into Z-Score

- Go long when Z-Score crosses over 0.5; Go short when Z-Score crosses below -0.5

- Close position when Z-Score falls back to 0.5/-0.5 threshold

- Set stop loss when Z-Score goes over 3 or below -3

The advantages of this strategy are:

- EMA as dynamic support/resistance to capture trends

- Stddev and Z-Score effectively gauge overbought/oversold levels, reducing false signals

- Exponential EMA puts more weight on recent prices, making it more sensitive

- Z-Score standardizes deviation for unified判断 rules

- Stop loss mechanism controls risk and limits losses

Some risks to consider:

- EMA can generate wrong signals when price gaps or breaks out

- Stddev/Z-Score thresholds need proper tuning for best performance

- Improper stop loss setting could lead to unnecessary losses

- Black swan events may trigger stop loss and miss trend opportunity

Solutions:

- Optimize EMA parameter to identify major trends

- Backtest to find optimal Stddev/Z-Score thresholds

- Test stop loss rationality with trailing stops

- Reassess market post-event, adjust strategy accordingly

Some ways to improve the strategy:

- Use volatility indictors like ATR instead of simple Stddev to gauge risk appetite

- Test different types of moving averages for better baseline

- Optimize EMA parameter to find best period

- Optimize Z-Score thresholds for improved performance

- Add volatility-based stops for more intelligent risk control

Overall this is a solid trend following strategy. It uses EMA to define trend direction and standardized deviation to clearly identify overbought/oversold levels for trade signals. Reasonable stop loss controls risk while letting profits run. Further parameter tuning and adding conditions can make this strategy more robust for practical application.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 21 | EMA Length |

Source (PineScript)

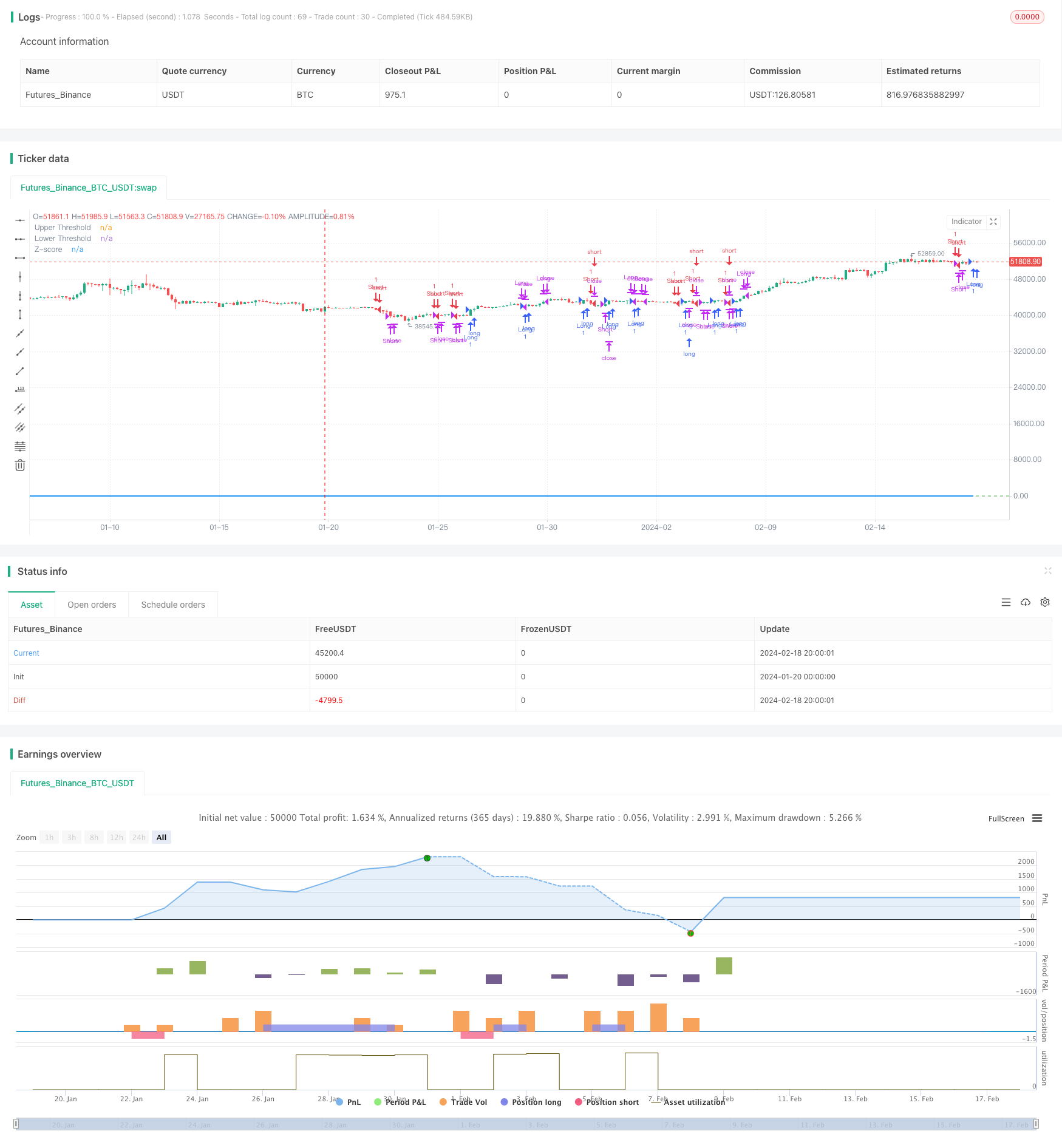

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("GC Momentum Strategy with Stoploss and Limits", overlay=true)

// Input for the length of the EMA

ema_length = input.int(21, title="EMA Length", minval=1)

// Exponential function parameters

steepness = 2

// Calculate the EMA

ema = ta.ema(close, ema_length)

// Calculate the deviation of the close price from the EMA

deviation = close - ema

// Calculate the standard deviation of the deviation

std_dev = ta.stdev(deviation, ema_length)

// Calculate the Z-score

z_score = deviation / std_dev

// Long entry condition if Z-score crosses +0.5 and is below 3 standard deviations

long_condition = ta.crossover(z_score, 0.5)

// Short entry condition if Z-score crosses -0.5 and is above -3 standard deviations

short_condition = ta.crossunder(z_score, -0.5)

// Exit long position if Z-score converges below 0.5 from top

exit_long_condition = ta.crossunder(z_score, 0.5)

// Exit short position if Z-score converges above -0.5 from below

exit_short_condition = ta.crossover(z_score, -0.5)

// Stop loss condition if Z-score crosses above 3 or below -3

stop_loss_long = ta.crossover(z_score, 3)

stop_loss_short = ta.crossunder(z_score, -3)

// Enter and exit positions based on conditions

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

if (exit_long_condition)

strategy.close("Long")

if (exit_short_condition)

strategy.close("Short")

if (stop_loss_long)

strategy.close("Long")

if (stop_loss_short)

strategy.close("Short")

// Plot the Z-score on the chart

plot(z_score, title="Z-score", color=color.blue, linewidth=2)

// Optional: Plot zero lines for reference

hline(0.5, "Upper Threshold", color=color.red)

hline(-0.5, "Lower Threshold", color=color.green)

Detail

https://www.fmz.com/strategy/442264

Last Modified

2024-02-20 16:27:18