Name

基于卡尔曼滤波的趋势跟踪策略Kalman-Filter-Based-Trend-Tracking-Strategy

Author

ChaoZhang

Strategy Description

本策略的核心是利用卡尔曼滤波技术对价格均线进行平滑处理,通过计算平滑后的均线的切线角,当切线角在指定周期内超过一定阈值时产生交易信号。该策略致力于跟踪中长线趋势,通过卡尔曼滤波技术减少噪音的影响,从而获得更加清晰和可靠的趋势信号。

本策略的核心逻辑主要包含以下几个步骤:

-

计算1分钟价格的简单移动平均线(SMA)作为原始均线;

-

对原始均线进行卡尔曼滤波,输出平滑后的均线;

-

计算平滑后的均线的切线角;

-

定义参数周期,统计周期内切线角的总和;

-

当周期内切线角总和大于360度时产生买入信号;当小于-360度时产生卖出信号。

通过这样的设计,当价格出现向上或向下的趋势时,均线的切线角会逐步积累,当积累到一定程度时产生交易信号,因而能够有效跟踪中长线趋势。

其中,卡尔曼滤波是本策略的关键所在。卡尔曼滤波是一种递归算法,它在预测当前状态的同时,也会预测过程噪声和测量噪声的值,并利用这些噪声的值来校正当前状态的预测,从而获得更加准确和可靠的状态估计。

在本策略中,价格的SMA可以看作是状态的测量,受到市场噪音的影响,卡尔曼滤波器会递归地估计价格的真实趋势,大幅减少噪声的影响,使得后续的均线运算更加可靠,从而产生更稳定和准确的交易信号。

相比简单移动平均线等指标策略,本策略最大的优势在于利用卡尔曼滤波减少了噪声的影响,使得交易信号更加清晰可靠。具体优势主要体现在以下几个方面:

-

减少假信号。卡尔曼滤波通过自适应地估计和消除噪声,有效过滤掉了大量由随机波动引发的假信号,使得产生的交易信号更加可靠。

-

更佳跟踪效果。平滑后的均线形态更加流畅,能够更好地反映价格中长线趋势,从而实现更出色的趋势跟踪效果。

-

可调参数设置灵活。可调整的参数包括均线长度、卡尔曼滤波的参数和统计周期,能够灵活适应不同市场环境。

-

风险可控。本策略更多关注中长线趋势而不是短期波动,实现了较好的风险回报平衡。

-

实现简单,容易扩展。本策略的核心算法较为简洁,易于实现和测试,也提供了扩展的空间,如可引入机器学习算法自动优化参数等。

本策略也存在以下主要风险:

-

趋势反转风险。本策略侧重趋势跟踪,一旦发生剧烈的趋势反转则会产生较大损失。可通过适当缩短统计周期以减少单笔损失。

-

参数优化风险。不当的参数设置可能导致交易频繁或信号滞后,需要充分测试优化。可结合机器学习算法自动优化。

-

过优化风险。在历史数据上过度优化也可能导致参数失效,需要控制在样本外有效。

-

实现复杂度增加风险。引入卡尔曼滤波和切线角算法会增加代码复杂度,需要确保正确实现。

考虑到上述风险因素,本策略可优化的方向包括:

-

引入止损和仓位管理。适当的止损可以有效控制单笔损失风险;动态仓位管理也可以根据市场情况调整仓位覆盖风险。

-

自动参数优化。通过机器学习优化算法,可以实现参数的自动优化,避免过优化风险。

-

集成其他指标。可以在策略中集成一些其他指标,形成指标组合,以提升策略稳定性。

-

增加效率评估。引入更多风险调整指标,对策略效率和稳定性进行评估,从而得出更全面准确的结论。

-

扩展多个品种。如果效果良好,可以考虑扩展到更多品种,从中长期积累更丰富的样本,也方便跨品种参数优化。

本策略总体来说是一个较为简单实用的趋势跟踪策略。相比传统移动平均线策略,引入卡尔曼滤波算法是其最大的创新点,也使得策略能够产生更加清晰和可靠的交易信号。下一步通过进一步优化,本策略可望取得更加优异的效果。总的来说,本策略为量化交易策略提供了一种新的思路,值得进一步研究和应用。

||

The core of this strategy is to use Kalman filter technology to smooth the price moving average, and generate trading signals when the tangent angle of the smoothed moving average exceeds a certain threshold within a specified period. The strategy aims to track medium and long term trends by using Kalman filter technology to reduce the impact of noise, so as to obtain clearer and more reliable trend signals.

The core logic of this strategy mainly includes the following steps:

-

Calculate the simple moving average (SMA) of the 1-minute price as the original moving average;

-

Kalman filter the original moving average to output a smoothed moving average;

-

Calculate the tangent angle of the smoothed moving average;

-

Define the parameter period and statistically sum the tangent angles within the period;

-

Generate a buy signal when the sum of tangent angles within the period is greater than 360 degrees; generate a sell signal when less than -360 degrees.

With this design, when the price shows an upward or downward trend, the tangent angle of the moving average will gradually accumulate. When it accumulates to a certain extent, trading signals will be generated. Therefore, it can effectively track medium and long term trends.

Among them, the Kalman filter is the key. The Kalman filter is a recursive algorithm that predicts the value of process noise and measurement noise while predicting the current state, and uses these noise values to correct the prediction of the current state to obtain a more accurate and reliable state estimation.

In this strategy, the SMA of the price can be seen as the measurement of the state. Affected by market noise, the Kalman filter will recursively estimate the true trend of prices, greatly reduce the impact of noise, make the subsequent moving average calculation more reliable, and thus produce more stable and accurate trading signals.

Compared with simple moving average and other technical indicator strategies, the biggest advantage of this strategy is that it uses Kalman filter to reduce the impact of noise, making trading signals clearer and more reliable. The specific advantages are mainly reflected in the following aspects:

-

Reduce false signals. Kalman filtering effectively filters out a lot of false signals caused by random fluctuations by adaptively estimating and eliminating noise, making the trading signals generated more reliable.

-

Better tracking effect. The smoothed moving average shape is smoother and better reflects the medium and long term trend of prices, thus achieving better trend tracking effect.

-

Flexible adjustable parameters. Adjustable parameters include the length of moving average, parameters of Kalman filter and statistical cycle, which can flexibly adapt to different market environments.

-

Controllable risk. This strategy focuses more on medium and long term trends rather than short term fluctuations, achieving good risk-return balance.

-

Easy to implement and expand. The core algorithm of this strategy is quite concise and easy to implement and test. It also provides room for expansion, such as introducing machine learning algorithms to automatically optimize parameters.

The main risks of this strategy also include:

-

Trend reversal risk. This strategy focuses on trend tracking. In case of a sharp trend reversal, it will lead to greater losses. This can be mitigated by appropriately shortening the statistical cycle to reduce per trade loss.

-

Parameter optimization risk. Inappropriate parameter settings may lead to frequent trading or signal lagging. It requires sufficient testing and optimization. It can be combined with machine learning algorithms for automatic optimization.

-

Over-optimization risk. Excessive optimization on historical data may also lead to ineffective parameters. Out-of-sample validity needs to be controlled.

-

Increased complexity risk. Introducing Kalman filter and tangent angle algorithms increases code complexity. Correct implementation needs to be ensured.

Considering the above risks, the optimization directions of this strategy include:

-

Introduce stop loss and position sizing. Appropriate stop loss can effectively control the risk of single trade loss; dynamic position sizing can also adjust positions to hedge risks according to market conditions.

-

Automatic parameter optimization. Machine learning optimization algorithms can achieve automatic parameter optimization to avoid over-optimization risks.

-

Integrate other indicators. Some other indicators can be integrated into the strategy to form indicator combinations to enhance strategy stability.

-

Increase efficiency evaluation. Introduce more risk-adjusted metrics to evaluate the efficiency and stability of strategies for a more comprehensive and accurate conclusion.

-

Expand to more products. If effective, it can be considered to expand to more products. In the medium and long term, it accumulates richer samples and facilitates cross-product parameter optimization.

In general, this strategy is a relatively simple and practical trend tracking strategy. Compared with traditional moving average strategies, the introduction of the Kalman filter algorithm is its biggest innovation point, which also enables the strategy to produce clearer and more reliable trading signals. With further optimization, this strategy is expected to achieve better results. Overall, this strategy provides a new idea for quantitative trading strategies and is worth further research and application.

[/trans]

Source (PineScript)

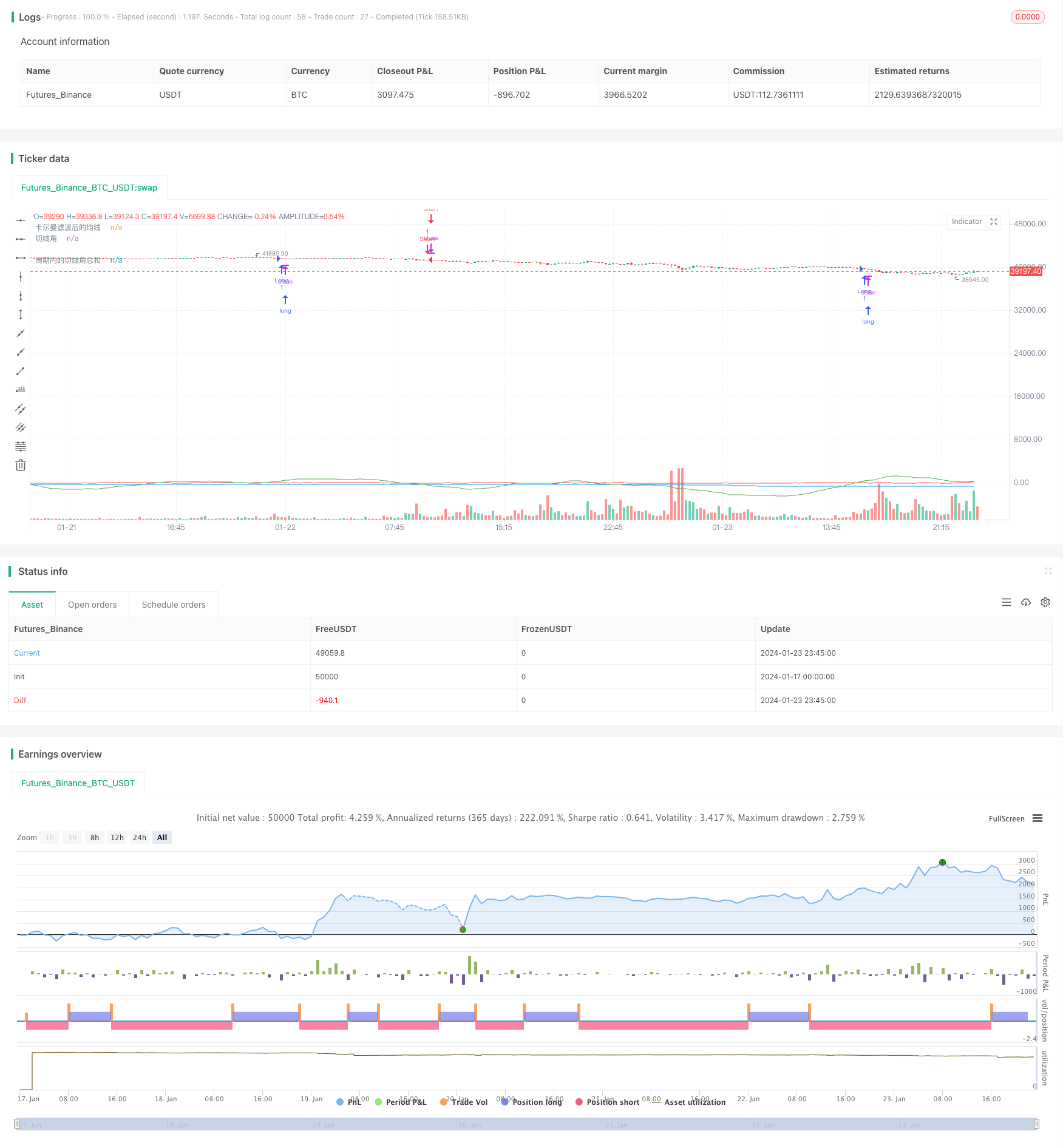

/*backtest

start: 2024-01-17 00:00:00

end: 2024-01-24 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@library=math

strategy("策略360°(测试)", overlay=true)

// 定义1分钟均线

ma1 = request.security(syminfo.tickerid, "1", ta.sma(close, 1)) // 在这里使用了 math.sma() 函数

//plot(ma1, color=color.yellow, title="原始均线")

// 定义卡尔曼滤波函数,参考了[1](https://www.tradingview.com/pine-script-docs/en/v5/language/Methods.html)和[2](https://www.tradingview.com/pine-script-docs/en/v5/language/Operators.html)的代码

kalman(x, g) =>

kf = 0.0

dk = x - nz(kf[1], x) // 在这里使用了 nz() 函数

smooth = nz(kf[1], x) + dk * math.sqrt(g * 2) // 在这里使用了 math.sqrt() 函数

velo = 0.0

velo := nz(velo[1], 0) + g * dk // 在这里使用了 nz() 函数

kf := smooth + velo

kf

// 定义卡尔曼滤波后的均线

ma2 = kalman(ma1, 0.01)

plot(ma2, color=color.blue, title="卡尔曼滤波后的均线")

// 定义切线角

angle = math.todegrees(math.atan(ma2 - ma2[1])) // 在这里使用了 math.degrees() 和 math.atan() 函数

// 定义累加的切线角

cum_angle = 0.0

cum_angle := nz(cum_angle[1], 0) + angle // 在这里使用了 nz() 函数

// 定义30分钟周期

period = 30 // 您可以根据您的需要修改这个参数

// 定义周期内的切线角总和

sum_angle = 0.0

sum_angle := math.sum(angle, period) // 在这里使用了 math.sum() 函数,把周期内的切线角总和改成简单地把 5 个切线角相加

// 定义买入和卖出条件

buy = sum_angle > 360// 在这里使用了 math.radians() 函数

sell = sum_angle < -360

// 执行买入和卖出操作

strategy.entry("Long", strategy.long, when=buy)

strategy.close("Short", when=buy)

strategy.entry("Short", strategy.short, when=sell)

strategy.close("Long", when=sell)

// 绘制曲线图

plot(sum_angle, color=color.green, title="周期内的切线角总和")

plot(angle, color=color.red, title="切线角") // 这是我为您添加的代码,用于显示实时计算的切线角

Detail

https://www.fmz.com/strategy/439972

Last Modified

2024-01-25 14:12:26