Name

基于卡马奇拉枢轴与布林带的量化策略Camarilla-Pivot-Points-Strategy-Based-on-Bollinger-Bands

Author

ChaoZhang

Strategy Description

该策略首先根据前一交易日的最高价、最低价以及收盘价计算出卡马奇拉枢轴点。然后结合布林带指标对价格进行过滤,在价格突破枢轴点时产生交易信号。

- 计算前一交易日的最高价、最低价、收盘价

- 根据公式计算出卡马奇拉枢轴线,包含上轨H4、H3、H2、H1和下轨L1、L2、L3、L4

- 计算20日布林带上轨和下轨

- 当价格上穿下轨时做多,下穿上轨时做空

- 止损点设在布林带上轨或下轨附近

- 卡马奇拉枢轴线包含多个关键支撑阻力位,增强交易信号的可靠性

- 与布林带指标结合,可有效过滤假突破

- 多组参数组合,交易灵活

- 布林带指标参数设置不当可能导致交易信号错误

- 卡马奇拉枢轴线关键位计算依赖前一交易日价格,可能受隔夜跳空影响

- 多头空头操作都有亏损风险

- 优化布林带参数,寻找最佳参数组合

- 结合其它指标过滤假突破信号

- 增加止损策略,降低单笔亏损

该策略综合运用卡马奇拉枢轴线和布林带指标,在价格突破关键支撑阻力位时产生交易信号。可通过参数优化和信号过滤来提高策略收益率和稳定性。总体来说,该策略交易思路清晰,可操作性强,值得实盘验证。

||

This strategy first calculates the Camarilla pivot points based on the previous trading day's highest price, lowest price and closing price. It then filters the price with Bollinger Bands indicator to generate trading signals when price breaks through the pivot points.

- Calculate highest price, lowest price and closing price of previous trading day

- Calculate Camarilla pivot lines including upper rails H4, H3, H2, H1 and lower rails L1, L2, L3, L4 according to formulas

- Calculate 20-day Bollinger Bands upper band and lower band

- Go long when price breaks above lower band, go short when price breaks below upper band

- Set stop loss near Bollinger Bands upper or lower band

- Camarilla pivot lines contain multiple key support and resistance levels to enhance reliability of trading signals

- Combining with Bollinger Bands effectively filters false breakouts

- Multiple parameter combinations make trading flexible

- Improper Bollinger Bands parameter settings may cause wrong trading signals

- Camarilla pivot points rely on previous trading day's price, may be impacted by overnight gaps

- Both long and short positions carry loss risks

- Optimize Bollinger Bands parameters to find best combination

- Add other indicators to filter false breakout signals

- Increase stop loss strategies to reduce single loss

This strategy combines Camarilla pivot lines and Bollinger Bands, generating trading signals when price breaks key support and resistance levels. Strategy profitability and stability can be improved through parameter optimization and signal filtering. Overall, this strategy has clear trading logic and high operability, worth live trading verification.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | D | Resolution |

| v_input_2 | true | width |

| v_input_3 | 0 | Sell from : R1 |

| v_input_4 | 0 | Buu from : S1 |

| v_input_5 | false | Trade reverse |

Source (PineScript)

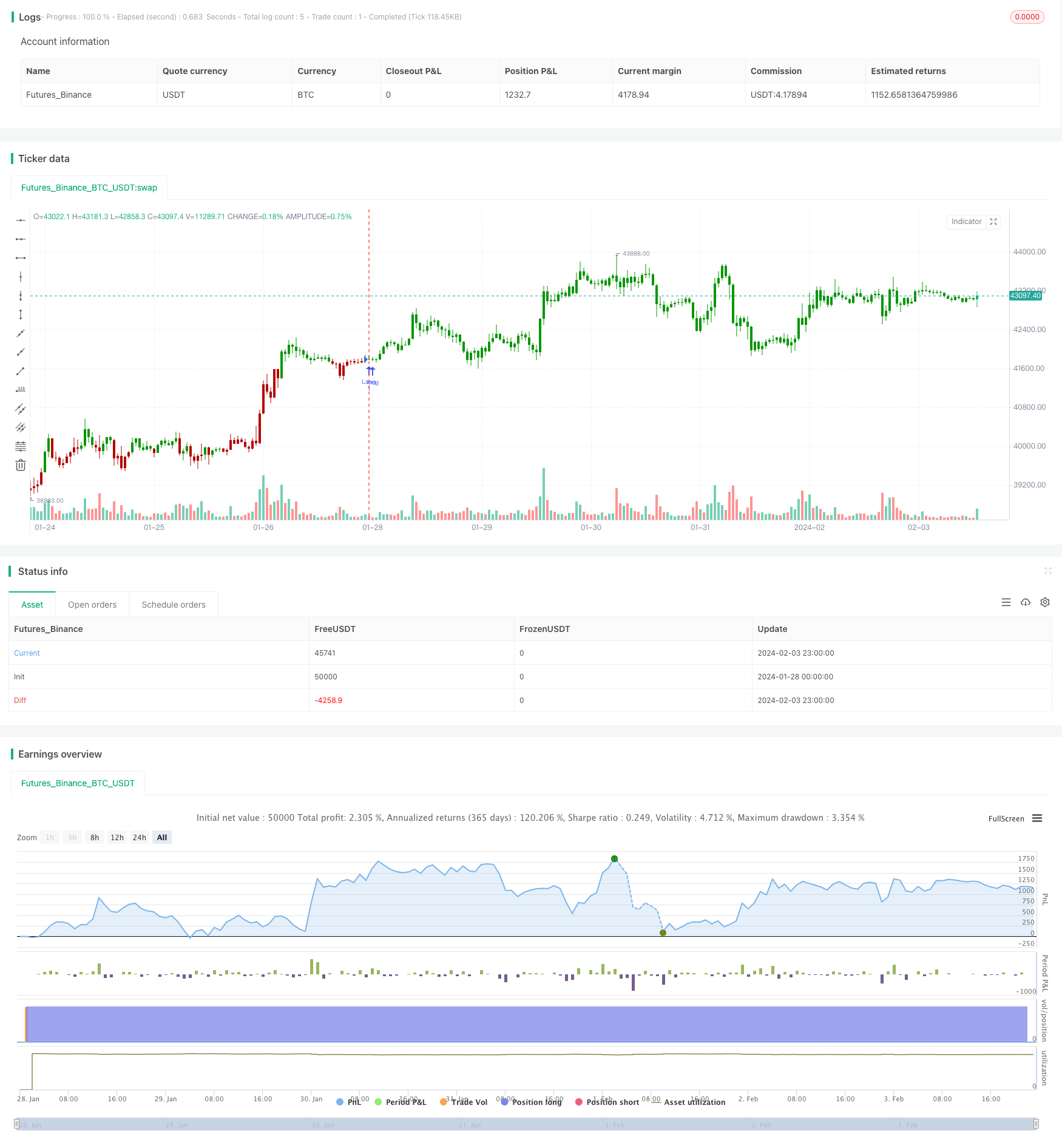

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/05/2020

// Camarilla pivot point formula is the refined form of existing classic pivot point formula.

// The Camarilla method was developed by Nick Stott who was a very successful bond trader.

// What makes it better is the use of Fibonacci numbers in calculation of levels.

//

// Camarilla equations are used to calculate intraday support and resistance levels using

// the previous days volatility spread. Camarilla equations take previous day’s high, low and

// close as input and generates 8 levels of intraday support and resistance based on pivot points.

// There are 4 levels above pivot point and 4 levels below pivot points. The most important levels

// are L3 L4 and H3 H4. H3 and L3 are the levels to go against the trend with stop loss around H4 or L4 .

// While L4 and H4 are considered as breakout levels when these levels are breached its time to

// trade with the trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points V2 Backtest", shorttitle="CPP V2", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

width = input(1, minval=1)

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

H4 = (0.55*(xHigh-xLow)) + xClose

H3 = (0.275*(xHigh-xLow)) + xClose

H2 = (0.183*(xHigh-xLow)) + xClose

H1 = (0.0916*(xHigh-xLow)) + xClose

L1 = xClose - (0.0916*(xHigh-xLow))

L2 = xClose - (0.183*(xHigh-xLow))

L3 = xClose - (0.275*(xHigh-xLow))

L4 = xClose - (0.55*(xHigh-xLow))

pos = 0

S = iff(BuyFrom == "S1", H1,

iff(BuyFrom == "S2", H2,

iff(BuyFrom == "S3", H3,

iff(BuyFrom == "S4", H4,0))))

B = iff(SellFrom == "R1", L1,

iff(SellFrom == "R2", L2,

iff(SellFrom == "R3", L3,

iff(SellFrom == "R4", L4,0))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Detail

https://www.fmz.com/strategy/441083

Last Modified

2024-02-05 14:23:59