Name

基于双均线区间突破策略Dual-Moving-Average-Range-Breakout-Strategy

Author

ChaoZhang

Strategy Description

该策略通过计算不同周期的均线,判断价格突破关键均线,实现低风险趋势追踪。

当10日均线上穿200日均线,并且20日均线上穿50日均线时,做多;当10日均线下穿200日均线,并且20日均线下穿50日均线时,做空。这里通过双重均线判断,可以有效过滤假突破。

策略首先计算10日、20日、50日和200日四条不同周期的指数移动平均线(EMA)。其中,10日线代表短期趋势,20日线代表中期趋势,50日线代表中长期趋势,200日线代表长期趋势。当短期趋势线上穿或下穿长期趋势线时,表示价格可能出现较大的向上或向下突破。但如果仅仅依靠一条均线的突破来判断,容易出现假突破。所以策略采用了双重均线判断:即10日线和200日线构成第一道关口判断长短期趋势关系,20日线和50日线构成第二道关口判断中长期趋势关系。只有当两道关口的判断结果一致时,才会产生交易信号。

这样通过双重均线过滤,可以有效降低假突破概率,使得产生的交易信号更加可靠。

- 使用双重均线判断,可有效过滤假突破,信号更加可靠

- 多时间周期参与,判断过程更为全面和谨慎

- 参数设置简单,容易理解和使用

- 跟随趋势能力较强,但没有利用反转机会

- 当趋势发生转折时,止损可能较大

- 需要较长的历史数据支持,新股或数据不足时效果可能不佳

可以通过适当放宽均线突破的幅度来改善,或者加入其他指标如成交量的确认来优化。

- 增加成交量的确认。交易量可以验证价格的突破,避免在低量的假突破下入场。

- 结合其它指标,如MACD、KDJ等作为辅助。更多指标可以提高系统稳定性。

- 自动优化参数。通过遗传算法等优化10日、20日等均线的参数设置,适应不同市场环境。

综上所述,该策略整体以双均线为主,辅以参数优化、成交量以及其它指标,可以有效构建一个稳定的趋势跟踪体系。

该策略总体来说是一个简单实用的趋势跟踪策略。它使用双重均线作为主要交易判断依据,通过双重过滤降低假突破概率,产生的信号更加可靠。同时,参数设置简单,容易掌握使用。完善的风险管理和进一步的优化仍有很大的空间,可以使策略更加稳定和盈利。总之,该策略以其简单性见长,适合做为量化交易的入门策略来使用。

||

This strategy identifies trend breakouts by calculating moving averages over different timeframes. It allows low-risk trend following.

Go long when the 10-day EMA crosses above the 200-day EMA and the 20-day EMA crosses above the 50-day EMA. Go short when the 10-day EMA crosses below the 200-day EMA and the 20-day EMA crosses below the 50-day EMA. The dual moving average design filters false breakouts effectively.

The strategy first calculates four exponential moving averages (EMAs) over the 10-day, 20-day, 50-day and 200-day periods. The 10-day EMA represents short-term trend, 20-day intermediate, 50-day medium-term and 200-day long-term trend. When the shorter EMA crosses the longer EMA, it signals a potential trend reversal. However, using just one EMA crossover produces false signals easily.

To improve reliability, the strategy applies two layers of filtering: the 10/200 EMA cross gauges long/short-term trend shifts while the 20/50 EMA cross gauges medium/intermediate-term shifts. Trades are triggered only when both EMA pairs align in the same direction.

The dual EMA filtering significantly reduces false signals, generating more reliable trade entries.

- Dual EMA filtering lowers false signals substantially

- Multiple timeframes offer robustness

- Simple parameterization facilitates usage

- Strong trend-following but misses reversals

- Potentially large stops when trends shift

- Insufficient history disadvantages new/exotic assets

Improvements include relaxing breakout thresholds, adding volume confirmation and optimizing parameters.

- Add volume confirmation. Volume verifies if breakout is real or on low activity.

- Incorporate additional indicators like MACD, KDJ for greater stability.

- Optimize parameters like 10/20-day EMA durations for changing markets.

In summary, the dual moving average core supplemented with optimization, volume and more indicators can build a steady trend tracking system.

A simple but practical trend following strategy. The dual EMA core filters false breakouts reliably for quality signals. Easy parameterization also facilitates adoption. Further improvements in risk management and optimization can boost performance. Overall an accessible introductory quant strategy underpinned by simplicity.

[/trans]

Source (PineScript)

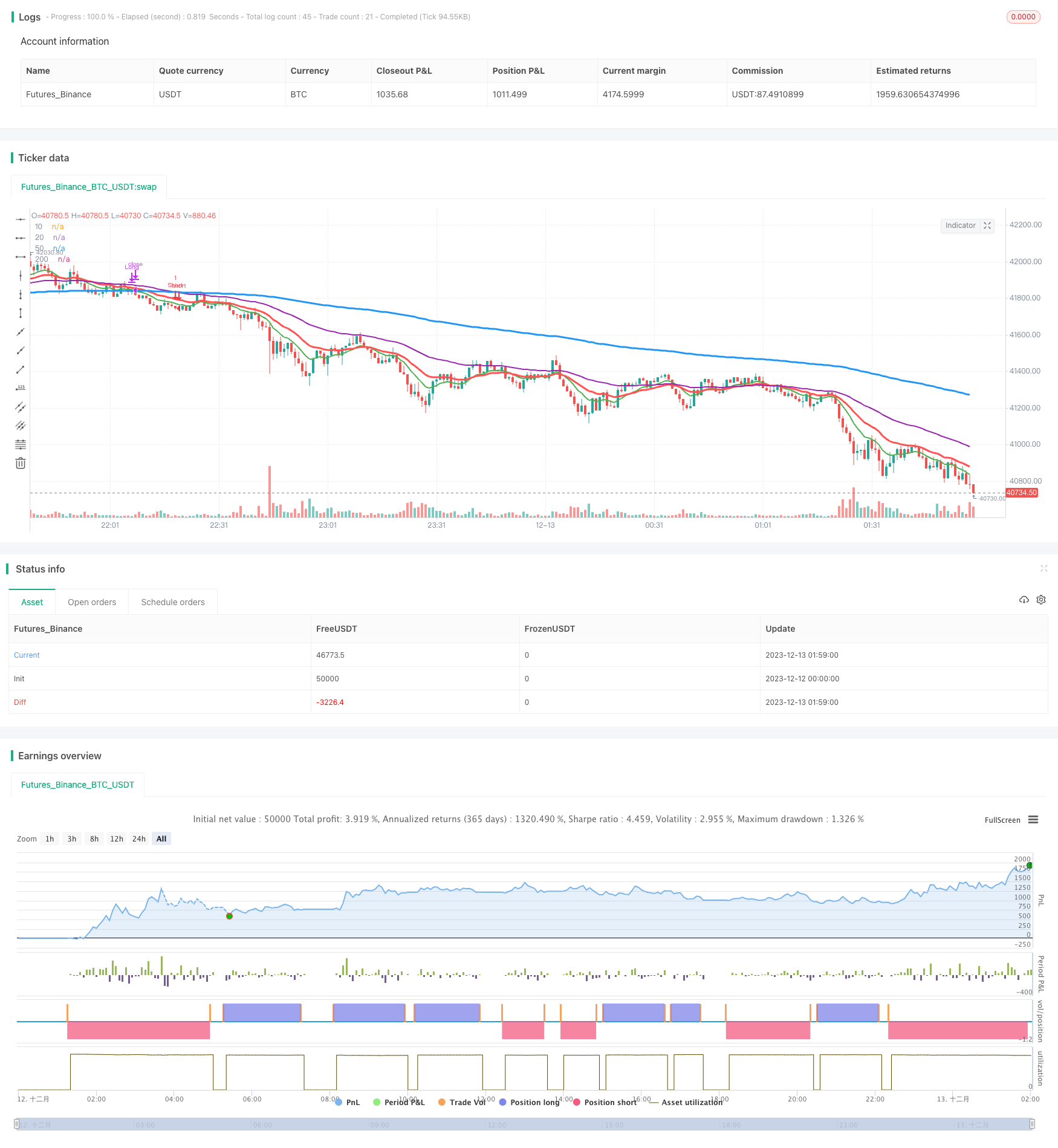

/*backtest

start: 2023-12-12 00:00:00

end: 2023-12-13 02:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Advancing Our Basic Strategy", overlay=true)

ema10 = ema(close, 10)

ema20 = ema(close, 20)

ema50 = ema(close, 50)

ema200 = ema(close, 200)

long = ema10 > ema200 and ema20 > ema50

short = ema10 < ema200 and ema20 < ema50

longcondition = long and long[10] and not long[11]

shortcondition = short and short[10] and not short[11]

closelong = ema10 < ema200 or ema20 < ema50 and not long[11]

closeshort = ema10 > ema200 or ema20 > ema50 and not short[11]

plot(ema10, title="10", color=green, linewidth=2)

plot(ema20, title="20", color=red, linewidth=3)

plot(ema50, title="50", color=purple, linewidth=2)

plot(ema200, title="200", color=blue, linewidth=3)

testPeriodStart = timestamp(2018,8,1,0,0)

testPeriodStop = timestamp(2038,8,30,0,0)

if time >= testPeriodStart and time <= testPeriodStop

strategy.entry("Long", strategy.long, 1, when=longcondition)

strategy.entry("Short", strategy.short, 1, when=shortcondition)

strategy.close("Long", when = closelong)

strategy.close("Short", when = closeshort)

Detail

https://www.fmz.com/strategy/435955

Last Modified

2023-12-20 13:59:38