Name

基于双均线反转跟踪策略Dual-Moving-Average-Reversal-Tracking-Strategy

Author

ChaoZhang

Strategy Description

双均线反转跟踪策略是一种利用移动平均线交叉作为交易信号的量化交易策略。该策略结合了MACD指标的快慢均线差值及其信号线,以及成交量的多空比例判断,形成交易信号,以捕捉市场反转机会。

该策略主要判断快线和慢线的关系,当快线上穿慢线时生成做多信号,快线下穿慢线时生成做空信号。此外,还会结合MACD差值的多空状态、差值和信号线的关系、成交量的多空情况等综合判断市场的多空状态。

具体来说,策略会判断MACD差值的大小和方向、差值和信号线的交叉情况、差值和信号线方向一致或相反的情况等。这些情况反映了市场的subidabubb急跌反弹特征。此外,成交量的多空分布也会作为辅助判断指标。

当判断到差值和信号线显示市场反转信号,且成交量对应确认市场反转时,就会产生交易策略。

- 利用双均线交叉判断市场反转点,爬虫理论依据稳固

- 结合成交量判断,避免假突破

- MACD指标判断 subsection 态势,识别反弹特征

- Parameters 部分控制策略灵活度高

-

双均线交叉造成 whipsaw 问题

- 调整均线参数,增大Threshold

-

成交量无法完全过滤假突破

- 结合副指标如OBV判断真实成交量趋势

-

无法判断subsection调整的深度与力度

- 增加止损,评估重要支持位

-

利用机器学习模型代替规则判断

- 提高策略鲁棒性,降低过拟合

-

增加止损止盈技巧

- 锁定部分利润,降低风险

-

结合情绪指标、消息面分析

- 提高模型判断准确性

-

移植到其他品种、市场

- 测试策略扩展性

双均线反转跟踪策略综合考量了均线指标、MACD指标和成交量指标,通过捕捉其反转信号,选择合适的反转点建立持仓。策略优化空间还很大,可通过机器学习和风控手段进一步增强策略稳定性和收益率。

||

The Dual Moving Average Reversal Tracking strategy is a quantitative trading strategy that utilizes moving average crossovers as trading signals. The strategy combines the MACD indicator's fast and slow moving average difference and its signal line, as well as the long/short ratio of trading volumes, to form trading signals and capture market reversal opportunities.

The strategy mainly judges the relationship between the fast line and slow line. It generates a buy signal when the fast line crosses above the slow line, and a sell signal when the fast line crosses below the slow line. In addition, it also comprehensively judges the market's long/short status based on the long/short state of the MACD difference value, the relationship between the difference and signal line, the long/short situation of trading volumes, etc.

Specifically, the strategy judges the size and direction of the MACD difference value, the crossover between the difference and signal line, the consistent or opposite direction between the difference and signal line, etc. These situations reflect the submarket rebound characteristics after a plunge. In addition, the long/short distribution of trading volumes is also used as an auxiliary judgment indicator.

When the difference and signal line show market reversal signals, and trading volumes correspond to confirm the market reversal, trading signals will be generated.

- Utilize dual moving average crossovers to determine market reversal points, solid theoretical basis

- Incorporate trading volume judgment to avoid false breakouts

- MACD indicator judges subsection sentiment, identifies rebound features

- High flexibility of parameters

- Whipsaw problem caused by moving average crossover

- Adjust moving average parameters, increase threshold

- Trading volumes unable to completely filter false breakouts

- Incorporate secondary indicators like OBV to judge real trading volume trends

- Unable to judge depth and strength of subsection adjustment

- Increase stop loss, evaluate important support areas

- Utilize machine learning models instead of rules-based judgments

- Improve strategy robustness, reduce overfitting

- Increase stop loss and take profit techniques

- Lock in partial profits, reduce risks

- Incorporate sentiment indicators, news analytics

- Improve model judgment accuracy

- Port to other products, markets

- Test strategy extendibility

The Dual Moving Average Reversal Tracking strategy comprehensively considers indicators like moving averages, MACD, and trading volumes. By capturing their reversal signals, appropriate reversal points are selected to establish positions. There is still large room for optimizing this strategy, robustness and profitability can be further improved by techniques like machine learning and risk management.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 0.26 | Signal Bias |

| v_input_2 | 0.8 | MACD Bias |

| v_input_3 | 3 | Short LookBack |

| v_input_4 | 10 | Long LookBack |

Source (PineScript)

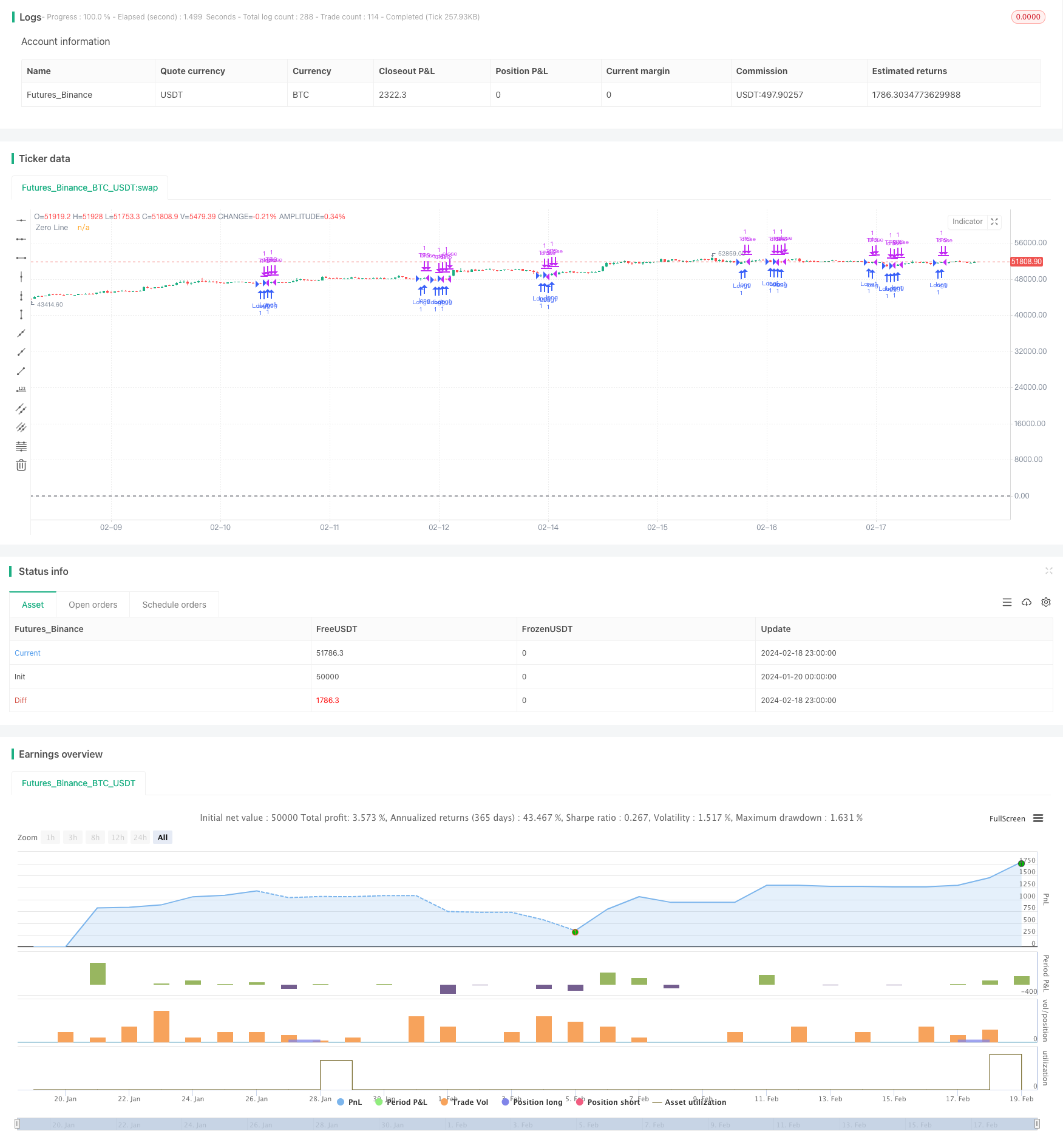

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("3 10 Oscillator Profile Flagging", shorttitle="3 10 Oscillator Profile Flagging", overlay=true)

signalBiasValue = input(title="Signal Bias", defval=0.26)

macdBiasValue = input(title="MACD Bias", defval=0.8)

shortLookBack = input( title="Short LookBack", defval=3)

longLookBack = input( title="Long LookBack", defval=10)

fast_ma = ta.sma(close, 3)

slow_ma = ta.sma(close, 10)

macd = fast_ma - slow_ma

signal = ta.sma(macd, 16)

hline(0, "Zero Line", color = color.black)

buyVolume = volume*((close-low)/(high-low))

sellVolume = volume*((high-close)/(high-low))

buyVolSlope = buyVolume - buyVolume[1]

sellVolSlope = sellVolume - sellVolume[1]

signalSlope = ( signal - signal[1] )

macdSlope = ( macd - macd[1] )

//plot(macdSlope, color=color.red, title="Total Volume")

//plot(signalSlope, color=color.green, title="Total Volume")

intrabarRange = high - low

getLookBackSlope(lookBack) => signal - signal[lookBack]

getBuyerVolBias(lookBack) =>

j = 0

for i = 1 to lookBack

if buyVolume[i] > sellVolume[i]

j += 1

j

getSellerVolBias(lookBack) =>

j = 0

for i = 1 to lookBack

if sellVolume[i] > buyVolume[i]

j += 1

j

getVolBias(lookBack) =>

float b = 0

float s = 0

for i = 1 to lookBack

b += buyVolume[i]

s += sellVolume[i]

b > s

getSignalBuyerBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] > signalBiasValue

j += 1

j

getSignalSellerBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] < ( 0 - signalBiasValue )

j += 1

j

getSignalNoBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] < signalBiasValue and signal[i] > ( 0 - signalBiasValue )

j += 1

j

getPriceRising(lookBack) =>

j = 0

for i = 1 to lookBack

if close[i] > close[i + 1]

j += 1

j

getPriceFalling(lookBack) =>

j = 0

for i = 1 to lookBack

if close[i] < close[i + 1]

j += 1

j

getRangeNarrowing(lookBack) =>

j = 0

for i = 1 to lookBack

if intrabarRange[i] < intrabarRange[i + 1]

j+= 1

j

getRangeBroadening(lookBack) =>

j = 0

for i = 1 to lookBack

if intrabarRange[i] > intrabarRange[i + 1]

j+= 1

j

bool isNegativeSignalReversal = signalSlope < 0 and signalSlope[1] > 0

bool isNegativeMacdReversal = macdSlope < 0 and macdSlope[1] > 0

bool isPositiveSignalReversal = signalSlope > 0 and signalSlope[1] < 0

bool isPositiveMacdReversal = macdSlope > 0 and macdSlope[1] < 0

bool hasBearInversion = signalSlope > 0 and macdSlope < 0

bool hasBullInversion = signalSlope < 0 and macdSlope > 0

bool hasSignalBias = math.abs(signal) >= signalBiasValue

bool hasNoSignalBias = signal < signalBiasValue and signal > ( 0 - signalBiasValue )

bool hasSignalBuyerBias = hasSignalBias and signal > 0

bool hasSignalSellerBias = hasSignalBias and signal < 0

bool hasPositiveMACDBias = macd > macdBiasValue

bool hasNegativeMACDBias = macd < ( 0 - macdBiasValue )

bool hasBullAntiPattern = ta.crossunder(macd, signal)

bool hasBearAntiPattern = ta.crossover(macd, signal)

bool hasSignificantBuyerVolBias = buyVolume > ( sellVolume * 1.5 )

bool hasSignificantSellerVolBias = sellVolume > ( buyVolume * 1.5 )

// 7.48 Profit 52.5%

if ( hasSignificantBuyerVolBias and getPriceRising(shortLookBack) == shortLookBack and getBuyerVolBias(shortLookBack) == shortLookBack and hasPositiveMACDBias and hasBullInversion)

strategy.entry("Short1", strategy.short)

strategy.exit("TPS", "Short1", limit=strategy.position_avg_price - 0.75, stop=strategy.position_avg_price + 0.5)

// 32.53 Profit 47.91%

if ( getPriceFalling(shortLookBack) and (getVolBias(shortLookBack) == false) and signalSlope < 0 and hasSignalSellerBias)

strategy.entry("Long1", strategy.long)

strategy.exit("TPS", "Long1", limit=strategy.position_avg_price + 0.75, stop=strategy.position_avg_price - 0.5)

Detail

https://www.fmz.com/strategy/442274

Last Modified

2024-02-20 17:08:43