Name

基于双均线的长线反转策略Dual-Moving-Average-Reversal-Strategy

Author

ChaoZhang

Strategy Description

该策略主要利用了14和28日的简单移动平均线形成的黄金交叉和死亡交叉进行反转操作。当快均线从下方向上突破慢均线时,表明行情开始反转,可以建立多头仓位;当快均线从上方向下跌破慢均线时,表明行情开始反转,可以建立空头仓位。

由于其利用简单移动平均线来判断市场趋势变化的原理,我将该策略命名为“基于双均线的长线反转策略”。

该策略的核心逻辑在于利用 14 日和 28 日两条不同期限的简单移动平均线来判断市场趋势,具体规则如下:

-

定义快线为 14 日简单移动平均线,慢线定义为 28 日简单移动平均线。

-

当快线从下方向上突破慢线时,为多头信号,做多入场。

-

当快线从上方向下跌破慢线时,为空头信号,做空入场。

-

做多/做空后,快线重新跌破慢线时,为平仓信号。

该策略同时结合止损、止盈、跟踪止盈进行风险管理。针对做多和做空情况,分别定义了长仓止损价格、做多止盈价格、做空止盈价格、长仓跟踪止盈价格。这些参数都通过百分比形式设置,使策略更加灵活。

- 利用双均线判断市场主要趋势的策略,原理简单清晰,容易理解和验证。

- 快慢均线的周期设置为 14 和 28 日 ,分别代表短期和中期趋势转换,能较好发现反转机会。

- 结合止盈、止损和跟踪止盈来控制风险,使盈利能够锁定,避免亏损扩大。

- 可同时做多做空,满足不同市场环境的需要。

- 双均线交叉具有一定滞后性,可能错过最佳入场时机。

- 长短均线交叉容易发生误信号,应避免设置太短的均线周期。

- 停损距离设置太小可能增加止损被冲击的概率。应根据不同品种合理设置止损距离。

- 可引入更多指标进行组合,提高策略的稳健性。例如加入布林带判定趋势,或引入MACD校验入场时机。

- 测试不同的均线参数组合,寻找更匹配该品种特性的均线周期。

- 测试不同的止损距离设置,找到最优止损位置。

- 测试加入其他指标进行优化,寻找最优参数组合以减少误信号。

- 优化仓位管理规则,使盈利更加丰厚。

该策略整体来说是一个非常经典的基于双均线判断趋势反转的策略。它有着操作原理简单,较易掌握等优势;同时也存在一些后期可以持续优化的方向。总体而言,该策略从原理和操作上都较为成熟,是量化交易的一个很好的入门策略。

||

This strategy mainly utilizes the golden cross and death cross formed by the 14-day and 28-day simple moving averages to make reversal operations. When the fast moving average crosses above the slow moving average from below, it indicates the market is starting to reverse and a long position can be established. When the fast moving average crosses below the slow moving average from above, it also signals the market is reversing and a short position can be taken.

Since it uses the principle of using simple moving averages to determine changes in market trends, I named this strategy "Dual Moving Average Reversal Strategy".

The core logic of this strategy is to use 14-day and 28-day simple moving averages with different periods to determine market trends. The specific rules are as follows:

-

The fast line is defined as the 14-day simple moving average and the slow line is defined as the 28-day simple moving average.

-

When the fast line crosses above the slow line from below, it gives a bullish signal to go long.

-

When the fast line crosses below the slow line from above, it gives a bearish signal to go short.

-

After going long/short, when the fast line crosses below/above the slow line again, it gives the signal to close positions.

This strategy also incorporates stop loss, take profit and trailing stop loss for risk management. For long and short positions, stop loss price, long take profit price, short take profit and trailing stop loss price are defined separately in percentage form to make the strategy more flexible.

-

The strategy judges market main trends using dual moving averages, with simple and clear principles easy to understand and verify.

-

The moving average periods are set at 14 and 28 days, representing short-term and medium-term trend changes respectively, which can better discover reversal opportunities.

-

By incorporating take profit, stop loss and trailing stop loss to control risks, it allows profits to be locked in and avoids loss magnification.

-

It can go both long and short to meet the needs of different market environments.

-

Dual moving average crossovers have some laggingness, possibly missing the best entry timing.

-

Crossovers between short and long moving averages are prone to generating false signals. Avoid setting very short moving average periods.

-

If the stop loss distance is set too small, it may increase the probability of stops being hit. Reasonable stop loss distances should be set according to different products.

-

More indicators can be introduced to form a combination and improve the strategy's robustness. For example, adding Bollinger Bands to judge trends, or introducing MACD to verify entry timing.

-

Test different moving average parameter combinations to find periods that match the characteristics of the product better.

-

Test different stop loss distance settings to find the optimal stop loss location.

-

Test the addition of other indicators for optimization to find the optimal parameter combination to reduce false signals.

-

Optimize position sizing rules for more sizable profits.

Overall this is a very classic strategy based on dual moving averages to determine trend reversals. It has advantages like simple operating principles and relatively easy to grasp. At the same time, there are also some directions that can be continuously optimized afterwards. In general, this strategy is quite mature in terms of principles and operations, making it a very good introductory quantitative trading strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | (ZIG) Enable Alert message {True} |

| v_input_2 | 0 | (ZIG) Integration type: ZIGTVONLYINTEGRATION |

| v_input_3 | 0 | (ZIG) Provider type: ZIGCOPYTRADERPROVIDER |

| v_input_4 | 0 | (STRAT) Strategy Type: L |

| v_input_5 | true | (DEBUG) Enable debug on order comments {True} |

| v_input_6 | false | (STOPTAKE) Take Profit? {false} |

| v_input_7 | true | (STOPTAKE) Stop Loss? {True} |

| v_input_8 | true | (TRAILING) Enable Trailing Take Profit (%) {True} |

| v_input_9 | 1.1 | (STOPTAKE) Take Profit % {3.0} |

| v_input_10 | 2 | (STOPTAKE) Stop Loss % {2.0} |

| v_input_11 | 1.2 | (TRAILING) Trailing Take Profit Trigger (%) {2.5} |

| v_input_12 | 25 | (TRAILING) Trailing Take Profit as a percentage of Trailing Take Profit Trigger (%) {25.0} |

| v_input_13 | 0 | (ZIG) Zignaly Alert Type {WebHook}: ZIGNALYW |

| v_input_14 | 0 | (ZIG) Exchange: Binance,ZIGEXKUCOIN |

| v_input_15 | 0 | (ZIG) Exchange Type {Spot}: spot,ZIGEXFUTURES |

| v_input_16 | true | (ZIG) Leverage {1} |

| v_input_17 | 2 | Number of decimal digits for Prices {2} |

| v_input_18 | 3 | (DECIMAL) Maximum number of decimal for contracts {3} |

| v_input_19 | 6 | (RECENT) Number of minutes to wait to open a new order after the previous one has been opened {6} |

| v_input_20 | 100 | (CAPITAL) Capital quote invested per order in USDT units {100.0} |

| v_input_21 | 25 | (CAPITAL) Capital percentage invested per order (%) {25.0} |

Source (PineScript)

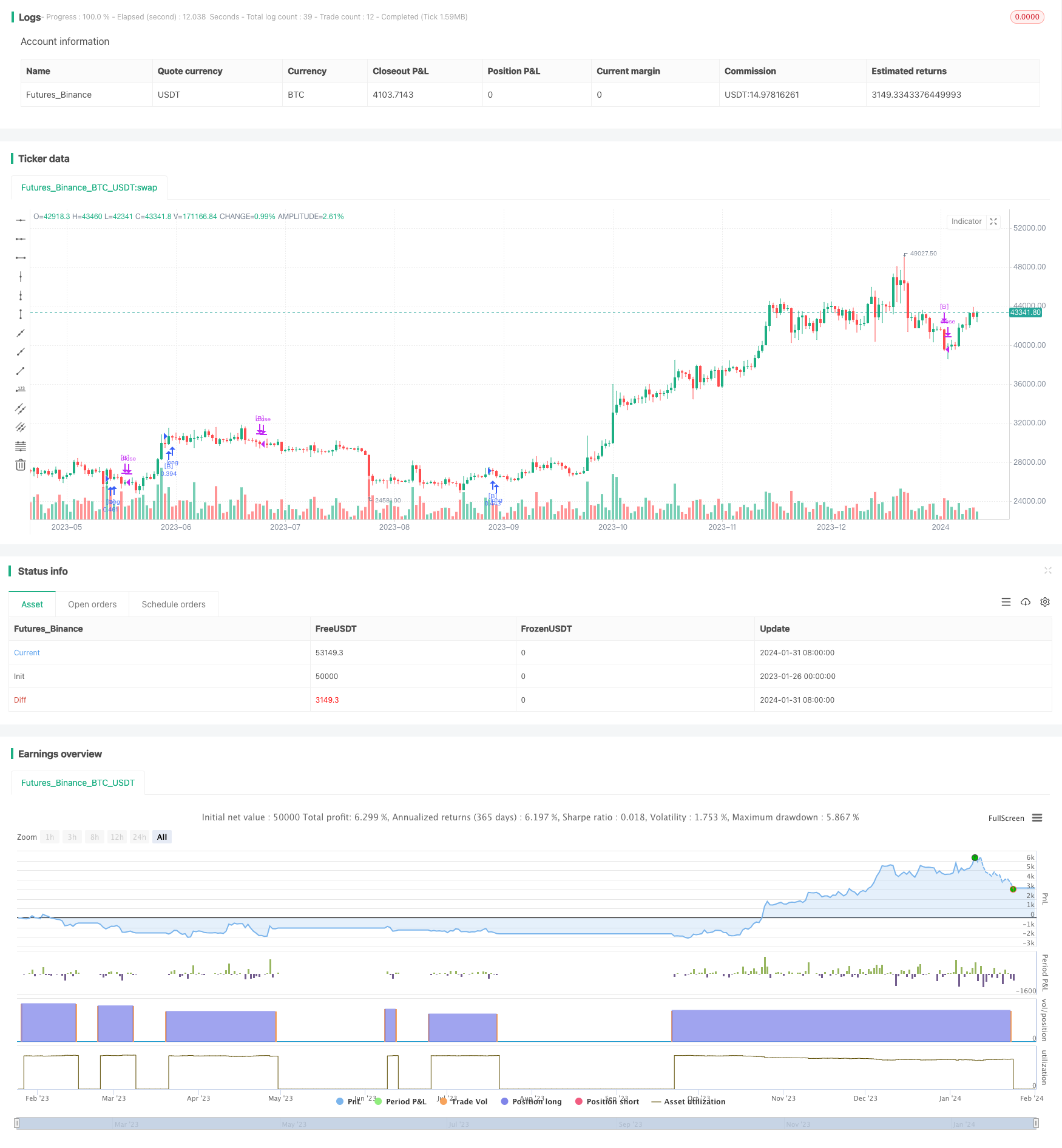

/*backtest

start: 2023-01-26 00:00:00

end: 2024-02-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ruckard

//@version=4

// Current version: v20201031 ( A061 )

// Tradingview Public description - BEGIN

//

// This strategy serves as a beginner's guide to connect TradingView signals to Zignaly Crypto Trading Platform.

//

// It was originally tested at BTCUSDT pair and 1D timeframe.

// The strategy is a slightly modified copy of default TradingView strategy that appears when you create a blank new strategy.

// It decides to go long when 14-period SMA crosses over 28-period SMA and goes short when 14-period SMA crosses under 28-period SMA.

//

// Before using this documentation it's recommended that you:

// [LIST]

// [*] Use default TradingView strategy script or another script and setup its associated alert manually. Just make the alert pop-up in the screen.

// [*] Create a 'Copy-Trader provider' (or Signal Provider) in Zignaly and send signals to it either thanks to your browser or with some basic programming.

// [/LIST]

// [B]SETTINGS[/B]

// [B]__ SETTINGS - Capital[/B]

// [LIST]

// [*] (CAPITAL) Capital quote invested per order in USDT units {100.0}. This setting is only used when '(ZIG) Provider type' is set to 'Signal Provider'.

// [*] (CAPITAL) Capital percentage invested per order (%) {25.0}. This setting is only used when '(ZIG) Provider type' is set to 'Copy Trader Provider'.

// [/LIST]

// [B]__ SETTINGS - Misc[/B]

// [LIST]

// [*] (ZIG) Enable Alert message {True}: Whether to enable alert message or not.

// [*] (DEBUG) Enable debug on order comments {True}: Whether to show alerts on order comments or not.

// [*] Number of decimal digits for Prices {2}.

// [*] (DECIMAL) Maximum number of decimal for contracts {3}.

// [/LIST]

// [B]__ SETTINGS - Zignaly[/B]

// [LIST]

// [*] (ZIG) Integration type {TradingView only}: [b]Hybrid[/b]: Both TradingView and Zignaly handle take profit, trailing stops and stop losses. Useful if you are scared about TradingView not firing an alert. It might arise problems if TradingView and Zignaly get out of sync. [b]TradingView only[/b]: TradingView sends entry and exit orders to Zignaly so that Zignaly only buys or sells. Zignaly won't handle stop loss or other settings on its own.

// [*] (ZIG) Zignaly Alert Type {WebHook}: 'Email' or 'WebHook'.

// [*] (ZIG) Provider type {Copy Trader Provider}: 'Copy Trader Provider' or 'Signal Provider'. 'Copy Trader Provider' sends a percentage to manage. 'Signal Provider' sends a quote to manage.

// [*] (ZIG) Exchange: 'Binance' or 'Kucoin'.

// [*] (ZIG) Exchange Type {Spot}: 'Spot' or 'Futures'.

// [*] (ZIG) Leverage {1}. Set it to '1' when '(ZIG) Exchange Type' is set to 'Spot'.

// [/LIST]

// [B]__ SETTINGS - Strategy[/B]

// [LIST]

// [*] (STRAT) Strategy Type: 'Long and Short', 'Long Only' or 'Short Only'.

// [*] (STOPTAKE) Take Profit? {false}: Whether to enable Take Profit.

// [*] (STOPTAKE) Stop Loss? {True}: Whether to enable Stop Loss.

// [*] (TRAILING) Enable Trailing Take Profit (%) {True}: Whether to enable Trailing Take Profit.

// [*] (STOPTAKE) Take Profit % {3.0}: Take profit percentage. This setting is only used when '(STOPTAKE) Take Profit?' setting is set to true.

// [*] (STOPTAKE) Stop Loss % {2.0}: Stop loss percentage. This setting is only used when '(STOPTAKE) Stop Loss?' setting is set to true.

// [*] (TRAILING) Trailing Take Profit Trigger (%) {2.5}: Trailing Stop Trigger Percentage. This setting is only used when '(TRAILING) Enable Trailing Take Profit (%)' setting is set to true.

// [*] (TRAILING) Trailing Take Profit as a percentage of Trailing Take Profit Trigger (%) {25.0}: Trailing Stop Distance Percentage. This setting is only used when '(TRAILING) Enable Trailing Take Profit (%)' setting is set to true.

// [*] (RECENT) Number of minutes to wait to open a new order after the previous one has been opened {6}.

// [/LIST]

// [B]DEFAULT SETTINGS[/B]

// By default this strategy has been setup with these beginner settings:

// [LIST]

// [*] '(ZIG) Integration type' : TradingView only

// [*] '(ZIG) Provider type' : 'Copy Trader Provider'

// [*] '(ZIG) Exchange' : 'Binance'

// [*] '(ZIG) Exchange Type' : 'Spot'

// [*] '(STRAT) Strategy Type' : 'Long Only'

// [*] '(ZIG) Leverage' : '1' (Or no leverage)

// [/LIST]

// but you can change those settings if needed.

// [B]FIRST STEP[/B]

// [LIST]

// [*] For both future or spot markets you should make sure to change '(ZIG) Zignaly Alert Type' to match either WebHook or Email. If you have a non paid account in TradingView as in October 2020 you would have to use Email which it's free to use.

// [/LIST]

// [B]RECOMMENDED SETTINGS[/B]

// [B]__ RECOMMENDED SETTINGS - Spot markets[/B]

// [LIST]

// [*] '(ZIG) Exchange Type' setting should be set to 'Spot'

// [*] '(STRAT) Strategy Type' setting should be set to 'Long Only'

// [*] '(ZIG) Leverage' setting should be set to '1'

// [/LIST]

// [B]__ RECOMMENDED SETTINGS - Future markets[/B]

// [LIST]

// [*] '(ZIG) Exchange Type' setting should be set to 'Futures'

// [*] '(STRAT) Strategy Type' setting should be set to 'Long and Short'

// [*] '(ZIG) Leverage' setting might be changed if desired.

// [/LIST]

// [B]__ RECOMMENDED SETTINGS - Signal Providers[/B]

// [LIST]

// [*] '(ZIG) Provider type' setting should be set to 'Signal Provider'

// [*] '(CAPITAL) Capital quote invested per order in USDT units' setting might be changed if desired.

// [/LIST]

// [B]__ RECOMMENDED SETTINGS - Copy Trader Providers[/B]

// [LIST]

// [*] '(ZIG) Provider type' setting should be set to 'Copy Trader Provider'

// [*] '(CAPITAL) Capital percentage invested per order (%)' setting might be changed if desired.

// [*] Strategy Properties setting: 'Initial Capital' might be changed if desired.

// [/LIST]

// [B]INTEGRATION TYPE EXPLANATION[/B]

// [LIST]

// [*] 'Hybrid': Both TradingView and Zignaly handle take profit, trailing stops and stop losses. Useful if you are scared about TradingView not firing an alert. It might arise problems if TradingView and Zignaly get out of sync.

// [*] 'TradingView only': TradingView sends entry and exit orders to Zignaly so that Zignaly only buys or sells. Zignaly won't handle stop loss or other settings on its own.

// [/LIST]

// [B]HOW TO USE THIS STRATEGY[/B]

// [LIST]

// [*] Beginner: Copy and paste the strategy and change it to your needs. Turn off '(DEBUG) Enable debug on order comments' setting.

// [*] Medium: Reuse functions and inputs from this strategy into your own as if it was a library.

// [*] Advanced: Check Strategy Tester. List of trades. Copy and paste the different suggested 'alert_message' variable contents to your script and change them to your needs.

// [*] Expert: You needed a way to pass data from TradingView script to the alert. Now you know it's the 'alert_message' variable. You can find several examples in the source code using the variable. You also have seen 'ALERTS SETUP' explanation below. An additional quick look at 'Strategy Tester', 'List of Trades' and you are ready to go.

// [/LIST]

// [B] ALERTS SETUP[/B]

// This is the important piece of information that allows you to connect TradingView to Zignaly in a semi-automatic manner.

// [B] __ ALERTS SETUP - WebHook[/B]

// [LIST]

// [*] Webhook URL: https : // zignaly . com / api / signals.php?key=MYSECRETKEY

// [*] Message: { {{strategy.order.alert_message}} , "key" : "MYSECRETKEY" }

// [/LIST]

// [B] __ ALERTS SETUP - Email[/B]

// [LIST]

// [*] Setup a new Hotmail account

// [*] Add it as an 'SMS email' in TradingView Profile settings page.

// [*] Confirm your own the email address

// [*] Create a rule in your Hotmail account that 'Redirects' (not forwards) emails to 'signals @ zignaly . email' when (1): 'Subject' includes 'Alert', (2): 'Email body' contains string 'MYZIGNALYREDIRECTTRIGGER' and (3): 'From' contains 'noreply @ tradingview . com'.

// [*] In 'More Actions' check: Send Email-to-SMS

// [*] Message: ||{{strategy.order.alert_message}}||key=MYSECRETKEY||

// MYZIGNALYREDIRECTTRIGGER

// [/LIST]

// '(DEBUG) Enable debug on order comments' is turned on by default so that you can see in the Strategy Tester. List of Trades. The different orders alert_message that would have been sent to your alert. You might want to turn it off it some many letters in the screen is problem.

// [B]STRATEGY ADVICE[/B]

// [LIST]

// [*] If you turn on 'Take Profit' then turn off 'Trailing Take Profit'.

// [/LIST]

//

// [B]ZIGNALY SIDE ADVICE[/B]

// [LIST]

// [*] If you are a 'Signal Provider' make sure that 'Allow reusing the same signalId if there isn't any open position using it?' setting in the profile tab is set to true.

// [*] You can find your 'MYSECRETKEY' in your 'Copy Trader/Signal' provider Edit tab at 'Signal URL'.

// [/LIST]

//

// [B]ADDITIONAL ZIGNALY DOCUMENTATION[/B]

// This beginner's guide is quite basic and meant to be an introduction. Please read additional documentation to learn what you actually can do with Zignaly.

// [LIST]

// [*] docs . zignaly . com / signals / how-to -- How to send signals to Zignaly

// [*] 3 Ways to send signals to Zignaly

// [*] SIGNALS

// [/LIST]

//

// [B]FINAL REMARKS[/B]

// [LIST]

// [*] This strategy tries to match the Pine Script Coding Conventions as best as possible.

// [*] You can check my 'Ruckard TradingLatino' strategy for a more complex strategy that it's also integrated with Zignaly. Unfortunatley it does not use Pine Script Coding Conventions as much.

// [/LIST]

// Tradingview Public description - END

strategy("Zignaly Tutorial A061", shorttitle="A061ZigTuto", overlay=true, max_bars_back=5000, calc_on_order_fills=false, calc_on_every_tick=false, pyramiding=0, initial_capital=1000, slippage=1, commission_type=strategy.commission.percent, commission_value=0.1)

// INPUTS - BEGIN

// Strategy - Inputs

i_enableZignalyAlert = input(true, "(ZIG) Enable Alert message {True}")

_ZIGHYBRIDINTEGRATION_ = "Hybrid" , _ZIGTVONLYINTEGRATION_ = "TradingView only"

i_zignalyIntegrationType = input(_ZIGTVONLYINTEGRATION_, "(ZIG) Integration type", options=[_ZIGTVONLYINTEGRATION_, _ZIGHYBRIDINTEGRATION_])

_ZIGSIGNALPROVIDER_ = "Signal Provider" , _ZIGCOPYTRADERPROVIDER_ = "Copy Trader Provider"

i_zignalyProviderType = input(_ZIGCOPYTRADERPROVIDER_, "(ZIG) Provider type", options=[_ZIGSIGNALPROVIDER_, _ZIGCOPYTRADERPROVIDER_])

L_S = "Long and Short" , _L_ = "Long Only" , _S_ = "Short Only"

i_strategyType = input(_L_, "(STRAT) Strategy Type", options=[L_S, _L_, _S_])

// Order comments based debug

i_enableOrderCommentDebug = input(true, title="(DEBUG) Enable debug on order comments {True}", type=input.bool)

i_enableTakeProfit = input(false, "(STOPTAKE) Take Profit? {false}")

i_enableStopLoss = input(true, "(STOPTAKE) Stop Loss? {True}")

i_enableTrailingTakeProfit = input(true, title="(TRAILING) Enable Trailing Take Profit (%) {True}", type=input.bool)

i_TakeProfit = input(1.1, title="(STOPTAKE) Take Profit % {3.0}") / 100

i_StopLoss = input(2.0, title="(STOPTAKE) Stop Loss % {2.0}", minval=0.01 ) / 100

// Trailing Take Profit - Inputs

i_trailingTakeProfitPercentageTrigger = input(1.2, "(TRAILING) Trailing Take Profit Trigger (%) {2.5}",minval=0,step=0.01,type=input.float) * 0.01

i_trailingTakeProfitPercentageOffset = input(25.0, "(TRAILING) Trailing Take Profit as a percentage of Trailing Take Profit Trigger (%) {25.0}",minval=0,step=0.01,type=input.float) * 0.01

// Zignaly - Email (zignalye)

_ZIGNALYE_="Email", _ZIGNALYW_="WebHook"

i_zignalyAlertType = input(_ZIGNALYW_, "(ZIG) Zignaly Alert Type {WebHook}", options=[_ZIGNALYW_, _ZIGNALYE_])

_ZIGEXBINANCE_ = "Binance" , _ZIGEXKUCOIN_ = "Kucoin"

i_zignalyExchange = input(_ZIGEXBINANCE_, "(ZIG) Exchange", options=[_ZIGEXBINANCE_, _ZIGEXKUCOIN_])

_ZIGEXTYPESPOT_ = "spot" , _ZIGEXFUTURES_ = "futures"

i_zignalyExchangeType = input(_ZIGEXTYPESPOT_, "(ZIG) Exchange Type {Spot}", options=[_ZIGEXTYPESPOT_, _ZIGEXFUTURES_])

i_zignalyLeverage = input(1, "(ZIG) Leverage {1}",minval=1,step=1,maxval=125,type=input.integer)

var i_zignalyLeverage_str = tostring(i_zignalyLeverage) // It needs to run only once

i_priceDecimalDigits = input(2, "Number of decimal digits for Prices {2}", minval=0, maxval=10, step=1)

// Decimal - Inputs

i_contractMaximumDecimalNumber = input(3, title="(DECIMAL) Maximum number of decimal for contracts {3}",minval=0)

i_tooRecentMinutesNumber = input(6, "(RECENT) Number of minutes to wait to open a new order after the previous one has been opened {6}", minval=1, maxval=100, step=1)

i_CapitalQuote = input(100.0, title="(CAPITAL) Capital quote invested per order in USDT units {100.0}")

i_CapitalPercentage = input(25.0, title="(CAPITAL) Capital percentage invested per order (%) {25.0}",minval=0,step=0.01,type=input.float) * 0.01

// INPUTS - END

// Strategy - INIT - BEGIN

// Dynamic Trailing Take Profit - Variables

var int buyOrderOpenBarIndex = na

var int sellOrderOpenBarIndex = na

var float buyStopLoss = na

var float sellStopLoss = na

var float newBuyStopLoss = na

var float newSellStopLoss = na

// Handle to avoid two long and short orders being too next to each other

var bool _oldInsideABuyOrder = false

var bool oldInsideASellOrder = false

var bool insideABuyOrder = false

var bool insideASellOrder = false

_oldInsideABuyOrder := insideABuyOrder

oldInsideASellOrder := insideASellOrder

var int lastOrderOpenBarTime = na

// Handle recalculate after Stop Loss / Take Profit order

if (strategy.position_size == 0.0)

insideABuyOrder := false

insideASellOrder := false

else

lastOrderOpenBarTime := time_close

// Zignaly

exchangeTickerID = syminfo.basecurrency + syminfo.currency

var string zignalySeparator = ","

var string zignalyQuote = "\""

var string zignalyEquals = "="

if ( i_zignalyAlertType == _ZIGNALYE_)

zignalySeparator := "||"

zignalyQuote := ""

zignalyEquals := "="

else

zignalySeparator := ","

zignalyQuote := "\""

zignalyEquals := ":"

zignalyCommonAlertMessage = zignalyQuote + "exchange" + zignalyQuote + zignalyEquals + zignalyQuote + i_zignalyExchange + zignalyQuote + zignalySeparator + zignalyQuote + "exchangeAccountType" + zignalyQuote + zignalyEquals + zignalyQuote + i_zignalyExchangeType + zignalyQuote + zignalySeparator + zignalyQuote + "pair" + zignalyQuote + zignalyEquals + zignalyQuote + "" + exchangeTickerID + zignalyQuote + zignalySeparator + zignalyQuote + "leverage" + zignalyQuote + zignalyEquals + zignalyQuote + i_zignalyLeverage_str + zignalyQuote

var string tmpOrderComment = na

var string tmpOrderAlertMessage = na

var int i_tooRecentMinutesNumber_ms = i_tooRecentMinutesNumber * 60 * 1000 // Convert minutes into milliseconds only once

// Strategy - INIT - END

// FUNCTIONS - BEGIN

// Decimals - Functions

f_getContractMultiplier(_contractMaximumDecimalNumber) =>

_contractMultiplier = 1

if (_contractMaximumDecimalNumber == 0)

_contractMultiplier // Return 1

else

for _counter = 1 to _contractMaximumDecimalNumber

_contractMultiplier:= _contractMultiplier * 10

_contractMultiplier

f_priceDecimalDigitsZeroString () =>

// Dependencies: i_priceDecimalDigits (initialized in inputs).

_zeroString = ""

if not (i_priceDecimalDigits == 0)

for _digit = 1 to i_priceDecimalDigits

_zeroString := _zeroString + "0"

_zeroString

// Zignalye - Functions - BEGIN

f_getZignalyLongAlertMessage(_entryQuantityContractsUSDT, _currentCapital) =>

// Dependencies: i_enableStopLoss (initialized in inputs).

// Dependencies: i_enableTakeProfit (initialized in inputs).

// Dependencies: i_TakeProfit (initialized in inputs).

// Dependencies: i_enableTrailingTakeProfit (initialized in inputs).

// Dependencies: i_trailingTakeProfitPercentageOffset (initialized in inputs).

// Dependencies: i_trailingTakeProfitPercentageTrigger (initialized in inputs).

// Dependencies: i_zignalyIntegrationType (initialized in inputs).

// Function Dependencies: f_priceDecimalDigitsZeroString()

var string _zignaleStopLossCombo = ""

var string _zignaleTakeProfitCombo = ""

var string _zignaleTrailingTakeProfitCombo = ""

_zignalyLongCommonAlertMessage = zignalyQuote + "type" + zignalyQuote + zignalyEquals + zignalyQuote + "entry" + zignalyQuote + zignalySeparator + zignalyQuote + "side" + zignalyQuote + zignalyEquals + zignalyQuote + "long" + zignalyQuote + zignalySeparator + zignalyQuote + "orderType" + zignalyQuote + zignalyEquals + zignalyQuote + "market" + zignalyQuote + zignalySeparator + zignalyQuote + "signalId" + zignalyQuote + zignalyEquals + zignalyQuote + "LONG-" + exchangeTickerID + zignalyQuote

float _floatEntryQuantityContractsUSDT = _entryQuantityContractsUSDT

_entryQuantityContractsUSDTStr = tostring(_entryQuantityContractsUSDT, "0." + f_priceDecimalDigitsZeroString())

float _floatCurrentCapital = _currentCapital

float _entryQuantityContractsPercent = (_floatEntryQuantityContractsUSDT / _floatCurrentCapital) * 100.00

_entryQuantityContractsPercentStr = tostring(_entryQuantityContractsPercent, "0." + f_priceDecimalDigitsZeroString())

// This is actually not needed because with pyramiding=0 it's impossible that an order is scaled (and thus modified)

float _constantBuyStopLoss = na

if (_oldInsideABuyOrder and insideABuyOrder)

_constantBuyStopLoss := buyStopLoss

else

_constantBuyStopLoss := newBuyStopLoss

if (i_enableStopLoss and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleStopLossCombo := zignalySeparator + zignalyQuote + "stopLossPercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "-" + tostring((nz(_constantBuyStopLoss) * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleStopLossCombo := ""

if (i_enableTakeProfit and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleTakeProfitCombo := zignalySeparator + zignalyQuote + "takeProfitPercentage1" + zignalyQuote + zignalyEquals + zignalyQuote + "" + tostring((i_TakeProfit * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleTakeProfitCombo := ""

if (i_enableTrailingTakeProfit and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleTrailingTakeProfitCombo := zignalySeparator + zignalyQuote + "trailingStopDistancePercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "-" + tostring((i_trailingTakeProfitPercentageOffset * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote + zignalySeparator + zignalyQuote + "trailingStopTriggerPercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + tostring((i_trailingTakeProfitPercentageTrigger * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleTrailingTakeProfitCombo := ""

var string _message = ""

if (i_zignalyProviderType == _ZIGCOPYTRADERPROVIDER_)

_message :=

zignalyCommonAlertMessage +

zignalySeparator +

_zignalyLongCommonAlertMessage +

zignalySeparator +

zignalyQuote + "positionSizePercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + _entryQuantityContractsPercentStr + zignalyQuote +

_zignaleStopLossCombo +

_zignaleTakeProfitCombo +

_zignaleTrailingTakeProfitCombo

else // _ZIGSIGNALPROVIDER_

_message :=

zignalyCommonAlertMessage +

zignalySeparator +

_zignalyLongCommonAlertMessage +

zignalySeparator +

zignalyQuote + "positionSizeQuote" + zignalyQuote + zignalyEquals + zignalyQuote + "" + _entryQuantityContractsUSDTStr + zignalyQuote +

_zignaleStopLossCombo +

_zignaleTakeProfitCombo +

_zignaleTrailingTakeProfitCombo

_message

f_getZignalyLongCloseAlertMessage() =>

// Dependencies: zignalyQuote

// Dependencies: zignalyEquals

// Dependencies: zignalySeparator

// Dependencies: zignalyCommonAlertMessage

_zignalyLongCloseCommonAlertMessage = zignalyQuote + "type" + zignalyQuote + zignalyEquals + zignalyQuote + "exit" + zignalyQuote + zignalySeparator + zignalyQuote + "side" + zignalyQuote + zignalyEquals + zignalyQuote + "long" + zignalyQuote + zignalySeparator + zignalyQuote + "orderType" + zignalyQuote + zignalyEquals + zignalyQuote + "market" + zignalyQuote + zignalySeparator + zignalyQuote + "signalId" + zignalyQuote + zignalyEquals + zignalyQuote + "LONG-" + exchangeTickerID + zignalyQuote

var string _message = ""

_message := zignalyCommonAlertMessage + zignalySeparator + _zignalyLongCloseCommonAlertMessage

_message

f_getZignalyShortAlertMessage(_entryQuantityContractsUSDT, _currentCapital) =>

// Dependencies: i_enableStopLoss (initialized in inputs).

// Dependencies: i_enableTakeProfit (initialized in inputs).

// Dependencies: i_TakeProfit (initialized in inputs).

// Dependencies: i_enableTrailingTakeProfit (initialized in inputs).

// Dependencies: i_trailingTakeProfitPercentageOffset (initialized in inputs).

// Dependencies: i_trailingTakeProfitPercentageTrigger (initialized in inputs).

// Dependencies: i_zignalyIntegrationType (initialized in inputs).

// Function Dependencies: f_priceDecimalDigitsZeroString()

var string _zignaleStopLossCombo = ""

var string _zignaleTakeProfitCombo = ""

var string _zignaleTrailingTakeProfitCombo = ""

_zignalyLongCloseCommonAlertMessage = zignalyQuote + "type" + zignalyQuote + zignalyEquals + zignalyQuote + "entry" + zignalyQuote + zignalySeparator + zignalyQuote + "side" + zignalyQuote + zignalyEquals + zignalyQuote + "short" + zignalyQuote + zignalySeparator + zignalyQuote + "orderType" + zignalyQuote + zignalyEquals + zignalyQuote + "market" + zignalyQuote + zignalySeparator + zignalyQuote + "signalId" + zignalyQuote + zignalyEquals + zignalyQuote + "SHORT-" + exchangeTickerID + zignalyQuote

float _floatEntryQuantityContractsUSDT = _entryQuantityContractsUSDT

_entryQuantityContractsUSDTStr = tostring(_entryQuantityContractsUSDT, "0." + f_priceDecimalDigitsZeroString())

float _floatCurrentCapital = _currentCapital

float _entryQuantityContractsPercent = (_floatEntryQuantityContractsUSDT / _floatCurrentCapital) * 100.00

_entryQuantityContractsPercentStr = tostring(_entryQuantityContractsPercent, "0." + f_priceDecimalDigitsZeroString())

// This is actually not needed because with pyramiding=0 it's impossible that an order is scaled (and thus modified)

float _constantSellStopLoss = na

if (oldInsideASellOrder and insideASellOrder)

_constantSellStopLoss := sellStopLoss

else

_constantSellStopLoss := newSellStopLoss

if (i_enableStopLoss and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleStopLossCombo := zignalySeparator + zignalyQuote + "stopLossPercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + tostring((nz(_constantSellStopLoss) * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleStopLossCombo := ""

if (i_enableTakeProfit and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleTakeProfitCombo := zignalySeparator + zignalyQuote + "takeProfitPercentage1" + zignalyQuote + zignalyEquals + zignalyQuote + "-" + tostring((i_TakeProfit * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleTakeProfitCombo := ""

if (i_enableTrailingTakeProfit and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleTrailingTakeProfitCombo := zignalySeparator + zignalyQuote + "trailingStopDistancePercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + tostring((i_trailingTakeProfitPercentageOffset * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote + zignalySeparator + zignalyQuote + "trailingStopTriggerPercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "-" + tostring((i_trailingTakeProfitPercentageTrigger * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleTrailingTakeProfitCombo := ""

var string _message = ""

if (i_zignalyProviderType == _ZIGCOPYTRADERPROVIDER_)

_message :=

zignalyCommonAlertMessage +

zignalySeparator +

_zignalyLongCloseCommonAlertMessage +

zignalySeparator +

zignalyQuote + "positionSizePercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + _entryQuantityContractsPercentStr + zignalyQuote +

_zignaleStopLossCombo +

_zignaleTakeProfitCombo +

_zignaleTrailingTakeProfitCombo

else // _ZIGSIGNALPROVIDER_

_message :=

zignalyCommonAlertMessage +

zignalySeparator +

_zignalyLongCloseCommonAlertMessage +

zignalySeparator +

zignalyQuote + "positionSizeQuote" + zignalyQuote + zignalyEquals + zignalyQuote + "" + _entryQuantityContractsUSDTStr + zignalyQuote +

_zignaleStopLossCombo +

_zignaleTakeProfitCombo +

_zignaleTrailingTakeProfitCombo

_message

f_getZignalyShortCloseAlertMessage() =>

// Dependencies: zignalyQuote

// Dependencies: zignalyEquals

// Dependencies: zignalySeparator

// Dependencies: zignalyCommonAlertMessage

zignalyShortCloseCommonAlertMessage = zignalyQuote + "type" + zignalyQuote + zignalyEquals + zignalyQuote + "exit" + zignalyQuote + zignalySeparator + zignalyQuote + "side" + zignalyQuote + zignalyEquals + zignalyQuote + "short" + zignalyQuote + zignalySeparator + zignalyQuote + "orderType" + zignalyQuote + zignalyEquals + zignalyQuote + "market" + zignalyQuote + zignalySeparator + zignalyQuote + "signalId" + zignalyQuote + zignalyEquals + zignalyQuote + "SHORT-" + exchangeTickerID + zignalyQuote

var string _message = ""

_message := zignalyCommonAlertMessage + zignalySeparator + zignalyShortCloseCommonAlertMessage

_message

// Zignalye - Functions - END

// Order comment - Functions - BEGIN

f_getOrderComment(_typeOrder, _side, _alertMessage) =>

// Dependencies: i_enableOrderCommentDebug (initialized in inputs).

// TODO: Add descriptive comments

// _typeOrder="entry" or _typeOrder="close"

// _side: true means long ; false means short ; We can use strategy.long or strategy.short as true and false aliases

// _alertMessage

var string _orderComment = ""

if (i_enableOrderCommentDebug)

_orderComment := _alertMessage

else

// TODO: Use human explanations instead of default order comment value (na)

_orderComment := na

_orderComment

// Order comment - Functions - END

// Too recent orders functions

f_getTooRecentOrderNotOpenAdvice () =>

// Dependencies: i_tooRecentMinutesNumber_ms

// Dependencies: lastOrderOpenBarTime

// Condition 1: The order was open

// Condition 2: The order was long or short

// Condition 3: Time since order was last open is smaller than minimum between orders

// Returns boolean

bool _isTooRecent = ((time_close) <= (lastOrderOpenBarTime + i_tooRecentMinutesNumber_ms))

bool _tooRecentOrderBuyNotOpenAdvice = na

if (na(lastOrderOpenBarTime))

_tooRecentOrderBuyNotOpenAdvice := false

else

_tooRecentOrderBuyNotOpenAdvice := _isTooRecent

_tooRecentOrderBuyNotOpenAdvice

// FUNCTIONS - END

// Strategy Body - BEGIN

// Simple Logic to go LONG/LONG or go SHORT/SHORT - BEGIN

// longCondition = crossover(sma(close, 14), sma(close, 28))

// shortCondition = crossunder(sma(close, 14), sma(close, 28))

longCondition = sma(close, 14) >= sma(close, 28)

shortCondition = sma(close, 14) < sma(close, 28)

// Simple Logic to go LONG/LONG or go SHORT/SHORT - END

// Position price calculation - BEGIN

float positionPrice = na

if (insideASellOrder or insideABuyOrder)

positionPrice := strategy.position_avg_price

else

positionPrice := close

// Position price calculation - END

tooRecentOrderNotOpenAdvice = f_getTooRecentOrderNotOpenAdvice ()

newBuyStopLoss := i_StopLoss

newSellStopLoss := i_StopLoss

// Decide if we are going to LONG/Go LONG - BEGIN

PRE_LONG = false

PRE_LONG := longCondition and (not tooRecentOrderNotOpenAdvice)

// LONG = PRE_LONG[1] and PRE_LONG // Wait for confirmation

LONG = PRE_LONG // Do not wait for confirmation

// Decide if we are going to LONG/Go LONG - END

// Decide if we are going to SHORT/Go SHORT - BEGIN

PRE_SHORT = false

PRE_SHORT := shortCondition and (not tooRecentOrderNotOpenAdvice)

// SHORT = PRE_SHORT[1] and PRE_SHORT // Wait for confirmation

SHORT = PRE_SHORT // Do not wait for confirmation

// Decide if we are going to SHORT/Go SHORT - END

// Decide if a LONG/LONG entry should be closed - BEGIN

LONG_CLOSE = true

LONG_CLOSE := not (longCondition)

// Let's make sure LONG does not trigger if LONG_CLOSE would tell us to close the LONG

if LONG_CLOSE

LONG := false

// Decide if a LONG/LONG entry should be closed - END

// Decide if a SHORT/SHORT entry should be closed - BEGIN

SHORT_CLOSE = true

SHORT_CLOSE := not (shortCondition)

// Let's make sure SHORT does not trigger if SHORT_CLOSE would tell us to close the SHORT

if SHORT_CLOSE

SHORT := false

// Decide if a SHORT/SHORT entry should be closed - END

// How much to LONG/GO LONG/SHORT/GO SHORT - BEGIN

// Custom take profit and stop loss

LongTakeProfit = positionPrice * (1 + i_TakeProfit)

ShortTakeProfit = positionPrice * (1 - i_TakeProfit)

float LongStopLoss = na

float ShortStopLoss = na

LongStopLoss := positionPrice * (1 - buyStopLoss)

ShortStopLoss := positionPrice * (1 + sellStopLoss)

strategy.initial_capital = 50000

float entryQuantity = na

float currentCapital = strategy.initial_capital + strategy.netprofit

if (i_zignalyProviderType == _ZIGCOPYTRADERPROVIDER_)

entryQuantity := i_CapitalPercentage * currentCapital

else // _ZIGSIGNALPROVIDER_

entryQuantity := i_CapitalQuote

float entryQuantityContractsReducer = 0.99

contractMultiplier = f_getContractMultiplier(i_contractMaximumDecimalNumber)

// We assume the current price is current bar close

entryQuantityContracts = (floor(((entryQuantity / close) * entryQuantityContractsReducer) * contractMultiplier) / contractMultiplier)

entryQuantityContractsUSDT = entryQuantityContracts * (close)

// How much to LONG/GO LONG/SHORT/GO SHORT - END

// GO LONG only logic - BEGIN

var float tmpPositionBeforeOpeningOrder = na

if (i_strategyType == _L_)

if LONG

tmpPositionBeforeOpeningOrder := strategy.position_avg_price

tmpOrderAlertMessage := f_getZignalyLongAlertMessage(entryQuantityContractsUSDT, currentCapital)

tmpOrderComment := f_getOrderComment("entry", strategy.long, tmpOrderAlertMessage)

strategy.entry("[B]", strategy.long, qty=entryQuantityContracts, alert_message=i_enableZignalyAlert ? tmpOrderAlertMessage : na, comment=tmpOrderComment)

if (na(tmpPositionBeforeOpeningOrder)) // bar_index should only be saved when there is no order opened

buyOrderOpenBarIndex := bar_index + 1

if (not insideABuyOrder)

buyStopLoss := newBuyStopLoss

insideABuyOrder := true

0 // Workaround for making every if branch to return the same type of value

else if LONG_CLOSE

tmpOrderComment := f_getOrderComment("close", strategy.long, f_getZignalyLongCloseAlertMessage())

strategy.close("[B]", alert_message=i_enableZignalyAlert ? f_getZignalyLongCloseAlertMessage() : na, comment=tmpOrderComment)

insideABuyOrder := false

0 // Workaround for making every if branch to return the same type of value

// GO LONG only logic - END

// GO SHORT only logic - BEGIN

if (i_strategyType == _S_)

if SHORT

tmpPositionBeforeOpeningOrder := strategy.position_avg_price

tmpOrderAlertMessage := f_getZignalyShortAlertMessage(entryQuantityContractsUSDT, currentCapital)

tmpOrderComment := f_getOrderComment("entry", strategy.short, tmpOrderAlertMessage)

strategy.entry("[S]", strategy.short, qty=entryQuantityContracts, alert_message=i_enableZignalyAlert ? tmpOrderAlertMessage : na, comment=tmpOrderComment)

if (na(tmpPositionBeforeOpeningOrder)) // bar_index should only be saved when there is no order opened

sellOrderOpenBarIndex := bar_index + 1

if (not insideASellOrder)

sellStopLoss := newSellStopLoss

insideASellOrder := true

0 // Workaround for making every if branch to return the same type of value

else if SHORT_CLOSE

tmpOrderComment := f_getOrderComment("close", strategy.short, f_getZignalyShortCloseAlertMessage())

strategy.close("[S]", alert_message=i_enableZignalyAlert ? f_getZignalyShortCloseAlertMessage() : na, comment=tmpOrderComment)

insideASellOrder := false

0 // Workaround for making every if branch to return the same type of value

// GO SHORT only logic - END

// GO LONG and SHORT logic - BEGIN

if (i_strategyType == L_S)

// Asumption: Above we have:

// if LONG_CLOSE

// LONG := false

// if SHORT_CLOSE

// SHORT := false

// LONG and SHORT cannot be true at the same time

// Anyways we will take it into account

if (LONG == true) and (SHORT == true)

LONG := true

SHORT := false

SHORT_CLOSE := true

if LONG

tmpPositionBeforeOpeningOrder := strategy.position_avg_price

tmpOrderAlertMessage := f_getZignalyLongAlertMessage(entryQuantityContractsUSDT, currentCapital)

tmpOrderComment := f_getOrderComment("entry", strategy.long, tmpOrderAlertMessage)

strategy.entry("[B]", strategy.long, qty=entryQuantityContracts, alert_message=i_enableZignalyAlert ? tmpOrderAlertMessage : na, comment=tmpOrderComment)

if (na(tmpPositionBeforeOpeningOrder)) // bar_index should only be saved when there is no order opened

buyOrderOpenBarIndex := bar_index + 1

if (not insideABuyOrder)

buyStopLoss := newBuyStopLoss

insideABuyOrder := true

if LONG_CLOSE

tmpOrderComment := f_getOrderComment("close", strategy.long, f_getZignalyLongCloseAlertMessage())

strategy.close("[B]", alert_message=i_enableZignalyAlert ? f_getZignalyLongCloseAlertMessage() : na, comment=tmpOrderComment)

insideABuyOrder := false

if SHORT

tmpPositionBeforeOpeningOrder := strategy.position_avg_price

tmpOrderAlertMessage := f_getZignalyShortAlertMessage(entryQuantityContractsUSDT, currentCapital)

tmpOrderComment := f_getOrderComment("entry", strategy.short, tmpOrderAlertMessage)

strategy.entry("[S]", strategy.short, qty=entryQuantityContracts, alert_message=i_enableZignalyAlert ? tmpOrderAlertMessage : na, comment=tmpOrderComment)

if (na(tmpPositionBeforeOpeningOrder)) // bar_index should only be saved when there is no order opened

sellOrderOpenBarIndex := bar_index + 1

if (not insideASellOrder)

sellStopLoss := newSellStopLoss

insideASellOrder := true

if SHORT_CLOSE

tmpOrderComment := f_getOrderComment("close", strategy.short, f_getZignalyShortCloseAlertMessage())

strategy.close("[S]", alert_message=i_enableZignalyAlert ? f_getZignalyShortCloseAlertMessage() : na, comment=tmpOrderComment)

insideASellOrder := false

// GO LONG and SHORT logic - END

// Handle STOP LOSS (and similar) order exits - BEGIN

// Quick Paste - BEGIN

float longTrailingTakeProfitPrice = na

float longTrailingTakeProfitPoints = na

float longTrailingTakeProfitOffset = na

float shortTrailingTakeProfitPrice = na

float shortTrailingTakeProfitPoints = na

float shortTrailingTakeProfitOffset = na

// Calculate trailing_take_profit_offset based on tick units

longTmpTtpBaseValue = positionPrice * (1 + i_trailingTakeProfitPercentageTrigger)

longTmpTtpTop_value = longTmpTtpBaseValue * (1 + i_trailingTakeProfitPercentageOffset)

longTrailingTakeProfitOffsetFloat = longTmpTtpTop_value - longTmpTtpBaseValue

float longTrailingTakeProfitOffsetTick = floor (longTrailingTakeProfitOffsetFloat / syminfo.mintick)

shortTmpTtpBaseValue = positionPrice * (1 - i_trailingTakeProfitPercentageTrigger)

shortTmpTtpBottomValue = shortTmpTtpBaseValue * (1 - i_trailingTakeProfitPercentageOffset)

shortTrailingTakeProfitOffsetFloat = shortTmpTtpBaseValue - shortTmpTtpBottomValue

float shortTrailingTakeProfitOffsetTick = floor (shortTrailingTakeProfitOffsetFloat / syminfo.mintick)

if i_enableTrailingTakeProfit

longTrailingTakeProfitPrice := positionPrice * (1 + i_trailingTakeProfitPercentageTrigger)

longTrailingTakeProfitOffset := longTrailingTakeProfitOffsetTick

shortTrailingTakeProfitPrice := positionPrice * (1 - i_trailingTakeProfitPercentageTrigger)

shortTrailingTakeProfitOffset := shortTrailingTakeProfitOffsetTick

else

longTrailingTakeProfitPrice := na

longTrailingTakeProfitOffset := na

shortTrailingTakeProfitPrice := na

shortTrailingTakeProfitOffset := na

// Quick Paste - END

// This might trigger additional close orders than needed in zignaly

// Better close an existing order twice than regreting zignaly not having closed it.

tmpOrderComment := f_getOrderComment("close", strategy.long, f_getZignalyLongCloseAlertMessage())

strategy.exit("[SL/TP]", "[B]", stop= i_enableStopLoss ? LongStopLoss : na, limit= i_enableTakeProfit ? LongTakeProfit : na, trail_price= i_enableTrailingTakeProfit ? longTrailingTakeProfitPrice : na, trail_offset = i_enableTrailingTakeProfit ? longTrailingTakeProfitOffset : na, alert_message= i_enableZignalyAlert ? f_getZignalyLongCloseAlertMessage() : na, comment=tmpOrderComment)

tmpOrderComment := f_getOrderComment("close", strategy.short, f_getZignalyShortCloseAlertMessage())

strategy.exit("[SL/TP]", "[S]", stop= i_enableStopLoss ? ShortStopLoss : na, limit= i_enableTakeProfit ? ShortTakeProfit : na, trail_price= i_enableTrailingTakeProfit ? shortTrailingTakeProfitPrice : na, trail_offset = i_enableTrailingTakeProfit ? shortTrailingTakeProfitOffset : na, alert_message= i_enableZignalyAlert ? f_getZignalyShortCloseAlertMessage() : na, comment=tmpOrderComment)

// Handle STOP LOSS (and similar) order exits - END

// Strategy Body - END

Detail

https://www.fmz.com/strategy/440864

Last Modified

2024-02-02 17:37:16