Name

基于双重指标突破策略Dual-Indicators-Breakthrough-Strategy

Author

ChaoZhang

Strategy Description

双重指标突破策略通过结合RSI指标和收盘价指标,实现低买高卖的方式进行交易。该策略简单实用,回撤风险较小,适合中长线持仓。

该策略主要基于以下两个指标进行判断:

- RSI指标:当RSI2小于15时,做多入场。

- 前一日收盘价:当今日收盘价高于前一日的最高价时,平仓离场。

入场条件是RSI超买,表明股票被高度低估,具有较强的反转可能性。离场条件是收盘价突破前一日最高价,表明股票正在进入多头行情,应适当止盈。

双重指标突破策略具有以下优势:

- 策略操作简单,容易实施。

- 基于双重指标,可以有效控制假信号。

- RSI指标参数优化空间大,可调整至最佳状态。

- 追踪中长线趋势,回撤风险较小。

- 可广泛适用于大中盘股票,实战效果良好。

该策略也存在一些风险:

- 个股波动过大,RSI参数需要调整。

- 多头行情中容易预期短线回调。

- 前一日最高价突破幅度需要评估合理性。

可以通过优化RSI参数、评估行情类型、结合其他指标判断来规避上述风险。

该策略的优化方向主要集中在以下几个方面:

- 评估不同周期的RSI指标效果。

- 测试收盘价与其他价格指标的组合。

- 增加止损机制,如离场后一段时间再重入场。

- 结合交易量变动评估入场信号的可靠性。

- 利用机器学习算法自动优化参数。

双重指标突破策略整体而言是一个非常实用的量化策略。该策略操作简单,回撤风险较小,通过参数优化和规则完善可以成为聪明且稳定的量化程序。如果有效落地,可以为我们提供不错的中长线交易机会。

||

The dual indicators breakthrough strategy combines the RSI indicator and the closing price indicator to achieve low buying and high selling for trading. This strategy is simple and practical with low pullback risk and is suitable for medium and long term holds.

The strategy is mainly based on the following two indicators for judgment:

- RSI indicator: go long when RSI2 is less than 15.

- Previous day's closing price: close the position when today's closing price is higher than yesterday's highest price.

The entry condition is oversold RSI, indicating that the stock is highly undervalued and has a strong reversal potential. The exit condition is that the closing price breaks through the highest price of the previous day, indicating that the stock is entering a bullish trend and profits should be taken appropriately.

The dual indicator breakthrough strategy has the following advantages:

- The strategy operation is simple and easy to implement.

- False signals can be effectively controlled based on dual indicators.

- RSI indicator has large parameter optimization space for adjustment to optimal state.

- Track medium and long term trends with low pullback risk.

- Widely applicable to large and medium caps with good practical results.

The strategy also has some risks:

- Excessive fluctuations in individual stocks require RSI parameter adjustments.

- Expect short-term pullbacks in uptrends.

- Breakthrough amplitude of previous day's highest price needs evaluation of reasonableness.

The above risks can be avoided through optimization of RSI parameters, evaluation of market conditions, and use of other indicators for judgment.

The main optimization directions of this strategy are focused on the following aspects:

- Evaluate the effect of RSI indicators of different cycles.

- Test combinations of closing prices with other price indicators.

- Increase stop loss mechanisms, such as re-entry after a period of exit.

- Evaluate the reliability of entry signals in combination with trading volume changes.

- Automatically optimize parameters using machine learning algorithms.

In general, the dual indicator breakthrough strategy is a very useful quantitative strategy. The strategy is simple to operate with low pullback risks. Through parameter optimization and rule refinement, it can become an intelligent and stable quantitative program. If implemented effectively, it can provide us with good medium and long term trading opportunities.

[/trans]

Source (PineScript)

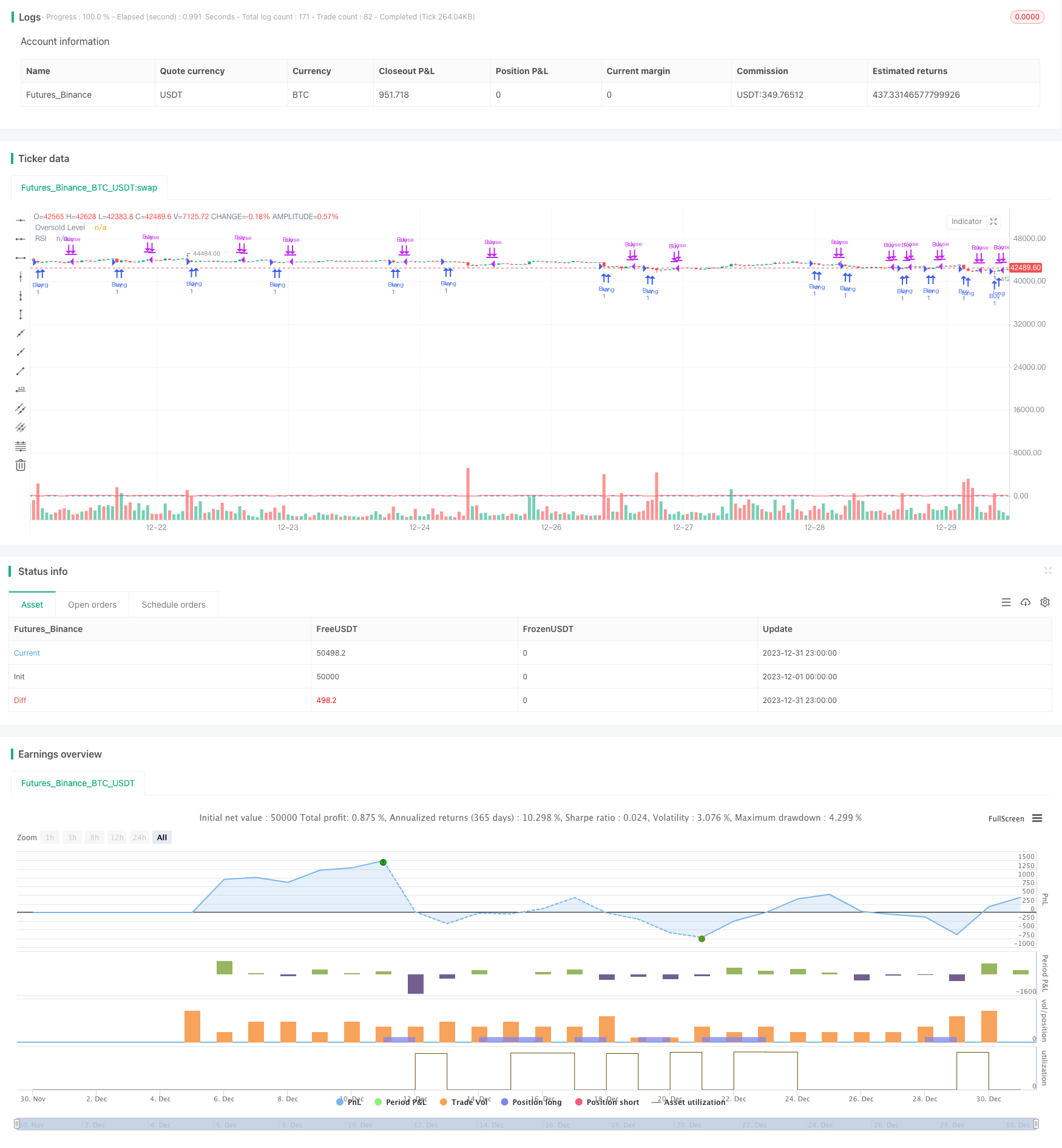

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © hobbiecode

// If RSI(2) is less than 15, then enter at the close.

// Exit on close if today’s close is higher than yesterday’s high.

//@version=5

strategy("Hobbiecode - RSI + Close previous day", overlay=true)

// RSI parameters

rsi_period = 2

rsi_lower = 15

// Calculate RSI

rsi_val = ta.rsi(close, rsi_period)

// Check if RSI is lower than the defined threshold

if (rsi_val < rsi_lower)

strategy.entry("Buy", strategy.long)

// Check if today's close is higher than yesterday's high

if (strategy.position_size > 0 and close > ta.highest(high[1], 1))

strategy.close("Buy")

// Plot RSI on chart

plot(rsi_val, title="RSI", color=color.red)

hline(rsi_lower, title="Oversold Level", color=color.blue)

Detail

https://www.fmz.com/strategy/439989

Last Modified

2024-01-25 15:39:06