Name

基于双EMA和AC指标的趋势跟踪策略Dual-EMA-and-AC-Indicator-Based-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

[trans]

本策略基于双EMA指标和AC加速振荡指标设计。其中,双EMA指标用于判断价格趋势方向,而AC指标则用于确认趋势信号,实现过滤效果。该策略结合了趋势跟踪和信号过滤两大功能,旨在提高信号质量,在趋势中获利。

该策略由两大模块组成:

-

双EMA模块

-

使用2日EMA和20日EMA构建双EMA指标。当价格上穿2日EMA时视为买入信号;当价格下破20日EMA时视为卖出信号。

-

该模块判断价格的短期和中期趋势方向,实现基本的趋势跟踪。

-

-

AC模块

-

使用AC加速振荡指标的正负值来确认趋势信号。只有当双EMA和AC指标同方向时,才产生交易信号。

-

该模块通过过滤假信号,提高了信号的可靠性。

-

综上,该策略整合双EMA判断大趋势,以及AC指标过滤假突破,形成系统性的趋势跟踪体系。

本策略具有如下优势:

-

双EMA跟踪中长线趋势,AC滤除短期噪音,组合效果好。

-

信号过滤效果佳,可避免多头获利后盲目做空,或空头获利后盲目做多的情况。

-

调参数灵活,可配合不同品种和市场环境调整参数,适用面广。

-

策略思路清晰,容易理解,便于量化交易者优化和改进。

-

可在趋势型品种中获得不错的跟踪获利。

本策略也存在一些风险:

-

双EMA参数设置不当可能错过较短的趋势或者产生多余交易。

-

AC参数设置不当可能过滤掉较弱的有效信号或者无法过滤足够的噪音。

-

无法应对急速变化的市场,如快速断崖式下跌。

-

无法在震荡市中获得足够盈利,应作为趋势跟踪策略使用。

本策略可从以下维度进行优化:

-

测试更多参数组合,寻找更匹配不同品种特点的最优参数。

-

增加止损模块,在亏损过大时止损退出。

-

结合更多指标进行信号过滤优化。

-

开发长短线组合策略,在趋势中跟踪中长线,利用短线针对性交易为长线减仓加仓。

本策略结合双EMA判趋势和AC滤噪的思路值得学习借鉴。该策略优势在于信号质量好,可靠性高,适合跟踪趋势型品种。如果参数调整合适,在趋势行情中可获得丰厚收益。

||

This strategy is designed based on dual EMA and AC acceleration oscillator indicators. The dual EMA indicator is used to determine the price trend direction, while the AC indicator is used to confirm the trend signal for filtering effect. This strategy combines both trend following and signal filtering functions to improve signal quality and profit from trends.

The strategy consists of two modules:

-

Dual EMA Module

-

Build a dual EMA indicator using 2-day EMA and 20-day EMA. A buy signal is generated when price crosses above 2-day EMA. A sell signal is generated when price crosses below 20-day EMA.

-

This module determines short-term and medium-term trend directions for basic trend following.

-

-

AC Module

-

Use the positive and negative values of the AC acceleration oscillator to confirm trend signals. Trading signals are only generated when dual EMA and AC indicators agree on directions.

-

This module filters out false signals and improves reliability.

-

In summary, this strategy integrates dual EMA for detecting major trends and AC indicator for filtering out false breakouts, forming a systematic trend following methodology.

The advantages of this strategy are:

-

Dual EMA traces medium-long term trends while AC filters out short-term noise, great combo effect.

-

Excellent filtering effect to avoid selling after long profit or buying after short profit.

-

Flexible parameter tuning adaptable to different products and market environments.

-

Clear strategy logic, easy to understand, optimize and improve.

-

Decent trend following profit potential for trending products.

There are some risks in this strategy:

-

Improper dual EMA parameter setting may miss shorter trends or generate redundant trades.

-

Improper AC parameter setting may filter out valid but weaker signals or fail to filter enough noise.

-

Unable to adapt to rapidly changing markets, like sharp cliff-styled crashes.

-

Insufficient profitability in ranging markets, should be used as trend following strategy.

The strategy can be optimized in the following aspects:

-

Test more parameter combinations to find optimal parameters fitting different product characteristics.

-

Add stop loss module to exit at oversized losses.

-

Filter signals with more indicators.

-

Develop long-short combo strategies to trace medium-long term trends, utilizing short-term trades to reduce or add positions along the trend.

The idea of combining dual EMA for trend and AC for noise filtering is worth learning. This strategy has quality signals and reliability, suitable for tracking trending products. With proper parameter tuning, great profits can be achieved by riding trends using this strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 14 | (?●═════ 2/20 EMA ═════●)Length |

| v_input_1 | 33 | (?●═════ Accelerator Oscillator ═════●)Length Slow |

| v_input_2 | 6 | Length Fast |

| v_input_bool_1 | false | (?●═════ MISC ═════●)Trade reverse |

| v_input_int_2 | true | (?●═════ Time Start ═════●)From Day |

| v_input_int_3 | true | From Month |

| v_input_int_4 | 2005 | From Year |

Source (PineScript)

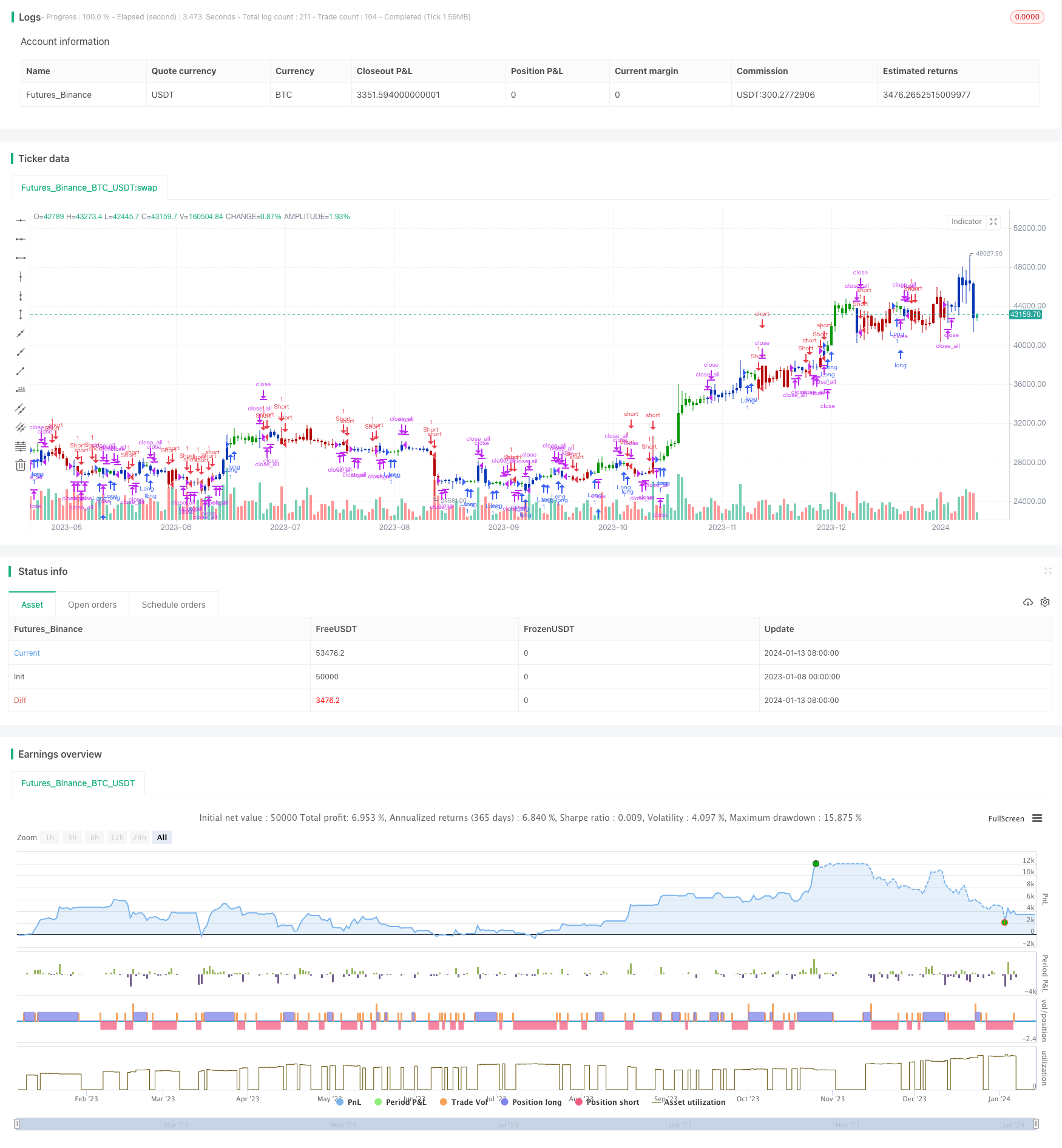

/*backtest

start: 2023-01-08 00:00:00

end: 2024-01-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/01/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// The Accelerator Oscillator has been developed by Bill Williams

// as the development of the Awesome Oscillator. It represents the

// difference between the Awesome Oscillator and the 5-period moving

// average, and as such it shows the speed of change of the Awesome

// Oscillator, which can be useful to find trend reversals before the

// Awesome Oscillator does.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

AC(nLengthSlow,nLengthFast) =>

pos = 0.0

xSMA1_hl2 = ta.sma(hl2, nLengthFast)

xSMA2_hl2 = ta.sma(hl2, nLengthSlow)

xSMA1_SMA2 = xSMA1_hl2 - xSMA2_hl2

xSMA_hl2 = ta.sma(xSMA1_SMA2, nLengthFast)

nRes = xSMA1_SMA2 - xSMA_hl2

cClr = nRes > nRes[1] ? color.blue : color.red

iff_1 = nRes > 0 ? 1 : nz(pos[1], 0)

pos := nRes < 0 ? -1 : iff_1

pos

strategy(title='Combo 2/20 EMA & Accelerator Oscillator (AC)', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ Accelerator Oscillator ═════●'

nLengthSlow = input(33, title="Length Slow", group=I2)

nLengthFast = input(6, title="Length Fast", group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosAC = AC(nLengthSlow,nLengthFast)

iff_1 = posEMA20 == -1 and prePosAC == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosAC == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)

Detail

https://www.fmz.com/strategy/438775

Last Modified

2024-01-15 12:02:54