Name

基于均线和支撑阻力的日本蜡烛快速跳空策略Kana-Candle-Breakout-Strategy-Based-on-Moving-Average-and-Support-Resistance

Author

ChaoZhang

Strategy Description

该策略是一个基于日本蜡烛技术分析的快速跳空策略,同时结合均线指标和支撑阻力指标来判断趋势和位置。其主要思想是在均线和趋势指标确认之后,等待价格快速跳空并迅速止盈。

该策略使用长度为20的简单移动平均线SMA和长度为200的指数移动平均线EMA来判断趋势方向。当价格在上升趋势时(SMA在EMA之上),并且当前日本蜡烛实体收盘价高于开盘价(白色实体),表明多头力量增强;当价格在下降趋势时(SMA在EMA之下),并且当前日本蜡烛实体收盘价低于开盘价(黑色实体),表明空头力量增强。

在趋势和力量得到确认的情况下,该策略等待价格快速跳空,进入场内。所谓“跳空”就是价格“跨过”预设的三条ATR通道(以200日ATR和系数为基准计算出来的通道)中的第一条通道线,进入第二条通道线以内。这是一个高概率的突破信号。

进场后,止盈或止损规则非常简单。只要价格触及通道的外沿(如上涨止盈线或下跌止损线),就会立即止盈或止损。这保证了策略的快速获利。

该策略最大的优势在于获利快而保守。使用快速跳空的方式进入场内,避免多次调整仓位。而通道突破带来的趋势加速效应,则可在短时间内获得较大利润。

相比于长线持有,如此高效的开平仓手法可显著降低策略的空仓率,进一步提升资金使用效率。同时,快速止盈止损机制也可有效控制单笔亏损。

该策略主要依赖均线指标判断趋势方向,存在回调和震荡的风险。当价格在通道内部震荡时,则可能导致超短线反向开仓和亏损。

此外,该策略过于依赖技术指标,没有结合基本面和重大事件分析。一旦发生黑天鹅事件,则技术指标QIAN失效,策略可能遭遇较大亏损。

为控制风险,可适当放宽通道范围,降低开仓频率。或者增加仓位管理模块,根据资金规模动态调整单笔仓位。

该策略可从以下几个方面进行优化:

-

增加仓位管理模块。根据账户资金规模,动态调整每单开仓数量,控制单笔亏损占比。

-

增加基本面过滤。在技术指标触发开仓条件时,判断公司基本面和重大事件,避免异动。

-

结合股票池管理。设定股票筛选规则,动态调整股票池。不同阶段选择最优股票池,提高稳定性。

-

结合机器学习模型。通过AI预测趋势和关键价格点,辅助确定通道范围和开仓时机。

该策略以简洁高效见长。使用均线判断大趋势,日本蜡烛判断力量方向,快速跳空入场,迅速止盈止损。可在短期内获利,适合高频交易。但也存在回撤和不确定性风险。通过持续优化,可使策略在不同市场环境下稳定运行。

||

This is a fast breakout strategy based on Japanese candlestick technical analysis, combined with moving average indicators and support resistance indicators to determine trend and position. Its main idea is to wait for a fast price breakout and take profit quickly after the confirmation of moving average and trend indicators.

The strategy uses a 20-period simple moving average (SMA) and a 200-period exponential moving average (EMA) to determine the trend direction. When the price is in an uptrend (SMA above EMA), and the current Japanese candlestick real body closes above the open (white body), it indicates strengthened buying power. When the price is in a downtrend (SMA below EMA), and the current Japanese candlestick real body closes below the open (black body), it indicates strengthened selling pressure.

With the confirmation of trend and momentum, the strategy waits for a fast price breakout and enters the market. The so-called “breakout” means the price “crosses over” the first channel line of the three preset ATR channels (calculated based on 200-day ATR and coefficients) and enters the second channel line. This is a high probability breakout signal.

After entering the market, the profit taking and stop loss rules are very simple. As long as the price touches the outer bounds of the channel (such as take profit line or stop loss line), it will take profit or stop loss immediately. This ensures fast gains of the strategy.

The biggest advantage of this strategy is fast profit-taking with relatively small risk. By entering the market quickly after breakout, it avoids multiple adjustments of positions. And the accelerating effect brought by channel breakout allows large profits in a short period of time.

Compared with long-term holding, such efficient opening and closing mechanics can significantly reduce the idling rate of the strategy and further improve capital efficiency. At the same time, the fast profit-taking and stop-loss mechanism can also effectively control single loss.

The strategy mainly relies on moving average indicators to determine the trend direction, with the risk of pullback and consolidation. When the price oscillates within the channel, it may lead to ultra short-term reverse opening and loss.

In addition, the strategy relies too much on technical indicators without combining fundamental and significant event analysis. In case of black swan events, the technical indicators would fail and the strategy may suffer major losses.

To control risks, we can appropriately expand the channel range to reduce opening frequency; or add position management module to dynamically adjust single position based on total capital.

The strategy can be optimized in the following aspects:

-

Add position management module. Dynamically adjust single opening position based on account size to control single loss percentage.

-

Add fundamental filtering. When technical indicators trigger opening signals, check company fundamentals and significant events to avoid abnormalities.

-

Combine stock pool management. Set rules to dynamically adjust stock pool. Select optimal stock pool in different stages to improve stability.

-

Combine machine learning models. Use AI to predict trends and key price levels, assisting in determining channel range and entry timing.

The strategy features simplicity and efficiency. It determines major trend with moving averages, momentum direction with Japanese candles, enters with fast breakout, and exits with quick profit taking and stop loss. It allows short-term gains suitable for high frequency trading. But it also has the risk of drawdown and uncertainty. Continuous optimization can make the strategy stable under different market environments.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 20 | Length |

| v_input_2 | true | multiplier1 |

| v_input_3 | 2 | multiplier2 |

| v_input_4 | 3 | multiplier3 |

| v_input_5 | 240 | Support Resistance TimeFrame |

| v_input_6 | true | Use Support/Resistance |

| v_input_7 | 0.5 | Take Profit Percent |

| v_input_8 | false | Use Take Profit |

| v_input_9_close | 0 | Source: close |

Source (PineScript)

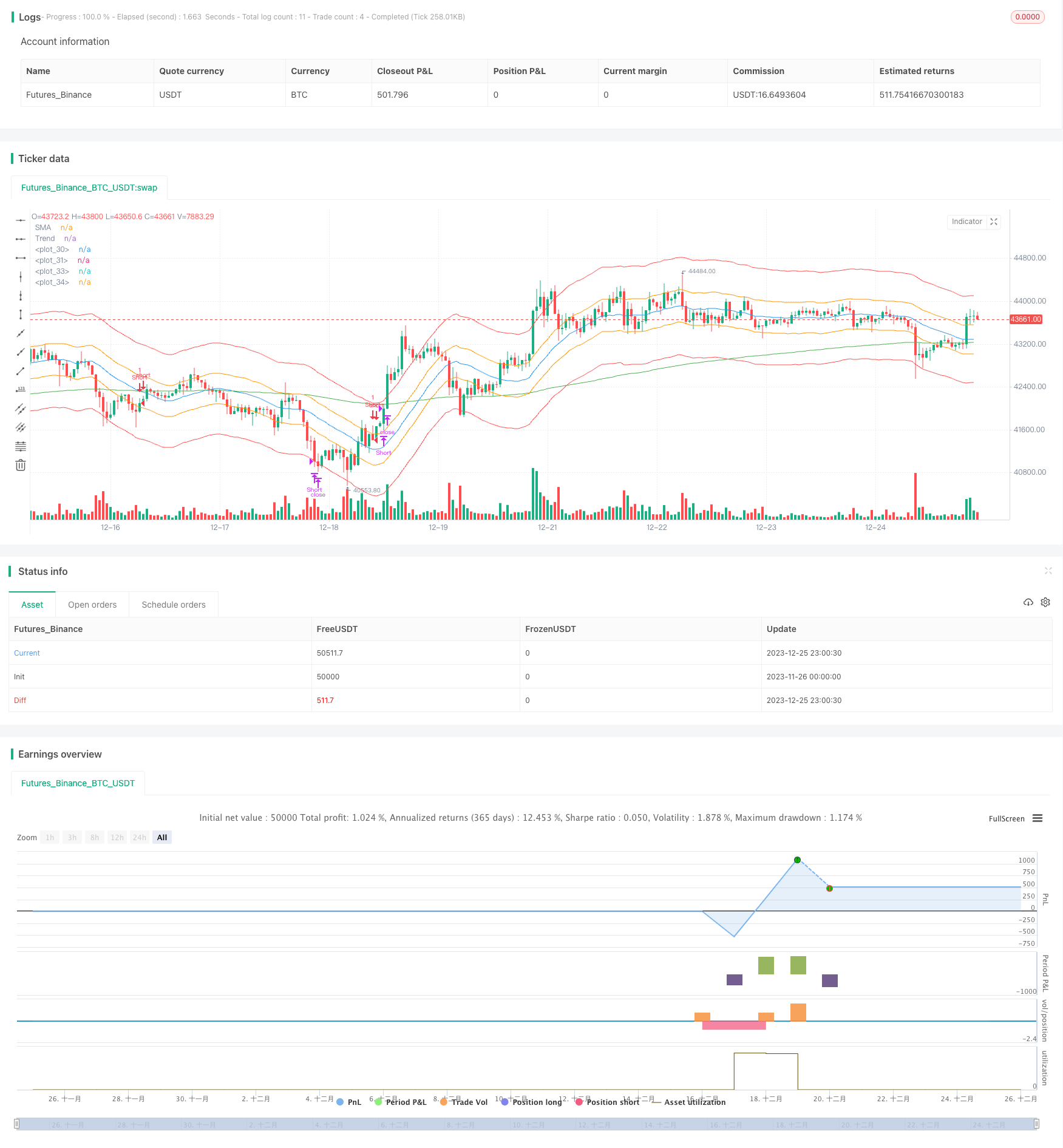

/*backtest

start: 2023-11-26 00:00:00

end: 2023-12-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Kana with S/R Strategy", title = "KANA with S/R", overlay=true)

len = input(20, minval=1, title="Length")

multiplier1 = input(1, minval=1, title="multiplier1")

multiplier2 = input(2, minval=1, title="multiplier2")

multiplier3 = input(3, minval=1, title="multiplier3")

srTimeFrame = input(240, minval=1, title="Support Resistance TimeFrame")

useSR = input(true, type = bool, title="Use Support/Resistance")

tpPercent = input(0.5, type=float, title = "Take Profit Percent")

useTP = input(false, type=bool, title = "Use Take Profit")

tp = (close * tpPercent / 100) / syminfo.mintick

src = input(close, title="Source")

mid = sma(src, len)

plot(mid, title="SMA", color=blue)

trend = ema(close, 200)

plot(trend, title="Trend", color=green)

upper1 = mid + atr(200) * multiplier1

upper2 = mid + atr(200) * multiplier2

upper3 = mid + atr(200) * multiplier3

lower1 = mid - atr(200) * multiplier1

lower2 = mid - atr(200) * multiplier2

lower3 = mid - atr(200) * multiplier3

plot(upper1, color = orange)

plot(upper3, color = red)

plot(lower1, color = orange)

plot(lower3, color = red)

haClose = request.security(heikinashi(syminfo.tickerid), timeframe.period, close)

haOpen = request.security(heikinashi(syminfo.tickerid), timeframe.period, open)

resistance = request.security(syminfo.tickerid,tostring(srTimeFrame), high)

support = request.security(syminfo.tickerid,tostring(srTimeFrame), low)

rsPos = (close - support[srTimeFrame]) / (resistance[srTimeFrame] - support[srTimeFrame])

MACD = ema(close, 120) - ema(close, 260)

aMACD = ema(MACD, 90)

hisline = MACD - aMACD

longCondition = (mid > trend) and (haOpen[1] < haClose[1]) and (mid > mid[1]) and (close < upper1) and hisline > 0 and (useSR == true ? (rsPos > 100) : true)

shortCondition = (mid < trend) and (haOpen[1] > haClose[1]) and (mid < mid[1]) and (close > lower1) and hisline < 0 and (useSR == true ? (rsPos < 0) : true)

longExit = (close > upper3 ) or (close < lower2)

shortExit = (close < lower3) or (close > upper2)

if (longCondition)

strategy.entry("Long", strategy.long)

if (useTP)

strategy.exit("Exit Long", "Long", profit = tp)

if (longExit)

strategy.close("Long")

if (shortCondition)

strategy.entry("Short", strategy.short)

if (useTP)

strategy.exit("Exit Short", "Short", profit = tp)

if (shortExit)

strategy.close("Short")

Detail

https://www.fmz.com/strategy/436764

Last Modified

2023-12-27 15:27:45