Name

基于多重均线交易策略Multiple-Moving-Average-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略名称为“多重均线交易策略”。该策略利用MACD指标与多重均线的交叉作为交易信号,结合ZLSMA指标辅助判断趋势,设定止盈止损Exiting逻辑,实现自动化交易。

-

计算MACD指标的快线、慢线和MACD柱。设置金叉做多,死叉做空。

-

计算5日线、25日线、45日线、100日线四条均线。均线越长代表趋势持续性越强。

-

计算两组均线之间的距离,如果距离超过某一阈值,说明均线发散,可设定为交易信号。

-

计算ZLSMA指标,表示价格中长线趋势方向。ZLSMA形成拐点时可判断趋势转折。

-

结合MACD指标交叉、均线发散信号和ZLSMA趋势判断,设定多空交易策略。

-

设置止盈止损点,实现自动化Exiting逻辑。

-

多重过滤信号提高策略效率。MACD指标与均线发散信号可相互验证,避免假突破。

-

ZLSMA指标辅助判断中长期趋势方向,避免逆势交易。

-

自动化Exiting设定止盈止损点,降低人为干预频率。

-

参数设置不当可能导致过度交易或漏单。需要优化参数以达到最佳效果。

-

固定止盈止损点会限制获利空间或扩大损失。可以结合ATR指标设置动态止损。

-

均线策略对震荡行情效果不佳,可考虑辅助其他指标或人工干预。

-

优化均线参数组合,测试不同长度均线的效果。

-

测试加入其他指标,如KDJ、BOLL等判断买卖点。

-

尝试动态止损策略,根据波动率设置止损位置。

-

加入机器学习模型,自动寻找最优参数。

本策略整合MACD指标、多重均线和ZLSMA趋势判断实现自动化交易。通过多重信号过滤提高策略稳定性,设置Exiting逻辑降低风险,具有一定的实战价值。后续通过参数优化、指标扩展、止损动态化等手段可进一步提升策略表现。

||

The strategy is named "Multiple Moving Average Trading Strategy". It utilizes the crossover of the MACD indicator and multiple moving averages as trading signals, with the assistance of the ZLSMA indicator to determine the trend, and sets the profit-taking and stop-loss exiting logic to realize automated trading.

-

Calculate the fast line, slow line and MACD histogram of the MACD indicator. Set long when seeing golden cross and short when seeing death cross.

-

Calculate the 5-day, 25-day, 45-day and 100-day moving averages. The longer the moving average, the stronger the trend sustainability it represents.

-

Calculate the distance between the two groups of moving averages. If the distance exceeds a certain threshold, it means the divergence of the moving averages, which can be set as trading signals.

-

Calculate the ZLSMA indicator, representing the mid-to-long term trend direction of the price. Trend reversals can be determined when ZLSMA forms turning points.

-

Combine the MACD crossover, moving average divergence signals and ZLSMA trend judgment to set long and short trading strategies.

-

Set take profit and stop loss points to realize automated exiting logic.

-

Multi-filter signals improve strategy efficiency. MACD and moving average divergence signals can verify each other to avoid false breakouts.

-

ZLSMA assists in determining the medium and long term trend direction to avoid trading against the trend.

-

Automated exiting by setting profit-taking and stop-loss points reduces human intervention frequency.

-

Improper parameter settings may lead to over-trading or missing orders. Parameters need to be optimized for best results.

-

Fixed profit-taking and stop-loss points limit profit potential or increase losses. Dynamic stops based on ATR can be considered.

-

Moving average strategies work poorly in range-bound markets. Other indicators or manual intervention may be needed.

-

Optimize combinations of moving average parameters by testing different length moving averages.

-

Test adding other indicators such as KDJ and BOLL to determine entry and exit points.

-

Try dynamic stop loss strategies based on volatility measures.

-

Add machine learning models to find optimal parameters automatically.

This strategy integrates MACD, multiple moving averages and ZLSMA trend determination to achieve automated trading. By filtering with multiple signals, strategy stability is improved; by setting exiting logic, risks are reduced. There is certain practical value for real trading. Subsequent parameter optimization, indicator expansion, dynamic stops etc. can further improve strategy performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 12 | Fast Length |

| v_input_2 | 26 | Slow Length |

| v_input_3_close | 0 | Source: close |

| v_input_int_1 | 9 | Signal Smoothing |

| v_input_string_1 | 0 | Oscillator MA Type: EMA |

| v_input_string_2 | 0 | Signal Line MA Type: EMA |

| v_input_4 | 5 | ma期間5 |

| v_input_5 | 25 | ma期間25 |

| v_input_6 | 45 | ma期間45 |

| v_input_7 | 100 | ma期間100 |

| v_input_8 | 0.03 | ema同士の乖離値 |

| v_input_int_2 | 32 | Length |

| v_input_int_3 | false | offset |

| v_input_9_close | 0 | Source: close |

| v_input_10 | 0.06 | ロング利確pips |

| v_input_11 | -0.06 | ショート利確pips |

| v_input_12 | -0.06 | ロング損切pips |

| v_input_13 | 0.06 | ショート損切pips |

Source (PineScript)

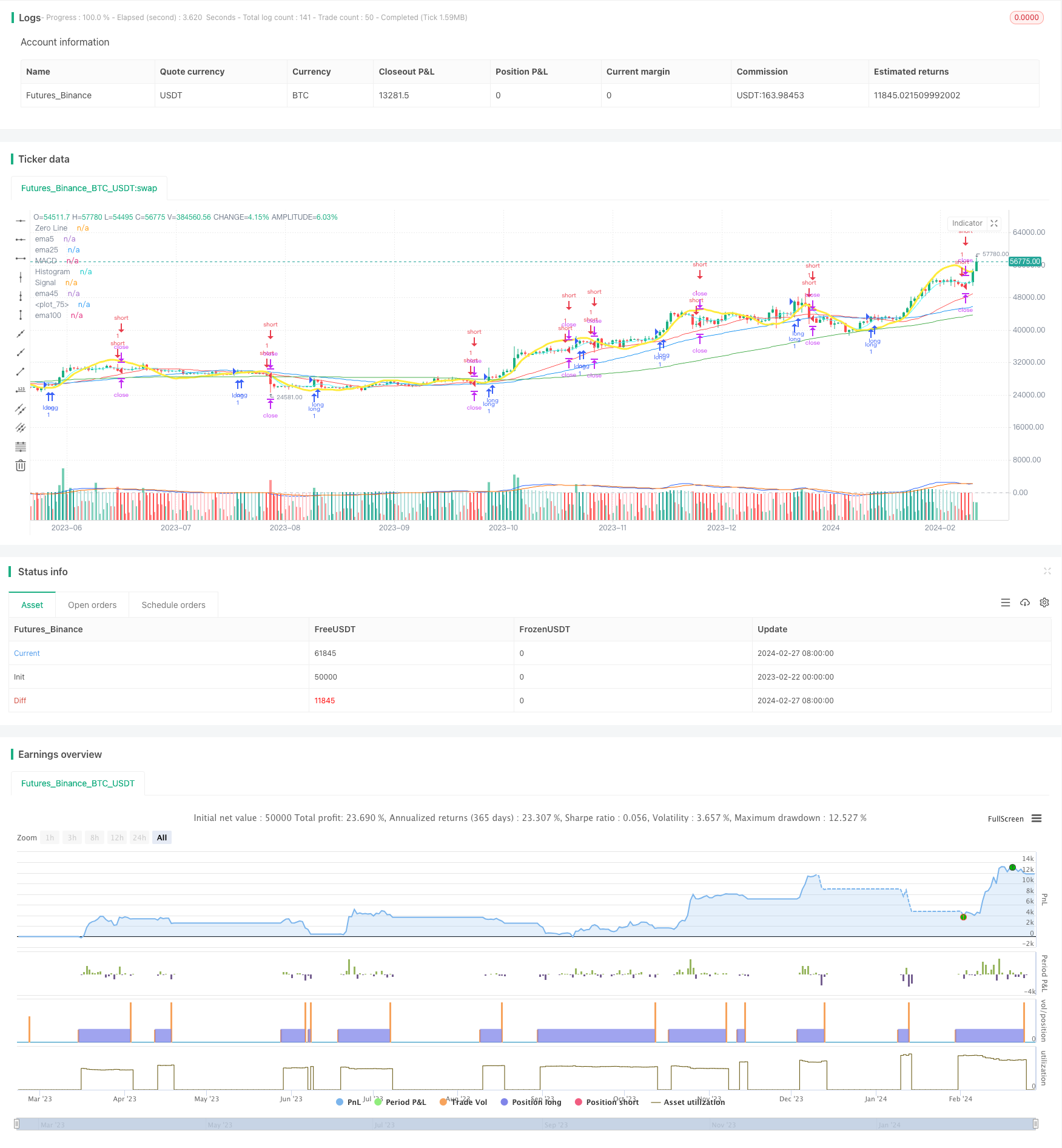

/*backtest

start: 2023-02-22 00:00:00

end: 2024-02-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MACD ZLSMA_izumi⑤(4つの条件、MCDがクロスしてたら)", overlay=true)

fast_length = input(title = "Fast Length", defval = 12)

slow_length = input(title = "Slow Length", defval = 26)

src = input(title = "Source", defval = close)

signal_length = input.int(title = "Signal Smoothing", minval = 1, maxval = 50, defval = 9)

sma_source = input.string(title = "Oscillator MA Type", defval = "EMA", options = ["SMA", "EMA"])

sma_signal = input.string(title = "Signal Line MA Type", defval = "EMA", options = ["SMA", "EMA"])

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

alertcondition(hist[1] >= 0 and hist < 0, title = 'Rising to falling', message = 'The MACD histogram switched from a rising to falling state')

alertcondition(hist[1] <= 0 and hist > 0, title = 'Falling to rising', message = 'The MACD histogram switched from a falling to rising state')

hline(0, "Zero Line", color = color.new(#787B86, 50))

plot(hist, title = "Histogram", style = plot.style_columns, color = (hist >= 0 ? (hist[1] < hist ? #26A69A : #B2DFDB) : (hist[1] < hist ? #FFCDD2 : #FF5252)))

plot(macd, title = "MACD", color = #2962FF)

plot(signal, title = "Signal", color = #FF6D00)

//MACDクロス設定

enterLong = ta.crossover(macd, signal)

enterShort = ta.crossunder(macd, signal)

//移動平均線の期間を設定

ema5 = input(5, title="ma期間5")

ema25 = input(25, title="ma期間25")

ema45 = input(45, title="ma期間45")

ema100 = input(100, title="ma期間100")

//移動平均線を計算

//sma関数で「ema25」バー分のcloseを移動平均線として「Kema」に設定

Kema5 = ta.sma(close,ema5)

Kema25 = ta.sma(close,ema25)

Kema45 = ta.sma(close,ema45)

Kema100 = ta.sma(close,ema100)

//移動平均線をプロット

plot(Kema5, color=color.rgb(82, 249, 255),title="ema5")

plot(Kema25, color=color.red,title="ema25")

plot(Kema45, color=color.blue,title="ema45")

plot(Kema100, color=color.green,title="ema100")

//ema同士の距離が30以上の時に「distancOK」にTureを返す

//distance1 = math.abs(Kema5-Kema25)

distance2 = math.abs(Kema25-Kema45)

distanceValue1 = input(0.030, title ="ema同士の乖離値")

//distanceOk1 = distance1 > distanceValue1

distanceOk2 = distance2 > distanceValue1

//2区間のema同士の距離が30以上の時に「distanceOKK」にTrueを返す

//distanceOkK1 = distanceOk1 and distanceOk2

distanceOkK1 = distanceOk2

//5EMAとロウソクの乖離判定

//DistanceValue5ema = input(0.03, title ="5emaとロウソクの乖離率")

//emaDistance = math.abs(Kema5 - close)

//emaDistance5ema = emaDistance < DistanceValue5ema

//ZLSMA追加のコード

length = input.int(32, title="Length")

offset = input.int(0, title="offset")

src2 = input(close, title="Source")

lsma = ta.linreg(src2, length, offset)

lsma2 = ta.linreg(lsma, length, offset)

eq= lsma-lsma2

zlsma = lsma+eq

//ZLSMAのプロット

plot(zlsma, color=color.yellow, linewidth=3)

//ZLSMAの前回高値を検索

//var float zlsmaHigh = na

//var float zlsmaHighValue = na

//if ta.highest(zlsma,35) == zlsma[3]

// zlsmaHighValue := zlsmaHigh

// zlsmaHigh := zlsma[3]

//if (na(zlsmaHighValue))

// zlsmaHighValue := zlsmaHigh

//ZLSMAの前回安値を検索

//var float zlsmaLow = na

//var float zlsmaLowValue = na

//if ta.lowest(zlsma,35) == zlsma[3]

// zlsmaLowValue := zlsmaLow

// zlsmaLow := zlsma[3]

///if (na(zlsmaLowValue))

// zlsmaLowValue := zlsmaLow

//利確・損切りポイントの初期化(変数の初期化)

var longProfit = 0.0

var longStop = 0.0

var shortProfit = 0.0

var shortStop = 0.0

//inputで設定画面の選択項目を設定

longProfitValue = input(0.06, title ="ロング利確pips")

shortProfitValue = input(-0.06, title ="ショート利確pips")

longStopValue = input(-0.06, title ="ロング損切pips")

shortStopValue = input(0.06, title ="ショート損切pips")

// クロスの強さを推定

//angleThreshold = input(0.001, title = "クロスの強さ調節" )

// クロスの強さの閾値、この値を調整してクロスの強さの基準を変える

//macdDiff = macdLine - signalLine

//strongCross = math.abs(macdDiff) > angleThreshold

// エントリー条件 (MACDラインとシグナルラインがクロス)

//ta.crossover(macdLine, signalLine) and strongCross

//ロングエントリー条件

if distanceOkK1 and enterLong

strategy.entry("long", strategy.long, comment="long")

longProfit := close + longProfitValue

longStop := close + longStopValue

// if na(strategy.position_avg_price) and close>strategy.position_avg_price + 0.05 * syminfo.mintick

// longStop := strategy.position_avg_price + 10 * syminfo.mintick

// strategy.exit("exit", "long",stop = longStop)

strategy.exit("exit", "long", limit = longProfit,stop = longStop)

if distanceOkK1 and enterShort

strategy.entry("short", strategy.short, comment="short")

shortProfit := close + shortProfitValue

shortStop := close + shortStopValue

// if na(strategy.position_avg_price) and close>strategy.position_avg_price - 0.05 * syminfo.mintick

// shortStop := strategy.position_avg_price - 0.1 * syminfo.mintick

// strategy.exit("exit", "long",stop = longStop)

strategy.exit("exit", "short", limit = shortProfit,stop = shortStop)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

Detail

https://www.fmz.com/strategy/443133

Last Modified

2024-02-29 14:32:29