Name

基于指数移动平均和成交量加权的多因子量化策略Quantitative-Strategy-Based-on-Exponential-Moving-Average-and-Volume-Weighting

Author

ChaoZhang

Strategy Description

本策略名为“基于指数移动平均和成交量加权的多因子量化策略”,主要通过结合指数移动平均线和成交量加权这两个因子来实现量化交易。该策略综合考虑了价格趋势、成交量信息和最新价格信息,可以有效捕捉市场机会,具有一定的优势。

该策略的核心指标是nRes,它结合了指数移动平均线xMAVolPrice、成交量指数移动平均线xMAVol和最新收盘价close,通过以下公式计算:

xMAVolPrice = ema(volume * close, length)

xMAVol = ema(volume, length)

nRes = xMAVolPrice / xMAVol

其中,xMAVolPrice是收盘价与成交量的乘积的指数移动平均,反映了价格与成交量的综合信息;xMAVol是仅仅成交量的指数移动平均;nRes则是两个指数移动平均的比值,反映了调整后的价格信息。

该策略通过判断nRes与最新收盘价的大小关系,来决定做多做空方向:

if (nRes < close[1])

做多

if (nRes > close[1])

做空

如果nRes小于最新收盘价,则表示成交量调整后的价格低于最新价格,属于买入信号;如果nRes大于最新收盘价,则表示成交量调整后的价格高于最新价格,属于卖出信号。

综上,该策略通过比较成交量调整后的价格指标nRes和最新收盘价,决定做多做空方向,属于典型的量化交易策略。

该策略主要具有以下几个优势:

-

结合多因子信息。该策略不仅考虑了价格信息,还结合了交易量信息,充分利用了股票的多因子特征,可以更准确判断市场走势。

-

减少假信号。通过成交量加权,可以过滤掉一些成交量不足造成的假突破。这可以有效减少不必要的交易,避免被套。

-

实时性强。相比简单移动平均线等指标,该策略中的指数移动平均线对最新数据更敏感,可以更快捕捉到最近的市场变化。

-

容易实施。该策略思路简单清晰,易于理解和实现,适合量化交易的要求。

尽管该策略有一定优势,但也面临以下风险:

-

成交量信息不可靠。成交量指标容易受到操纵,不够稳定,可能产生误导。

-

多空判断机会稀少。相比简单跟随趋势的策略,该策略判断机会相对较少,容易造成交易不足的情况。

-

参数选择困难。移动平均天数length等参数的选择会对策略表现有很大影响,选择不当可能大幅降低收益。

-

行情剧烈变化的风险。快速行情中,指标计算可能来不及反应最新价格,导致错过最佳交易时点的风险。

对应解决方法:优化参数设置,严格控制仓位规模,设置止损止盈;结合其他因子指标做校验;适当调整持仓频率。

该策略主要可从以下几个方向进行优化:

-

更灵活的开仓逻辑。可以在nRes与收盘价差值大于某阈值时开仓,而不仅仅是二分类判断,可以把握更多机会。

-

增加仓位管理机制。可以根据市场波动程度,动态调整每次交易的头寸大小,有效控制风险。

-

结合其他因子。可以加入更多因子,如情绪面指标、基本面因子等,使策略判断更全面。

-

参数自适应优化。可以建立算法自动优化length等参数,使其能根据不同周期的行情特征进行自适应调整。

-

利用机器学习模型。可以采用RNN等深度学习模型对多维特征进行建模,实现端到端的非线性策略。

本策略综合考虑价格、成交量等多因子信息,通过成交量指数移动平均线调整价格指标,与最新收盘价比较判断交易方向。相比单一指标,具有信息量更丰富、减少假信号等优点。但也面临成交量被操纵、判断时点较少等风险。未来可从优化开仓逻辑、仓位管理、加入更多因子等方面进行改进,使策略效果更佳。

||

This strategy is named "Quantitative Strategy Based on Exponential Moving Average and Volume Weighting". It mainly implements quantitative trading by combining the two factors of exponential moving average and volume weighting. The strategy comprehensively considers price trends, volume information and latest price information, which can effectively capture market opportunities and has certain advantages.

The core indicator of this strategy is nRes, which combines the exponential moving average xMAVolPrice, the exponential moving average of volume xMAVol and the latest closing price close, and is calculated by the following formula:

xMAVolPrice = ema(volume * close, length)

xMAVol = ema(volume, length)

nRes = xMAVolPrice / xMAVol

Where xMAVolPrice is the exponential moving average of the product of closing price and volume, reflecting the combined information of price and volume; xMAVol is merely the exponential moving average of volume; nRes is the ratio of the two exponential moving averages, reflecting the adjusted price information.

The strategy determines the direction of long and short positions by comparing the size relationship between nRes and the latest closing price:

if (nRes < close[1])

long

if (nRes > close[1])

short

If nRes is less than the latest closing price, it means that the volume adjusted price is lower than the latest price, which is a buy signal; if nRes is greater than the latest closing price, it means that the volume adjusted price is higher than the latest price, which is a sell signal.

In summary, the strategy compares the volume adjusted price indicator nRes with the latest closing price to determine the direction of long and short positions, which is a typical quantitative trading strategy.

The main advantages of this strategy are:

-

Combining multi-factor information. The strategy considers not only price information, but also combines volume information to make full use of the multi-factor characteristics of stocks to more accurately judge market trends.

-

Reduce false signals. Volume weighting can filter out some false breakouts caused by insufficient volume. This can effectively reduce unnecessary trading and avoid being trapped.

-

Better timeliness. Compared with simple moving averages, the exponential moving averages in this strategy are more sensitive to the latest data and can quickly capture recent market changes.

-

Easy to implement. The strategy idea is simple and clear, easy to understand and implement, and meets the requirements of quantitative trading.

Although the strategy has certain advantages, it also faces the following risks:

-

Volume information is unreliable. Volume indicators are prone to manipulation and lack stability, which may be misleading.

-

Few opportunities for long and short judgment. Compared with simple trend-following strategies, the opportunities for this strategy to make judgments are relatively small, which can easily lead to insufficient trading.

-

Difficulty in parameter selection. The choice of parameters such as the moving average day length will have a great impact on the performance of the strategy. Improper selection may greatly reduce returns.

-

Risk of violent market changes. In the fast-moving market, indicator calculation may not be able to react to the latest prices in time, resulting in missing the best trading point.

The corresponding solutions: optimize parameter settings, strictly control position size, set stop loss and take profit; combine other factor indicators for verification; appropriately adjust the position holding frequency.

The main directions for optimizing this strategy are:

-

More flexible open positions logic. Positions can be opened when the difference between nRes and closing price is greater than a certain threshold, not just binary classification judgment, so as to seize more opportunities.

-

Increase position management mechanisms. According to market volatility, dynamically adjust the size of each trade to effectively control risks.

-

Combine other factors. More factors can be added, such as sentiment indicators, fundamental factors, etc., to make strategy judgments more comprehensive.

-

Adaptive parameter optimization algorithms. Algorithms can be established to automatically optimize parameters such as length, so that they can adjust adaptively according to the characteristics of different cycle markets.

-

Use machine learning models. RNN and other deep learning models can be used for multivariate feature modeling to achieve end-to-end nonlinear strategies.

This strategy comprehensively considers factors like price and volume, and compares the volume adjusted price indicator with the latest closing price to determine the trading direction. Compared with a single indicator, it has the advantages of richer information and reducing false signals. But it also faces risks such as volume manipulation and fewer judgment timings. In the future, aspects such as optimizing opening position logic, position management, and incorporating more factors can be improved to make the strategy more effective.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 22 | length |

| v_input_2 | false | Trade reverse |

Source (PineScript)

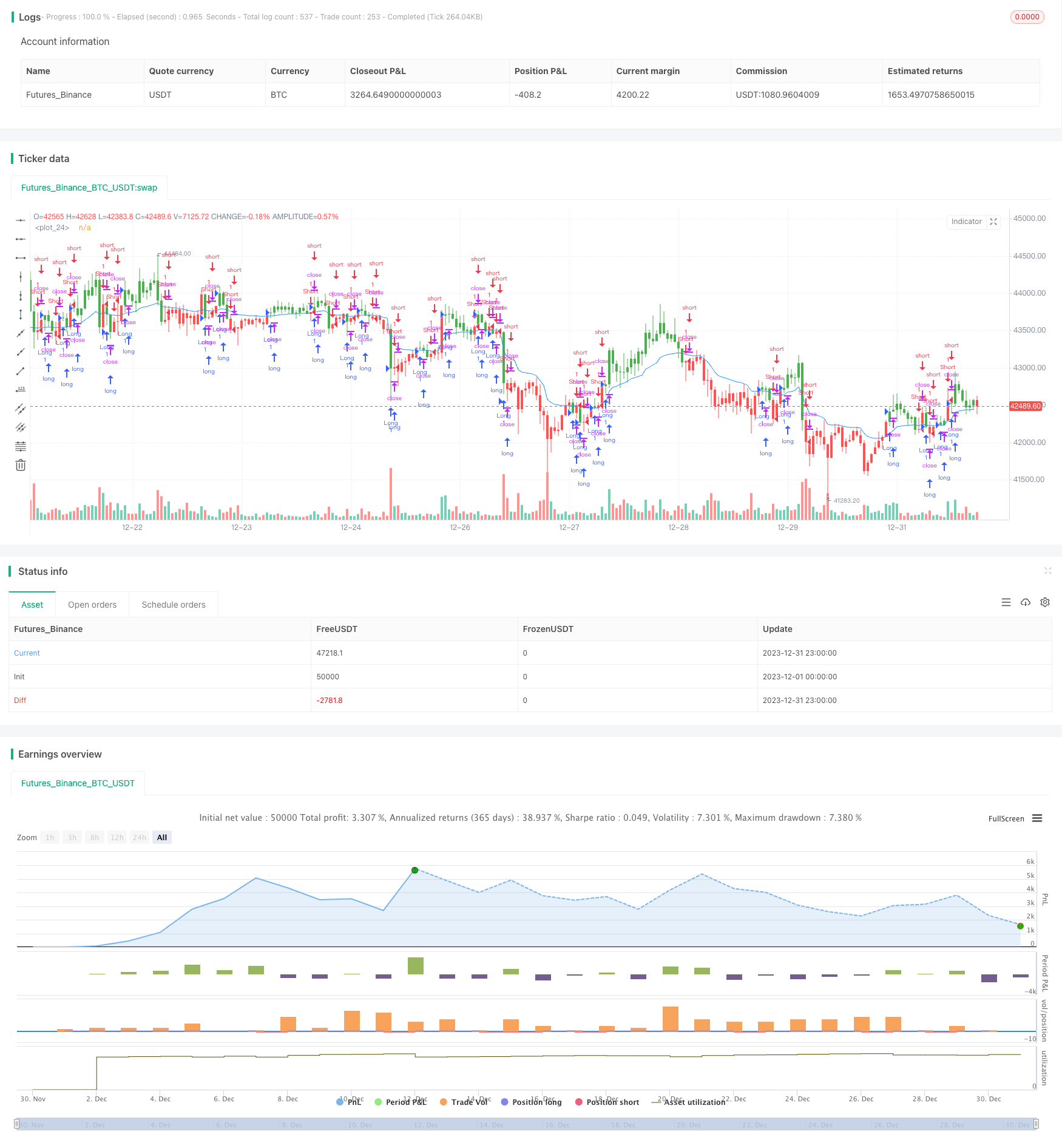

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 06/03/2017

// The related article is copyrighted material from Stocks & Commodities 2009 Oct

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Combining Exponential And Volume Weighting", overlay=true)

length = input(22, minval=1)

reverse = input(false, title="Trade reverse")

xMAVolPrice = ema(volume * close, length)

xMAVol = ema(volume, length)

nRes = xMAVolPrice / xMAVol

pos = iff(nRes < close[1], 1,

iff(nRes > close[1], -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(nRes, color=blue)

Detail

https://www.fmz.com/strategy/439987

Last Modified

2024-01-25 15:31:21