Name

基于月相的双向交易策略Bidirectional-Trading-Strategy-Based-on-Moon-Phases

Author

ChaoZhang

Strategy Description

本策略基于月相的变化,在新月时做多,满月时做空,实现双向交易。

该策略使用自定义函数计算月相,根据日期可以准确计算出月相的年龄。年龄小于15时为新月,年龄大于15且小于30时为满月。策略根据月相判断做多做空信号,在新月时开仓做多,满月时开仓做空,平仓时则相反,满月平多仓,新月平空仓。

用户可以选择“新月做多,满月做空”或者“新月做空,满月做多”两种策略。策略使用布尔变量跟踪当前是否持有仓位。在信号出现而之前无仓位时开新仓,信号反转时平掉当前仓位。策略可视化显示买入卖出标记。

- 利用月相周期性,捕捉长线趋势

- 可自定义颜色、填充等策略显示

- 可选择双向交易策略

- 显示开平仓标记,操作清晰

- 可定制回测起始时间,优化策略

- 月相周期长,无法捕捉短线趋势

- 无法限制亏损,可能造成大额损失

- 固定周期,容易形成模式

风险解决方法:

- 结合其他指标,实现多级别交易

- 增加止损机制

- 优化仓位管理,降低单笔损失影响

本策略可以从以下方面进行优化:

- 结合更多周期指标,形成交易信号过滤器,提高策略稳定性

- 增加仓位管理模块,优化仓位大小,降低单笔亏损的影响

- 增加止损模块,避免亏损扩大

- 优化开仓和平仓条件,减少掉期,提高获胜率

本策略利用月相的周期性规律,实现了基于新月和满月的双向交易策略。策略显示清晰,可定制性强,适合捕捉长线趋势。但因无法限损,风险较大,建议结合其他短周期指标使用,并增加仓位和止损管理模块,以进一步优化。

||

This strategy trades both long and short based on moon phases, going long on new moons and going short on full moons.

The strategy calculates moon phases accurately based on dates using a custom function. Moon age less than 15 is a new moon, and between 15 and 30 a full moon. It generates long and short signals based on moon phases, opening long positions on new moons and short positions on full moons. It closes positions on reverse signals - closing longs on full moons and shorts on new moons.

Users can choose between "long on new moon, short on full moon" or vice versa. Boolean variables track if trades are currently open. It opens new trades when signals appear while no position is open, and closes current positions on reverse signals. Buy and sell markers are displayed visually.

- Captures long-term trends using moon cycle periodicity

- Customizable display colors, fill, etc

- Choice of bidirectional strategies

- Clear open/close markers

- Customizable backtest start time for optimization

- Long moon cycle fails to capture short-term moves

- No stop loss can lead to heavy losses

- Fixed cycles prone to pattern formation

Risk Mitigation:

- Add other short-cycle indicators for multi-timeframe trading

- Implement stop loss

- Optimize position sizing to limit loss impact

The strategy can be improved by:

- Adding more indicators to filter signals and improve robustness

- Adding position sizing to optimize and lower loss impact

- Adding stop loss module to limit losses

- Optimizing open/close conditions to reduce slippage and improve win rate

The strategy exploits the periodicity of moon cycles to implement a bidirectional trading strategy based on new and full moons. It has clear signals, high customizability, and catches long-term trends well. But the inability to limit losses poses significant risks. It is recommended to combine short-cycle indicators and add position sizing and stop losses to further optimize the strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | black | New Moon Color |

| v_input_2 | white | Full Moon Color |

| v_input_3 | true | Fill Background? |

| v_input_4 | #fffff0aa | New Moon Background Color |

| v_input_5 | #aaaaaaaa | Full Moon Background Color |

| v_input_6 | 0 | strategy: buy on new moon, sell on full moon |

| v_input_7 | true | Show Buy/Sell Signals |

| v_input_8 | true | Long enabled |

| v_input_9 | true | Short enabled |

| v_input_10 | 2017 | Backtesting From Year |

| v_input_11 | true | And Month |

| v_input_12 | true | And Day |

| v_input_13 | false | And Hour |

| v_input_14 | false | And Minute |

Source (PineScript)

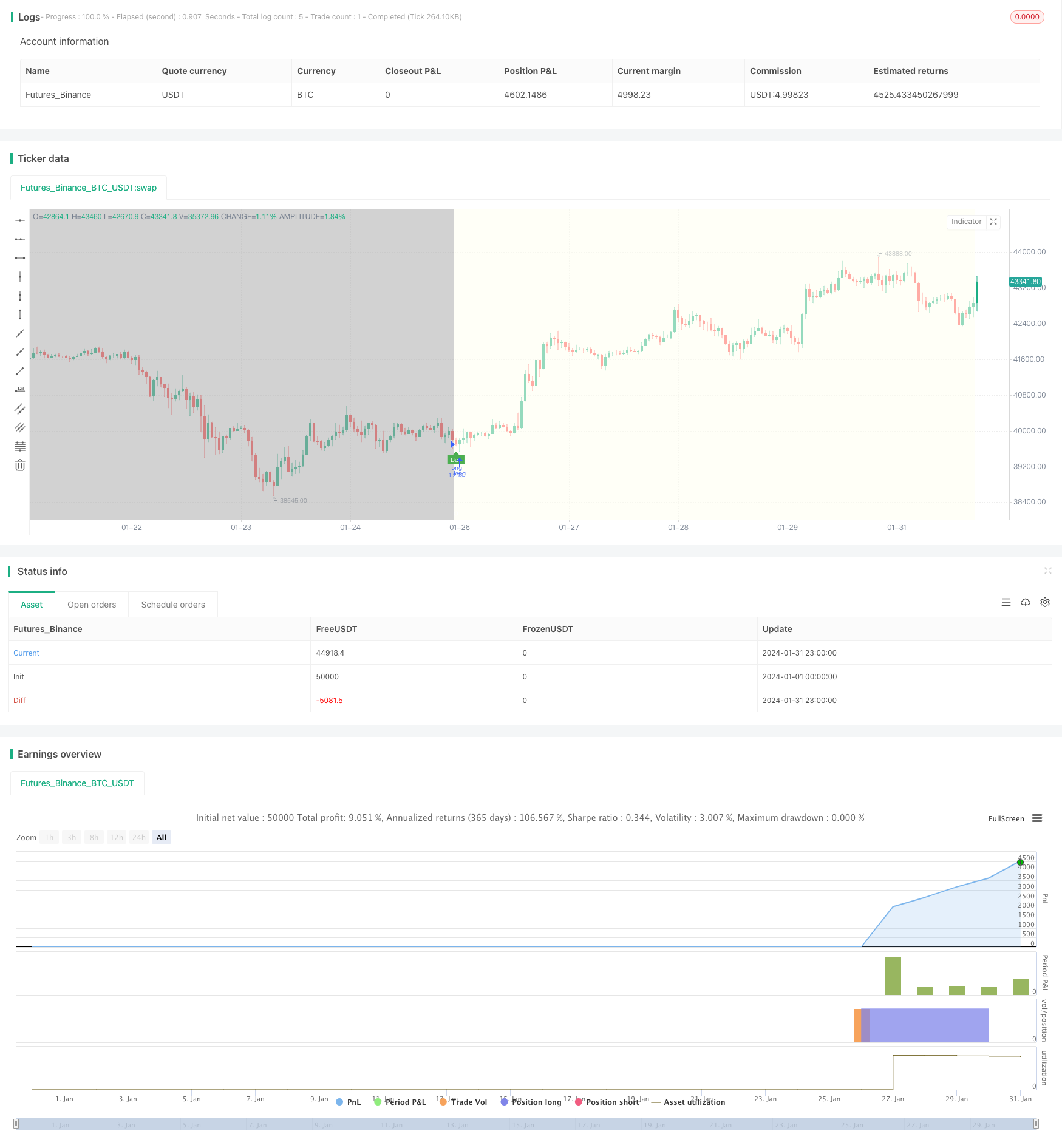

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ---------------------------© paaax----------------------------

// ---------------- Author1: Pascal Simon (paaax) ----------------

// -------------------- www.pascal-simon.de ---------------------

// ---------------- www.tradingview.com/u/paaax/-----------------

// Source: https://gist.github.com/L-A/3497902#file-moonobject-js

// -------------------------© astropark--------------------------

// --------------- Author2: Astropark (astropark) ---------------

// -------------- https://bit.ly/astroparktrading ---------------

// -------------- www.tradingview.com/u/astropark/---------------

// @version=4

strategy(title="[astropark] Moon Phases [strategy]", overlay=true, pyramiding = 10, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital = 100000, currency = currency.USD, commission_value = 0.1)

// INPUT --- {

newMoonColor = input(color.black, "New Moon Color")

fullMoonColor = input(color.white, "Full Moon Color")

fillBackground = input(true, "Fill Background?")

newMoonBackgroundColor = input(#fffff0aa, "New Moon Background Color")

fullMoonBackgroundColor = input(#aaaaaaaa, "Full Moon Background Color")

//} --- INPUT

// FUNCTION --- {

normalize(_v) =>

x = _v

x := x - floor(x)

if x < 0

x := x + 1

x

calcPhase(_year, _month, _day) =>

int y = na

int m = na

float k1 = na

float k2 = na

float k3 = na

float jd = na

float ip = na

y := _year - floor((12 - _month) / 10)

m := _month + 9

if m >= 12

m := m - 12

k1 := floor(365.25 * (y + 4712))

k2 := floor(30.6 * m + 0.5)

k3 := floor(floor((y / 100) + 49) * 0.75) - 38

jd := k1 + k2 + _day + 59

if jd > 2299160

jd := jd - k3

ip := normalize((jd - 2451550.1) / 29.530588853)

age = ip * 29.53

//} --- FUNCTION

// INIT --- {

age = calcPhase(year, month, dayofmonth)

moon =

floor(age)[1] > floor(age) ? 1 :

floor(age)[1] < 15 and floor(age) >= 15 ? -1 : na

//} --- INIT

// PLOT --- {

plotshape(

moon==1,

"Full Moon",

shape.circle,

location.top,

color.new(newMoonColor, 20),

size=size.normal

)

plotshape(

moon==-1,

"New Moon",

shape.circle,

location.bottom,

color.new(fullMoonColor, 20),

size=size.normal

)

var color col = na

if moon == 1 and fillBackground

col := fullMoonBackgroundColor

if moon == -1 and fillBackground

col := newMoonBackgroundColor

bgcolor(col, title="Moon Phase", transp=10)

//} --- PLOT

// STRATEGY --- {

strategy = input("buy on new moon, sell on full moon", options=["buy on new moon, sell on full moon","sell on new moon, buy on full moon"])

longCond = strategy == "buy on new moon, sell on full moon" ? moon == -1 : moon == 1

shortCond = strategy == "buy on new moon, sell on full moon" ? moon == 1 : moon == -1

weAreInLongTrade = false

weAreInShortTrade = false

weAreInLongTrade := (longCond or weAreInLongTrade[1]) and shortCond == false

weAreInShortTrade := (shortCond or weAreInShortTrade[1]) and longCond == false

buySignal = longCond and weAreInLongTrade[1] == false

sellSignal = shortCond and weAreInShortTrade[1] == false

showBuySellSignals = input(defval=true, title = "Show Buy/Sell Signals")

longEnabled = input(true, title="Long enabled")

shortEnabled = input(true, title="Short enabled")

analysisStartYear = input(2017, "Backtesting From Year", minval=1980)

analysisStartMonth = input(1, "And Month", minval=1, maxval=12)

analysisStartDay = input(1, "And Day", minval=1, maxval=31)

analysisStartHour = input(0, "And Hour", minval=0, maxval=23)

analysisStartMinute = input(0, "And Minute", minval=0, maxval=59)

analyzeFromTimestamp = timestamp(analysisStartYear, analysisStartMonth, analysisStartDay, analysisStartHour, analysisStartMinute)

plotshape(showBuySellSignals and buySignal, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(showBuySellSignals and sellSignal, title="Sell Label", text="Sell", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

strategy.entry("long", strategy.long, when = time > analyzeFromTimestamp and buySignal and longEnabled)

strategy.entry("short", strategy.short, when = time > analyzeFromTimestamp and sellSignal and shortEnabled)

strategy.close("long", when = sellSignal)

strategy.close("short", when = buySignal)

//} --- STRATEGY

Detail

https://www.fmz.com/strategy/442402

Last Modified

2024-02-21 16:15:25