Name

基于相对成交量和趋势的交易策略Relative-Volume-Trend-Following-Trading-Strategy

Author

ChaoZhang

Strategy Description

[trans]

该策略结合相对成交量指标和价格行情判断的趋势指标,实现了一个融合趋势跟踪和突破的自动化交易系统。当成交量增加且波动较小时买入,根据止损点和价格行情判断止盈或止损。

-

使用 Bollinger Bands 判断价格是否波动较小。具体实现是比较ATR和BOLL通道带宽。

-

计算过去N天的平均成交量,和当前Volume比较判断成交量是否增加。

-

当价格低位运行,成交量增加,波动较小时买入。

-

设置止损点,跟踪最低价更新。

-

当价格向下突破止损点时止损。

-

当价格形成多头吞噬模式时止盈。

-

结合成交量和波动性指标,可以有效过滤假突破。

-

采用趋势跟踪止损方法,可以最大限度锁定利润。

-

利用多头吞噬等形态判断作为止盈信号,可以在趋势反转前夕及时止盈。

-

策略较为直观简单,容易理解和跟踪。

-

止损和止盈规则比较明确,降低了闭市antisipate带来的不确定性。

-

成交量指标存在滞后,可能错过最佳入场点。

-

多头吞噬等形态判断作为止盈信号可能不足够可靠,存在过早止盈的风险。

-

止损点靠后的策略,存在单笔损失可能较大的风险。

-

需要合理参数调整,如ATR和成交量周期等,否则可能出现频繁交易。

-

需要关注和优化止盈止损规则,降低不必要平仓的可能。

-

尝试结合其他指标过滤入场信号,如MACD等。

-

优化ATR和成交量周期参数,降低频繁交易风险。

-

尝试其他止盈信号,如价格突破下轨等Exit机制。

-

研究通过动态调整止损位来锁定更多利润的可能性。

-

测试不同持仓时间对绩效的影响,寻找最优持仓周期。

-

回测不同品种合约效果,找到最佳适用品种。

该策略整体较为简单直观,通过结合成交量指标和价格行情判断,实现了趋势跟踪型策略。优点是信号生成较为清晰,跟踪容易,降低反向操作风险。但仍需优化过滤信号的质量和止盈止损规则,使策略更稳定可靠。通过继续改进参数设定、进场退出机制等,有望产生更加优异的绩效表现。

||

This strategy combines relative volume indicator and price action trend judgment to build an automated trading system integrating trend following and breakout. It buys when volume increases and volatility is low, and sells based on stop loss and price action.

-

Use Bollinger Bands to determine if price volatility is low. Specifically by comparing ATR and BOLL band width.

-

Calculate the average volume of past N days, compare with current volume to see if volume has increased.

-

Buy when price is near low, volume increases and volatility is low.

-

Set stop loss, track lowest price.

-

Sell when price breaks below stop loss.

-

Sell when price forms bullish engulfing pattern.

-

Combining volume and volatility filters false breakout effectively.

-

Trailing stop loss locks in profit maximally.

-

Exit signals like bullish engulfing catch trend reversal early.

-

Intuitive and easy to follow.

-

Clear rules on stop loss and take profit reduce uncertainty.

-

Volume indicator lags, could miss best entry point.

-

Exit signals like engulfing lack reliability, risks early exit.

-

Wider stop risks larger loss on single trade.

-

Needs tuning of parameters like ATR period and volume period to avoid over trading.

-

Need to optimize exit rules to avoid unnecessary exit.

-

Try additional filters like MACD to improve entry signals.

-

Optimize ATR and volume periods to reduce over trading.

-

Explore other exit signals like price breaking lower band.

-

Research trailing stop loss to lock in more profit.

-

Test different holding periods for best performance.

-

Backtest on different products to find the best fit.

The strategy is relatively simple, using volume and price action for trend following. It has clear signals and easy tracking. But the quality of filters and exit rules can be further improved for more reliable performance. With continued efforts on parameter tuning and entry/exit design, outstanding results could be achieved.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | timestamp(01 Apr 2016 13:30 +0000) | Backtest Start Time |

| v_input_2 | false | Define backtest end-time (If false, will test up to most recent candle) |

| v_input_3 | timestamp(01 May 2021 19:30 +0000) | Backtest End Time (if checked above) |

| v_input_4 | 10 | Length of ATR [Trailing Stop Loss] (x2) |

| v_input_5 | 5 | SMA(volume) length (for relative comparison) |

Source (PineScript)

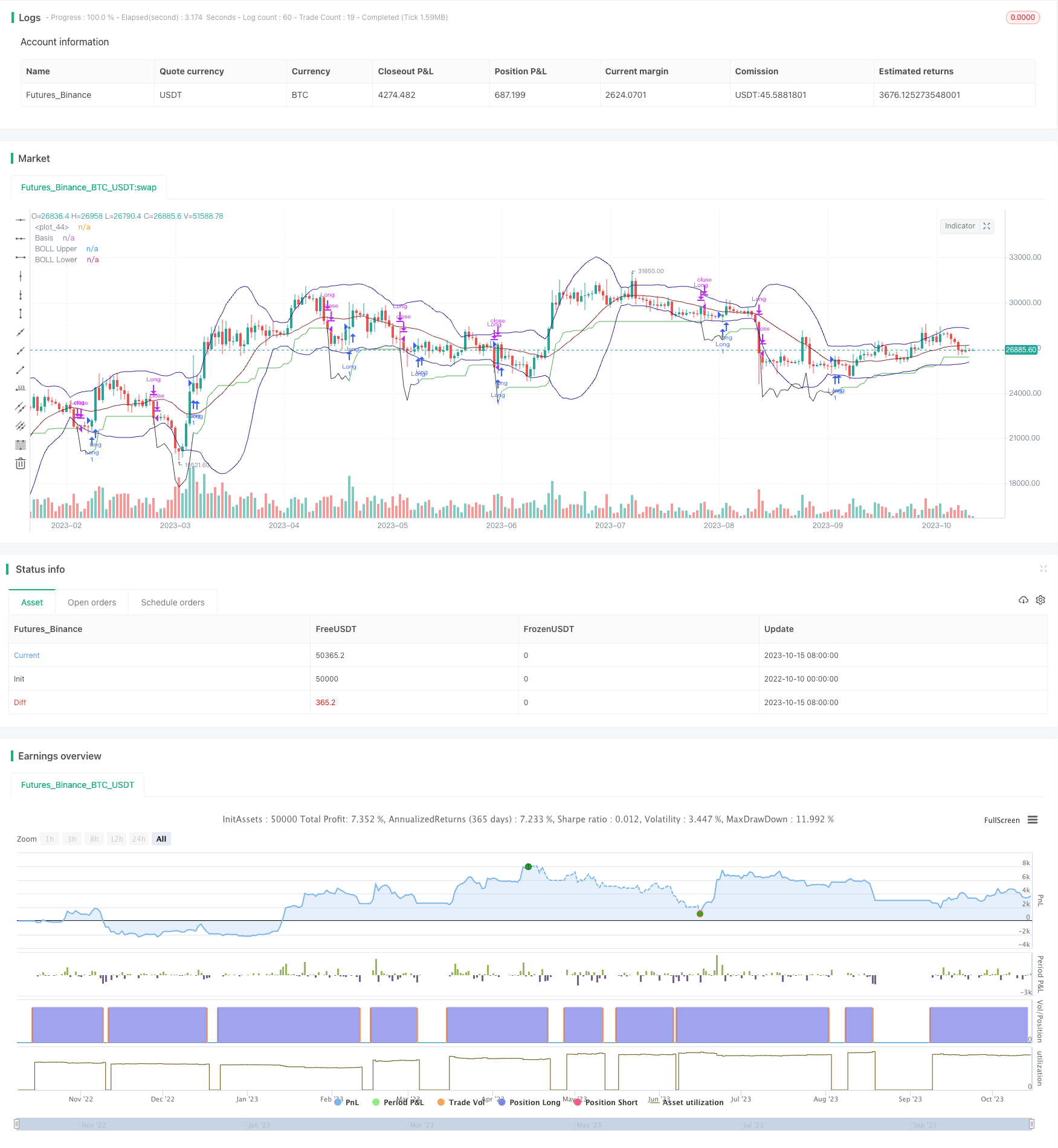

/*backtest

start: 2022-10-10 00:00:00

end: 2023-10-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DojiEmoji (kevinhhl)

//@version=4

strategy("[KL] Relative Volume Strategy",overlay=true,pyramiding=1)

ENUM_LONG = "Long"

VERBOSE_MODE = false

opened_position = false

// Timeframe {

backtest_timeframe_start = input(defval = timestamp("01 Apr 2016 13:30 +0000"), title = "Backtest Start Time", type = input.time)

USE_ENDTIME = input(false,title="Define backtest end-time (If false, will test up to most recent candle)")

backtest_timeframe_end = input(defval = timestamp("01 May 2021 19:30 +0000"), title = "Backtest End Time (if checked above)", type = input.time)

within_timeframe = true

// }

// Volatility Indicators {

// BOLL:

BOLL_length = 20, BOLL_src = close, SMA20 = sma(BOLL_src, BOLL_length), BOLL_sDEV_x2 = 2 * stdev(BOLL_src, BOLL_length)

BOLL_upper = SMA20 + BOLL_sDEV_x2, BOLL_lower = SMA20 - BOLL_sDEV_x2

plot(SMA20, "Basis", color=#872323, offset = 0)

BOLL_p1 = plot(BOLL_upper, "BOLL Upper", color=color.navy, offset = 0, transp=50)

BOLL_p2 = plot(BOLL_lower, "BOLL Lower", color=color.navy, offset = 0, transp=50)

//fill(BOLL_p1, BOLL_p2, title = "Background", color=#198787, transp=85)

// ATR v. sDev of prices

ATR_x2 = atr(input(10,title="Length of ATR [Trailing Stop Loss] (x2)"))*2

//plot(SMA20+ATR_x2, "SMA20 + ATR_x2", color=color.gray, offset = 0, transp=50)

//plot(SMA20-ATR_x2, "SMA20 - ATR_x2", color=color.gray, offset = 0, transp=50)

//plotchar(ATR_x2, "ATR_x2", "", location = location.bottom)

is_low_volat = ATR_x2 > BOLL_sDEV_x2

// }

// Trailing stop loss {

TSL_source = low

var entry_price = float(0), var stop_loss_price = float(0)

TSL_line_color = color.green

if strategy.position_size == 0 or not within_timeframe

TSL_line_color := color.black

stop_loss_price := TSL_source - ATR_x2

else if strategy.position_size > 0

stop_loss_price := max(stop_loss_price, TSL_source - ATR_x2)

plot(stop_loss_price, color=TSL_line_color)

// }

// Relative volume indicator {

LEN_RELATIVE_VOL = input(5, title="SMA(volume) length (for relative comparison)")

relative_vol = sma(volume,LEN_RELATIVE_VOL)

// }

// price actions {

bar_range_ratio = abs(close-open)/(high-low)

engulfing = low < low[1] and high > high[1] and abs(close-open) > abs(close-open)[1]

// }

// MAIN:

if within_timeframe

entry_msg = "", exit_msg = close <= entry_price ? "stop loss" : "take profit"

// ENTRY :::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::

if close > open and volume > relative_vol and is_low_volat

if strategy.position_size > 0

entry_msg := "adding"

else if strategy.position_size == 0

entry_msg := "initial"

if strategy.position_size == 0

entry_price := close

stop_loss_price := TSL_source - ATR_x2

ATR_x2 := ATR_x2

strategy.entry(ENUM_LONG, strategy.long, comment=entry_msg)

// EXIT ::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::

if strategy.position_size > 0

bExit = false

// EXIT: Case (A) touches trailing stop loss

if TSL_source <= stop_loss_price

exit_msg := exit_msg + "[TSL]"

bExit := true

// EXIT: Case (B)

else if close < open and not is_low_volat and engulfing and (high-low) > ATR_x2

exit_msg := VERBOSE_MODE ? exit_msg + "[engulfing bearish]" : exit_msg

bExit := true

strategy.close(ENUM_LONG, when=bExit, comment=exit_msg)

// CLEAN UP:

if strategy.position_size == 0

entry_price := 0

stop_loss_price := float(0)

Detail

https://www.fmz.com/strategy/429495

Last Modified

2023-10-17 16:19:59