Name

基于移动平均线交叉与日内K线形态的量化交易策略Moving-Average-Crossover-Strategy-with-Intraday-Candlestick-Patterns

Author

ChaoZhang

Strategy Description

本策略基于9日移动平均线和15日移动平均线的交叉以及一些典型的日内K线形态来产生交易信号。当快线上穿慢线且满足一定的角度条件和特定K线形态时,做多;当快线下穿慢线时,做空。同时设置止损位和止盈位来控制风险。

当短期移动平均线(9日线)上穿较长期移动平均线(15日线)时,表示短期价格上涨势头较强,做多;当短期移动平均线下穿长期移动平均线时,表示短期价格下跌势头较强,做空。同时,要求移动平均线的角度大于30度,确保有足够的上涨或下跌动力。加入特定的日内K线形态判断,如锤子线、书本线等,可以过滤掉一些假突破的信号。

此策略主要利用了移动平均线的趋势跟踪功能以及部分K线形态的特点,通过参数调整可以适应不同市场的品种。

该策略结合了移动平均线指标和日内K线形态判断,可以有效过滤掉部分噪音,使交易信号更加可靠。尤其是增加了角度阈值的判断,可以确保只在价格变化动量足够大时才发出信号,避免无谓的假信号。此外,策略设定了止损和止盈水平,可以自动减少单子的最大损失和实现盈利的回撤。这些举措使策略的稳定性和盈利能力都得到提高。

移动平均线作为一种趋势跟踪型指标,可以抓住中长期的价格趋势。而日内K线形态反映了短期内市场参与者的力量对比,结合使用可以在不同时间尺度上获得交易提示。此策略整合了多种判断指标的优点,在实际交易中应该能取得较好的效果。

该策略可能存在的风险主要有以下几点:

-

假突破风险。当市场处于震荡整理状态时,移动平均线可能出现多次交叉,这时根据交叉發出的信号大多为假信号。此时无法获利,反而可能被套。加入K线形态和角度条件可以减轻这种风险。

-

趋势反转风险。移动平均线作为趋势跟踪指标,在趋势反转时无法给出提前的信号。这时持有头寸可能遭遇巨额亏损。此种风险可以通过严格的止损来控制。

-

参数优化风险。不同市场品种对参数设置会有不同的适应性。如果不做调整直接使用某一参数组合,也可能带来损失。这需要通过回测和模拟实盘来找到最佳参数。

总的来说,这个策略在缺乏行情环境判断时,可能产生一定的假信号和追高杀跌的风险。可以通过加入对大级别趋势和量价特征的判断来进一步优化,减小这些风险。

该策略还可以从以下几个方面进行进一步优化:

-

增加对大级别趋势的判断。例如 확인中长线是否处于上升或下跌通道,避免逆势交易。

-

加入量能指标的分析。例如通达信的费率指标可以判断买卖力道,避免贸然做空高费率的股价或做多低费率的股价。

-

结合股票基本面情况。精选某些财报预期向好、业绩稳步增长的个股进行交易,可以提高胜率。

-

优化移动平均线系统的参数组合。可以尝试不同长度周期的均线,或加入三均线、五均线等,构建出参数调整空间更大的交易系统。

-

测试不同的止损、止盈参数。根据回测结果设定让利盘系数,以取得最佳的风险收益比。

通过以上几个方向的优化,可以期待该策略盈利水平和稳定性会有明显的进一步提升。

总的来说,本策略整合了移动平均线指标和部分日内K线形态的优点,在发出交易信号时条件较为严格,可以过滤掉大量噪音,使穿越信号的质量大大提高。同时通过设置止损和止盈来控制最大损失和实现的利润。这是一种值得推荐的稳定型量化交易策略。

下一步的工作是通过参数优化,进一步提高策略的胜率和盈利能力。加入更多指标也可以使整体交易系统的健壮性得到加强。在严格的实盘模拟后,该策略有望成为产生稳定利润的有效量化工具。

||

This strategy generates trading signals based on the crossover of 9-day and 15-day moving averages, combined with some typical intraday candlestick patterns. It goes long when the fast MA crosses above the slow MA and meets certain angle conditions and candlestick patterns. It goes short when the fast MA crosses below the slow MA. Stop loss and take profit levels are set to control risks.

When the short-term moving average (9-day MA) crosses above the longer-term moving average (15-day MA), it indicates stronger short-term upward momentum to go long. When the short-term MA crosses below the long-term MA, it signals stronger short-term downward momentum to go short. In addition, the angle of the MA needs to be greater than 30 degrees to ensure sufficient upward or downward power. Specific intraday candlestick patterns are used to filter out false signals.

This strategy mainly utilizes the trend-following capability of moving averages and the characteristics of certain candlestick patterns. It can be adapted to different products through parameter tuning.

This strategy combines moving average indicators and intraday candlestick patterns to effectively filter out noise and make trading signals more reliable. Especially with the angle threshold, it ensures there is enough price change momentum before generating signals, avoiding unnecessary false signals. Also, the stop loss and take profit levels can automatically limit the maximum loss and drawdown of profit. These measures improve both the stability and profitability.

As a trend-following indicator, the moving average can capture medium- to long-term price trends. The intraday candlesticks reflect the power comparison of short-term market participants. Using them together can obtain trading implication across different time frames. This strategy integrates the strengths of multiple indicators and should achieve good performance in actual trading.

The main risks of this strategy include:

-

False breakout risk. During market consolidation, moving averages may have multiple crosses, most of which are false signals. Getting whipsawed here would incur losses. The candlestick patterns and angle conditions can mitigate this risk.

-

Trend reversal risk. Moving averages cannot give early warnings of trend reversals. Holding positions here may lead to huge losses. This risk can be controlled via strict stop loss.

-

Parameter optimization risk. Different markets adapt differently to parameter settings. Directly applying one set of parameters without adjustment may lead to losses. Proper parameters need to be found through backtesting and paper trading.

In general, this strategy may generate some false signals and chase high/low risks without considering market conditions. Further improvements can be made by incorporating analysis of major trends and price-volume characteristics to optimize it.

The following aspects of this strategy can be further improved:

-

Add analysis of major trends, e.g, confirm medium-/long-term channels, to avoid trading against trends.

-

Incorporate volume indicators. For example, on-balance volume can be used to avoid shorting high-momentum price or buying low-momentum price.

-

Combine fundamentals analysis. Select stocks with improving prospect and earnings to improve winning rate.

-

Optimize moving average parameters. Test different length periods, triple or quintuple MA systems for greater tuning flexibility.

-

Test stop loss/take profit parameters. Set order book rebate ratios based on backtest results to achieve optimal risk-reward ratio.

The above optimization directions should significantly improve both the profitability and stability of this strategy.

In summary, this strategy combines the strengths of moving averages and selected candlestick patterns. The trading signals are generated with relatively strict criteria, filtering out lots of noise and improving signal quality. The stop loss and take profit controls further limit risks and lock in gains. It is a stable quantitative trading strategy worth recommending.

The next step is to further improve the win rate and profitability through parameter optimization. Adding more indicators can also strengthen the robustness. With rigorous paper trading tests, this strategy has the potential to become an effective quantitative tool that generates steady profits.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 9 | Fast MA Length |

| v_input_2 | 15 | Slow MA Length |

| v_input_3 | 0.25 | Stop Loss (%) |

| v_input_4 | 0.25 | Target (%) |

| v_input_5 | 30 | Angle Threshold (degrees) |

Source (PineScript)

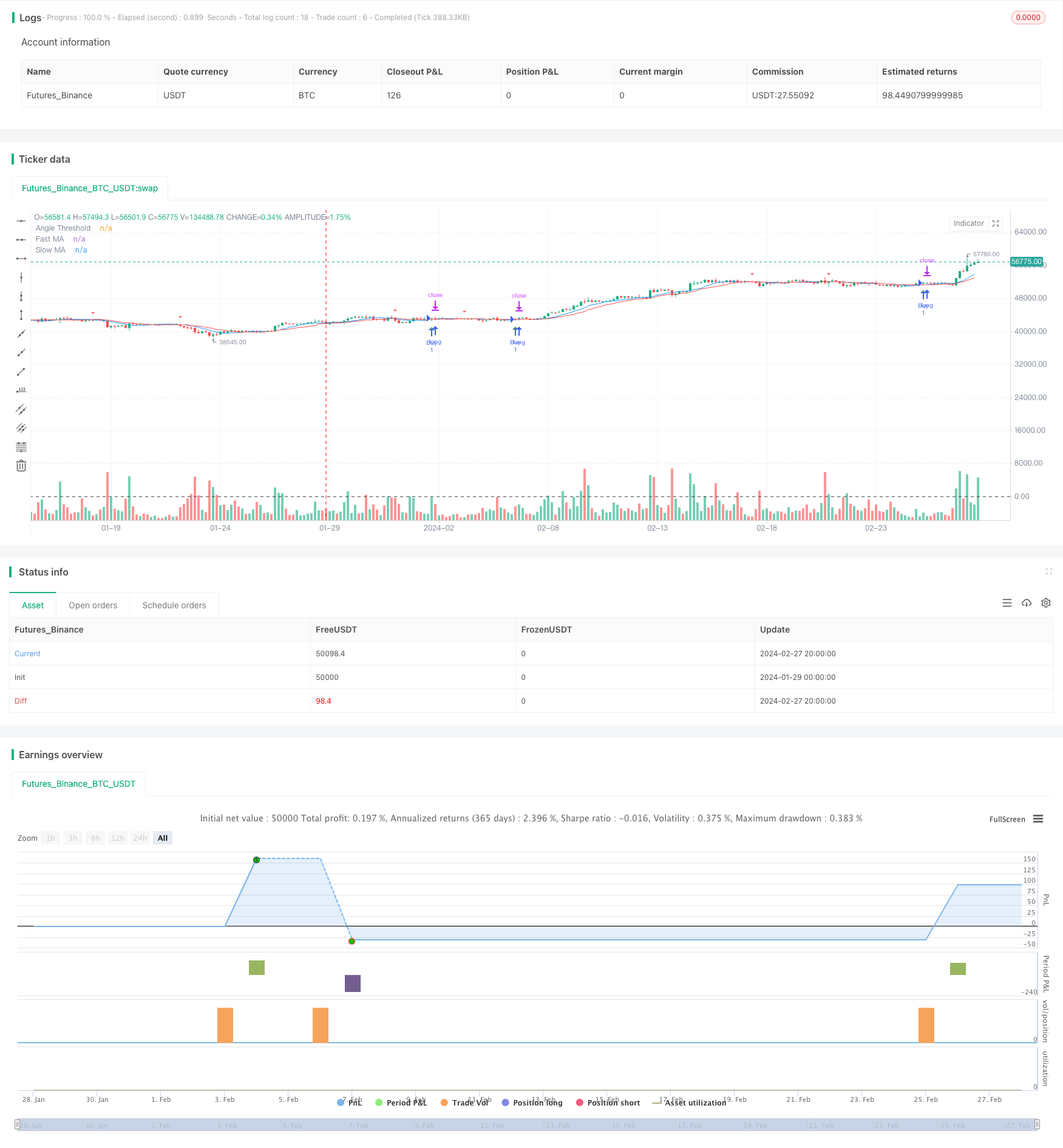

/*backtest

start: 2024-01-29 00:00:00

end: 2024-02-28 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Moving Average Crossover Strategy with Candlestick Patterns", overlay=true)

// Define input parameters

fast_length = input(9, "Fast MA Length")

slow_length = input(15, "Slow MA Length")

stop_loss_percent = input(0.25, "Stop Loss (%)")

target_percent = input(0.25, "Target (%)")

angle_threshold = input(30, "Angle Threshold (degrees)")

// Calculate moving averages

fast_ma = sma(close, fast_length)

slow_ma = sma(close, slow_length)

// Define candlestick patterns

is_pin_bar() =>

pin_bar = abs(open - close) > 2 * abs(open[1] - close[1])

high_tail = max(open, close) - high > abs(open - close) * 1.5

low_tail = low - min(open, close) > abs(open - close) * 1.5

pin_bar and high_tail and low_tail

is_marubozu() =>

marubozu = abs(open - close) > abs(open[1] - close[1]) * 0.75

no_upper_shadow = high == max(open, close)

no_lower_shadow = low == min(open, close)

marubozu and no_upper_shadow and no_lower_shadow

is_full_body() =>

full_body = abs(open - close) > abs(open[1] - close[1]) * 0.95

full_body

// Plot moving averages

plot(fast_ma, color=color.blue, title="Fast MA")

plot(slow_ma, color=color.red, title="Slow MA")

// Calculate angle of slow moving average

ma_angle = abs(180 * (atan(slow_ma[1] - slow_ma) / 3.14159))

// Generate buy/sell signals based on angle condition and candlestick patterns

buy_signal = crossover(fast_ma, slow_ma) and ma_angle >= angle_threshold and (is_pin_bar() or is_marubozu() or is_full_body())

sell_signal = crossunder(fast_ma, slow_ma)

// Calculate stop-loss and target levels

stop_loss_level = close * (1 - stop_loss_percent / 100)

target_level = close * (1 + target_percent / 100)

// Execute trades based on signals with stop-loss and target

strategy.entry("Buy", strategy.long, when=buy_signal)

strategy.exit("Exit", "Buy", stop=stop_loss_level, limit=target_level)

// Plot buy/sell signals on chart (optional)

plotshape(series=buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Plot angle line

hline(angle_threshold, "Angle Threshold", color=color.black, linestyle=hline.style_dashed)

Detail

https://www.fmz.com/strategy/443109

Last Modified

2024-02-29 12:07:21