Name

基于超趋势指标和简单移动平均线策略Super-Trend-Dual-Moving-Average-Strategy

Author

ChaoZhang

Strategy Description

超趋势双均线策略是一种基于超趋势指标和简单移动平均线的量化交易策略。该策略利用超趋势指标判断市场趋势方向,再结合200日简单移动平均线进行过滤,在大趋势方向上开仓做多做空。

该策略使用两个指标:

-

超趋势指标:它根据真实波幅ATR和一个乘数来计算上轨和下轨。当收盘价高于上轨就是看涨,低于下轨就是看跌。

-

200日简单移动平均线:它对最近200天的收盘价进行算术平均。收盘价高于该线代表大趋势看涨,低于该线代表大趋势看跌。

策略逻辑:

-

当超趋势指标看涨(超趋势指标值大于0)并且收盘价高于200日均线时,做多头入场。

-

当超趋势指标看跌(超趋势指标值小于0)并且收盘价低于200日均线时,做空头入场。

-

当超趋势指标与之前信号反向时平仓出场。

-

止损设置为25%。

该策略结合超趋势指标判断短期趋势和200日均线判断长期趋势,能有效过滤假突破,降低交易频率的同时提高胜率。在大的行情中,趋势足够明确,止损空间大,盈利空间大。

该策略的主要风险在于止损幅度较大,高杠杆情况下会Increase the risk of forced liquidation。此外,当行情盘整时,超趋势指标会产生多余信号,从而增加交易频率和成本。

可通过适当调整ATR周期、乘数参数以及止损幅度来降低风险。

该策略可以从以下几个方面进行优化:

-

调整ATR周期和乘数参数,优化超趋势指标的参数;

-

尝试其它均线指标,如EMA、VIDYA等进行替换;

-

增加其它辅助指标,如BOLL通道或KD指标进一步过滤信号;

-

优化止损策略,如移至盈亏平衡点或随大级别止损。

本策略整体来说非常实用,既考虑了短期趋势判断又考虑了长期趋势判断,止损设置也较为合理。通过参数调整与优化仍可获得更好的效果,值得实盘验证与运用。

||

The Super Trend Dual Moving Average Strategy is a quantitative trading strategy based on the Super Trend indicator and simple moving average. This strategy uses the Super Trend indicator to determine the direction of the market trend, and then combines the 200-day simple moving average for filtering, opening long and short positions along the major trend direction.

The strategy uses two indicators:

-

Super Trend Indicator: It calculates the upper and lower rails based on the true volatility ATR and a multiplier. When the closing price is higher than the upper rail, it indicates a bullish view. When lower than the lower rail, it indicates a bearish view.

-

200-day Simple Moving Average: It takes the arithmetic average of the closing prices over the past 200 days. When the closing price is higher than this line, it represents a major bullish trend. When lower than this line, it represents a major bearish trend.

Strategy Logic:

-

When the Super Trend indicator gives a bullish signal (Super Trend value greater than 0) and the closing price is higher than the 200-day MA, go long.

-

When the Super Trend indicator gives a bearish signal (Super Trend value less than 0) and the closing price is lower than the 200-day MA, go short.

-

Close the position when the Super Trend indicator gives a reverse signal against the previous one.

-

The stop loss is set at 25%.

The strategy combines the Super Trend indicator to determine the short-term trend and the 200-day MA to determine the long-term trend, which can effectively filter false breakouts, reduce trading frequency while improving win rate. In a significant market trend, the trend is clear enough with large stop loss space and profit target.

The main risk of this strategy is that the stop loss range is relatively large. It may increase the risk of forced liquidation in high leverage situations. In addition, when the market is range-bound, the Super Trend indicator will generate redundant signals, thus increasing transaction costs and trading frequency.

The risk can be reduced by appropriately adjusting the ATR period, multiplier parameters and stop loss range.

The strategy can be optimized in the following aspects:

-

Adjust the ATR period and multiplier parameters to optimize the Super Trend indicator.

-

Try other MA indicators such as EMA and VIDYA for replacement.

-

Add other auxiliary indicators such as BOLL channel or KD indicator for further signal filtering.

-

Optimize stop loss strategy, such as moving it to breakeven point or trailing stop along with higher timeframe levels.

Overall, this strategy is very practical. It considers both short-term trend judgment and long-term trend judgment with reasonable stop loss settings. It can achieve better results through parameter adjustment and optimization, which is worth real trading verification and application.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 10 | Lenght ATR |

| v_input_2 | 3 | Mult. |

| v_input_3 | 200 | Lenght SMA |

| v_input_float_1 | 25 | % Stop Loss |

Source (PineScript)

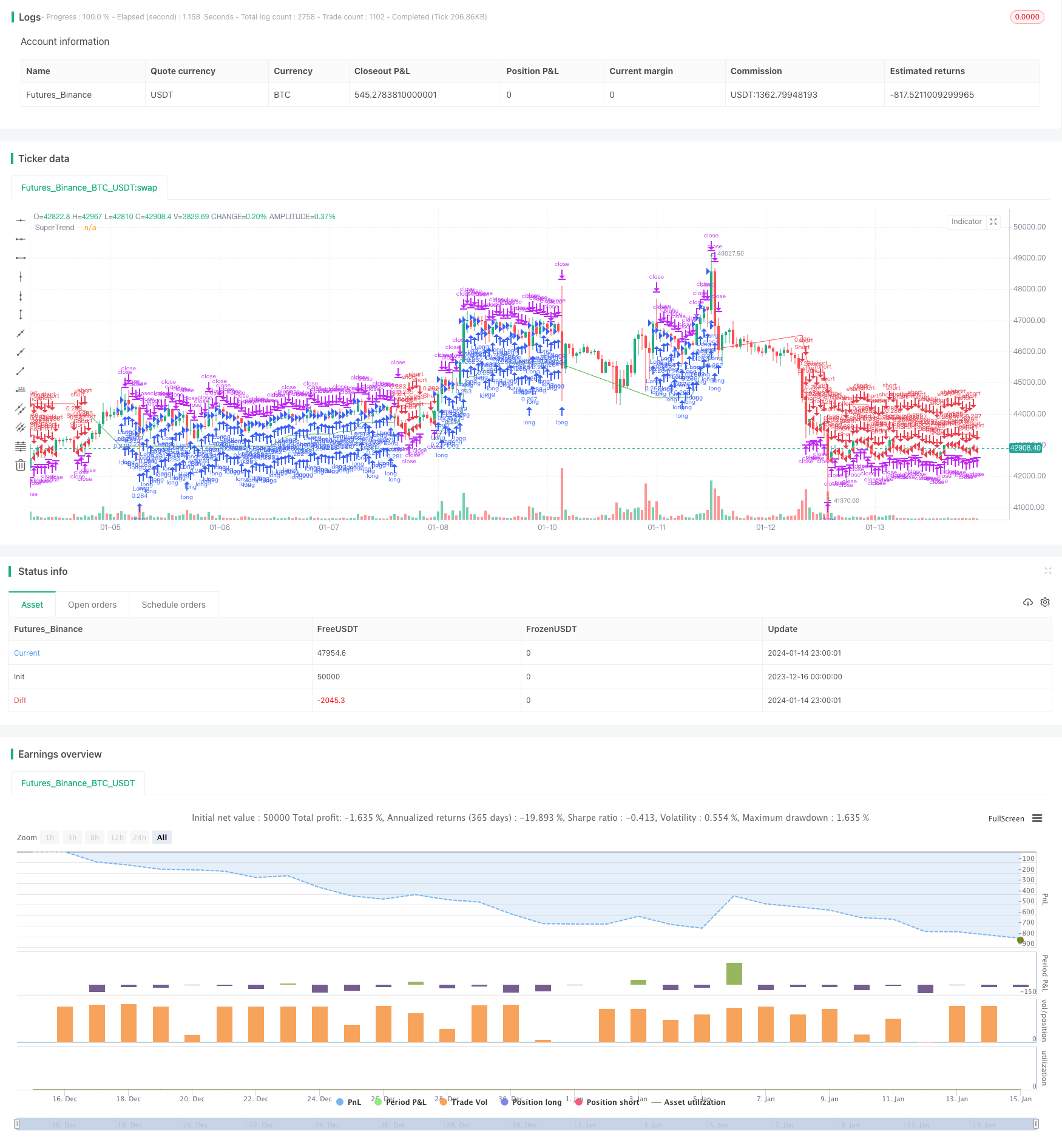

/*backtest

start: 2023-12-16 00:00:00

end: 2024-01-15 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © wielkieef

//@version=5

strategy("Smart SuperTrend Strategy ", shorttitle="ST Strategy", overlay=true, pyramiding=1, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=25, calc_on_order_fills=false, slippage=0, commission_type=strategy.commission.percent, commission_value=0.01)

// Parametry wskaźnika SuperTrend

atrLength = input(10, title="Lenght ATR")

factor = input(3.0, title="Mult.")

// Parametry dla SMA

lengthSMA = input(200, title="Lenght SMA")

// Parametry dla Stop Loss

sl = input.float(25.0, '% Stop Loss', step=0.1)

// Obliczanie ATR

atr = ta.atr(atrLength)

// Obliczanie podstawowej wartości SuperTrend

up = hl2 - (factor * atr)

dn = hl2 + (factor * atr)

// Obliczanie 200-SMA

sma200 = ta.sma(close, lengthSMA)

// Inicjalizacja zmiennych

var float upLevel = na

var float dnLevel = na

var int trend = na

var int trendWithFilter = na

// Logika SuperTrend

upLevel := close[1] > upLevel[1] ? math.max(up, upLevel[1]) : up

dnLevel := close[1] < dnLevel[1] ? math.min(dn, dnLevel[1]) : dn

trend := close > dnLevel[1] ? 1 : close < upLevel[1] ? -1 : nz(trend[1], 1)

// Filtr SMA i aktualizacja trendWithFilter

trendWithFilter := close > sma200 ? math.max(trend, 0) : math.min(trend, 0)

// Logika wejścia

longCondition = trend == 1

shortCondition = trend == -1

// Wejście w pozycje

if (longCondition) and close > sma200

strategy.entry("Long", strategy.long)

if (shortCondition) and close < sma200

strategy.entry("Short", strategy.short)

// Warunki zamknięcia pozycji

Long_close = trend == -1 and close > sma200

Short_close = trend == 1 and close < sma200

// Zamknięcie pozycji

if (Long_close)

strategy.close("Long")

if (Short_close)

strategy.close("Short")

// Kolory superTrendu z filtrem sma200

trendColor = trendWithFilter == 1 ? color.green : trendWithFilter == -1 ? color.red : color.blue

//ploty

plot(trendWithFilter == 1 ? upLevel : trendWithFilter == -1 ? dnLevel : na, color=trendColor, title="SuperTrend")

// Stop Loss ( this code is from author RafaelZioni, modified by wielkieef )

per(procent) =>

strategy.position_size != 0 ? math.round(procent / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// --------------------------------------------------------------------------------------------------------------------

strategy.exit('SL',loss=per(sl))

//by wielkieef

Detail

https://www.fmz.com/strategy/438944

Last Modified

2024-01-16 15:19:09