Name

基于超趋势通道的量化交易策略Quant-Trading-Strategy-Based-on-SuperTrend-Channel

Author

ChaoZhang

Strategy Description

本策略基于超趋势通道指标设计 Entries 和 Exits 信号,实现自动化量化交易。超趋势通道指标可明确突破点和支持阻力位,帮助判断趋势方向。本策略融合该指标的优势,进行长短双向交易。

本策略使用 ATR 和唐奇安通道计算长短两个止损线。具体来说,通过 ATR 周期和 ATR 倍数参数计算 ATR 值,然后与最高价和最低价的平均值相加减,得到长短两个止损线。当收盘价从下向上突破长止损线时产生做多信号;当收盘价从上向下突破短止损线时产生做空信号。

做多做空后,会实时更新止损线,以锁定利润。新的止损线不会低于或高于之前值,从而避免止损被击穿。在止损线和之前止损线之间出现新高或新低时,更新止损线到最新价格。

本策略最大的优势在于,超趋势通道指标能清晰判断趋势方向和关键支持阻力位。结合 ATR 动态止损,可以有效控制单笔损失。

具体来说,超趋势通道指标中的两个止损线,一个代表持仓成本,一个代表最近支撑或压力位。这为 Entries 和 Exits 提供了非常明确的依据。同时,止损线会实时更新,可以锁定利润,避免止损被击穿。

整体来说,本策略在确定趋势后及时 Entries,通过动态止损控制风险,是一种相对稳健的量化交易策略。

本策略的主要风险在于,可能出现止损线被突破的情况。当价格剧烈波动时,新的止损线有可能低于或高于之前值,导致止损被击穿,增加损失。

此外,在震荡行情中,超趋势通道指标生成的 Entries 信号效果不佳,容易形成错误交易。这时需要人工干预,判断趋势后再启动策略。

本策略可以从以下几个方面进行优化:

-

优化 ATR 周期和 ATR 倍数参数,找到最佳组合。可以通过回测不同参数,分析收益率、夏普比率等指标。

-

增加其他指标过滤,避免在震荡行情出错 Entries。可以考虑加入移动平均线、布林带等指标判断趋势方向。

-

结合量能指标优化止损位置。可以根据成交量突增的位置来调整止损线,进一步锁定利润。

-

增加机器学习模型进行参数自适应优化。可以利用 RNN、LSTM 等模型预测参数值,实现参数动态优化。

本策略基于超趋势通道指标设计,判断趋势方向明确,具有较高的胜率。同时,应用 ATR 动态跟踪止损来控制单笔损失。通过参数优化、指标优化等手段可进一步增强策略效果。总体来说这是一种适合自动化量化交易的稳健策略。

||

This strategy generates Entries and Exits signals based on the SuperTrend channel indicator to realize automated quant trading. The SuperTrend channel indicator can identify breakout points and support/resistance levels clearly to determine the trend direction. This strategy incorporates the advantages of this indicator to conduct both long and short trading.

This strategy uses ATR and Donchian Channel to calculate two stop-loss lines for long and short positions. Specifically, it computes the ATR value using the ATR period and multiplier parameters, then adds and subtracts it from the average of highest high and lowest low to obtain the long and short stop-loss lines. When the closing price breaks above the long stop-loss line upwards, a long signal is generated. When the closing price breaks below the short stop-loss line downwards, a short signal is triggered.

After taking long or short positions, the stop-loss lines are updated dynamically to lock in profits. The new stop-loss line will not be lower or higher than the previous one, avoiding stop-loss penetration. When a new high or low appears between the current and previous stop-loss line, the stop-loss line is adjusted to the latest price.

The biggest advantage of this strategy is that the SuperTrend channel indicator can clearly identify the trend direction and key support/resistance levels. Together with the dynamic ATR stop-loss, it can effectively control single trade loss.

Specifically, the two stop-loss lines in the SuperTrend channel indicator represent the position cost basis and the latest support/resistance. They offer very clear guidance for Entries and Exits. Meanwhile, the stop-loss line updates dynamically to lock in profits and prevent stop-loss penetration.

In general, this strategy enters timely when the trend is determined, controls risk via dynamic stop-loss, making it a relatively robust quantitative trading strategy.

The major risk of this strategy lies in the possibility of stop-loss penetration. When price fluctuates violently, the new stop-loss line may become lower or higher than the previous one, causing stop-loss penetration and increased losses.

Besides, the Entries signals generated by the SuperTrend channel indicator do not work well in ranging markets, leading to wrong trades occasionally. Manual intervention is required to determine the trend direction before enabling the strategy.

This strategy can be optimized in the following aspects:

-

Optimize the ATR period and multiplier parameters to find the best combination through backtesting various values and analyzing metrics like return and Sharpe ratio.

-

Add other indicators for signal filtration to avoid wrong Entries in ranging markets. Moving averages, Bollinger Bands etc. can be used to determine the trend direction.

-

Incorporate volume indicators to fine tune the stop-loss position. Stop-loss lines can be adjusted based on volume surges to further lock in profits.

-

Introduce machine learning models for adaptive parameter optimization. Techniques like RNN and LSTM can be leveraged to predict optimal parameter values dynamically.

This strategy originates from the SuperTrend channel indicator with a clear judgment of trend direction and relatively high winning rate. It also applies dynamic ATR tracking stop-loss to control single trade loss. Performance can be further improved through parameter optimization, indicator optimization etc. In general, it is a robust strategy suitable for automated quant trading.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 7 | ATR Period |

| v_input_2 | 7 | ATR Multiplier |

| v_input_3 | true | Show Buy/Sell Labels ? |

Source (PineScript)

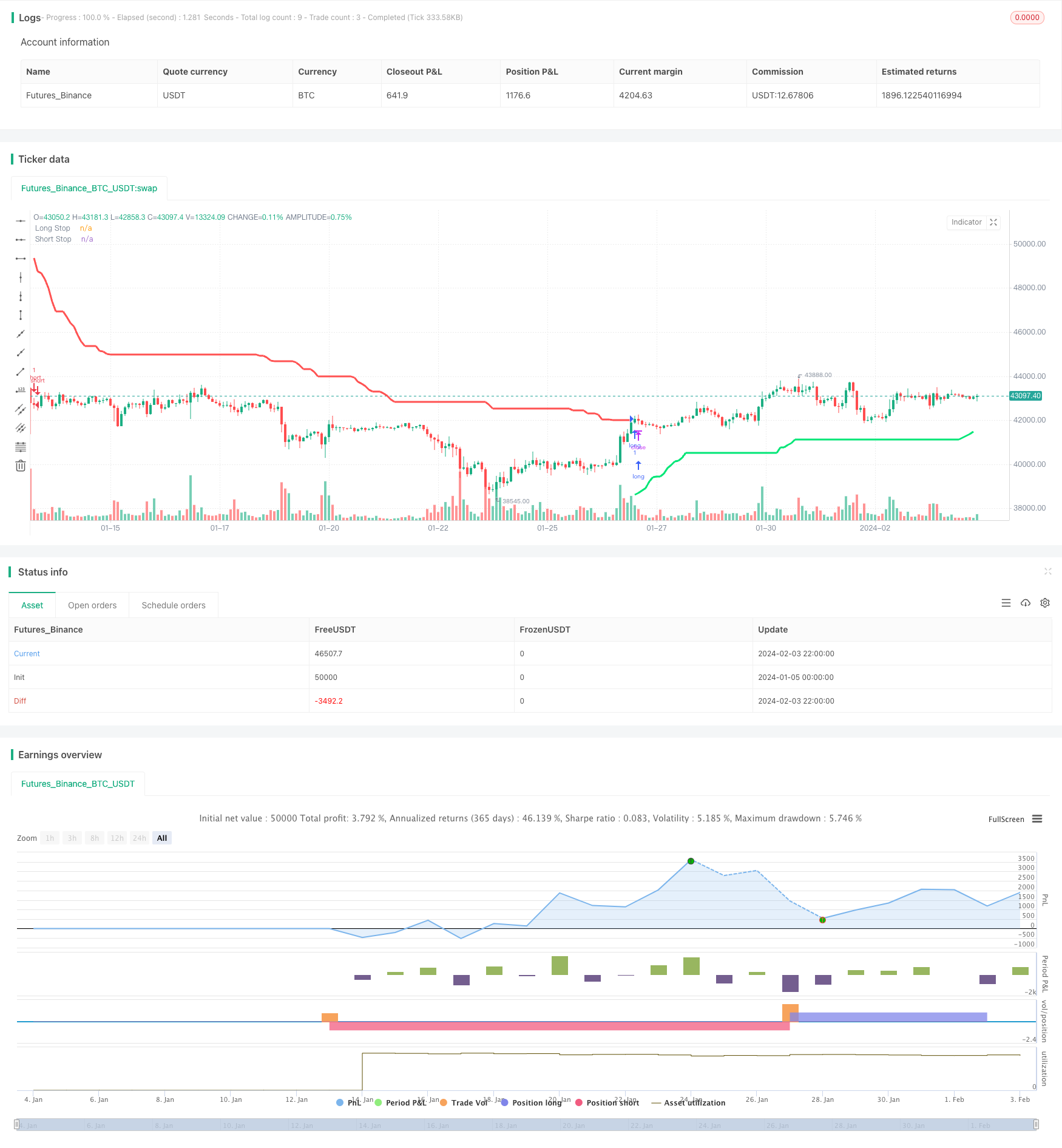

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//EU ESCREVI ISSO TUDO, PARA FICAR BEM CLARO

strategy("SuperTrend Strategy", overlay=true)

//AQUI OS INPUTS PARA A SUPERTREND

length = input(title="ATR Period", type=input.integer, defval=7)

mult = input(title="ATR Multiplier", type=input.float, step=0.1, defval=7)

showLabels = input(title="Show Buy/Sell Labels ?", type=input.bool, defval=true)

//AQUI O CALCULO DO ATR STOPS

atr = mult * atr(length)

//AQUI A TRANSFORMAÇÃO DO ATR STOPS EM SUPERTREND

//-

//A LÓGICA PARA LONGSTOP

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? max(longStop, longStopPrev) : longStop

//A LÓGICA PARA SELLSTOP

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

//DIREÇÃO DO INDICADOR

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and close > shortStopPrev ? 1 :

dir == 1 and close < longStopPrev ? -1 : dir

//DEFININDO AS CORES DAS LINHAS DA SUPERTREND

longColor = color.lime

shortColor = color.red

//PLOTANDO NO GRÁFICO A SUPERTREND E A ESTRATÉGIA

plot(dir == 1 ? longStop : na, title="Long Stop", style=plot.style_linebr, linewidth=3, color=longColor)

buySignal = dir == 1 and dir[1] == -1

plot(dir == 1 ? na : shortStop, title="Short Stop", style=plot.style_linebr, linewidth=3, color=shortColor)

sellSignal = dir == -1 and dir[1] == 1

//DEFININDO AS FUNÇÕES DE COMPRA E VENDA

strategy.entry("long", strategy.long, when = buySignal)

strategy.entry("short", strategy.short, when = sellSignal)

Detail

https://www.fmz.com/strategy/441076

Last Modified

2024-02-05 13:57:28