Name

基于ATR波动率指标构建的通道策略Channel-strategy-based-on-ATR

Author

阿基米德的浴缸

Strategy Description

[trans]

- 名称: 基于ATR波动率指标构建的通道策略

- 思路:通道自适应策略,固定止损+浮动止盈

- 数据周期:多周期

- OKEX期货

- 合约 : this_week 当周

- 官方网站:www.quantinfo.com

-

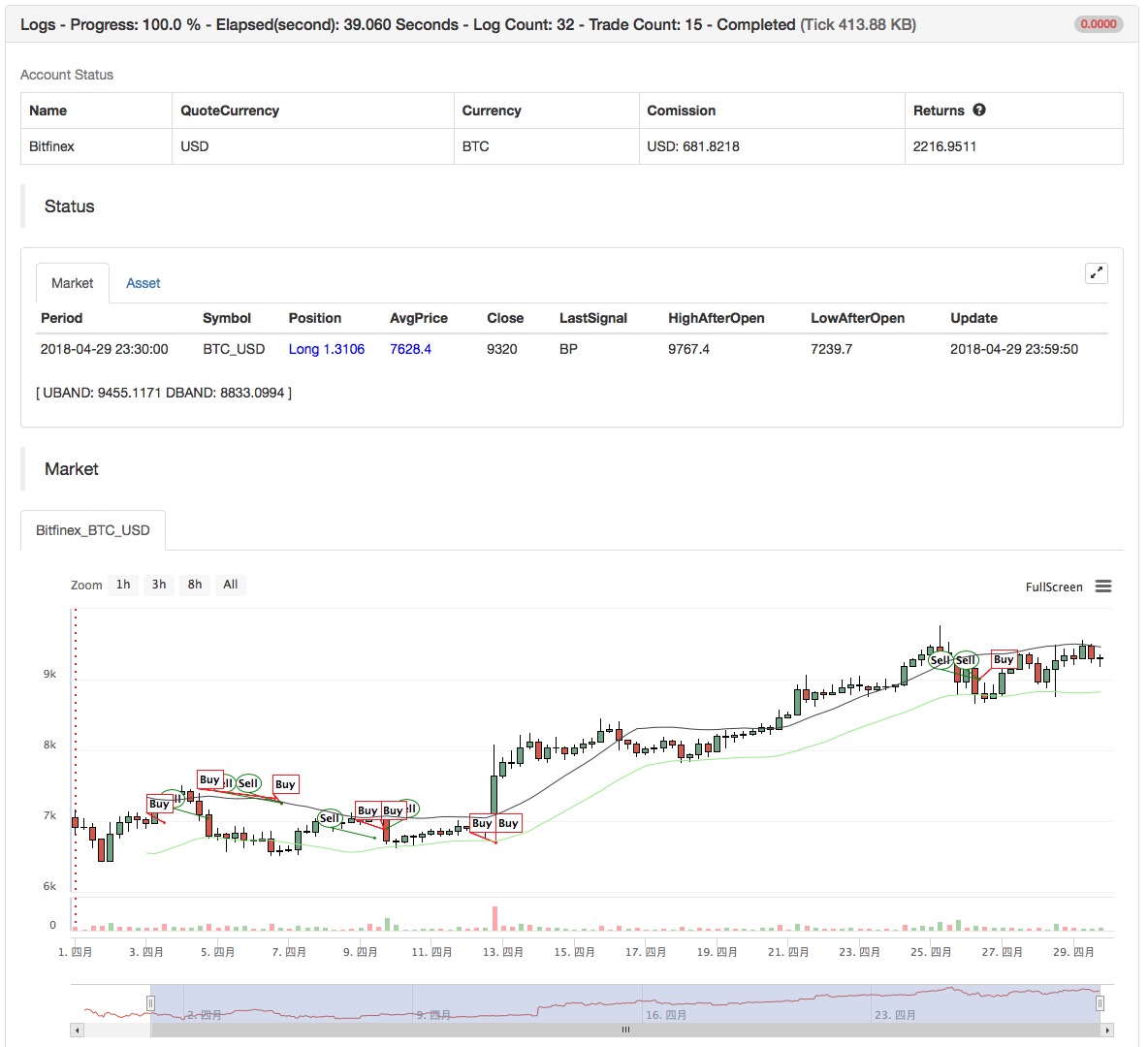

主图: 画UBAND, 公式:UBAND^^MAC+MATR; 画DBAND, 公式:DBAND^^MAC-MATR;

-

副图: 无

||

-

Strategy name: Channel strategy based on ATR volatility index

-

Strategy idea: Channel Adaptive Strategy, Fixed Stop + Floating Stop

-

Data Cycle: Multi-Cycle

-

Main chart: Draw UBAND, formula: UBAND ^^ MAC + MATR; Draw DBAND, formula: DBAND ^^ MAC-MATR;

-

Secondary chart: none

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| SLOSS | 2 | 止损百分比 |

| N | 200 | ATR指标参数 |

| M | 4 | 上下轨系数 |

Source (MyLanguage)

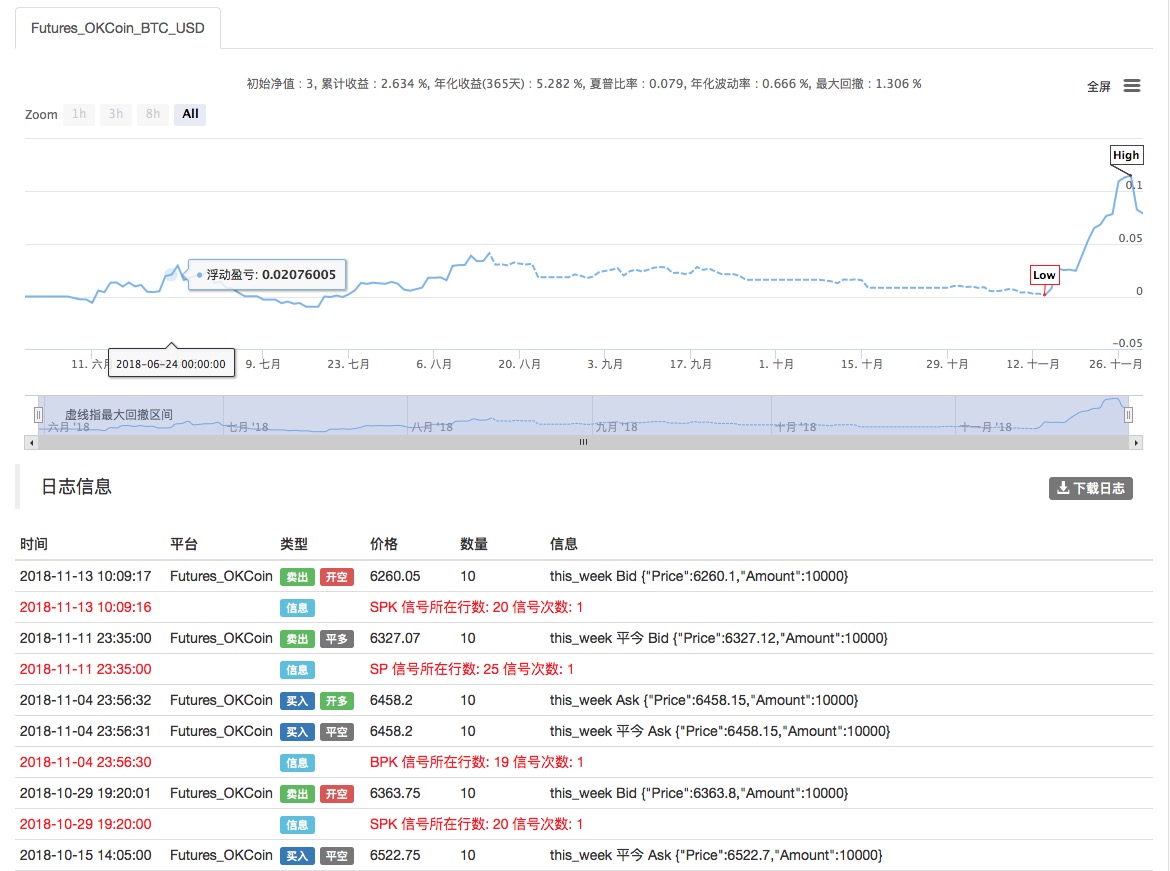

(*backtest

start: 2018-06-01 00:00:00

end: 2018-07-01 00:00:00

period: 1h

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

args: [["TradeAmount",10,126961],["ContractType","this_week",126961]]

*)

TR1:=MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW));

ATR:=MA(TR1,N);

MAC:=MA(C,N);

UBAND^^MAC+M*ATR;

DBAND^^MAC-M*ATR;

H>=HHV(H,N),BPK;

L<=LLV(L,N),SPK;

(H>=HHV(H,M*N) OR C<=UBAND) AND BKHIGH>=BKPRICE*(1+M*SLOSS*0.01),SP;

(L<=LLV(L,M*N) OR C>=DBAND) AND SKLOW<=SKPRICE*(1-M*SLOSS*0.01),BP;

// 止损

// stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP;

C<=BKPRICE*(1-SLOSS*0.01),SP;

AUTOFILTER;Detail

https://www.fmz.com/strategy/128126

Last Modified

2018-12-18 12:55:34