Name

基于EMA和MACD的趋势跟踪策略EMA-and-MACD-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

本策略的核心是利用EMA和MACD这两个指标来识别趋势方向和入场时机。当价格突破EMA时认为趋势发生转变,而MACD的离散指标则进一步确认趋势信号。根据价格与EMA和MACD的关系可以判断买入和卖出的时机。

该策略主要依靠20周期的EMA线和MACD指标来判断趋势方向。具体交易信号生成规则如下:

买入信号:当价格低于20EMA而MACD指标线在0轴下方时,等待价格突破向上跨过20EMA,同时检查MACD指标线是否同时由负转正或刚刚由负转正,如果满足则在20EMA上方10点钱价格发出买入信号。

卖出信号:当价格高于20EMA而MACD指标线在0轴上方时,等待价格突破向下跨过20EMA,同时检查MACD指标线是否同时由正转负或刚刚由正转负,如果满足则在20EMA下方10点钱价格发出卖出信号。

该策略结合趋势判断和指标过滤,可以有效识别趋势的变化点,避免在盘整区域出现虚假信号。

该策略最大的优势在于利用EMA判断大趋势方向的同时,又用MACD指标进行双重确认,从而过滤掉部分噪音交易信号。EMA线能较好地判断主要趋势方向,而MACD则可进一步判定是否蓄势待发。所以这种组合过滤方式使得策略信号较为可靠。

另一方面,该策略也提供了风险控制机制。采用固定止损和止盈的方式,可控有效地管理风险。此外部分仓位迎合保本离场,另一部分则试图跟踪趋势获利。这种方式平衡了风险和收益。

该策略最大的风险在于EMA和MACD所判断的趋势信号不一定完全可靠。价格可能出现一定程度的反转,导致止损被触发。另外在盘整之中也可能出现错误信号。这需要通过参数优化来尽量避免。

另一方面,固定止损止盈设置也存在一定风险。当行情出现剧烈波动时,固定值的止损止盈难以完全适应市场,容易被套住或过早离场。这需要根据当时的波动性和流动性来调整止损止盈参数。

该策略可以从以下几个方面进行优化:

-

测试不同参数的EMA周期,寻找最优参数组合

-

优化MACD的参数,使其更符合所交易品种的特点

-

尝试变化止损止盈的设置方式,如采用ATR止损等

-

添加其他指标进行信号过滤,提高信号质量

-

评估不同品种的交易效果,选择最佳适配品种

通过参数和模型的优化,可以进一步提升策略的稳定性和盈利能力。同时也要控制优化过程的过度拟合风险。

该策略整体来说较为稳健,利用双重指标结合判断趋势信号,可以在一定程度上过滤噪音交易。风险控制也较为妥当。通过进一步优化参数和模型,该策略可以成为一个值得实盘验证的量化交易策略。

||

The core of this strategy is to identify trend direction and entry timing using the EMA and MACD indicators. When price breaks through the EMA, it is considered that the trend has changed, and the MACD divergence indicator further confirms the trend signal. The timing of buys and sells can be determined based on the relationship between price and EMA and MACD.

This strategy mainly relies on the 20-period EMA line and the MACD indicator to determine trend direction. The specific trading signal generation rules are as follows:

Buy signal: When the price is below the 20EMA and the MACD indicator line is below the 0 axis, wait for the price to break upwards across the 20EMA, while checking if the MACD indicator line has turned from negative to positive at the same time or has just turned from negative to positive. If the criteria are met, a buy signal is issued at a price 10 ticks above the 20EMA.

Sell signal: When the price is above the 20EMA and the MACD indicator line is above the 0 axis, wait for the price to break downwards across the 20EMA, while checking if the MACD indicator line has turned from positive to negative at the same time or has just turned from positive to negative. If the criteria are met, a sell signal is issued at a price 10 ticks below the 20EMA.

This strategy combines trend judgment and indicator filtering to effectively identify trend change points and avoid false signals in consolidation zones.

The biggest advantage of this strategy is that while using the EMA to judge the major trend direction, the MACD indicator is also used for double confirmation, which filters out some noisy trading signals. The EMA line can better determine the main trend direction, while the MACD can further determine whether it is brewing. Therefore, this combination filter method makes the strategy signal more reliable.

On the other hand, the strategy also provides a risk control mechanism. By adopting fixed stop loss and take profit, risks can be controlled effectively. In addition, some of the positions cater to risk-off, while the other part attempts to follow the trend for profit. This balances risk and return.

The biggest risk of this strategy is that the trend signals judged by the EMA and MACD may not be completely reliable. Prices may reverse to some extent, causing the stop loss to be triggered. False signals may also occur during consolidation. This needs to be avoided as much as possible through parameter optimization.

On the other hand, fixed stop loss and take profit settings also carry certain risks. When the market sees dramatic fluctuations, the fixed value of stop loss and take profit may not fully adapt to the market, which is prone to being trapped or exiting prematurely. This requires adjusting the stop loss and take profit parameters according to the volatility and liquidity at that time.

The strategy can be optimized in the following ways:

-

Test different parameter periods for the EMA to find the optimal parameter combination

-

Optimize the parameters of the MACD to make it more suited to the characteristics of the trading variety

-

Try changing the settings of stop loss and take profit, such as using ATR stop loss, etc.

-

Add other indicators for signal filtering to improve signal quality

-

Evaluate trading performance across different varieties and select the best fit

Through parameter and model optimization, the stability and profitability of the strategy can be further improved. At the same time, the risk of overfitting in the optimization process needs to be controlled.

Overall, this strategy is quite robust, using double indicator combined judgment to filter noisy trades to some extent. Risk control is also adequate. Through further optimization of parameters and models, this strategy can become a worthwhile quantitative trading strategy to verify in live trading.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 20 | EMA Period |

| v_input_2 | 12 | MACD Short Period |

| v_input_3 | 26 | MACD Long Period |

| v_input_4 | 9 | MACD Signal Period |

| v_input_5 | 10 | Risk Amount (in pips) |

Source (PineScript)

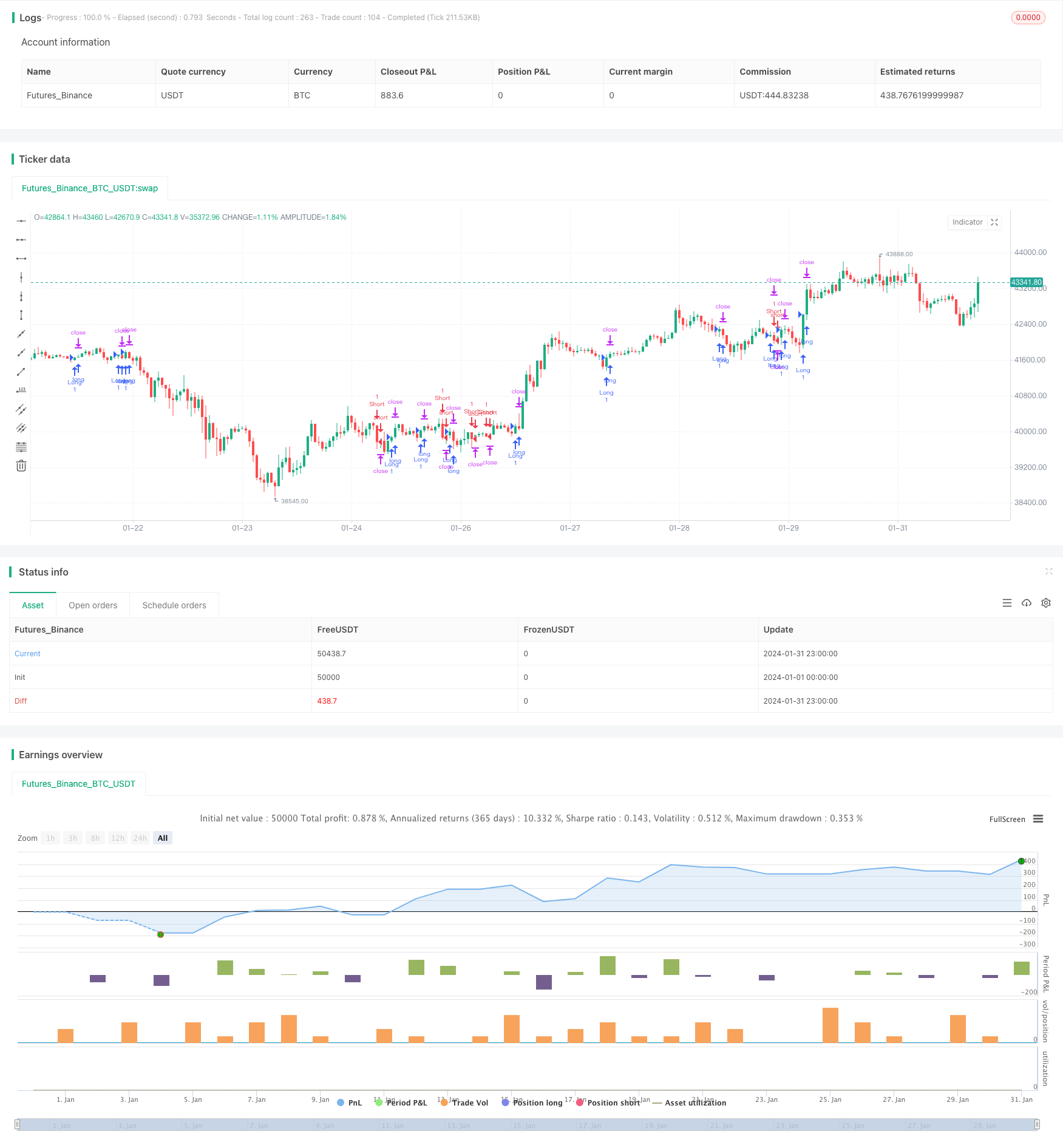

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA and MACD Trading Strategy", overlay=true)

// Define inputs

emaPeriod = input(20, title="EMA Period")

macdShort = input(12, title="MACD Short Period")

macdLong = input(26, title="MACD Long Period")

macdSignal = input(9, title="MACD Signal Period")

riskAmount = input(10, title="Risk Amount (in pips)")

// Calculate indicators

ema = ema(close, emaPeriod)

[macdLine, signalLine, _] = macd(close, macdShort, macdLong, macdSignal)

// Define long trade conditions

longCondition = crossover(close, ema) and (macdLine > 0 or crossover(macdLine, signalLine)) // Removed unnecessary argument

// Define short trade conditions

shortCondition = crossunder(close, ema) and (macdLine < 0 or crossunder(macdLine, signalLine)) // Removed unnecessary argument

// Execute long trade

if (longCondition)

stopLoss = close - riskAmount

takeProfit = close + riskAmount

strategy.entry("Long", strategy.long)

strategy.exit("Exit", "Long", stop=stopLoss, limit=takeProfit)

// Execute short trade

if (shortCondition)

stopLoss = close + riskAmount

takeProfit = close - riskAmount

strategy.entry("Short", strategy.short)

strategy.exit("Exit", "Short", stop=stopLoss, limit=takeProfit)

Detail

https://www.fmz.com/strategy/442540

Last Modified

2024-02-22 16:28:46