Name

基于Ichimoku云图MACD和Stochastic的多时间框架趋势跟踪策略Ichimoku-Cloud-MACD-and-Stochastic-Based-Multi-Timeframe-Trend-Tracking-Strategy

Author

ChaoZhang

Strategy Description

本策略融合了Ichimoku云图、移动平均线、MACD、Stochastic和ATR等多个指标,实现多时间框架下的趋势识别和跟踪。在获得较高概率的趋势信号后,采用ATR周期止损止盈方式进行风险控制。

-

Ichimoku云图判断中长线趋势方向。CLOSE价格上穿云图的转折线和基准线为多头信号,下穿为空头信号。

-

MACD判断短线趋势和超买超卖情况。MACD柱线上穿信号线为多头信号,下穿为空头信号。

-

Stochastic KD判断超买超卖区。K线上穿20为多头信号,下穿80为空头信号。

-

移动平均线判断中期趋势。收盘价上穿移动平均线为多头信号,下穿为空头信号。

-

综合以上多个指标信号,过滤掉部分假信号,形成高概率的持续性趋势信号。

-

基于ATR计算止损止盈价格。以一定的ATR倍数作为止损位和止盈位,实现风险控制。

-

多时间框架识别趋势,提高信号准确率。

-

广泛运用指标组合过滤技术,有效过滤假信号。

-

ATR周期性止损止盈,最大程度控制单笔损失。

-

可自定义入场条件严格程度,满足不同风险偏好。

-

以趋势跟踪为主,无法识别突发事件带来的逆转。

-

ATR周期性止损可能过于理想化,实盘中难以完全复制。

-

参数设置不当可能导致交易频率过高或信号识别准确率不足。

-

需要调整参数找到平衡,适应不同品种和市场环境。

-

增加机器学习算法,辅助判断趋势转折点。

-

优化ATR倍数参数,不同品种可以设置不同倍数。

-

结合交易量变化等其他因素,提高突破信号的准确率。

-

根据回测结果不断优化参数,找到最佳参数组合。

本策略综合运用Ichimoku云图、MACD、Stochastic等多个指标进行多时间框架的趋势识别,在抓住趋势的同时尽量避免被突发事件套牢。ATR周期性止损止盈方式有效控制单笔亏损,是一种值得推荐的趋势跟踪策略。通过引入更多辅助判断指标和机器学习方法,本策略还有进一步优化的空间。

||

This strategy integrates Ichimoku Cloud, moving average, MACD, Stochastic and ATR indicators to identify and track trends across multiple timeframes. It adopts ATR-based stop loss and take profit methods for risk control after obtaining high probability trend signals.

-

Ichimoku Cloud judges medium and long term trend directions. The CLOSE price crossing above Ichimoku's turning line and baseline is a bullish signal, and crossing below them is a bearish signal.

-

MACD judges short-term trends and overbought/oversold situations. MACD histogram crossing above MACD signal line is a bullish signal, and crossing below is a bearish signal.

-

Stochastic KD judges overbought/oversold zones. K line crossing above 20 is a bullish signal, and crossing below 80 is a bearish signal.

-

Moving average judges medium-term trends. Close price crossing above MA is a bullish signal, and crossing below is a bearish signal.

-

Integrate signals from the above indicators to filter out some false signals and form high probability sustainable trend signals.

-

Use ATR to calculate stop loss and take profit price. Use a certain multiple of ATR as stop loss and take profit bits to control risks.

-

Identify trends across multiple timeframes to improve signal accuracy.

-

Widely employ indicator combos to effectively filter out false signals.

-

ATR-based stop loss & take profit significantly limits per trade loss.

-

Customizable strictness of entry conditions caters to different risk appetites.

-

Trend following nature fails to detect reversals caused by black swan events.

-

Idealized ATR stop loss is hard to fully replicate in live trading.

-

Improper parameter settings may lead to overtrading or insufficient signal accuracy.

-

Parameter tweak is needed to fit different products and market environments.

-

Introduce machine learning to aid judging trend reversal points.

-

Optimize ATR multiplier parameter values for different products.

-

Incorporate other factors like volume changes to improve breakthrough signal accuracy.

-

Keep optimizing parameters based on backtest results to find best parameter combinations.

This strategy leverages Ichimoku Cloud, MACD, Stochastic and more for multi-timeframe trend identification, capturing trends while avoiding being trapped by black swan events. The ATR-based stop loss & take profit effectively limits per trade loss. With more auxiliary judgments and machine learning methods introduced, this strategy has further optimization potential.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 9 | Conversion Line Length |

| v_input_2 | 26 | Base Line Length |

| v_input_3 | 52 | Lagging Span 2 Length |

| v_input_4 | 26 | Displacement |

| v_input_5 | 12 | Fast Length |

| v_input_6 | 26 | Slow Length |

| v_input_7_close | 0 | Source: close |

| v_input_8 | 9 | Signal Smoothing |

| v_input_9 | false | Simple MA (Oscillator) |

| v_input_10 | false | Simple MA (Signal Line) |

| v_input_11 | 5 | %K Length |

| v_input_12 | 3 | %K Smoothing |

| v_input_13 | 3 | %D Smoothing |

| v_input_14 | 8 | Atr Length |

| v_input_15 | true | Stop loss multi Atr |

| v_input_16 | true | Take profit multi Atr |

| v_input_17 | 0 | Smoothing: RMA |

| v_input_18 | 0 | Position side: Both |

| v_input_19 | true | Show sl&tp lines |

| v_input_20 | 100 | MA Length |

| v_input_21 | timestamp(1 Jan 2020 00:00 +0000) | Backtesting Start Time |

| v_input_22 | timestamp(31 Dec 2025 23:59 +0000) | Backtesting End Time |

Source (PineScript)

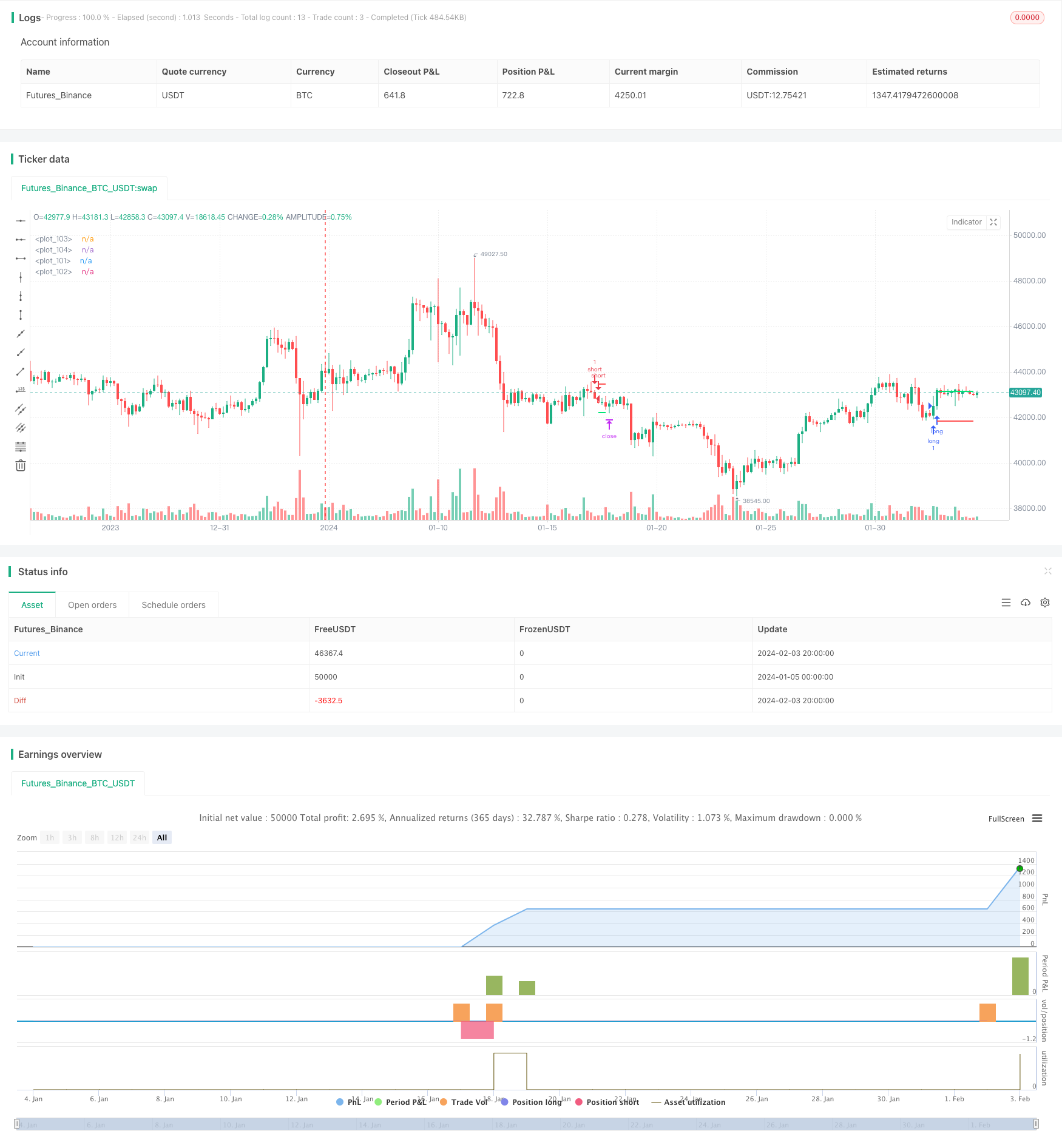

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © FXFUNDINGMATE

//@version=4

strategy(title="FXFUNDINGMATE TREND INDICATOR", overlay=true)

//Ichimoku Cloud

conversionPeriods = input(9, minval=1, title="Conversion Line Length")

basePeriods = input(26, minval=1, title="Base Line Length")

laggingSpan2Periods = input(52, minval=1, title="Lagging Span 2 Length")

displacement = input(26, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)[displacement - 1]

leadLine2 = donchian(laggingSpan2Periods)[displacement - 1]

//macd

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA (Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA (Signal Line)", type=input.bool, defval=false)

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

//kd

periodK = input(5, title="%K Length", minval=1)

smoothK = input(3, title="%K Smoothing", minval=1)

periodD = input(3, title="%D Smoothing", minval=1)

k = sma(stoch(close, high, low, periodK), smoothK)

d = sma(k, periodD)

//atr

atrlength = input(title="Atr Length", defval=8, minval=1)

SMulti = input(title="Stop loss multi Atr", defval=1.0)

TMulti = input(title="Take profit multi Atr", defval=1.0)

smoothing = input(title="Smoothing", defval="RMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, length) =>

if smoothing == "RMA"

rma(source, length)

else

if smoothing == "SMA"

sma(source, length)

else

if smoothing == "EMA"

ema(source, length)

else

wma(source, length)

atr = ma_function(tr(true), atrlength)

operation_type = input(defval = "Both", title = "Position side", options = ["Long", "Short", "Both"])

operation = operation_type == "Long" ? 1 : operation_type == "Short" ? 2 : 3

showlines = input(true, title="Show sl&tp lines")

// MA

sma_len = input(100, title="MA Length", type=input.integer)

sma = sma(close, sma_len)

longCond = crossover(k, 20) and macd > 0 and close > sma and close > leadLine1 and close > leadLine2

shortCond = crossunder(k, 80) and macd < 0 and close < sma and close < leadLine1 and close < leadLine2

entry_price = float(0.0) //set float

entry_price := strategy.position_size != 0 or longCond or shortCond ? strategy.position_avg_price : entry_price[1]

entry_atr = valuewhen(longCond or shortCond, atr,0)

short_stop_level = float(0.0) //set float

short_profit_level = float(0.0) //set float

long_stop_level = float(0.0) //set float

long_profit_level = float(0.0) //set float

short_stop_level := entry_price + SMulti * entry_atr

short_profit_level := entry_price - TMulti * entry_atr

long_stop_level := entry_price - SMulti * entry_atr

long_profit_level := entry_price + TMulti * entry_atr

// Strategy Backtest Limiting Algorithm

i_startTime = input(defval = timestamp("1 Jan 2020 00:00 +0000"), title = "Backtesting Start Time", type = input.time)

i_endTime = input(defval = timestamp("31 Dec 2025 23:59 +0000"), title = "Backtesting End Time", type = input.time)

timeCond = true

if (operation == 1 or operation == 3)

strategy.entry("long" , strategy.long , when=longCond and timeCond, alert_message = "Long")

strategy.exit("SL/TP", from_entry = "long" , limit = long_profit_level , stop = long_stop_level , alert_message = "Long exit")

if (operation == 2 or operation == 3)

strategy.entry("short", strategy.short, when=shortCond and timeCond, alert_message="Short")

strategy.exit("SL/TP", from_entry = "short", limit = short_profit_level , stop = short_stop_level , alert_message = "Short exit")

if time > i_endTime

strategy.close_all(comment = "close all", alert_message = "close all")

plot(showlines and strategy.position_size <= 0 ? na : long_stop_level, color=color.red, style=plot.style_linebr, linewidth = 2)

plot(showlines and strategy.position_size <= 0 ? na : long_profit_level, color=color.lime, style=plot.style_linebr, linewidth = 2)

plot(showlines and strategy.position_size >= 0 ? na : short_stop_level, color=color.red, style=plot.style_linebr, linewidth = 2)

plot(showlines and strategy.position_size >= 0 ? na : short_profit_level, color=color.lime, style=plot.style_linebr, linewidth = 2)

//}

Detail

https://www.fmz.com/strategy/441048

Last Modified

2024-02-05 10:30:45