Name

基于MA线的趋势追踪策略Trend-Following-Strategy-Based-on-MA-Lines

Author

ChaoZhang

Strategy Description

该策略通过计算不同周期的MA移动平均线,判断市场趋势方向,在趋势向上时做多,趋势向下时做空,实现趋势追踪。

- 计算20周期、60周期和120周期的MA线

- 比较MA20、MA60和MA120的大小关系,判断目前的趋势方向

- 如果MA20>MA60>MA120,判断为趋势向上

- 如果MA20<MA60<MA120,判断为趋势向下

- 在MA20上穿MA60时做多入市,在MA20下穿MA60时做空入市

- 以MA60作为止盈止损的参考线

- 多头止盈线为MA60的3倍

- 空头止盈线为MA60的0.9倍

- 使用不同周期的MA组合判断趋势,避免whipsaws

- 只在趋势转折点入场,增加胜率

- 有清晰的止盈止损规则,降低风险

- 在震荡行情中,MA线交叉可能频繁,造成过于频繁交易

- 止盈止损参数需要优化,否则可能过早止损或止盈不足

- 增加判断震荡行情的指标,避免震荡市频繁交易

- 优化MA周期参数组合,找到最佳参数

- 测试并优化止盈止损系数,确保最大化收益和降低风险之间的平衡

该策略整体思路清晰,使用MA判断趋势非常经典,在参数优化和指标优化后,可以成为一个非常实用的趋势追踪策略。

||

This strategy calculates moving averages (MA) of different periods to determine the market trend direction. It goes long when the trend is up and goes short when the trend is down to follow the trend.

- Calculate 20-period, 60-period and 120-period MAs

- Compare the magnitude relationship among MA20, MA60 and MA120 to determine the current trend direction

- If MA20>MA60>MA120, judge the trend to be upward

- If MA20<MA60<MA120, judge the trend to be downward

- Go long when MA20 crosses over MA60, and go short when MA20 crosses below MA60

- Use MA60 as the reference line for take profit and stop loss

- Take profit line for long position is 3 times of MA60

- Take profit line for short position is 0.9 times of MA60

- Use MA combos of different periods to determine trend to avoid whipsaws

- Only enter at trend reversal points to increase winning rate

- Have clear rules for take profit and stop loss to reduce risks

- In range-bound markets, MA crossovers may happen frequently, causing too frequent trading

- Parameters for take profit and stop loss need to be optimized, otherwise position may be stopped out prematurely or take profit is not enough

- Add indicators to identify range-bound markets to avoid overtrading

- Optimize MA period combinations to find the best parameters

- Test and optimize take profit and stop loss coefficients to balance maximizing returns and minimizing risks

The strategy has a clear logic of using MAs to determine trends. After parameter optimization and indicator optimization, it can become a very practical trend following strategy.

[/trans]

Source (PineScript)

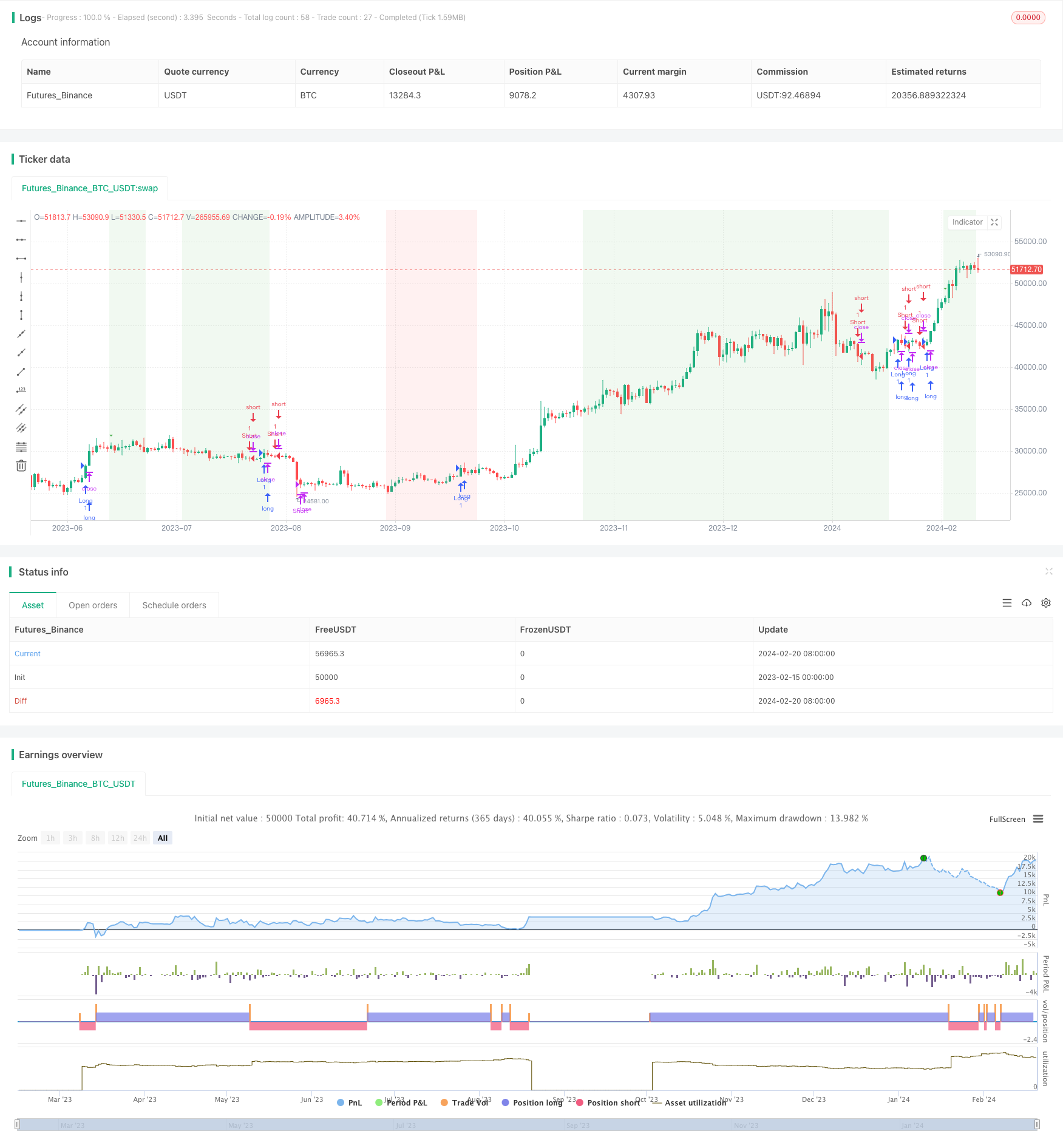

/*backtest

start: 2023-02-15 00:00:00

end: 2024-02-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MA60上多下空", overlay=true)

// 计算MA20/60/120

ma20 = ta.sma(close, 20)

ma60 = ta.sma(close, 60)

ma120 = ta.sma(close, 120)

// 判断MA的趋势

maUpTrend = ma20 > ma60 and ma60 > ma120

maDownTrend = ma20 < ma60 and ma60 < ma120

// 画竖直线标记MA趋势转折点

plotshape(maUpTrend and ta.crossover(ma20, ma60), style=shape.triangledown, location=location.abovebar, color=color.green, size=size.small)

plotshape(maDownTrend and ta.crossunder(ma20, ma60), style=shape.triangleup, location=location.belowbar, color=color.red, size=size.small)

// 画背景标记MA趋势

bgcolor(maUpTrend ? color.new(color.green, 90) : na)

bgcolor(maDownTrend ? color.new(color.red, 90) : na)

// 建立多头仓位的条件

longCondition = ta.crossover(close, ma60)

// 建立空头仓位的条件

shortCondition = ta.crossunder(close, ma60)

// 在穿过MA60时,根据条件建立相应的多头或空头仓位

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// 止盈止损规则

calculateReturns() =>

close / strategy.position_avg_price - 1

takeProfitCondition = calculateReturns() >= 3 // 仓位盈利达到300%

stopLossCondition = calculateReturns() <= -0.1 // 仓位亏损达到10%

if (takeProfitCondition)

strategy.close("Long", comment="Take Profit")

strategy.close("Short", comment="Take Profit")

if (stopLossCondition)

strategy.close("Long", comment="Stop Loss")

strategy.close("Short", comment="Stop Loss")

Detail

https://www.fmz.com/strategy/442553

Last Modified

2024-02-22 17:24:02